ITT Corporation (NYSE: ITT) today reported 2010 first-quarter

revenue of $2.6 billion and income from continuing operations of

$146 million, or $0.79 per share. Excluding special items, income

from continuing operations for the quarter was $156 million, or

$0.84 per share, representing 17 percent year-over-year growth.

Special items in the year-ago period included a $54 million

tax-related gain, compared with a $10 million expense in the first

quarter of 2010, primarily related to the recent U.S. healthcare

reform legislation.

“Promising organic growth combined with ITT’s focused execution

got us off to a great start in 2010. Our Motion & Flow Control

business delivered significant increases in revenue and operating

income. Our Defense & Information Solutions business made great

progress on its strategic realignment, and significant productivity

gains drove margin improvements in both our Fluid Technology and

Motion & Flow Control businesses,” said Steve Loranger, ITT’s

chairman, president and chief executive officer.

The company also raised its full-year 2010 adjusted earnings per

share guidance from its previously announced forecast of $3.90 to

$4.10 to a new forecast of $4.05 to $4.20. Revenue guidance for the

year is revised from the company’s previously announced forecast of

three percent growth to a new forecast of four percent growth.

Organic revenue (defined as total revenue excluding foreign

exchange and merger and acquisition impacts) is expected to grow

three percent, compared with a previous forecast of two percent

growth.

“Our global teams delivered results above expectations, and we

are seeing improving conditions in certain end markets, giving us

confidence in raising our full-year earnings outlook,” said

Loranger. “We also delivered higher than expected free cash flow,

and our strong financial position enabled us to announce an 18

percent dividend increase in the quarter, while we continued to

advance our cash deployment and portfolio strategy through ITT’s

acquisition of Nova Analytics.

“We believe our strategies to align the portfolio with enduring

human needs, while delivering organic growth and focused execution,

will continue to drive excellent, sustainable growth -- as ITT has

demonstrated this quarter and over the past five years.”

First-Quarter Segment Results

Defense & Information Solutions

- First-quarter 2010 revenue for

the Defense segment was $1.5 billion, down four percent compared to

the year-ago period. Volume declines from strong prior-year results

for tactical radios and counter improvised explosive device units

were partially offset by growth in service contracts, special

purpose jammers and very strong international night vision goggle

revenues.

- Strong productivity in the

segment was more than offset by increased costs related to the

business’ strategic realignment, higher pension costs, and lower

volumes, resulting in an 11 percent decline in operating income to

$146 million.

- Backlog at the end of the

quarter was $5 billion, and significant orders during the quarter

included international night vision goggles, airborne integrated

defensive electronic countermeasures, Saudi Arabia tactical radios

and next generation satellite radios. ITT was also selected by the

U.S. Air Force Space and Missile Systems to provide components and

services for the next generation of the Global Positioning System

(GPS).

Fluid Technology

- First-quarter 2010 Fluid

Technology revenue of $801 million was up eight percent on a

year-over-year basis. Organic revenue was flat, as growth in

residential markets was offset by a decline versus the strong

year-ago period in industrial projects. Organic orders for the

segment were up three percent, largely driven by stabilizing

residential market conditions and strong mining, oil and gas

projects.

- First-quarter segment operating

income was $91 million, up 32 percent from the comparable

prior-year period, driven by exceptional productivity and lower

restructuring and realignment costs.

- Key recent achievements include

an award to create an energy-efficient water system in Chongqing,

China; a full suite of treatment equipment to upgrade a water

reclamation plant in Maryland with ITT’s Flygt, Leopold, WEDECO and

Sanitaire product lines; a desalination award in Saudi Arabia; and

the start-up of the one of the largest dissolved air flotation

water treatment systems in North America. The company also

completed the acquisition of Nova Analytics, establishing a new

growth platform for ITT in the $6 billion analytical

instrumentation market.

Motion & Flow Control

- First-quarter 2010 revenue for

the Motion & Flow Control segment grew 26 percent on a

comparable basis to $387 million. Organic revenue was up 25

percent, driven by the 2009 European auto stimulus programs, share

gains in rail and beverage in emerging markets, restocking in the

marine and connectors markets and recovering industrial markets.

Organic orders were up 32 percent.

- Operating income of $55 million

was up 96 percent, driven by strong productivity, volume and

mix.

- Key business achievements during

the quarter included a locomotive damper order for a rail project

in China, European automotive platform wins, and a five-year fuel

valve award in the aerospace sector. The business also garnered

emerging market share gains in beverage.

Guidance

For the second quarter of 2010, ITT projects adjusted earnings

per share will be flat compared with the year-ago period, in the

range of $1.05 to $1.07. ITT’s new full-year 2010 adjusted earnings

per share guidance range is now $4.05 to $4.20 per share. At the

midpoint, this represents nine percent growth from 2009.

For the full year, ITT revenue is now expected to grow four

percent, compared with prior revenue guidance of three percent

growth. Organic revenue growth for the full year is now forecast at

three percent compared with a prior forecast of two percent.

Based on expected timing of orders and customer fielding plans,

the company projects 2010 Defense & Information Solutions

revenue growth of three percent. Fluid Technology revenue is

expected to grow five percent, from a previously announced forecast

of two percent growth, due to the Nova acquisition. Total revenue

growth guidance for Motion & Flow Control is increased to six

percent from the previous forecast of one percent growth. On an

organic basis, revenue growth of seven percent is now forecast at

Motion & Flow Control compared to the flat prior guidance.

Investor Call Today

ITT's senior management will host a conference call for

investors today at 9:00 a.m. Eastern Daylight Time to review

first-quarter performance and answer questions. The briefing can be

monitored live via webcast at the following address on the

company's Web site: www.itt.com/ir.

About ITT Corporation

ITT Corporation is a high-technology engineering and

manufacturing company operating on all seven continents in three

vital markets: water and fluids management, global defense and

security, and motion and flow control. With a heritage of

innovation, ITT partners with its customers to deliver

extraordinary solutions that create more livable environments,

provide protection and safety and connect our world. Headquartered

in White Plains, N.Y., the company generated 2009 revenue of $10.9

billion. www.itt.com

Safe Harbor Statement

Certain material presented herein includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

(the “Act"). These forward-looking statements include statements

that describe the Company's business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future operating

or financial performance. Whenever used, words such as

"anticipate," "estimate," "expect," "project," "intend," "plan,"

"believe," "target" and other terms of similar meaning are intended

to identify such forward-looking statements. Forward-looking

statements are uncertain and to some extent unpredictable, and

involve known and unknown risks, uncertainties and other important

factors that could cause actual results to differ materially from

those expressed in, or implied from, such forward-looking

statements. Factors that could cause results to differ materially

from those anticipated include: Economic, political and social

conditions in the countries in which we conduct our businesses;

Changes in U.S. or international government defense budgets;

Decline in consumer spending; Sales and revenues mix and pricing

levels; Availability of adequate labor, commodities, supplies and

raw materials; Interest and foreign currency exchange rate

fluctuations and changes in local government regulations;

Competition and industry capacity and production rates; Ability of

third parties, including our commercial partners, counterparties,

financial institutions and insurers, to comply with their

commitments to us; Our ability to borrow or refinance our existing

indebtedness and availability of liquidity sufficient to meet our

needs; Changes in the value of goodwill or intangible assets;

Acquisitions or divestitures; Personal injury claims; Uncertainties

with respect to our estimation of asbestos liability exposure and

related insurance recoveries; Our ability to effect restructuring

and cost reduction programs and realize savings from such actions;

Government regulations and compliance therewith; Changes in

technology; Intellectual property matters; Governmental

investigations; Potential future employee benefit plan

contributions and other employment and pension matters;

Contingencies related to actual or alleged environmental

contamination, claims and concerns; Changes in generally accepted

accounting principles; Other factors set forth in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2009 and our

other filings with the Securities and Exchange Commission.

The Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

ITT CORPORATION AND

SUBSIDIARIES

CONSOLIDATED CONDENSED INCOME

STATEMENTS

(In millions, except per

share)

(Unaudited)

Three Months Ended March 31,

2010 2009

Revenue $

2,636

$

2,557 Costs of revenue 1,908 1,888

Selling, general and administrative expenses 383 383 Research and

development expenses 63 53 Asbestos-related costs, net 15 -

Restructuring and asset impairment charges, net

17 11 Total costs

and expenses 2,386 2,335 Operating income 250 222 Interest

expense 25 26 Interest income 3 4 Miscellaneous expense, net

5 3 Income from

continuing operations before

income tax expense

223

197

Income tax expense

77

10 Income from continuing operations 146 187

Loss from discontinued operations, net of tax

-

(3 ) Net income

$

146 $ 184

Earnings (Loss) Per Share Basic: Continuing

operations $ 0.80 $ 1.02 Discontinued operations

- (0.01 ) Net Income $ 0.80

$ 1.01 Diluted: Continuing operations $ 0.79 $ 1.02 Discontinued

operations

- (0.01 )

Net Income $ 0.79 $ 1.01 Average common shares — basic 183.3

182.0 Average common shares — diluted 184.9 183.2

ITT CORPORATION AND

SUBSIDIARIESCONSOLIDATED CONDENSED BALANCE SHEETS(In

millions)(Unaudited)

March 31, December 31,

2010 2009 Assets Current Assets: Cash

and cash equivalents $

880

$

1,216

Receivables, net 1,853 1,797 Inventories, net 821 802 Deferred

income taxes 235 234 Other current assets (a)

238 207 Total

current assets 4,027 4,256 Plant, property and equipment,

net 1,049 1,051 Deferred income taxes 546 583 Goodwill 4,071 3,864

Other intangible assets, net 664 519 Asbestos-related assets 584

604 Other non-current assets

259

252 Total assets

$

11,200 $ 11,129

Liabilities and Shareholders' Equity Current

Liabilities: Accounts payable $ 1,207 $ 1,291 Accrued expenses (b)

970 1,035 Accrued taxes 93 105 Short-term debt and current

maturities of long-term debt 289 75 Postretirement benefits 73 73

Deferred income taxes

35

37 Total current liabilities 2,667 2,616

Postretirement benefits 1,775 1,788 Long-term debt 1,365 1,431

Asbestos-related liabilities 860 867 Other non-current liabilities

614 549 Total

liabilities 7,281 7,251 Shareholders' equity

3,919 3,878 Total

liabilities and shareholders' equity

$

11,200 $ 11,129

(a) Includes asbestos-related assets of $62 for both

periods presented. (b) Includes asbestos-related liabilities of $66

for both periods presented.

ITT CORPORATION AND

SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended March 31, 2010

2009 Operating Activities

Net income

$

146

$

184

Less: Loss from discontinued operations

-

3 Income from continuing

operations 146 187 Adjustments to income from continuing

operations: Depreciation and amortization 69 66 Stock-based

compensation 8 8 Asbestos-related costs, net 15 - Restructuring and

asset impairment charges, net 17 11 Payments for restructuring (16

) (26 ) Contributions to pension plans (2 ) (5 ) Change in

receivables (68 ) 76 Change in inventories 3 (44 ) Change in

accounts payable and accrued expenses (73 ) (17 ) Change in accrued

and deferred taxes 7 (4 ) Change in other assets (22 ) (46 ) Change

in other liabilities (11 ) (2 ) Other, net

4

9 Net Cash — Operating Activities

77 213

Investing Activities

Capital expenditures

(52

)

(48

)

Acquisitions, net of cash acquired (391 ) (1 ) Proceeds from sale

of assets and businesses 1 10 Other, net

1

2 Net Cash — Investing Activities

(441 )

(37 )

Financing Activities

Short-term debt, net

151

(166

)

Long-term debt repaid (1 ) (3 ) Proceeds from issuance of common

stock 5 2 Dividends paid (85 ) (32 ) Tax impact from equity

compensation activity 1 (1 ) Other, net

5

- Net Cash — Financing Activities

76 (200 )

Exchange rate effects on cash and cash equivalents

(48 )

(30 ) Net change in cash and

cash equivalents (336 ) (54 ) Cash and cash equivalents — beginning

of year

1,216 965

Cash and Cash Equivalents — end of period

$ 880 $

911 Key Performance Indicators

and Non-GAAP Measures Management reviews key performance

metrics including sales and revenues, segment operating income and

margins, earnings per share, orders growth, and backlog, among

others, in connection with its management of our business. In

addition, we consider the following non-GAAP measures to be key

performance indicators for purposes of this REG-G reconciliation:

Organic Sales and Revenues defined as reported GAAP

sales and revenues excluding the impact of foreign currency

fluctuations and contributions from acquisitions and divestitures

(for the first 12 months). The Company believes that Organic Sales

and Revenues provide a useful measure of the operation's underlying

revenue performance after adjusting for foreign exchange,

acquisitions and divestitures that may impact comparability. The

Company utilizes Organic Sales and Revenues to measure, evaluate

and manage the Company's revenue performance. The Company's

definition of Organic Sales and Revenue may not be comparable to

similar measures utilized by other companies.

Organic

Orders are Non-GAAP performance measures that may provide

useful information related to the Company's future revenue

performance. Organic Orders exclude the impact of foreign currency

fluctuations and contributions from acquisitions and divestitures

(for the first 12 months). The Company's definition of Organic

Orders may not be comparable to similar measures utilized by other

companies.

Adjusted Income from Continuing Operations

and

Adjusted EPS are defined as reported GAAP Income from

Continuing Operations and reported GAAP Diluted Earnings Per Share,

adjusted to exclude Special items. Special items that may include,

but are not limited to, unusual and infrequent non-operating items

and non-operating tax settlements or adjustments related to prior

periods. These items are not a substitute for GAAP measures.

Special items represent significant charges or credits that impact

current results, but may not be related to the Company’s ongoing

operations and performance. The Company uses Adjusted Income from

Continuing Operations and Adjusted EPS to measure, evaluate and

manage the Company. The Company believes that results excluding

Special Items provide a useful analysis of ongoing operating

trends. The Company's definitions of Adjusted Income from

Continuing Operations and Adjusted EPS may not be comparable to

similar measures utilized by other companies.

Free Cash

Flow is defined as GAAP Net Cash - Operating Activities less

Capital Expenditures and other Special Items. Free Cash Flow should

not be considered a substitute for income or cash flow data

prepared in accordance with GAAP. The Company's definition of Free

Cash Flow may not be comparable to similar measures utilized by

other companies. Management believes that Free Cash Flow is an

important measure of performance and it is utilized as one measure

of the Company's ability to generate cash. Note that due to other

financial obligations and commitments, the entire Free Cash Flow

amount may not be available for discretionary purposes.

Management believes that the above metrics are useful to investors

evaluating our operating performance for the periods presented, and

provide a tool for evaluating our ongoing operations and our

management of assets held from period to period. These metrics,

however, are not a measure of financial performance under GAAP and

should not be considered a substitute for sales and revenue growth

(decline), or cash flows from operating, investing and financing

activities as determined in accordance with GAAP and may not be

comparable to similarly titled measures reported by other

companies.

ITT Corporation Non-GAAP

Reconciliation Reported vs. Organic Revenue / Order

Growth First Quarter 2010 & 2009

($ Millions)

(As Reported -

GAAP) (As Adjusted - Organic) (A) (B) (C) (D) (E)

= B+C+D (F) = E / A

Revenue3M 2010

Revenue3M 2009

Change2010 vs. 2009

% Change2010 vs. 2009

Acquisition /Divestitures3M

2010

FX Contribution3M 2010

ChangeAdj. 10 vs. 09

% ChangeAdj. 10 vs. 09 ITT Corporation - Consolidated

2,636 2,557 79 3.1% (13) (50) 16 0.6% Defense &

Information Solutions 1,450 1,508 (58) -3.8% 0 0 (58) -3.8%

Electronic Systems 508 676 (168) -24.9% 0 0 (168) -24.9% Geospatial

Systems 297 275 22 8.0% 0 0 22 8.0% Information Systems 651 575 76

13.2% 0 0 76 13.2% Fluid Technology 801 744 57 7.7% (16)

(42) (1) -0.1% Water & WasteWater 378 344 34 9.9% (4) (32) (2)

-0.6% Residential and Commercial Water Group 267 238 29 12.2% (12)

(6) 11 4.6% Industrial Process 172 184 (12) -6.5% 0 (5) (17) -9.2%

Motion & Flow Control 387 306 81 26.5% 3 (8) 76 24.8%

Motion Technologies 169 113 56 49.6% 0 (5) 51 45.1% Interconnect

Solutions 98 87 11 12.6% 0 (2) 9 10.3% Control Technologies 66 64 2

3.1% 1 0 3 4.7% Flow Control 54 43 11 25.6% 2 (1) 12 27.9%

Orders3M 2010

Orders3M 2009

Change2010 vs. 2009

% Change2010 vs. 2009

AcquisitionContribution3M 2010

FX Contribution3M 2010 ChangeAdj. 10 vs. 09 % ChangeAdj. 10 vs. 09

Defense & Information Solutions 1,256 1,504 (248) -16.5%

0 0 (248) -16.5% Fluid Technology 890 802 88 11.0% (17) (47)

24 3.0% Motion & Flow Control 374 281 93 33.1% 3 (6) 90

32.0% Total Segment Orders 2,518 2,586 (68) -2.6% (14) (53)

(135) -5.2% Note: Excludes intercompany eliminations.

ITT Corporation Segment Operating Income & OI

Margin First Quarter of 2010 & 2009

($ Millions)

Q1 2010

Q1 2009

%

Change 10 vs.

As Reported As Reported

09

Revenue: Defense & Information Solutions 1,450

1,508 -3.8 % Fluid Technology 801 744 7.7 % Motion & Flow

Control 387 306 26.5 % Intersegment eliminations (2 ) (1 ) 100.0 %

Total Revenue 2,636 2,557 3.1 %

Operating

Margin: Defense & Information Solutions 10.1 % 10.9 % (80 )

BP Fluid Technology 11.4 % 9.3 % 210 BP Motion & Flow Control

14.2 % 9.2 % 500 BP Total Operating Segments 11.1 % 10.2 %

90 BP

Income: Defense & Information

Solutions 146 164 -11.0 % Fluid Technology 91 69 31.9 % Motion

& Flow Control 55 28 96.4 % Total Segment

Operating Income 292 261 11.9 %

ITT

Corporation Non-GAAP Reconciliation Reported vs. Adjusted

Income from Continuing Operations & Adjusted EPS First

Quarter of 2010 & 2009

($ Millions, except EPS and shares)

Q1 2010As Reported

Q1 2010Adjustments Q1 2010As Adjusted Q1 2009As Reported Q1

2009Adjustments Q1 2009As Adjusted Change2010 vs. 2009As Adjusted

Percent Change2010 vs. 2009As Adjusted

Segment Operating Income 292 292

261 261 Interest Income

(Expense) (22 ) (1 )

#A

(23 ) (22 ) (22 ) Other Income (Expense) (5 ) (5 ) (3 ) (3 )

Corporate (Expense) (42 ) (42 ) (39 ) (39 )

Income from Continuing

Operations before Tax 223 (1 ) 222 197

197 Income

Tax Expense (77 ) 11

#B

(66 ) (10 ) (54 )

#C

(64 ) Income from

Continuing Operations 146 10 156 187

(54 ) 133

Diluted EPS from Continuing Operations 0.79 0.05 0.84

1.02 (0.30 ) 0.72

$0.12

16.7 % #A - Interest refund related to prior year tax

settlement. #B - Primarily related to a reduction of deferred tax

assets associated with the U.S. Patient Protection and Affordable

Care Act (the Healthcare Reform Act). #C - Primarily the reversal

of a deferred tax liability no longer required as a result of the

restructuring of certain international legal entities.

ITT Corporation Non-GAAP Reconciliation Net Cash -

Operating Activities vs. Free Cash Flow First Quarter of

2010 & 2009

($ Millions)

3M 2010 3M 2009

Net Cash - Operating

Activities 77 213 Capital Expenditures

(52) (48)

Free Cash Flow 25 165

Income from Continuing Operations 146 187

Free Cash Flow Conversion 17% 88%

Non-Cash Special Tax Items 11 (58) Income from

Continuing Operations, ExcludingNon-Cash Special Tax Items

157 129 Adjusted Free Cash Flow

Conversion 16% 128% ITT

Corporation Debt Coverage Ratios 2010 & 2009 ($

Millions) March 30, 2010

December 30, 2009 Net Debt/Net Capitalization 16.5 %

7.0 % Total Debt/Total Capitalization 29.7 % 28.0 %

Short Term Debt 289 75 Long Term Debt 1,365 1,431

Total Debt 1,654 1,506 Cash & Cash equivalents 880 1,216

Net Debt 774 290 Total Shareholders' Equity

3,919 3,878 Net Debt 774 290 Net Capitalization 4,693

4,168

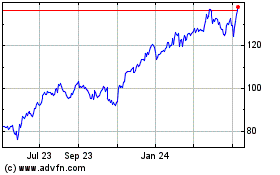

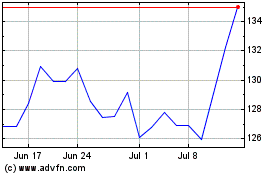

ITT (NYSE:ITT)

Historical Stock Chart

From May 2024 to Jun 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2023 to Jun 2024