SoftBank to Make $900 Million Investment in Pacific Biosciences

February 09 2021 - 9:07PM

Dow Jones News

By Maureen Farrell

SoftBank Group Corp. plans to put $900 million into red-hot

gene-sequencing company Pacific Biosciences of California Inc., as

the Japanese technology conglomerate ramps up a new public-equity

investing effort.

PacBio, as it is known, produces next-generation DNA-sequencing

systems used to research diseases and develop treatments. The

investment, in the form of convertible debt, is designed to help

accelerate the commercialization of the company's technology,

SoftBank and PacBio plan to announce Wednesday.

It comes on top of a roughly 6% stake in PacBio that SoftBank

had already accumulated and will give the Japanese investor

significant sway over the Menlo Park, Calif., company.

PacBio has a market value of $7.4 billion after a dramatic jump

in its shares in recent months that was sparked in part by a new

joint venture with Invitae Corp., a medical-genetics company.

PacBio, whose shares are up 11-fold since July, has also brought in

new management, including a chief executive.

SoftBank, best known lately for making big investments in

private technology companies out of a $100 billion fund, has been

retooling, selling off large holdings and buying back stock. It has

also increased its focus on publicly traded companies. The PacBio

investment will be made through SoftBank's recently established

asset-management arm, SB Northstar, which invests in listed tech

companies.

The unit has recently made bets on companies including Kahoot, a

Norwegian online-educational-game platform, and Sinch, a Swedish

firm that helps companies communicate with customers using

cloud-based tools. Both are up since SoftBank invested.

SoftBank just announced a record-breaking quarter for the $100

billion Vision Fund and a net profit overall equivalent to about

$11 billion.

SB Northstar posted an investment loss of almost $1.6 billion,

but SoftBank Chief Executive Masayoshi Son said on an investor call

that it was notching gains now. The unit, in which Mr. Son has a

one-third stake, made waves last year when it placed a big bet that

the stock prices of some large tech companies would go up.

The PacBio investment is part of SoftBank's plan to build up its

portfolio of biotech and life-sciences companies, people familiar

with the strategy said. SoftBank has recently invested in the

initial public offerings of six U.S. life-sciences companies, these

people said.

Roughly a year ago, PacBio's larger competitor Illumina Inc.

called off plans to acquire the company in a $1.2 billion deal that

was announced in November 2018. Illumina said it was backing away

following challenges from the Federal Trade Commission.

Illumina paid PacBio a $98 million breakup fee. But under their

arrangement, if PacBio raised more than $100 million subsequently,

it would owe Illumina $52 million. PacBio will now have to pay that

sum.

"We believe that PacBio's [technology] will be the de facto

standard tool for population genomics, fundamentally altering the

practice of health care," said Akshay Naheta, CEO of SB Management,

which runs the Northstar portfolio.

It will also enable PacBio to lower the price tag for its

systems, which is expected to lead to more rapid deployment,

PacBio's recently named CEO, Christian Henry, said in an interview.

He called the SoftBank investment a "transformational

transaction."

Write to Maureen Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

February 09, 2021 20:52 ET (01:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

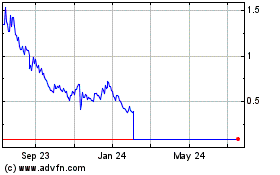

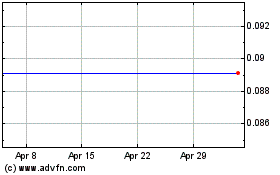

Invitae (NYSE:NVTA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Invitae (NYSE:NVTA)

Historical Stock Chart

From Jul 2023 to Jul 2024