ITT Beats Estimates - Analyst Blog

April 29 2011 - 9:41AM

Zacks

ITT Corporation (ITT) released its first

quarter 2011 earnings results and reported earnings per share from

continuing operations of 98 cents, outperforming the Zacks

Consensus Estimate of 93 cents. Earnings in the quarter increased

by 18% year over year.

Total Revenue

Total revenue in the quarter was $2.76 billion compared with

$2.57 billion in the prior-year period. This was ahead of the Zacks

Consensus Estimate of $2.64 billion.

Segment Results

First-quarter 2011 Defense and Information Solution revenue was

$1.3 billion, down 4% year over year, due largely to the combined

impact of changing U.S. Department of Defense purchase strategies

and decreased revenue from jammers and radios. Orders were 26%

healthier than in the year-ago period, driven by increased service

activity and new key program wins.

Total Fluid revenues of $992 million improved 24% reflecting the

impact of acquisitions as well as strong organic growth in the

Water and Wastewater and Residential and Commercial Water

businesses. Organic revenues grew 8% in the quarter. Industrial

process led the way within the Oil & Gas projects and mining

markets.

Motion and Flow Control's revenue grew 11% in the first quarter

to $430 million. Organic orders were up 20% driven by significant

growth in the aerospace market at Control Technologies, as well as

robust performances in the automotive and rail markets.

Income and Expenses

Operating income in the quarter was $188 million compared with

$245 million. SG&A expense amounted to $430 million and R&D

expense was $61 million.

Balance Sheet & Cash Flow

At the end of the quarter, cash and cash equivalents were $1,074

million with long-term debt of $1,354 million and shareowners'

equity of $4,768 million.

Outlook

ITT has narrowed its 2011 full-year adjusted earnings per share

guidance range to $4.70 to $4.82, up from the previously announced

range of $4.62 to $4.82. The company has, however, revised its

total revenue outlook downward for 2011 from $11.4 billion to $11.3

billion due to uncertainty in the U.S. defense market.

ITT plays an important role in vital markets, including water

and fluids management, global defense and security, and motion and

flow control. It possesses industry leading brands in the Fluid

Technology and Motion & Flow Control businesses. The company is

well diversified and serves attractive end markets with a broad

geographic footprint.

We are particularly bullish about these two segments: a) water

equipment (primarily pumps), which should benefit from the

replacement and upgrade of ageing networks in developed markets and

the build out of infrastructure in emerging markets, and b) ITT’s

Defense business, with the bulk of sales derived from electronic

and network-centric warfare.

The Defense Electronics & Services business segment is

subject to a number of risks, including defense budgets and

government contract requirements and regulations, which could have

an adverse impact on the results of its operations.

The Fluid Technology and Motion & Flow Control business

segments are subject to certain industry risks, which could have an

adverse impact on the results of its operations.

Adverse macroeconomic and business conditions, particularly in

the local economies of the countries or regions where the company

operates, may negatively affect its revenues, profitability and

operations.

The company’s Defense Electronics and Services segment develops,

manufactures, and supports high-technology electronic systems and

components for worldwide defense and commercial markets, and

provides communications systems and engineering and applied

research. Principal manufacturing facilities are located in the

United Kingdom and United States of America.

ITT Corporation, with 2010 revenues of $10.99 billion, is a

global multi-industry leader in high-technology engineering and

manufacturing. It is engaged in the design, manufacture, and sale

of a wide-range of engineered products and the provision of

services. Lockheed Martin Corporation (LMT) is a

major competitor.

We currently have a Neutral recommendation on ITT

Corporation.

ITT CORP (ITT): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

Zacks Investment Research

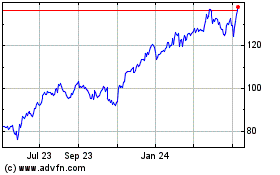

ITT (NYSE:ITT)

Historical Stock Chart

From May 2024 to Jun 2024

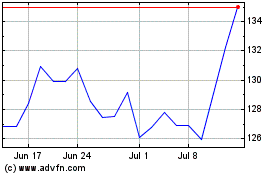

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2023 to Jun 2024