0000855886falseN-2N-CSRSSix months ended 4-30-23. Unaudited.Asset coverage equals the total net assets plus borrowings divided by the borrowings of the fund outstanding at period end (Note 8). As debt outstanding changes, the level of invested assets may change accordingly. Asset coverage ratio provides a measure of leverage.

0000855886

2022-11-01

2023-04-30

0000855886

2021-11-01

2022-10-31

0000855886

2020-11-01

2021-10-31

0000855886

2019-11-01

2020-10-31

0000855886

2018-11-01

2019-10-31

0000855886

2017-11-01

2018-10-31

0000855886

jhpdf:ChangingDistributionLevelReturnOfCapitalRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:ConcentrationRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:CreditAndCounterpartyRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:CybersecurityAndOperationalRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:EconomicAndMarketEventsRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:EquitySecuritiesRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:EsgIntegrationRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:FixedIncomeSecuritiesRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:HedgingDerivativesAndOtherStrategicTransactionsRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:IlliquidAndRestrictedSecuritiesRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:InvestmentCompanySecuritiesRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:LargeCompanyRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:LeveragingRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:LiborDiscontinuationRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:LiquidityRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:PreferredAndConvertibleSecuritiesRiskMember

2022-11-01

2023-04-30

0000855886

jhpdf:U.s.GovernmentAgencyObligationsRiskMember

2022-11-01

2023-04-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-05908

John Hancock Premium Dividend Fund

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service) Registrant's telephone number, including area code:

617-543-9634

Date of fiscal year end: | October 31 |

Date of reporting period: | April 30, 2023 |

ITEM 1. REPORTS TO STOCKHOLDERS.

Semiannual report

John Hancock

Premium Dividend Fund

Closed-end U.S. equity

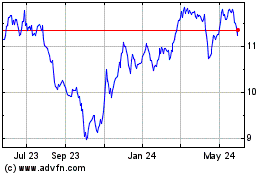

Ticker: PDT

April 30, 2023

Managed distribution plan

The fund has adopted a managed distribution plan (Plan). Under the Plan, the fund makes monthly distributions of an amount equal to $0.0975 per share, which will be paid monthly until further notice. The fund may make additional distributions (i) for purposes of not incurring federal income tax on investment company taxable income and net capital gain, if any, not included in such regular distributions and (ii) for purposes of not incurring federal excise tax on ordinary income and capital gain net income, if any, not included in such regular monthly distributions.

The Plan provides that the Board of Trustees of the fund may amend the terms of the Plan or terminate the Plan at any time without prior notice to the fund’s shareholders. The Plan is subject to periodic review by the fund’s Board of Trustees.

You shouldn’t draw any conclusions about the fund’s investment performance from the amount of the fund’s distributions or from the terms of the Plan. The fund’s total return at net asset value (NAV) is presented in the "Financial highlights" section of this report.

With each distribution that does not consist solely of net investment income, the fund will issue a notice to shareholders and an accompanying press release that will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend on the fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income-tax purposes. The fund may, at times, distribute more than its net investment income and net realized capital gains; therefore, a portion of your distribution may result in a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the fund is paid back to you. A return of capital does not necessarily reflect the fund’s investment performance and should not be confused with "yield" or "income".

Dear shareholder,

Despite significant volatility, the U.S. stock market finished the six months ended April 30, 2023, with a gain. In late 2022 and early 2023, stocks began to recover from the elevated inflation, recession fears, and geopolitical tensions. As inflationary pressure started to ease, the U.S. Federal Reserve dialed back the size of its interest-rate hikes. Healthy employment trends, abating pandemic-related challenges, and a normalizing U.S. economy also aided returns.

During the final two months of the period, however, the markets sustained another jolt when a number of significant U.S. regional banks unexpectedly collapsed.

In these uncertain times, your financial professional can assist with positioning your portfolio so that it’s sufficiently diversified to help meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I’d like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you’ve placed in us.

Sincerely,

Global Head of Retail,

Manulife Investment Management

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO’s views as of this report’s period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Premium Dividend Fund

Table of contents

2 | |

3 | |

5 | |

13 | |

17 | |

19 | |

29 | |

33 | |

34 | |

35 | |

| 1 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | |

The fund seeks to provide high current income, consistent with modest growth of capital.

AVERAGE ANNUAL TOTAL RETURNS AS OF 4/30/2023 (%)

The Primary Blended Index is 70% ICE BofA U.S. All Capital Securities and 30% S&P 500 Utilities Index.

The Intercontinental Exchange (ICE) Bank of America (BofA) U.S. All Capital Securities Index tracks all fixed-to floating-rate, perpetual callable and capital securities of the ICE BofA U.S. Corporate Index.

The S&P 500 Utilities Index tracks the performance of companies in the S&P 500 Index that are primarily involved in water, electrical power, and natural gas distribution industries.

It is not possible to invest directly in an index. Index figures do not reflect expenses, which would result in lower returns.

The performance data contained within this material represents past performance, which does not guarantee future results.

Investment returns and principal value will fluctuate and a shareholder may sustain losses. Further, the fund’s performance at net asset value (NAV) is different from the fund’s performance at closing market price because the closing market price is subject to the dynamics of secondary market trading. Market risk may increase when shares are purchased at a premium to NAV or sold at a discount to NAV. Current month-end performance may be higher or lower than the performance cited. The fund’s most recent performance can be found at jhinvestments.com or by calling 800-852-0218.

| | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 2 |

PORTFOLIO COMPOSITION AS OF 4/30/2023 (% of total investments)

SECTOR COMPOSITION AS OF 4/30/2023 (% of total investments)

TOP 10 ISSUERS AS OF 4/30/2023 (% of total investments) |

| NiSource, Inc. | 4.3 |

| The PNC Financial Services Group, Inc. | 3.3 |

| Bank of America Corp. | 3.0 |

| BP PLC | 2.9 |

| The Williams Companies, Inc. | 2.9 |

| Enbridge, Inc. | 2.9 |

| Edison International | 2.8 |

| Morgan Stanley | 2.8 |

| Duke Energy Corp. | 2.7 |

| Spire, Inc. | 2.3 |

TOTAL | 29.9 |

| Cash and cash equivalents are not included. |

| 3 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | |

COUNTRY COMPOSITION AS OF 4/30/2023 (% of total investments) |

| United States | 87.7 |

| United Kingdom | 5.6 |

| Canada | 4.7 |

| France | 1.4 |

| Other countries | 0.6 |

TOTAL | 100.0 |

| | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 4 |

AS OF 4-30-23 (unaudited)

| | | | | Shares | Value |

Common stocks 74.8% (46.4% of Total investments) | | | $447,199,681 |

| (Cost $346,537,604) | | | | | |

Communication services 4.1% | | | | 24,351,746 |

Diversified telecommunication services 4.1% | | | | |

| AT&T, Inc. (A) | | | | 620,000 | 10,955,396 |

| Verizon Communications, Inc. (A) | | | | 345,000 | 13,396,350 |

Consumer staples 1.5% | | | | 9,197,240 |

Tobacco 1.5% | | | | |

| Philip Morris International, Inc. (A) | | | | 92,000 | 9,197,240 |

Energy 15.1% | | | | 90,586,645 |

Oil, gas and consumable fuels 15.1% | | | | |

| BP PLC, ADR | | | | 705,950 | 28,435,666 |

| Enbridge, Inc. (A)(B) | | | | 281,200 | 11,180,512 |

| Kinder Morgan, Inc. | | | | 539,001 | 9,243,867 |

| ONEOK, Inc. (A)(B) | | | | 210,000 | 13,736,100 |

| The Williams Companies, Inc. (A)(B) | | | | 925,000 | 27,990,500 |

Financials 3.0% | | | | 17,813,475 |

Banks 1.1% | | | | |

| Columbia Banking System, Inc. (A) | | | | 300,879 | 6,426,775 |

Capital markets 1.9% | | | | |

| Ares Management Corp., Class A (A) | | | | 130,000 | 11,386,700 |

Utilities 51.1% | | | | 305,250,575 |

Electric utilities 27.7% | | | | |

| Alliant Energy Corp. (A) | | | | 299,000 | 16,486,860 |

| American Electric Power Company, Inc. (A)(B) | | | | 110,000 | 10,166,200 |

| Constellation Energy Corp. (A)(B) | | | | 118,333 | 9,158,974 |

| Duke Energy Corp. (A)(B) | | | | 220,000 | 21,753,600 |

| Entergy Corp. (A)(B) | | | | 60,000 | 6,454,800 |

| Eversource Energy (A)(B) | | | | 169,033 | 13,118,651 |

| Exelon Corp. (A) | | | | 160,000 | 6,790,400 |

| FirstEnergy Corp. (A)(B) | | | | 435,000 | 17,313,000 |

| OGE Energy Corp. (A) | | | | 530,000 | 19,896,200 |

| Pinnacle West Capital Corp. (A) | | | | 50,000 | 3,923,000 |

| PPL Corp. (A) | | | | 660,000 | 18,955,200 |

| The Southern Company (A) | | | | 135,000 | 9,929,250 |

| Xcel Energy, Inc. (A) | | | | 170,000 | 11,884,700 |

Gas utilities 3.8% | | | | |

| Spire, Inc. (A) | | | | 200,000 | 13,546,000 |

| UGI Corp. (A) | | | | 265,000 | 8,978,200 |

| 5 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | | | | Shares | Value |

Utilities (continued) | | | | |

Multi-utilities 19.6% | | | | |

| Algonquin Power & Utilities Corp. | | | | 267,750 | $8,104,793 |

| Black Hills Corp. (A)(B) | | | | 200,000 | 13,058,000 |

| CenterPoint Energy, Inc. (A)(B) | | | | 380,181 | 11,584,115 |

| Dominion Energy, Inc. (A)(B) | | | | 268,800 | 15,359,232 |

| DTE Energy Company (A) | | | | 105,000 | 11,803,050 |

| National Grid PLC, ADR (A)(B) | | | | 164,166 | 11,762,493 |

| NiSource, Inc. | | | | 670,000 | 19,068,200 |

| Public Service Enterprise Group, Inc. (A) | | | | 235,000 | 14,852,000 |

|

| Sempra Energy (A) | | | | 72,697 | 11,303,657 |

Preferred securities (C) 38.0% (23.5% of Total investments) | | | $227,088,302 |

| (Cost $252,538,545) | | | | | |

Communication services 0.8% | | | | 4,774,500 |

Media 0.8% | | | | |

| Paramount Global, 5.750% | | | | 150,000 | 4,774,500 |

Consumer discretionary 0.5% | | | | 2,933,700 |

Broadline retail 0.5% | | | | |

| QVC, Inc., 6.250% (A) | | | | 330,000 | 2,933,700 |

Financials 16.2% | | | | 96,907,691 |

Banks 7.3% | | | | |

| Bank of America Corp., 7.250% | | | | 6,000 | 7,103,580 |

| Citigroup, Inc., 7.125% (7.125% to 9-30-23, then 3 month CME Term SOFR + 4.302%) (A) | | | | 240,650 | 6,114,917 |

| Fulton Financial Corp., 5.125% (A) | | | | 197,400 | 3,276,840 |

| Huntington Bancshares, Inc., Series J, 6.875% (6.875% to 4-15-28, then 5 Year CMT + 2.704%) (A) | | | | 220,675 | 5,514,668 |

| KeyCorp, 6.200% (6.200% to 12-15-27, then 5 Year CMT + 3.132%) (A) | | | | 45,550 | 1,011,210 |

| Synovus Financial Corp., 6.300% (6.300% to 6-21-23, then 3 month LIBOR + 3.352%) (A) | | | | 188,000 | 4,224,360 |

| Wells Fargo & Company, 7.500% | | | | 14,000 | 16,352,420 |

Capital markets 5.1% | | | | |

| Brookfield Finance, Inc., 4.625% | | | | 170,000 | 2,769,300 |

| Morgan Stanley, 6.375% (6.375% to 10-15-24, then 3 month LIBOR + 3.708%) (A) | | | | 249,227 | 6,263,075 |

| Morgan Stanley, 6.500% (A) | | | | 374,000 | 9,776,360 |

| Morgan Stanley, 7.125% (7.125% to 10-15-23, then 3 month LIBOR + 4.320%) (A) | | | | 430,025 | 10,957,037 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 6 |

| | | | | Shares | Value |

Financials (continued) | | | | |

Capital markets (continued) | | | | |

| State Street Corp., 5.900% (5.900% to 3-15-24, then 3 month LIBOR + 3.108%) | | | | 25,000 | $607,500 |

Insurance 3.8% | | | | |

| American Equity Investment Life Holding Company, 6.625% (6.625% to 9-1-25, then 5 Year CMT + 6.297%) (A) | | | | 211,825 | 5,058,381 |

| Athene Holding, Ltd., Series A, 6.350% (6.350% to 6-30-29, then 3 month LIBOR + 4.253%) | | | | 284,213 | 6,164,580 |

| Brighthouse Financial, Inc., 6.600% (A) | | | | 125,485 | 3,004,111 |

| Lincoln National Corp., 9.000% (A) | | | | 330,275 | 8,709,352 |

Real estate 0.9% | | | | 5,464,939 |

Health care REITs 0.9% | | | | |

| Diversified Healthcare Trust, 5.625% (A) | | | | 476,040 | 5,464,939 |

Utilities 19.6% | | | | 117,007,472 |

Electric utilities 9.5% | | | | |

| Duke Energy Corp., 5.750% (A) | | | | 179,700 | 4,627,275 |

| NextEra Energy Capital Holdings, Inc., 5.650% (A) | | | | 6,200 | 159,216 |

| NextEra Energy, Inc., 6.219% | | | | 277,350 | 13,612,338 |

| NextEra Energy, Inc., 6.926% | | | | 114,550 | 5,422,797 |

| NSTAR Electric Company, 4.250% (A) | | | | 13,347 | 1,094,454 |

| NSTAR Electric Company, 4.780% (A) | | | | 100,000 | 8,605,000 |

| PG&E Corp., 5.500% | | | | 40,000 | 5,995,600 |

| SCE Trust II, 5.100% (A) | | | | 566,770 | 11,726,471 |

| SCE Trust VI, 5.000% (A) | | | | 229,530 | 4,542,399 |

| Union Electric Company, 3.700% (A) | | | | 12,262 | 861,283 |

Gas utilities 1.4% | | | | |

| Spire, Inc., 5.900% (A) | | | | 183,775 | 4,688,100 |

| Spire, Inc., 7.500% | | | | 77,057 | 3,804,304 |

Independent power and renewable electricity producers 2.3% | | | | |

| The AES Corp., 6.875% | | | | 150,000 | 13,501,500 |

Multi-utilities 6.4% | | | | |

| Algonquin Power & Utilities Corp., 6.200% (6.200% to 7-1-24, then 3 month LIBOR + 4.010%) (A) | | | | 300,000 | 6,864,000 |

| Integrys Holding, Inc., 6.000% (6.000% to 8-1-23, then 3 month LIBOR + 3.220%) (A) | | | | 352,044 | 8,290,636 |

| NiSource, Inc., 6.500% (6.500% to 3-15-24, then 5 Year CMT + 3.632%) (A) | | | | 250,000 | 6,237,500 |

| NiSource, Inc., 7.750% | | | | 149,635 | 15,865,799 |

| Sempra Energy, 5.750% (A) | | | | 45,000 | 1,108,800 |

|

| 7 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

Corporate bonds 43.7% (27.1% of Total investments) | | | $261,228,453 |

| (Cost $295,987,134) | | | | | |

Communication services 1.7% | | | | 10,507,560 |

Media 1.7% | | | | |

| Paramount Global (6.375% to 3-30-27, then 5 Year CMT + 3.999%) | 6.375 | 03-30-62 | | 12,250,000 | 10,507,560 |

Consumer discretionary 2.4% | | | | 14,155,587 |

Automobiles 2.4% | | | | |

| General Motors Financial Company, Inc. (5.700% to 9-30-30, then 5 Year CMT + 4.997%) (A)(B)(D) | 5.700 | 09-30-30 | | 9,250,000 | 8,082,188 |

| General Motors Financial Company, Inc. (6.500% to 9-30-28, then 3 month LIBOR + 3.436%) (A)(B)(D) | 6.500 | 09-30-28 | | 7,046,000 | 6,073,399 |

Energy 2.8% | | | | 16,694,598 |

Oil, gas and consumable fuels 2.8% | | | | |

| Enbridge, Inc. (6.250% to 3-1-28, then 3 month LIBOR + 3.641%) | 6.250 | 03-01-78 | | 10,000,000 | 9,031,998 |

| Enbridge, Inc. (7.375% to 10-15-27, then 5 Year CMT + 3.708%) | 7.375 | 01-15-83 | | 7,740,000 | 7,662,600 |

Financials 31.1% | | | | 185,954,856 |

Banks 23.8% | | | | |

| Bank of America Corp. (5.875% to 3-15-28, then 3 month LIBOR + 2.931%) (D) | 5.875 | 03-15-28 | | 7,000,000 | 6,335,000 |

| Bank of America Corp. (6.125% to 4-27-27, then 5 Year CMT + 3.231%) (A)(B)(D) | 6.125 | 04-27-27 | | 15,500,000 | 15,028,216 |

| BNP Paribas SA (7.375% to 8-19-25, then 5 Year U.S. Swap Rate + 5.150%) (D) | 7.375 | 08-19-25 | | 14,400,000 | 13,843,735 |

| Citigroup, Inc. (7.375% to 5-15-28, then 5 Year CMT + 3.209%) (D) | 7.375 | 05-15-28 | | 8,095,000 | 7,993,813 |

| Citizens Financial Group, Inc. (6.000% to 7-6-23, then 3 month LIBOR + 3.003%) (D) | 6.000 | 07-06-23 | | 18,000,000 | 15,435,000 |

| Citizens Financial Group, Inc. (6.375% to 4-6-24, then 3 month LIBOR + 3.157%) (D) | 6.375 | 04-06-24 | | 2,500,000 | 2,162,500 |

| CoBank ACB (6.450% to 10-1-27, then 5 Year CMT + 3.487%) (D) | 6.450 | 10-01-27 | | 7,000,000 | 6,596,956 |

| Comerica, Inc. (5.625% to 7-1-25, then 5 Year CMT + 5.291%) (A)(B)(D) | 5.625 | 07-01-25 | | 6,250,000 | 5,275,465 |

| HSBC Holdings PLC (6.500% to 3-23-28, then 5 Year ICE Swap Rate + 3.606%) (D) | 6.500 | 03-23-28 | | 5,000,000 | 4,420,750 |

| Huntington Bancshares, Inc. (5.625% to 7-15-30, then 10 Year CMT + 4.945%) (D) | 5.625 | 07-15-30 | | 6,500,000 | 5,798,157 |

| Huntington Bancshares, Inc. (3 month LIBOR + 2.880%) (A)(B)(D)(E) | 8.140 | 07-15-23 | | 3,000,000 | 2,718,000 |

| JPMorgan Chase & Co. (6.750% to 2-1-24, then 3 month LIBOR + 3.780%) (A)(B)(D) | 6.750 | 02-01-24 | | 7,334,000 | 7,325,199 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 8 |

| | Rate (%) | Maturity date | | Par value^ | Value |

Financials (continued) | | | | |

Banks (continued) | | | | |

| Lloyds Banking Group PLC (7.500% to 6-27-24, then 5 Year U.S. Swap Rate + 4.760%) (D) | 7.500 | 06-27-24 | | 9,750,000 | $9,377,696 |

| M&T Bank Corp. (3.500% to 9-1-26, then 5 Year CMT + 2.679%) (D) | 3.500 | 09-01-26 | | 9,600,000 | 6,312,000 |

| The PNC Financial Services Group, Inc. (3.400% to 9-15-26, then 5 Year CMT + 2.595%) (D) | 3.400 | 09-15-26 | | 4,900,000 | 3,748,866 |

| The PNC Financial Services Group, Inc. (6.000% to 5-15-27, then 5 Year CMT + 3.000%) (A)(B)(D) | 6.000 | 05-15-27 | | 11,285,000 | 10,466,838 |

| The PNC Financial Services Group, Inc. (6.200% to 9-15-27, then 5 Year CMT + 3.238%) (A)(B)(D) | 6.200 | 09-15-27 | | 7,680,000 | 7,232,314 |

| The PNC Financial Services Group, Inc. (6.250% to 3-15-30, then 7 Year CMT + 2.808%) (D) | 6.250 | 03-15-30 | | 9,100,000 | 8,340,150 |

| The PNC Financial Services Group, Inc. (3 month LIBOR + 3.678%) (A)(B)(D)(E) | 8.492 | 08-01-23 | | 2,185,000 | 2,174,440 |

| Wells Fargo & Company (5.900% to 6-15-24, then 3 month LIBOR + 3.110%) (A)(B)(D) | 5.900 | 06-15-24 | | 2,000,000 | 1,885,800 |

Capital markets 1.9% | | | | |

| The Charles Schwab Corp. (4.000% to 6-1-26, then 5 Year CMT + 3.168%) (A)(B)(D) | 4.000 | 06-01-26 | | 6,000,000 | 5,032,620 |

| The Charles Schwab Corp. (5.000% to 6-1-27, then 5 Year CMT + 3.256%) (A)(B)(D) | 5.000 | 06-01-27 | | 4,389,000 | 3,785,513 |

| The Charles Schwab Corp. (5.375% to 6-1-25, then 5 Year CMT + 4.971%) (A)(B)(D) | 5.375 | 06-01-25 | | 2,800,000 | 2,665,250 |

Consumer finance 2.0% | | | | |

| American Express Company (3.550% to 9-15-26, then 5 Year CMT + 2.854%) (A)(B)(D) | 3.550 | 09-15-26 | | 8,000,000 | 6,721,433 |

| Discover Financial Services (6.125% to 6-23-25, then 5 Year CMT + 5.783%) (D) | 6.125 | 06-23-25 | | 5,500,000 | 5,206,747 |

Insurance 3.4% | | | | |

| Markel Corp. (6.000% to 6-1-25, then 5 Year CMT + 5.662%) (D) | 6.000 | 06-01-25 | | 7,000,000 | 6,801,393 |

| SBL Holdings, Inc. (6.500% to 11-13-26, then 5 Year CMT + 5.620%) (D)(F) | 6.500 | 11-13-26 | | 10,000,000 | 5,821,900 |

| SBL Holdings, Inc. (7.000% to 5-13-25, then 5 Year CMT + 5.580%) (D)(F) | 7.000 | 05-13-25 | | 11,549,000 | 7,449,105 |

Utilities 5.7% | | | | 33,915,852 |

Electric utilities 3.3% | | | | |

| Edison International (5.000% to 12-15-26, then 5 Year CMT + 3.901%) (D) | 5.000 | 12-15-26 | | 4,650,000 | 3,974,891 |

| Edison International (5.375% to 3-15-26, then 5 Year CMT + 4.698%) (D) | 5.375 | 03-15-26 | | 8,000,000 | 7,124,200 |

| NextEra Energy Capital Holdings, Inc. (3 month LIBOR + 2.125%) (E) | 6.991 | 06-15-67 | | 10,000,000 | 8,364,261 |

| 9 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| | Rate (%) | Maturity date | | Par value^ | Value |

Utilities (continued) | | | | |

Multi-utilities 2.4% | | | | |

| CenterPoint Energy, Inc. (6.125% to 9-1-23, then 3 month LIBOR + 3.270%) (D) | 6.125 | 09-01-23 | | 9,000,000 | $8,572,500 |

|

| Dominion Energy, Inc. (4.350% to 1-15-27, then 5 Year CMT + 3.195%) (D) | 4.350 | 01-15-27 | | 7,000,000 | 5,880,000 |

Capital preferred securities (G) 1.2% (0.7% of Total investments) | | | $7,373,199 |

| (Cost $9,141,705) | | | | | |

Financials 1.2% | | | | 7,373,199 |

Insurance 1.2% | | | | |

| MetLife Capital Trust IV (7.875% to 12-15-37, then 3 month LIBOR + 3.960%) (F) | 7.875 | 12-15-37 | | 6,990,000 | 7,373,199 |

|

| | Yield* (%) | Maturity date | | Par value^ | Value |

Short-term investments 3.7% (2.3% of Total investments) | | | $21,904,058 |

| (Cost $21,935,345) | | | | | |

U.S. Government 1.2% | | | | 6,903,917 |

| U.S. Treasury Bill (A)(B) | 4.544 | 08-10-23 | | 7,000,000 | 6,903,917 |

| | | Yield (%) | | Shares | Value |

Short-term funds 2.5% | | | | | 15,000,141 |

|

| John Hancock Collateral Trust (H) | 4.9058(I) | | 1,500,449 | 15,000,141 |

|

Total investments (Cost $926,140,333) 161.4% | | | | $964,793,693 |

Other assets and liabilities, net (61.4%) | | | | (366,918,786) |

Total net assets 100.0% | | | | | $597,874,907 |

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund unless otherwise indicated. |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. |

Security Abbreviations and Legend |

| ADR | American Depositary Receipt |

| CME | Chicago Mercantile Exchange |

| CMT | Constant Maturity Treasury |

| ICE | Intercontinental Exchange |

| LIBOR | London Interbank Offered Rate |

| SOFR | Secured Overnight Financing Rate |

| (A) | All or a portion of this security is pledged as collateral pursuant to the Liquidity Agreement. Total collateral value at 4-30-23 was $539,416,185. A portion of the securities pledged as collateral were loaned pursuant to the Liquidity Agreement. The value of securities on loan amounted to $198,199,090. |

| (B) | All or a portion of this security is on loan as of 4-30-23, and is a component of the fund’s leverage under the Liquidity Agreement. |

| (C) | Includes preferred stocks and hybrid securities with characteristics of both equity and debt that pay dividends on a periodic basis. |

| (D) | Perpetual bonds have no stated maturity date. Date shown as maturity date is next call date. |

| (E) | Variable rate obligation. The coupon rate shown represents the rate at period end. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 10 |

| (F) | These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. |

| (G) | Includes hybrid securities with characteristics of both equity and debt that trade with, and pay, interest income. |

| (H) | Investment is an affiliate of the fund, the advisor and/or subadvisor. |

| (I) | The rate shown is the annualized seven-day yield as of 4-30-23. |

| * | Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end. |

| 11 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

Interest rate swaps |

Counterparty (OTC)/

Centrally cleared | Notional

amount | Currency | Payments

made | Payments

received | Fixed

payment

frequency | Floating

payment

frequency | Maturity

date | Unamortized

upfront

payment

paid

(received) | Unrealized

appreciation

(depreciation) | Value |

| Centrally cleared | 187,000,000 | USD | Fixed 3.662% | USD Federal Funds Rate Compounded OIS | Semi-Annual | Quarterly | May 2026 | — | — | — |

| | | | | | | | | — | — | — |

Derivatives Currency Abbreviations |

| USD | U.S. Dollar |

Derivatives Abbreviations |

| OIS | Overnight Index Swap |

| OTC | Over-the-counter |

At 4-30-23, the aggregate cost of investments for federal income tax purposes was $929,229,329. Net unrealized appreciation aggregated to $35,564,364, of which $130,553,002 related to gross unrealized appreciation and $94,988,638 related to gross unrealized depreciation.

See Notes to financial statements regarding investment transactions and other derivatives information.

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 12 |

STATEMENT OF ASSETS AND LIABILITIES

4-30-23 (unaudited)

Assets | |

| Unaffiliated investments, at value (Cost $911,138,707) | $949,793,552 |

| Affiliated investments, at value (Cost $15,001,626) | 15,000,141 |

Total investments, at value (Cost $926,140,333) | 964,793,693 |

| Cash | 136,119 |

| Dividends and interest receivable | 5,102,843 |

| Receivable for investments sold | 3,276,617 |

| Other assets | 264,175 |

Total assets | 973,573,447 |

Liabilities | |

| Liquidity agreement | 373,700,000 |

| Interest payable | 1,718,916 |

| Payable to affiliates | |

| Administrative services fees | 80,082 |

| Other liabilities and accrued expenses | 199,542 |

Total liabilities | 375,698,540 |

Net assets | $597,874,907 |

Net assets consist of | |

| Paid-in capital | $606,934,261 |

| Total distributable earnings (loss) | (9,059,354) |

Net assets | $597,874,907 |

| |

Net asset value per share | |

| Based on 49,174,486 shares of beneficial interest outstanding - unlimited number of shares authorized with no par value | $12.16 |

| 13 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

STATEMENT OF OPERATIONS

For the six months ended

4-30-23 (unaudited)

Investment income | |

| Dividends | $17,963,173 |

| Interest | 9,121,798 |

| Dividends from affiliated investments | 321,900 |

| Less foreign taxes withheld | (114,224) |

Total investment income | 27,292,647 |

Expenses | |

| Investment management fees | 3,862,229 |

| Interest expense | 9,627,004 |

| Administrative services fees | 496,346 |

| Transfer agent fees | 48,679 |

| Trustees’ fees | 27,351 |

| Custodian fees | 39,760 |

| Printing and postage | 48,315 |

| Professional fees | 76,546 |

| Stock exchange listing fees | 23,586 |

| Other | 13,120 |

Total expenses | 14,262,936 |

| Less expense reductions | (38,635) |

Net expenses | 14,224,301 |

Net investment income | 13,068,346 |

Realized and unrealized gain (loss) | |

Net realized gain (loss) on | |

| Unaffiliated investments and foreign currency transactions | (28,316,780) |

| Affiliated investments | 6,735 |

| Futures contracts | 1,767,826 |

| | (26,542,219) |

Change in net unrealized appreciation (depreciation) of | |

| Unaffiliated investments | 23,186,507 |

| Affiliated investments | 204 |

| Futures contracts | (2,799,573) |

| | 20,387,138 |

Net realized and unrealized loss | (6,155,081) |

Increase in net assets from operations | $6,913,265 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 14 |

STATEMENTS OF CHANGES IN NET ASSETS

| | Six months ended

4-30-23

(unaudited) | Year ended

10-31-22 |

Increase (decrease) in net assets | | |

From operations | | |

| Net investment income | $13,068,346 | $35,285,384 |

| Net realized gain (loss) | (26,542,219) | 20,077,718 |

| Change in net unrealized appreciation (depreciation) | 20,387,138 | (109,947,904) |

Increase (decrease) in net assets resulting from operations | 6,913,265 | (54,584,802) |

Distributions to shareholders | | |

| From earnings | (28,745,081) 1 | (57,179,674) |

Total distributions | (28,745,081) | (57,179,674) |

Fund share transactions | | |

| Issued in shelf offering | 394,294 | 2,659,431 |

| Issued pursuant to Dividend Reinvestment Plan | 668,448 | 1,806,330 |

Total from fund share transactions | 1,062,742 | 4,465,761 |

Total decrease | (20,769,074) | (107,298,715) |

Net assets | | |

| Beginning of period | 618,643,981 | 725,942,696 |

End of period | $597,874,907 | $618,643,981 |

Share activity | | |

Shares outstanding | | |

| Beginning of period | 49,091,976 | 48,800,759 |

| Issued in shelf offering | 29,487 | 183,557 |

| Issued pursuant to Dividend Reinvestment Plan | 53,023 | 107,660 |

End of period | 49,174,486 | 49,091,976 |

1 | A portion of the distributions may be deemed a tax return of capital at the fiscal year end. |

| 15 | JOHN HANCOCK PREMIUM DIVIDEND FUND | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

STATEMENT OF CASH FLOWS

For the six months ended

4-30-23 (unaudited)

| | |

Cash flows from operating activities | |

| Net increase in net assets from operations | $6,913,265 |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | |

| Long-term investments purchased | (56,194,907) |

| Long-term investments sold | 58,835,579 |

| Net purchases and sales of short-term investments | 14,246,743 |

| Net amortization of premium (discount) | 227,961 |

| (Increase) Decrease in assets: | |

| Receivable for futures variation margin | 156,430 |

| Collateral held at broker for futures contracts | 1,220,000 |

| Dividends and interest receivable | (156,400) |

| Receivable for investments sold | (3,195,419) |

| Other assets | (13,169) |

| Increase (Decrease) in liabilities: | |

| Interest payable | 404,036 |

| Payable to affiliates | (2,143) |

| Other liabilities and accrued expenses | (90,376) |

| Net change in unrealized (appreciation) depreciation on: | |

| Investments | (23,186,711) |

| Net realized (gain) loss on: | |

| Investments | 28,304,274 |

Net cash provided by operating activities | $27,469,163 |

Cash flows provided by (used in) financing activities | |

| Distributions to shareholders | $(28,076,633) |

| Fund shares issued in shelf offering | 613,953 |

Net cash used in financing activities | $(27,462,680) |

Net increase in cash | $6,483 |

Cash at beginning of period | $129,636 |

Cash at end of period | $136,119 |

Supplemental disclosure of cash flow information: | |

Cash paid for interest | $(9,222,968) |

Noncash financing activities not included herein consists of reinvestment of distributions | $668,448 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK PREMIUM DIVIDEND FUND | 16 |

Period ended | | 10-31-22 | 10-31-21 | 10-31-20 | 10-31-19 | 10-31-18 |

Per share operating performance | | | | | | |

Net asset value, beginning of period | $12.60 | $14.88 | $12.84 | $15.74 | $14.33 | $15.95 |

| Net investment income 2 | 0.27 | 0.72 | 0.83 | 0.83 | 0.72 | 0.85 |

| Net realized and unrealized gain (loss) on investments | (0.12) | (1.83) | 2.40 | (2.53) | 1.89 | (0.77) |

Total from investment operations | 0.15 | (1.11) | 3.23 | (1.70) | 2.61 | 0.08 |

Less distributions | | | | | | |

| From net investment income | (0.59) 3 | (1.17) | (1.17) | (1.17) | (1.17) | (1.17) |

| From net realized gain | — | — | (0.02) | (0.03) | (0.03) | (0.53) |

Total distributions | (0.59) | (1.17) | (1.19) | (1.20) | (1.20) | (1.70) |

| Premium from shares sold through shelf offering | — 4 | — 4 | — | — | — | — |

Net asset value, end of period | $12.16 | $12.60 | $14.88 | $12.84 | $15.74 | $14.33 |

Per share market value, end of period | $12.70 | $13.99 | $17.27 | $12.55 | $17.69 | $15.65 |

Total return at net asset value (%) 5,6 | | (8.30) | 25.56 | (10.89) | 18.52 | 0.19 |

Total return at market value (%) 5 | | (12.28) | 49.09 | (22.55) | 22.04 | 2.84 |

Ratios and supplemental data | | | | | | |

| Net assets, end of period (in millions) | $598 | $619 | $726 | $625 | $764 | $695 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions | 4.59 8 | 2.42 | 1.82 | 2.32 | 3.01 | 2.80 |

| Expenses including reductions 9 | 4.58 8 | 2.41 | 1.81 | 2.31 | 3.00 | 2.79 |

| Net investment income | 4.20 8 | 5.08 | 5.78 | 6.07 | 4.79 | 5.75 |

| Portfolio turnover (%) | 6 | 16 | 17 | 24 | 18 | 24 |

Senior securities | | | | | | |

| Total debt outstanding end of period (in millions) | $374 | $374 | $374 | $374 | $384 | $384 |

| Asset coverage per $1,000 of debt 10 | $2,600 | $2,655 | $2,943 | $2,672 | $2,992 | $2,811 |

| 17 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

1 | Six months ended 4-30-23. Unaudited. |

2 | Based on average daily shares outstanding. |

3 | A portion of the distributions may be deemed a tax return of capital at year end. |

4 | Less than $0.005 per share. |

5 | Total return based on net asset value reflects changes in the fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that distributions from income, capital gains and tax return of capital, if any, were reinvested. |

6 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

7 | Not annualized. |

8 | Annualized. |

9 | Expenses including reductions excluding interest expense were 1.48% (annualized), 1.39%, 1.41%, 1.48%, 1.41% and 1.44% for the periods ended 4-30-23, 10-31-22, 10-31-21, 10-31-20, 10-31-19 and 10-31-18, respectively. |

10 | Asset coverage equals the total net assets plus borrowings divided by the borrowings of the fund outstanding at period end (Note 8). As debt outstanding changes, the level of invested assets may change accordingly. Asset coverage ratio provides a measure of leverage. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK Premium Dividend Fund | 18 |

Notes to financial statements (unaudited)

John Hancock Premium Dividend Fund (the fund) is a closed-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act).

In 2022, the fund filed a registration statement with the Securities and Exchange Commission, registering an additional 2,000,000 common shares through an equity shelf offering program. Under this program, the fund, subject to market conditions, may raise additional equity capital from time to time by offering new common shares at a price equal to or above the fund’s net asset value per common share.

Note 2

—

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation.

Investments are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the Advisor’s Valuation Policies and Procedures.

In order to value the securities, the fund uses the following valuation techniques: Equity securities, including exchange-traded or closed-end funds, are typically valued at the last sale price or official closing price on the exchange or principal market where the security trades. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Investments by the fund in open-end mutual funds, including John Hancock Collateral Trust (JHCT), are valued at their respective NAVs each business day. Debt obligations are typically valued based on evaluated prices provided by an independent pricing vendor. Independent pricing vendors utilize matrix pricing, which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices. Swaps are generally valued using evaluated prices obtained from an independent pricing vendor.

In certain instances, the Pricing Committee of the Advisor may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and trading occurred as normal on another exchange or market.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the Pricing Committee following procedures established by the Advisor and adopted by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates,

| 19 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | |

prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Advisor’s assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the fund’s investments as of April 30, 2023, by major security category or type:

| | Total

value at

4-30-23 | Level 1

quoted

price | Level 2

significant

observable

inputs | Level 3

significant

unobservable

inputs |

Investments in securities: | | | | |

Assets | | | | |

Common stocks | $447,199,681 | $447,199,681 | — | — |

Preferred securities | | | | |

| Communication services | 4,774,500 | 4,774,500 | — | — |

| Consumer discretionary | 2,933,700 | 2,933,700 | — | — |

| Financials | 96,907,691 | 91,393,023 | $5,514,668 | — |

| Real estate | 5,464,939 | 5,464,939 | — | — |

| Utilities | 117,007,472 | 95,446,249 | 21,561,223 | — |

Corporate bonds | 261,228,453 | — | 261,228,453 | — |

Capital preferred securities | 7,373,199 | — | 7,373,199 | — |

Short-term investments | 21,904,058 | 15,000,141 | 6,903,917 | — |

Total investments in securities | $964,793,693 | $662,212,233 | $302,581,460 | — |

Derivatives: | | | | |

Assets | | | | |

| Swap contracts | — | — | — | — |

The fund holds liabilities for which the fair value approximates the carrying amount for financial statement purposes. As of April 30, 2023, the liability for the fund’s Liquidity agreement on the Statement of assets and liabilities is categorized as Level 2 within the disclosure hierarchy.

Real estate investment trusts.

The fund may invest in real estate investment trusts (REITs). Distributions from REITs may be recorded as income and subsequently characterized by the REIT at the end of their fiscal year as a reduction of cost of investments and/or as a realized gain. As a result, the fund will estimate the components of distributions from these securities. Such estimates are revised when the actual components of the distributions are known.

Security transactions and related investment income.

Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Dividend income is recorded on ex-date, except for dividends of certain foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes

| | SEMIANNUAL REPORT | JOHN HANCOCK Premium Dividend Fund | 20 |

aware of the dividends. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a tax return of capital and/or capital gain, if any, are recorded as a reduction of cost of investments and/or as a realized gain, if amounts are estimable. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Foreign investing.

Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on the value of securities is reflected as a component of the realized and unrealized gains (losses) on investments. Foreign investments are subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs), accounting standards and other factors.

Foreign taxes.

The fund may be subject to withholding tax on income, capital gains or repatriations imposed by certain countries, a portion of which may be recoverable. Foreign taxes are accrued based upon the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Taxes are accrued based on gains realized by the fund as a result of certain foreign security sales. In certain circumstances, estimated taxes are accrued based on unrealized appreciation of such securities. Investment income is recorded net of foreign withholding taxes.

Overdrafts.

Pursuant to the custodian agreement, the fund’s custodian may, in its discretion, advance funds to the fund to make properly authorized payments. When such payments result in an overdraft, the fund is obligated to repay the custodian for any overdraft, including any costs or expenses associated with the overdraft. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

Expenses.

Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Statement of cash flows.

A Statement of cash flows is presented when a fund has a significant amount of borrowing during the period, based on the average total borrowing in relation to total assets, or when a certain percentage of the fund’s investments is classified as Level 3 in the fair value hierarchy. Information on financial transactions that have been settled through the receipt and disbursement of cash is presented in the Statement of cash flows. The cash amount shown in the Statement of cash flows is the amount included in the fund’s Statement of assets and liabilities and represents the cash on hand at the fund’s custodian and does not include any short-term investments or collateral on derivative contracts, if any.

Federal income taxes.

The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of October 31, 2022, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Managed distribution plan.

The fund has adopted a managed distribution plan (Plan) on September 29, 2014. Under the current Plan, the fund makes monthly distributions of an amount equal to $0.0975 per share, which will be paid monthly until further notice.

| 21 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | |

Distributions under the Plan may consist of net investment income, net realized capital gains and, to the extent necessary, return of capital. Return of capital distributions may be necessary when the fund’s net investment income and net capital gains are insufficient to meet the minimum distribution. In addition, the fund may also make additional distributions for the purpose of not incurring federal income and excise taxes.

The Board of Trustees may terminate or reduce the amount paid under the Plan at any time. The termination or reduction may have an adverse effect on the market price of the fund’s shares.

Distribution of income and gains.

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends monthly under the managed distribution plan described above. Capital gain distributions, if any, are typically distributed annually.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from US GAAP. Distributions in excess of tax basis earnings and profits, if any, are reported in the fund’s financial statements as a return of capital. The final determination of tax characteristics of the distribution will occur at the end of the year and will subsequently be reported to shareholders.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals, derivative transactions, amortization and accretion on debt securities, contingent payment debt instruments and dividend redesignation.

Note 3

—

Derivative instruments

The fund may invest in derivatives in order to meet its investment objective. Derivatives include a variety of different instruments that may be traded in the over-the-counter (OTC) market, on a regulated exchange or through a clearing facility. The risks in using derivatives vary depending upon the structure of the instruments, including the use of leverage, optionality, the liquidity or lack of liquidity of the contract, the creditworthiness of the counterparty or clearing organization and the volatility of the position. Some derivatives involve risks that are potentially greater than the risks associated with investing directly in the referenced securities or other referenced underlying instrument. Specifically, the fund is exposed to the risk that the counterparty to an OTC derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction.

Certain derivatives are traded or cleared on an exchange or central clearinghouse. Exchange-traded or centrally-cleared transactions generally present less counterparty risk to a fund than OTC transactions. The exchange or clearinghouse stands between the fund and the broker to the contract and therefore, credit risk is generally limited to the failure of the exchange or clearinghouse and the clearing member.

Centrally-cleared swap contracts are subject to clearinghouse rules, including initial and variation margin requirements, daily settlement of obligations and the clearinghouse guarantee of payments to the broker. There is, however, still counterparty risk due to the potential insolvency of the broker with respect to any margin held in the brokers’ customer accounts. While clearing members are required to segregate customer assets from their own assets, in the event of insolvency, there may be a shortfall in the amount of margin held by the broker for its clients. Collateral or margin requirements for centrally-cleared derivatives are set by the broker or applicable clearinghouse. Margin for centrally-cleared transactions is detailed in the Statement of assets and liabilities as Receivable/Payable for centrally-cleared swaps. Securities pledged by the fund for centrally-cleared transactions, if any, are identified in the Fund’s investments.

Futures.

A futures contract is a contractual agreement to buy or sell a particular currency or financial instrument at a pre-determined price in the future. Futures are traded on an exchange and cleared through a central clearinghouse. Risks related to the use of futures contracts include possible illiquidity of the futures markets and contract prices that can be highly volatile and imperfectly correlated to movements in the underlying financial

| | SEMIANNUAL REPORT | JOHN HANCOCK Premium Dividend Fund | 22 |

instrument and potential losses in excess of the amounts recognized on the Statement of assets and liabilities. Use of long futures contracts subjects the fund to the risk of loss up to the notional value of the futures contracts. Use of short futures contracts subjects the fund to unlimited risk of loss.

Upon entering into a futures contract, the fund is required to deposit initial margin with the broker in the form of cash or securities. The amount of required margin is set by the broker and is generally based on a percentage of the contract value. The margin deposit must then be maintained at the established level over the life of the contract. Cash that has been pledged by the fund, if any, is detailed in the Statement of assets and liabilities as Collateral held at broker for futures contracts. Securities pledged by the fund, if any, are identified in the Fund’s investments. Subsequent payments, referred to as variation margin, are made or received by the fund periodically and are based on changes in the market value of open futures contracts. Futures contracts are marked-to-market daily and unrealized gain or loss is recorded by the fund. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

During the six months ended April 30, 2023, the fund used futures contracts to manage against changes in interest rates. The fund held futures contracts with USD notional values ranging up to $42.6 million, as measured at each quarter end. There were no open futures contracts as of April 30, 2023.

Swaps.

Swap agreements are agreements between the fund and a counterparty to exchange cash flows, assets, foreign currencies or market-linked returns at specified intervals. Swap agreements are privately negotiated in the OTC market (OTC swaps) or may be executed on a registered commodities exchange (centrally cleared swaps). Swaps are marked-to-market daily and the change in value is recorded as a component of unrealized appreciation/depreciation of swap contracts. The value of the swap will typically impose collateral posting obligations on the party that is considered out-of-the-money on the swap.

Upfront payments made/received by the fund, if any, are amortized/accreted for financial reporting purposes, with the unamortized/unaccreted portion included in the Statement of assets and liabilities. A termination payment by the counterparty or the fund is recorded as realized gain or loss, as well as the net periodic payments received or paid by the fund.

Entering into swap agreements involves, to varying degrees, elements of credit, market and documentation risk that may provide outcomes that produce losses in excess of the amounts recognized on the Statement of assets and liabilities. Such risks involve the possibility that there will be no liquid market for the swap, or that a counterparty may default on its obligation or delay payment under the swap terms. The counterparty may disagree or contest the terms of the swap. In addition to interest rate risk, market risks may also impact the swap. The fund may also suffer losses if it is unable to terminate or assign outstanding swaps or reduce its exposure through offsetting transactions.

Interest rate swaps.

Interest rate swaps represent an agreement between the fund and a counterparty to exchange cash flows based on the difference between two interest rates applied to a notional amount. The payment flows are usually netted against each other, with the difference being paid by one party to the other. The fund settles accrued net interest receivable or payable under the swap contracts at specified, future intervals.

During the six months ended April 30, 2023, the fund used interest rate swap contracts to manage against changes in the liquidity agreement interest rates. The fund held interest rate swaps with total USD notional amounts ranging up to $187 million, as measured at each quarter end.

| 23 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | |

Fair value of derivative instruments by risk category

The table below summarizes the fair value of derivatives held by the fund at April 30, 2023 by risk category:

Risk | Statement of assets

and liabilities

location | Financial

instruments

location | Assets

derivatives

fair value | Liabilities

derivatives

fair value |

| Interest rate | Swap contracts, at value 1 | Interest rate swaps | — | — |

1 | Reflects cumulative value of swap contracts. Receivable/payable for centrally cleared swaps, which includes value and margin, are shown separately on the Statement of assets and liabilities. |

Effect of derivative instruments on the Statement of operations

The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended April 30, 2023:

| | Statement of operations location - Net realized gain (loss) on: |

Risk | Futures contracts |

| Interest rate | $1,767,826 |

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended April 30, 2023:

| | Statement of operations location - Change in net unrealized appreciation (depreciation) of: |

Risk | Futures contracts |

| Interest rate | $(2,799,573) |

Note 4

—

Guarantees and indemnifications

Under the fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 5

—

Fees and transactions with affiliates

John Hancock Investment Management LLC (the Advisor) serves as investment advisor for the fund. John Hancock Investment Management Distributors LLC (the Distributor), an affiliate of the Advisor, serves as distributor for the common shares offered through the equity shelf offering of the fund. The Advisor and the Distributor are indirect, principally owned subsidiaries of John Hancock Life Insurance Company (U.S.A.), which in turn is a subsidiary of Manulife Financial Corporation (MFC).

Management fee.

The fund has an investment management agreement with the Advisor under which the fund pays a daily management fee to the Advisor, equivalent on an annual basis to 0.50% of the fund’s average daily managed assets (net assets plus borrowing under the Liquidity Agreement) (see Note 8). In addition, the fund pays to the Advisor 5.00% of the fund’s daily gross income, which amounted to $1,381,673 for the six months ended April 30, 2023. The Advisor has a subadvisory agreement with Manulife Investment Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Advisor. The fund is not responsible for payment of the subadvisory fees.

| | SEMIANNUAL REPORT | JOHN HANCOCK Premium Dividend Fund | 24 |

The Advisor has contractually agreed to waive a portion of its management fee and/or reimburse expenses for certain funds of the John Hancock group of funds complex, including the fund (the participating portfolios). This waiver is based upon aggregate net assets of all the participating portfolios. The amount of the reimbursement is calculated daily and allocated among all the participating portfolios in proportion to the daily net assets of each fund. During the six months ended April 30, 2023, this waiver amounted to 0.01% of the fund’s average daily net assets, on an annualized basis. This arrangement expires on July 31, 2024, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that this is appropriate under the circumstances at that time.

The expense reductions described above amounted to $38,635 for the six months ended April 30, 2023.

Expenses waived or reimbursed in the current fiscal period are not subject to recapture in future fiscal periods.

The investment management fees, including the impact of the waivers and reimbursements as described above, incurred for the six months ended April 30, 2023, were equivalent to a net annual effective rate of 0.77% of the fund’s average daily managed net assets.

Administrative services.

The fund has an administrative agreement with the Advisor under which the Advisor oversees the custodial, auditing, valuation, accounting, legal, compliance, stock transfer and dividend disbursing services and other operational activities and maintains fund communications with shareholders. The fund pays the Advisor a monthly administration fee at an annual rate of 0.10% of the fund’s average weekly managed assets.

Distributor.

The fund will compensate the Distributor with respect to sales of the common shares offered through the equity shelf offering at a commission rate of 1.00% of the gross proceeds of the sale of common shares, a portion of which is allocated to the selling dealers. During the year ended April 30, 2023, compensation to the Distributor was $26,864. The Distributor has an agreement with a sub-placement agent in the sale of common shares. The fund is not responsible for payment of commissions to the sub placement agent.

Trustee expenses.

The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. These Trustees receive from the fund and the other John Hancock closed-end funds an annual retainer. In addition, Trustee out-of-pocket expenses are allocated to each fund based on its net assets relative to other funds within the John Hancock group of funds complex.

Note 6

—

Fund share transactions

On December 17, 2014, the Board of Trustees approved a share repurchase plan, which is subsequently reviewed by the Board of Trustees each year in December. Under the current share repurchase plan, the fund may purchase in the open market, between January 1, 2023 and December 31, 2023, up to 10% of its outstanding common shares as of December 31, 2022. The share repurchase plan will remain in effect between January 1, 2023 and December 31, 2023.

During the six months ended April 30, 2023 and the year ended October 31, 2022, the fund had no activities under the repurchase program. Shares repurchased and corresponding dollar amounts, if any, are included on the Statements of changes in net assets. The anti-dilutive impacts of these share repurchases, if any, are included on the Financial highlights.

Transactions in common shares, if any, are presented in the Statements of changes in net assets. In 2021, the fund filed a registration statement with the Securities and Exchange Commission, registering an additional 2,000,000 common shares through an equity shelf offering program. Under this program, the fund, subject to market conditions, may raise additional equity capital from time to time by offering new common shares at a price equal to or above the fund’s net asset value per common share. Shares issued in shelf offering and corresponding dollar amounts, if any, are included on the Statements of changes in net assets. The net proceeds in excess of the net asset value of the shares sold were $27,219 and $203,126 for the period ended April 30, 2023 and year ended October 31, 2022, respectively. The premium from shares sold through these shelf offerings, if any, are included on the Financial highlights. Proceeds received in connection with the shelf offering are net of commissions and

| 25 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | |

offering costs. Total offering costs of $239,770 have been prepaid by the fund. As of April 30, 2023, $25,541 has been deducted from proceeds of shares issued and the remaining $214,229 is included in Other assets on the Statement of assets and liabilities.

The fund utilizes a Liquidity Agreement (LA) to increase its assets available for investment. When the fund leverages its assets, shareholders bear the expenses associated with the LA and have potential to benefit or be disadvantaged from the use of leverage. The Advisor’s fee is also increased in dollar terms from the use of leverage. Consequently, the fund and the Advisor may have differing interests in determining whether to leverage the fund’s assets. Leverage creates risks that may adversely affect the return for the holders of shares, including:

| • | the likelihood of greater volatility of NAV and market price of shares; |

| • | fluctuations in the interest rate paid for the use of the LA; |

| • | increased operating costs, which may reduce the fund’s total return; |

| • | the potential for a decline in the value of an investment acquired through leverage, while the fund’s obligations under such leverage remains fixed; and |

| • | the fund is more likely to have to sell securities in a volatile market in order to meet asset coverage or other debt compliance requirements. |

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost of leverage, the fund’s return will be greater than if leverage had not been used; conversely, returns would be lower if the cost of the leverage exceeds the income or capital appreciation derived. The use of securities lending to obtain leverage in the fund’s investments may subject the fund to greater risk of loss than would reinvestment of collateral in short term highly rated investments.

In addition to the risks created by the fund’s use of leverage, the fund is subject to the risk that it would be unable to timely, or at all, obtain replacement financing if the LA is terminated. Were this to happen, the fund would be required to de-leverage, selling securities at a potentially inopportune time and incurring tax consequences. Further, the fund’s ability to generate income from the use of leverage would be adversely affected.

Note 8

—

Liquidity Agreement

The fund has entered into a LA with State Street Bank and Trust Company (SSB) that allows it to borrow or otherwise access up to $383.7 million (maximum facility amount) through a line of credit, securities lending and reverse repurchase agreements. The amounts outstanding at April 30, 2023 are shown in the Statement of assets and liabilities as the Liquidity agreement.

The fund pledges its assets as collateral to secure obligations under the LA. The fund retains the risks and rewards of the ownership of assets pledged to secure obligations under the LA and makes these assets available for securities lending and reverse repurchase transactions with SSB acting as the fund’s authorized agent for these transactions. All transactions initiated through SSB are required to be secured with cash collateral received from the securities borrower (the Borrower) or cash is received from the reverse repurchase agreement (Reverse Repo) counterparties. Securities lending transactions will be secured with cash collateral in amounts at least equal to 100% of the market value of the securities utilized in these transactions. Cash received by SSB from securities lending or Reverse Repo transactions is credited against the amounts borrowed under the line of credit. As of April 30, 2023, the LA balance of $373,700,000 was comprised of $170,434,864 from the line of credit and $203,265,136 cash received by SSB from securities lending or Reverse Repo transactions.

Upon return of securities by the Borrower or Reverse Repo counterparty, SSB will return the cash collateral to the Borrower or proceeds from the Reverse Repo, as applicable, which will eliminate the credit against the line of credit and will cause the drawdowns under the line of credit to increase by the amounts returned. Income earned on the loaned securities is retained by SSB, and any interest due on the reverse repurchase agreements is paid by SSB.

| | SEMIANNUAL REPORT | JOHN HANCOCK Premium Dividend Fund | 26 |

SSB has indemnified the fund for certain losses that may arise if the Borrower or a Reverse Repo Counterparty fails to return securities when due. With respect to securities lending transactions, upon a default of the securities borrower, SSB uses the collateral received from the Borrower to purchase replacement securities of the same issue, type, class and series. If the value of the collateral is less than the purchase cost of replacement securities, SSB is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any of the fund’s losses on the reinvested cash collateral. Although the risk of the loss of the securities is mitigated by receiving collateral from the Borrower or proceeds from the Reverse Repo counterparty and through SSB indemnification, the fund could experience a delay in recovering securities or could experience a lower than expected return if the Borrower or Reverse Repo counterparty fails to return the securities on a timely basis.

Effective April 1, 2023, interest charged is at the rate of overnight bank funding rate (OBFR) plus 0.700% and is payable monthly on the aggregate balance of the drawdowns outstanding under the LA. Prior to April 1, 2023, interest was charged at a rate of one month London Interbank Offered Rate (LIBOR) plus 0.625%. As of April 30, 2023, the fund had an aggregate balance of $373,700,000 at an interest rate of 5.51%, which is reflected in the Liquidity agreement on the Statement of assets and liabilities. During the six months ended April 30, 2023, the average balance of the LA and the effective average interest rate were $373,700,000 and 5.19%, respectively.

The fund may terminate the LA with 60 days’ notice. If certain asset coverage and collateral requirements, or other covenants are not met, the LA could be deemed in default and result in termination. Absent a default or facility termination event, SSB is required to provide the fund with 360 days’ notice prior to terminating the LA.

Due to the anticipated discontinuation of LIBOR, as discussed in Note 9, the LA was amended to remove LIBOR as the reference rate for interest and has been replaced with OBFR for interest mutually agreed upon by the fund and SSB. However, there remains uncertainty regarding the future utilization of LIBOR and the nature of any replacement rate and the potential effect of a transition away from LIBOR on the fund cannot yet be fully determined.

Note 9

—

LIBOR Discontinuation Risk

LIBOR is a measure of the average interest rate at which major global banks can borrow from one another. Following allegations of rate manipulation and concerns regarding its thin liquidity, in July 2017, the U.K. Financial Conduct Authority, which regulates LIBOR, announced that it will stop encouraging banks to provide the quotations needed to sustain LIBOR. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing most LIBOR maturities, including some US LIBOR maturities, on December 31, 2021, and is expected to cease publishing the remaining and most liquid US LIBOR maturities on June 30, 2023. It is expected that market participants, such as the fund and SSB, have transitioned or will transition to the use of alternative reference or benchmark rates prior to the applicable LIBOR publication cessation date. However, although regulators have encouraged the development and adoption of alternative rates, such as the Secured Overnight Financing Rate (SOFR), there is currently no definitive information regarding the future utilization of LIBOR or of any particular replacement rate.

Although the transition process away from LIBOR has become increasingly well-defined in advance of the anticipated discontinuation dates, the impact on the transition away from LIBOR referenced financial instruments remains uncertain. It is expected that market participants will amend financial instruments referencing LIBOR to include fallback provisions and other measures that contemplate the discontinuation of LIBOR or other similar market disruption events, but neither the effect of the transition process nor the viability of such measures is known. To facilitate the transition of legacy derivatives contracts referencing LIBOR, the International Swaps and Derivatives Association, Inc. launched a protocol to incorporate fallback provisions. However, there are obstacles to converting certain longer term securities and transactions to a new benchmark or benchmarks and the effectiveness of one alternative reference rate versus multiple alternative reference rates in new or existing financial instruments and products has not been determined. Certain proposed replacement rates to LIBOR, such as SOFR, which is a broad measure of secured overnight US Treasury repo rates, are materially different from LIBOR, and changes in the applicable spread for financial instruments transitioning away from LIBOR will need to

| 27 | JOHN HANCOCK Premium Dividend Fund | SEMIANNUAL REPORT | |

be made to accommodate the differences. Furthermore, the risks associated with the expected discontinuation of LIBOR and transition to replacement rates may be exacerbated if an orderly transition to an alternative reference rate is not completed in a timely manner.

As market participants transition away from LIBOR, LIBOR’s usefulness may deteriorate. The transition process may lead to increased volatility and illiquidity in markets that currently rely on LIBOR to determine interest rates. LIBOR’s deterioration may adversely affect the liquidity and/or market value of securities that use LIBOR as a benchmark interest rate. The use of an alternative reference rate may result in increases to the interest paid by the fund pursuant to the LA and, therefore, may adversely affect the fund’s performance.

Note 10

—

Purchase and sale of securities

Purchases and sales of securities, other than short-term investments, amounted to $56,194,907 and $58,835,579, respectively, for the six months ended April 30, 2023.

Note 11

—

Industry or sector risk

The fund may invest a large percentage of its assets in one or more particular industries or sectors of the economy. If a large percentage of the fund’s assets are economically tied to a single or small number of industries or sectors of the economy, the fund will be less diversified than a more broadly diversified fund, and it may cause the fund to underperform if that industry or sector underperforms. In addition, focusing on a particular industry or sector may make the fund’s NAV more volatile. Further, a fund that invests in particular industries or sectors is particularly susceptible to the impact of market, economic, regulatory and other factors affecting those industries or sectors.

Note 12

—

Investment in affiliated underlying funds