ITT Sees Lower Defense Sales In 2011 Offset By Other Businesses

December 18 2010 - 6:15PM

Dow Jones News

ITT Corp. (ITT) predicted Friday that lower sales and income

from its defense segment next year will be offset by growth in its

other industrial businesses.

The company has been realigning its defense business toward the

aerospace market and foreign militaries, as well as expanding its

non-defense portfolio of businesses, particularly in fast-growing

economies overseas.

"The investments we have made position us for solid margin

expansion in 2011," said Chairman and Chief Executive Steve

Loranger in a written statement about the company's 2011

outlook.

The White Plains, NY., company forecast total revenue growth of

3% to 5% from 2010's revenue of about $11 billion. ITT expects

earnings per share of $4.62 to $4.82 next year. Analysts anticipate

the company will earn $4.62 per share next year on total revenue of

$11.5 billion. ITT also affirmed its 2010 earnings guidance of

$4.28 to $4.32 a share.

Defense has been the company's best-performing business segment

in recent years. But the U.S. Defense Department has begun scaling

back its purchases of ITT's tactical radios, jammers to block bomb

detonation signals and other equipment used by U.S. troops in Iraq

and Afghanistan as part of a broad reduction in defense spending.

ITT expects defense segment revenue to fall 2% next year from 2010

and sees operating income from defense slipping 3%. The company

expects defense segment revenue from non-military agencies and

foreign armies to improve next year.

Meanwhile, the company anticipates further strengthening of

sales in its other business segments, coupled with robust growth in

operating income.

In ITT's fluid technology segment, which makes pumps for

residential water plants and industrial processes, total revenue

growth of 12% is expected next year. The segment's organic sales,

which exclude revenue from acquisitions, are expected to rise about

5%. The company predicted operating income from the segment will

increase 22% next year.

Revenue from ITT's motion and flow control segment, which

supplies equipment and components to the automotive, marine and

beverage markets, is forecast to rise about 7% next year with

organic sales growth of about 5.5%. The company anticipates a 25%

increase in operating income from the business as ITT leverages the

benefits from pervious cost reductions and productivity

improvements.

ITT's stock closed Thursday's regular trading session up 1.74%,

or 87 cents, at $50.87 a share.

- -By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

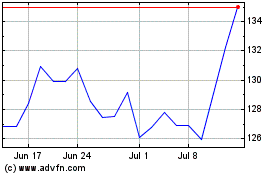

ITT (NYSE:ITT)

Historical Stock Chart

From May 2024 to Jun 2024

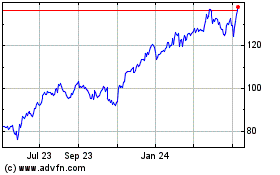

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2023 to Jun 2024