UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 7, 2024

Healthpeak

Properties, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Maryland |

001-08895 |

33-0091377 |

(State or other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

4600 South Syracuse Street, Suite 500

Denver, CO 80237

(Address of principal executive offices)

(Zip Code)

(720) 428-5050

(Registrant’s telephone number,

including area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which

registered |

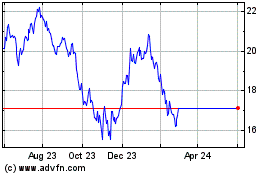

| Common stock, $1.00 par value |

PEAK |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

As previously disclosed, on

October 29, 2023, Healthpeak Properties, Inc. (“Healthpeak”) entered into an Agreement and Plan of Merger (the “Merger

Agreement”) by and among Healthpeak, DOC DR Holdco, LLC (formerly known as Alpine Sub, LLC), a wholly owned subsidiary of Healthpeak,

DOC DR, LLC (formerly known as Alpine OP Sub, LLC), a wholly owned subsidiary of Healthpeak OP, LLC (“Healthpeak OP”), Physicians

Realty Trust (“Physicians Realty Trust”), and Physicians Realty L.P. (the “Physicians Partnership”), pursuant

to which, among other things, and through a series of transactions, (i) each outstanding common share of Physicians Realty Trust (other

than Physicians Realty Trust common shares to be cancelled in accordance with the Merger Agreement), will be converted into the right

to receive 0.674 shares of Healthpeak common stock, and (ii) each outstanding common unit of the Physicians Partnership will be converted

into common units in the successor entity to the Physicians Partnership equal to the same exchange ratio. Following the transactions contemplated

in the Merger Agreement, the successor entities to Physicians Realty Trust and the Physicians Partnership will be direct and indirect

subsidiaries of Healthpeak OP, respectively. Consummation of the transactions contemplated by the Merger Agreement are subject to the

satisfaction or waiver of customary closing conditions, including the approval of the stockholders of Healthpeak and the shareholders

of Physicians Realty Trust.

On February 7, 2024, Physicians Realty Trust disclosed preliminary estimates of certain consolidated financial data for the three months

and year ended December 31, 2023. Such disclosure is filed as Exhibit 99.1 hereto and is incorporated by reference herein.

Forward-Looking Statements

This Current Report may include

“forward-looking statements,” including but not limited to those regarding the proposed transactions between Healthpeak and

Physicians Realty Trust, within the meaning of the Private Securities Litigation Reform Act. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements,

which are based on current expectations, estimates and projections about the industry and markets in which Healthpeak and Physicians Realty

Trust operate and beliefs of and assumptions made by Healthpeak management and Physicians Realty Trust management, involve uncertainties

that could significantly affect the financial or operating results of Healthpeak, Physicians Realty Trust or the combined company. Words

such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “predicts,” “projects,” “forecasts,” “will,” “may,”

“potential,” “can,” “could,” “should,” “pro forma,” and variations of such

words and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, but are

not limited to, statements about the benefits of the proposed transactions involving Healthpeak and Physicians Realty Trust, including

future acquisitions, dispositions, financing activity, financial and operating results, plans, objectives, expectations and intentions.

All statements that address operating performance, events or developments that Healthpeak and Physicians Realty Trust expects or anticipates

will occur in the future — including statements relating to creating value for shareholders or stockholders, as applicable, benefits

of the proposed transactions to clients, tenants, employees, shareholders or stockholders, as applicable, and other constituents of the

combined company, integrating the companies, cost savings and the expected timetable for completing the proposed transactions —

are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Although Healthpeak and Physicians Realty Trust believe the expectations reflected in any forward-looking

statements are based on reasonable assumptions, Healthpeak and Physicians Realty Trust can give no assurance that its expectations will

be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking

statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated

with the ability to consummate the proposed merger and the timing of the closing of the proposed merger; securing the necessary shareholder

and stockholder approvals and satisfaction of other closing conditions to consummate the proposed merger; the occurrence of any event,

change or other circumstance that could give rise to the termination of the merger agreement relating to the proposed transactions; the

ability to secure favorable interest rates on any borrowings incurred in connection with the proposed transactions; the impact of indebtedness

incurred in connection with the proposed transactions; the ability to successfully integrate portfolios, business operations, including

properties, tenants, property managers and employees; the ability to realize anticipated benefits and synergies of the proposed transactions

as rapidly or to the extent anticipated by financial analysts or investors; potential liability for a failure to meet regulatory or tax-related

requirements, including the maintenance of REIT status; material changes in the dividend rates on securities or the ability to pay dividends

on common shares or other securities; potential changes to tax legislation; changes in demand for developed properties; adverse changes

in the financial condition of joint venture partner(s) or major tenants; risks associated with the acquisition, development, expansion,

leasing and management of properties; risks associated with the geographic concentration of Healthpeak or Physicians Realty Trust; risks

associated with the industry concentration of tenants; the potential impact of announcement of the proposed transactions or consummation

of the proposed transactions on business relationships, including with clients, tenants, property managers, customers, employees and competitors;

risks related to diverting the attention of Healthpeak’s and Physicians Realty Trust’s management from ongoing business operations;

unfavorable outcomes of any legal proceedings that have been or may be instituted against Healthpeak or Physicians Realty Trust; costs

related to uninsured losses, condemnation, or environmental issues, including risks of natural disasters; the ability to retain key personnel;

costs, fees, expenses and charges related to the proposed transactions and the actual terms of the financings that may be obtained in

connection with the proposed transactions; changes in local, national and international financial markets, insurance rates and interest

rates; general adverse economic and local real estate conditions; risks related to the market value of shares of Healthpeak common stock

to be issued in the transaction; the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency

or a general downturn in their business; foreign currency exchange rates; increases in operating costs and real estate taxes; changes

in dividend policy or ability to pay dividends for Healthpeak or Physicians Realty Trust common shares; impairment charges; unanticipated

changes in Healthpeak’s or Physicians Realty Trust’s intention or ability to prepay certain debt prior to maturity and/or

hold certain securities until maturity; pandemics or other health crises, such as coronavirus (COVID-19); and those additional risks and

factors discussed in reports filed with the SEC by Healthpeak and Physicians Realty Trust. Moreover, other risks and uncertainties of

which Healthpeak or Physicians Realty Trust are not currently aware may also affect each of the companies’ forward-looking statements

and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made

in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they

are subsequently made available by Healthpeak or Physicians Realty Trust on their respective websites or otherwise. Neither Healthpeak

nor Physicians Realty Trust undertakes any obligation to update or supplement any forward-looking statements to reflect actual results,

new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking

statements were made.

Item 9.01. Financial Statements

and Exhibits.

| (a) | Financial statements of businesses acquired. |

The unaudited consolidated interim

financial statements of Physicians Realty Trust as of September 30, 2023 and for the three and nine months ended September 30, 2023 and

2022 are filed as Exhibit 99.2 hereto. The audited consolidated financial statements of Physicians Realty Trust as of and for the years

ended December 31, 2022, 2021 and 2020 are filed as Exhibit 99.3 hereto. The information in Exhibits 99.2 and 99.3 was provided by Physicians Realty Trust.

| (b) | Pro Forma Financial Information. |

The unaudited pro forma condensed combined balance

sheet as of September 30, 2023 and the unaudited pro forma condensed combined statements of operations for the nine months ended September

30, 2023 and the year ended December 31, 2022 of Healthpeak are filed as Exhibit 99.4 hereto. Such unaudited pro forma condensed combined financial statements have been prepared on the basis of certain assumptions and estimates

as of the dates set forth therein. Such unaudited pro forma condensed combined

financial statements are not necessarily indicative of the financial position that actually would have existed or the operating results

that actually would have been achieved if the adjustments set forth therein had been in effect as of the dates and for the periods indicated

or that may be achieved in future periods and should be read in conjunction with the historical financial statements of Healthpeak and

Physicians Realty Trust.

(d) Exhibits.

ADDITIONAL INFORMATION AND

WHERE TO FIND IT

In connection with the proposed

transaction, on December 15, 2023, Healthpeak and Physicians Realty Trust filed with the SEC a registration statement on Form S-4 containing

a joint proxy statement/prospectus and other documents regarding the proposed transaction. The joint proxy statement/prospectus contains

important information about the proposed transaction and related matters. The Form S-4 was declared effective, and each of Healthpeak

and Physicians Realty Trust commenced mailing of the joint proxy statement/prospectus included as part of the Form S-4, on January 11,

2024.

STOCKHOLDERS ARE URGED AND ADVISED

TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT HEALTHPEAK, PHYSICIANS REALTY TRUST AND THE PROPOSED TRANSACTION.

Investors and security holders

of Healthpeak and Physicians Realty Trust are able to obtain free copies of the registration statement, the joint proxy statement/prospectus

and other relevant documents filed by Healthpeak and Physicians Realty Trust with the SEC through the website maintained by the SEC at

www.sec.gov. Copies of the documents filed by Healthpeak with the SEC are also available on Healthpeak’s website at www.healthpeak.com,

and copies of the documents filed by Physicians Realty Trust with the SEC are available on Physicians Realty Trust’s website at

www.docreit.com.

PARTICIPANTS IN THE SOLICITATION

Healthpeak, Physicians Realty

Trust and their respective directors, trustees and executive officers may be deemed to be participants in the solicitation of proxies

from Healthpeak’s stockholders and Physicians Realty Trust’s shareholders in respect of the proposed transaction. Information

regarding Healthpeak’s directors and executive officers can be found in Healthpeak’s definitive proxy statement filed with

the SEC on March 17, 2023. Information regarding Physicians Realty Trust’s trustees and executive officers can be found in Physicians

Realty Trust’s definitive proxy statement filed with the SEC on March 23, 2023.

Additional information regarding

the interests of such potential participants is included in the joint proxy statement/prospectus and other relevant documents filed with

the SEC in connection with the proposed transaction. These documents are available on the SEC’s website and from Healthpeak and

Physicians Realty Trust, as applicable, using the sources indicated above.

NO OFFER OR SOLICITATION

This communication is for informational

purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote

in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: February 7, 2024

| |

Healthpeak Properties, Inc. |

| |

|

| |

By: |

/s/ Peter A. Scott |

| |

|

Peter A. Scott |

| |

|

Chief Financial Officer |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in the following Registration

Statements of Healthpeak Properties, Inc.:

| · | Form S-4, File No. 333-276055, as amended, related to the issuance of common shares of Healthpeak Properties, Inc.

in connection with the proposed merger with Physicians Realty Trust, |

| · | Form S-8, File No. 333-271514, related to the Healthpeak Properties, Inc. 2023 Performance Incentive Plan, |

| · | Form S-3ASR, File No. 333-269718, related to the unlimited shelf registration of common stock, preferred stock, depositary

shares, warrants, debt securities and guarantees of Healthpeak Properties, Inc. and debt securities and guarantees of Healthpeak

OP, LLC, and |

| · | Form S-8 POS, File No. 333-195735, related to securities to be offered to employees under the Healthpeak Properties, Inc.

2014 Performance Incentive Plan, as amended and restated, |

of our reports dated February 24, 2023, relating to the consolidated

financial statements and schedules of Physicians Realty Trust and the effectiveness of Physicians Realty Trust’s internal control

over financial reporting, appearing in this Current Report on Form 8-K of Healthpeak Properties, Inc.

/s/ Ernst & Young LLP

Milwaukee, Wisconsin

February 7, 2024

Exhibit 99.1

On February 7, 2024, Physicians Realty Trust (“we,”

“us,” “our,” the “Company” or “Physicians Realty Trust”), disclosed preliminary estimates

of certain consolidated financial data of Company for the three months and year ended December 31, 2023.

Preliminary Estimates for the Fourth Quarter and Full Year Ended

December 31, 2023

Set forth below are preliminary estimates of certain consolidated financial

data of the Company for the three months and year ended December 31, 2023. We have provided ranges, rather than specific amounts,

for these preliminary estimates, as our actual consolidated financial results remain subject to completion of our annual audit procedures

for the year ended December 31, 2023, which have commenced but are not yet completed. Our actual consolidated financial results for

the three months and year ended December 31, 2023 are expected to be reported in connection with the filing of our Annual Report

on Form 10-K for the year ended December 31, 2023 on February 22, 2024. Our actual consolidated financial results for the

three months and year ended December 31, 2023 may differ materially from these preliminary estimates, including as a result of audit

adjustments and other developments that may arise between now and the time our actual consolidated financial results for the three months

and year ended December 31, 2023 are finalized and reported. Moreover, these preliminary estimates should not be viewed as a substitute

for audited consolidated financial statements and related notes as of and for the year ended December 31, 2023 prepared in accordance

with Generally Accepted Accounting Principles (“GAAP”). Accordingly, you should not place undue reliance on these preliminary

estimates.

| | |

Three Months Ended

December 31, 2023 | | |

Year Ended

December 31, 2023 | |

| (Unaudited, subject to change) | |

Low | | |

High | | |

Low | | |

High | |

| Net income ($1,000s) | |

$ | 4,000 | | |

$ | 11,000 | | |

$ | 40,645 | | |

$ | 47,645 | |

| Earnings per share, diluted | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.16 | | |

$ | 0.19 | |

| FFO per common share, diluted | |

$ | 0.22 | | |

$ | 0.24 | | |

$ | 0.96 | | |

$ | 0.98 | |

| Normalized FFO per common share, diluted | |

$ | 0.25 | | |

$ | 0.27 | | |

$ | 0.98 | | |

$ | 1.00 | |

These preliminary estimates have been prepared by, and are the responsibility

of, our management. Our independent registered public accounting firm, Ernst & Young LLP, has not audited, reviewed, compiled

or applied agreed-upon procedures with respect to these preliminary estimates. Accordingly, our independent registered public accounting

firm does not express an opinion or any other form of assurance with respect thereto.

Non-GAAP Financial Measures

This Current Report on Form 8-K includes Funds From Operations

(“FFO”) and Normalized FFO which are non-GAAP financial measures. For purposes of the Securities and Exchange Commission's

(“SEC”) Regulation G, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial

performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts,

that are included in the most directly comparable financial measure calculated and presented in accordance with GAAP in the statement

of operations, balance sheet or statement of cash flows (or equivalent statements) of the Company, or includes amounts, or is subject

to adjustments that have the effect of including amounts, that are excluded from the most directly comparable financial measure so calculated

and presented. As used in this Current Report on Form 8-K, GAAP refers to generally accepted accounting principles in the United

States of America. Pursuant to the requirements of Regulation G, we have provided reconciliations of the non-GAAP financial measures to

the most directly comparable GAAP financial measures.

Funds

From Operations (“FFO”). Funds from operations, or “FFO”, is a widely recognized measure of REIT

performance. We believe that information regarding FFO is helpful to shareholders and potential investors because it facilitates an understanding

of the operating performance of our properties without giving effect to real estate depreciation and amortization, which assumes that

the value of real estate assets diminishes ratably over time. We calculate FFO in accordance with standards established by the National

Association of Real Estate Investment Trusts (“Nareit”). Nareit defines FFO as net income or loss (computed in accordance

with GAAP) before noncontrolling interests of holders of operating partnership units, excluding preferred distributions, gains (or losses)

on sales of depreciable operating property, impairment write-downs on depreciable assets, plus real estate related depreciation and amortization

(excluding amortization of deferred financing costs). Our FFO computation includes our share of required adjustments from our unconsolidated

joint ventures and may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with the Nareit definition

or that interpret the Nareit definition differently than we do. The GAAP measure that we believe to be most directly comparable to FFO,

net income, includes depreciation and amortization expenses, gains or losses on property sales, impairments, and noncontrolling interests.

In computing FFO, we eliminate these items because, in our view, they are not indicative of the results from the operations of our properties.

To facilitate a clear understanding of our historical operating results, FFO should be examined in conjunction with net income (determined

in accordance with GAAP) as presented in our financial statements. FFO does not represent cash generated from operating activities in

accordance with GAAP, should not be considered to be an alternative to net income or loss (determined in accordance with GAAP) as a measure

of our liquidity and is not indicative of funds available for our cash needs, including our ability to make cash distributions to shareholders.

Normalized

Funds From Operations (“Normalized FFO”). Changes in the accounting and reporting rules under GAAP have

prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, we use Normalized FFO, which

excludes from FFO net change in fair value of derivative financial instruments, acceleration of deferred financing costs, net change in

fair value of contingent consideration, gain on extinguishment of debt, merger and transaction related expenses, and other normalizing

items. Our Normalized FFO computation includes our share of required adjustments from our unconsolidated joint ventures and our use of

the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing

this amount. Normalized FFO should not be considered as an alternative to net income or loss (computed in accordance with GAAP), as an

indicator of our financial performance or of cash flow from operating activities (computed in accordance with GAAP), or as an indicator

of our liquidity, nor is it indicative of funds available to fund our cash needs, including its ability to make distributions. Normalized

FFO should be reviewed in connection with other GAAP measurements.

Physicians Realty Trust

Reconciliation of Non-GAAP Measures

(in thousands, except share and per share

data)

(unaudited)

| | |

Three Months Ended

December 31, 2023

(Preliminary) | | |

Year Ended

December 31, 2023

(Preliminary) | |

| | |

Low | | |

High | | |

Low | | |

High | |

| Net income | |

$ | 4,000 | | |

$ | 11,000 | | |

$ | 40,645 | | |

$ | 47,645 | |

| Earnings per share - diluted | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.16 | | |

$ | 0.19 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 4,000 | | |

$ | 11,000 | | |

$ | 40,645 | | |

$ | 47,645 | |

| Net income attributable to noncontrolling interests - partially owned properties | |

| (44 | ) | |

| (54 | ) | |

| (165 | ) | |

| (175 | ) |

| Depreciation and amortization expense | |

| 47,750 | | |

| 47,250 | | |

| 190,987 | | |

| 190,487 | |

| Depreciation and amortization expense - partially owned properties | |

| (112 | ) | |

| (137 | ) | |

| (522 | ) | |

| (547 | ) |

| Gain on the sale of investment properties, net | |

| — | | |

| — | | |

| (13 | ) | |

| (13 | ) |

| Proportionate share of unconsolidated joint venture adjustments | |

| 2,300 | | |

| 2,200 | | |

| 7,299 | | |

| 7,199 | |

| FFO applicable to common shares | |

$ | 53,894 | | |

$ | 60,259 | | |

$ | 238,231 | | |

$ | 244,596 | |

| Net change in fair value of derivative | |

| 516 | | |

| 426 | | |

| 701 | | |

| 611 | |

| Merger and transaction-related expense (1) | |

| 8,400 | | |

| 6,500 | | |

| 8,400 | | |

| 6,500 | |

| Gain on extinguishment of debt | |

| — | | |

| — | | |

| (1,763 | ) | |

| (1,763 | ) |

| Normalized FFO applicable to common shares | |

$ | 62,810 | | |

$ | 67,185 | | |

$ | 245,569 | | |

$ | 249,944 | |

| | |

| | | |

| | | |

| | | |

| | |

| FFO per common share - diluted | |

$ | 0.22 | | |

$ | 0.24 | | |

$ | 0.96 | | |

$ | 0.98 | |

| Normalized FFO per common share - diluted | |

$ | 0.25 | | |

$ | 0.27 | | |

$ | 0.98 | | |

$ | 1.00 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - diluted | |

| 249,642,987 | | |

| 249,642,987 | | |

| 249,344,713 | | |

| 249,344,713 | |

| (1) | During the year ended December 31, 2023, the Company

recorded merger and transaction-related expense related to the proposed merger with Healthpeak Properties, Inc. (“Healthpeak”),

which are primarily comprised of legal, accounting, tax, and other costs incurred prior to year-end. |

Forward-Looking Statements

This Current Report on Form 8-K may include “forward-looking

statements,” including but not limited to those regarding the proposed transactions between Physicians Realty Trust and Healthpeak

within the meaning of the Private Securities Litigation Reform Act. All statements other than statements of historical fact are “forward-looking

statements” for purposes of federal and state securities laws. These forward-looking statements, which are based on current expectations,

estimates and projections about the industry and markets in which Healthpeak and Physicians Realty Trust operate and beliefs of and assumptions

made by Healthpeak management and Physicians Realty Trust management, involve uncertainties that could significantly affect the financial

or operating results of Healthpeak, Physicians Realty Trust or the combined company. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,”

“projects,” “forecasts,” “will,” “may,” “potential,” “can,” “could,”

“should,” “pro forma,” and variations of such words and similar expressions are intended to identify such forward-looking

statements. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed transactions

involving Healthpeak and Physicians Realty Trust, including future financial and operating results, plans, objectives, expectations and

intentions. All statements that address operating performance, events or developments that Healthpeak and Physicians Realty Trust expects

or anticipates will occur in the future — including statements relating to creating value for shareholders, benefits of the proposed

transactions to clients, tenants, employees, shareholders and other constituents of the combined company, integrating the companies, cost

savings and the expected timetable for completing the proposed transactions — are forward-looking statements. These statements are

not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although

Healthpeak and Physicians Realty Trust believe the expectations reflected in any forward-looking statements are based on reasonable assumptions,

Healthpeak and Physicians Realty Trust can give no assurance that its expectations will be attained and, therefore, actual outcomes and

results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking

statements could be affected by factors including, without limitation, risks associated with the ability to consummate the proposed merger

and the timing of the closing of the proposed merger; securing the necessary shareholder approvals and satisfaction of other closing conditions

to consummate the proposed merger; the occurrence of any event, change or other circumstance that could give rise to the termination of

the merger agreement relating to the proposed transactions; the ability to secure favorable interest rates on any borrowings incurred

in connection with the proposed transactions; the impact of indebtedness incurred in connection with the proposed transactions; the ability

to successfully integrate portfolios, business operations, including properties, tenants, property managers and employees; the ability

to realize anticipated benefits and synergies of the proposed transactions as rapidly or to the extent anticipated by financial analysts

or investors; potential liability for a failure to meet regulatory or tax-related requirements, including the maintenance of REIT status;

material changes in the dividend rates on securities or the ability to pay dividends on common shares or other securities; potential changes

to tax legislation; changes in demand for developed properties; adverse changes in the financial condition of joint venture partner(s) or

major tenants; risks associated with the acquisition, development, expansion, leasing and management of properties; risks associated with

the geographic concentration of Healthpeak or Physicians Realty Trust; risks associated with the industry concentration of tenants; the

potential impact of the announcement of the proposed transactions or consummation of the proposed transactions on business relationships,

including with clients, tenants, property managers, customers, employees and competitors; risks related to diverting the attention of

Healthpeak’s and Physicians Realty Trust’s management from ongoing business operations; unfavorable outcomes of any legal

proceedings that have been or may be instituted against Healthpeak or Physicians Realty Trust; costs related to uninsured losses, condemnation,

or environmental issues, including risks of natural disasters; the ability to retain key personnel; costs, fees, expenses and charges

related to the proposed transactions and the actual terms of the financings that may be obtained in connection with the proposed transactions;

changes in local, national and international financial markets, insurance rates and interest rates; general adverse economic and local

real estate conditions; risks related to the market value of shares of Healthpeak common stock to be issued in the transaction; the inability

of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; foreign

currency exchange rates; increases in operating costs and real estate taxes; changes in dividend policy or ability to pay dividends for

Healthpeak or Physicians Realty Trust common shares; impairment charges; unanticipated changes in Healthpeak’s or Physicians Realty

Trust’s intention or ability to prepay certain debt prior to maturity and/or hold certain securities until maturity; pandemics or

other health crises, such as coronavirus (COVID-19); and those additional risks and factors discussed in reports filed with the SEC by

Healthpeak and Physicians Realty Trust. Moreover, other risks and uncertainties of which Healthpeak or Physicians Realty Trust are not

currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of

events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the

date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by Healthpeak

or Physicians Realty Trust on their respective websites or otherwise. Neither Healthpeak nor Physicians Realty Trust undertakes any obligation

to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations

or other circumstances that exist after the date as of which the forward-looking statements were made.

Exhibit 99.2

Physicians

Realty Trust

Consolidated

Balance Sheets

(In

thousands, except share and per share data)

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Investment

properties: | |

| | | |

| | |

| Land

and improvements | |

$ | 249,468 | | |

$ | 241,559 | |

| Building

and improvements | |

| 4,703,606 | | |

| 4,659,780 | |

| Construction

in progress | |

| 41,722 | | |

| 18,497 | |

| Tenant

improvements | |

| 95,447 | | |

| 88,640 | |

| Acquired

lease intangibles | |

| 509,468 | | |

| 505,335 | |

| | |

| 5,599,711 | | |

| 5,513,811 | |

| Accumulated

depreciation | |

| (1,140,208 | ) | |

| (996,888 | ) |

| Net

real estate property | |

| 4,459,503 | | |

| 4,516,923 | |

| Right-of-use

lease assets, net | |

| 227,967 | | |

| 231,225 | |

| Real

estate loans receivable, net | |

| 79,883 | | |

| 104,973 | |

| Investments

in unconsolidated entities | |

| 72,069 | | |

| 77,716 | |

| Net

real estate investments | |

| 4,839,422 | | |

| 4,930,837 | |

| Cash

and cash equivalents | |

| 195,772 | | |

| 7,730 | |

| Tenant

receivables, net | |

| 11,131 | | |

| 11,503 | |

| Other

assets | |

| 166,142 | | |

| 146,807 | |

| Total

assets | |

$ | 5,212,467 | | |

$ | 5,096,877 | |

| LIABILITIES

AND EQUITY | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Credit

facility | |

$ | 393,090 | | |

$ | 188,328 | |

| Notes

payable | |

| 1,451,536 | | |

| 1,465,437 | |

| Mortgage

debt | |

| 127,630 | | |

| 164,352 | |

| Accounts

payable | |

| 4,933 | | |

| 4,391 | |

| Dividends

and distributions payable | |

| 60,928 | | |

| 60,148 | |

| Accrued

expenses and other liabilities | |

| 95,637 | | |

| 87,720 | |

| Lease

liabilities | |

| 104,802 | | |

| 105,011 | |

| Acquired

lease intangibles, net | |

| 23,170 | | |

| 24,381 | |

| Total

liabilities | |

| 2,261,726 | | |

| 2,099,768 | |

| | |

| | | |

| | |

| Redeemable

noncontrolling interests - partially owned properties | |

| 3,066 | | |

| 3,258 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Common

shares, $0.01 par value, 500,000,000 common shares authorized, 238,482,769 and 233,292,030 common

shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 2,385 | | |

| 2,333 | |

| Additional

paid-in capital | |

| 3,817,545 | | |

| 3,743,876 | |

| Accumulated

deficit | |

| (1,012,869 | ) | |

| (881,672 | ) |

| Accumulated

other comprehensive income | |

| 15,216 | | |

| 5,183 | |

| Total

shareholders’ equity | |

| 2,822,277 | | |

| 2,869,720 | |

| Noncontrolling

interests: | |

| | | |

| | |

| Operating

Partnership | |

| 116,079 | | |

| 123,015 | |

| Partially

owned properties | |

| 9,319 | | |

| 1,116 | |

| Total

noncontrolling interests | |

| 125,398 | | |

| 124,131 | |

| Total

equity | |

| 2,947,675 | | |

| 2,993,851 | |

| Total

liabilities and equity | |

$ | 5,212,467 | | |

$ | 5,096,877 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Consolidated

Statements of Income

(In

thousands, except share and per share data) (Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Rental

and related revenues | |

$ | 134,520 | | |

$ | 128,636 | | |

$ | 397,096 | | |

$ | 385,755 | |

| Interest

income on real estate loans and other | |

| 4,027 | | |

| 2,877 | | |

| 10,895 | | |

| 8,315 | |

| Total

revenues | |

| 138,547 | | |

| 131,513 | | |

| 407,991 | | |

| 394,070 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| 20,050 | | |

| 18,299 | | |

| 59,837 | | |

| 52,356 | |

| General

and administrative | |

| 9,771 | | |

| 10,079 | | |

| 31,133 | | |

| 30,400 | |

| Operating

expenses | |

| 47,625 | | |

| 43,647 | | |

| 138,094 | | |

| 128,080 | |

| Depreciation

and amortization | |

| 47,932 | | |

| 47,040 | | |

| 143,555 | | |

| 142,002 | |

| Total

expenses | |

| 125,378 | | |

| 119,065 | | |

| 372,619 | | |

| 352,838 | |

| Income

before equity in (loss) gain of unconsolidated entities and gain on sale of investment properties, net: | |

| 13,169 | | |

| 12,448 | | |

| 35,372 | | |

| 41,232 | |

| Equity

in (loss) gain of unconsolidated entities | |

| (278 | ) | |

| (62 | ) | |

| 1,260 | | |

| (452 | ) |

| Gain

on sale of investment properties, net | |

| — | | |

| 53,894 | | |

| 13 | | |

| 57,375 | |

| Net

income | |

| 12,891 | | |

| 66,280 | | |

| 36,645 | | |

| 98,155 | |

| Net

income attributable to noncontrolling interests: | |

| | | |

| | | |

| | | |

| | |

| Operating

Partnership | |

| (505 | ) | |

| (3,252 | ) | |

| (1,443 | ) | |

| (4,830 | ) |

| Partially

owned properties (1) | |

| (51 | ) | |

| (70 | ) | |

| (121 | ) | |

| (384 | ) |

| Net

income attributable to common shareholders | |

$ | 12,335 | | |

$ | 62,958 | | |

$ | 35,081 | | |

$ | 92,941 | |

| Net

income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.05 | | |

$ | 0.28 | | |

$ | 0.15 | | |

$ | 0.41 | |

| Diluted | |

$ | 0.05 | | |

$ | 0.28 | | |

$ | 0.15 | | |

$ | 0.41 | |

| Weighted

average common shares: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 238,480,299 | | |

| 226,529,041 | | |

| 238,124,981 | | |

| 225,743,856 | |

| Diluted | |

| 249,445,312 | | |

| 239,898,462 | | |

| 249,226,913 | | |

| 239,145,383 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends

and distributions declared per common share | |

$ | 0.23 | | |

$ | 0.23 | | |

$ | 0.69 | | |

$ | 0.69 | |

(1)

Includes amounts attributable to redeemable noncontrolling interests.

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Consolidated

Statements of Comprehensive Income

(In

thousands) (Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net

income | |

$ | 12,891 | | |

$ | 66,280 | | |

$ | 36,645 | | |

$ | 98,155 | |

| Other

comprehensive income: | |

| | | |

| | | |

| | | |

| | |

| Change

in fair value of interest rate swap agreements, net | |

| 7,697 | | |

| 1,753 | | |

| 11,796 | | |

| 6,215 | |

| Reclassification

of accumulated gains on interest rate swap to earnings | |

| (1,763 | ) | |

| — | | |

| (1,763 | ) | |

| — | |

| Total

other comprehensive income | |

| 5,934 | | |

| 1,753 | | |

| 10,033 | | |

| 6,215 | |

| Comprehensive

income | |

| 18,825 | | |

| 68,033 | | |

| 46,678 | | |

| 104,370 | |

| Comprehensive

income attributable to noncontrolling interests - Operating Partnership | |

| (739 | ) | |

| (3,336 | ) | |

| (1,839 | ) | |

| (5,137 | ) |

| Comprehensive

income attributable to noncontrolling interests - partially owned properties | |

| (51 | ) | |

| (70 | ) | |

| (121 | ) | |

| (384 | ) |

| Comprehensive

income attributable to common shareholders | |

$ | 18,035 | | |

$ | 64,627 | | |

$ | 44,718 | | |

$ | 98,849 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Consolidated

Statements of Equity

(In

thousands) (Unaudited)

| | |

Par

Value | | |

Additional

Paid in

Capital | | |

Accumulated

Deficit | | |

Accumulated

Other Comprehensive Income (Loss) | | |

Total

Shareholders’

Equity | | |

Operating

Partnership

Noncontrolling

Interest | | |

Partially

Owned

Properties

Noncontrolling

Interest | | |

Total

Noncontrolling

Interests | | |

Total

Equity | |

| Balance

at December 31, 2022 | |

$ | 2,333 | | |

$ | 3,743,876 | | |

$ | (881,672 | ) | |

$ | 5,183 | | |

$ | 2,869,720 | | |

$ | 123,015 | | |

$ | 1,116 | | |

$ | 124,131 | | |

$ | 2,993,851 | |

| Net

proceeds from sale of common shares | |

| 44 | | |

| 65,769 | | |

| — | | |

| — | | |

| 65,813 | | |

| — | | |

| — | | |

| — | | |

| 65,813 | |

| Restricted

share award grants, net | |

| 5 | | |

| (1,127 | ) | |

| (408 | ) | |

| — | | |

| (1,530 | ) | |

| — | | |

| — | | |

| — | | |

| (1,530 | ) |

| Conversion

of OP Units | |

| 2 | | |

| 2,417 | | |

| — | | |

| — | | |

| 2,419 | | |

| (2,419 | ) | |

| — | | |

| (2,419 | ) | |

| — | |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (54,912 | ) | |

| — | | |

| (54,912 | ) | |

| (2,263 | ) | |

| — | | |

| (2,263 | ) | |

| (57,175 | ) |

| Contributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 7,884 | | |

| 7,884 | | |

| 7,884 | |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (53 | ) | |

| (53 | ) | |

| (53 | ) |

| Change

in fair value of interest rate swap agreements | |

| — | | |

| — | | |

| — | | |

| (1,021 | ) | |

| (1,021 | ) | |

| — | | |

| — | | |

| — | | |

| (1,021 | ) |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (431 | ) | |

| — | | |

| — | | |

| (431 | ) | |

| 431 | | |

| — | | |

| 431 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 10,202 | | |

| — | | |

| 10,202 | | |

| 423 | | |

| 64 | | |

| 487 | | |

| 10,689 | |

| Balance

as of March 31, 2023 | |

$ | 2,384 | | |

$ | 3,810,504 | | |

$ | (926,790 | ) | |

$ | 4,162 | | |

$ | 2,890,260 | | |

$ | 119,187 | | |

$ | 9,011 | | |

$ | 128,198 | | |

$ | 3,018,458 | |

| Net

proceeds from sale of common shares | |

| — | | |

| 294 | | |

| — | | |

| — | | |

| 294 | | |

| — | | |

| — | | |

| — | | |

| 294 | |

| Restricted

share award grants, net | |

| 1 | | |

| 3,459 | | |

| (561 | ) | |

| — | | |

| 2,899 | | |

| — | | |

| — | | |

| — | | |

| 2,899 | |

| Purchase

of OP Units | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (72 | ) | |

| — | | |

| (72 | ) | |

| (72 | ) |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (54,936 | ) | |

| — | | |

| (54,936 | ) | |

| (2,257 | ) | |

| — | | |

| (2,257 | ) | |

| (57,193 | ) |

| Contributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 287 | | |

| 287 | | |

| 287 | |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (52 | ) | |

| (52 | ) | |

| (52 | ) |

| Change

in fair value of interest rate swap agreements | |

| — | | |

| — | | |

| — | | |

| 5,120 | | |

| 5,120 | | |

| — | | |

| — | | |

| — | | |

| 5,120 | |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (393 | ) | |

| — | | |

| — | | |

| (393 | ) | |

| 393 | | |

| — | | |

| 393 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 12,544 | | |

| — | | |

| 12,544 | | |

| 515 | | |

| 59 | | |

| 574 | | |

| 13,118 | |

| Balance

as of June 30, 2023 | |

$ | 2,385 | | |

$ | 3,813,864 | | |

$ | (969,743 | ) | |

$ | 9,282 | | |

$ | 2,855,788 | | |

$ | 117,766 | | |

$ | 9,305 | | |

$ | 127,071 | | |

$ | 2,982,859 | |

| Restricted

share award grants, net | |

| — | | |

| 3,746 | | |

| (523 | ) | |

| — | | |

| 3,223 | | |

| — | | |

| — | | |

| — | | |

| 3,223 | |

| Conversion

of OP Units | |

| — | | |

| 350 | | |

| — | | |

| — | | |

| 350 | | |

| (350 | ) | |

| — | | |

| (350 | ) | |

| — | |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (54,938 | ) | |

| — | | |

| (54,938 | ) | |

| (2,257 | ) | |

| — | | |

| (2,257 | ) | |

| (57,195 | ) |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (53 | ) | |

| (53 | ) | |

| (53 | ) |

| Reclassification

of accumulated gains on interest rate swap to earnings | |

| — | | |

| — | | |

| — | | |

| (1,763 | ) | |

| (1,763 | ) | |

| — | | |

| — | | |

| — | | |

| (1,763 | ) |

| Change

in fair value of interest rate swap agreements | |

| — | | |

| — | | |

| — | | |

| 7,697 | | |

| 7,697 | | |

| — | | |

| — | | |

| — | | |

| 7,697 | |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (415 | ) | |

| — | | |

| — | | |

| (415 | ) | |

| 415 | | |

| — | | |

| 415 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 12,335 | | |

| — | | |

| 12,335 | | |

| 505 | | |

| 67 | | |

| 572 | | |

| 12,907 | |

| Balance

as of September 30, 2023 | |

$ | 2,385 | | |

$ | 3,817,545 | | |

$ | (1,012,869 | ) | |

$ | 15,216 | | |

$ | 2,822,277 | | |

$ | 116,079 | | |

$ | 9,319 | | |

$ | 125,398 | | |

$ | 2,947,675 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Consolidated

Statements of Equity

(In

thousands) (Unaudited)

| | |

Par

Value | | |

Additional

Paid in

Capital | | |

Accumulated

Deficit | | |

Accumulated

Other

Comprehensive

Income (Loss) | | |

Total

Shareholders’

Equity | | |

Operating

Partnership

Noncontrolling

Interest | | |

Partially

Owned

Properties

Noncontrolling

Interest | | |

Total

Noncontrolling

Interests | | |

Total

Equity | |

| Balance

at December 31, 2021 | |

$ | 2,247 | | |

$ | 3,610,954 | | |

$ | (776,001 | ) | |

$ | (892 | ) | |

$ | 2,836,308 | | |

$ | 150,241 | | |

$ | 484 | | |

$ | 150,725 | | |

$ | 2,987,033 | |

| Net

proceeds from sale of common shares | |

| 3 | | |

| 5,029 | | |

| — | | |

| — | | |

| 5,032 | | |

| — | | |

| — | | |

| — | | |

| 5,032 | |

| Restricted

share award grants, net | |

| 3 | | |

| 118 | | |

| (421 | ) | |

| — | | |

| (300 | ) | |

| — | | |

| — | | |

| — | | |

| (300 | ) |

| Purchase

of OP Units | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (184 | ) | |

| — | | |

| (184 | ) | |

| (184 | ) |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (51,879 | ) | |

| — | | |

| (51,879 | ) | |

| (2,740 | ) | |

| — | | |

| (2,740 | ) | |

| (54,619 | ) |

| Contributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 569 | | |

| 569 | | |

| 569 | |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (55 | ) | |

| (55 | ) | |

| (55 | ) |

| Change

in market value of Redeemable Noncontrolling Interest in partially owned properties | |

| — | | |

| — | | |

| 717 | | |

| — | | |

| 717 | | |

| — | | |

| — | | |

| — | | |

| 717 | |

| Change

in fair value of interest rate swap agreement | |

| — | | |

| — | | |

| — | | |

| 1,379 | | |

| 1,379 | | |

| — | | |

| — | | |

| — | | |

| 1,379 | |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (217 | ) | |

| — | | |

| — | | |

| (217 | ) | |

| 217 | | |

| — | | |

| 217 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 13,092 | | |

| — | | |

| 13,092 | | |

| 692 | | |

| 82 | | |

| 774 | | |

| 13,866 | |

| Balance

as of March 31, 2022 | |

$ | 2,253 | | |

$ | 3,615,884 | | |

$ | (814,492 | ) | |

$ | 487 | | |

$ | 2,804,132 | | |

$ | 148,226 | | |

$ | 1,080 | | |

$ | 149,306 | | |

$ | 2,953,438 | |

| Net

proceeds from sale of common shares | |

| 9 | | |

| 18,475 | | |

| — | | |

| — | | |

| 18,484 | | |

| — | | |

| — | | |

| — | | |

| 18,484 | |

| Restricted

share award grants, net | |

| 1 | | |

| 3,588 | | |

| (911 | ) | |

| — | | |

| 2,678 | | |

| — | | |

| — | | |

| — | | |

| 2,678 | |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (52,116 | ) | |

| — | | |

| (52,116 | ) | |

| (2,712 | ) | |

| — | | |

| (2,712 | ) | |

| (54,828 | ) |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (61 | ) | |

| (61 | ) | |

| (61 | ) |

| Change

in market value of Redeemable Noncontrolling Interest in partially owned properties | |

| — | | |

| — | | |

| 527 | | |

| — | | |

| 527 | | |

| — | | |

| — | | |

| — | | |

| 527 | |

| Change

in fair value of interest rate swap agreement | |

| — | | |

| — | | |

| — | | |

| 3,083 | | |

| 3,083 | | |

| — | | |

| — | | |

| — | | |

| 3,083 | |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (488 | ) | |

| — | | |

| — | | |

| (488 | ) | |

| 488 | | |

| — | | |

| 488 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 16,891 | | |

| — | | |

| 16,891 | | |

| 886 | | |

| 79 | | |

| 965 | | |

| 17,856 | |

| Balance

as of June 30, 2022 | |

$ | 2,263 | | |

$ | 3,637,459 | | |

$ | (850,101 | ) | |

$ | 3,570 | | |

$ | 2,793,191 | | |

$ | 146,888 | | |

$ | 1,098 | | |

$ | 147,986 | | |

$ | 2,941,177 | |

| Net

proceeds from sale of common shares | |

| 5 | | |

| 7,925 | | |

| — | | |

| — | | |

| 7,930 | | |

| — | | |

| — | | |

| — | | |

| 7,930 | |

| Restricted

share award grants, net | |

| — | | |

| 4,326 | | |

| (536 | ) | |

| — | | |

| 3,790 | | |

| — | | |

| — | | |

| — | | |

| 3,790 | |

| Purchase

of OP Units | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,139 | ) | |

| — | | |

| (2,139 | ) | |

| (2,139 | ) |

| Dividends/distributions

declared | |

| — | | |

| — | | |

| (52,563 | ) | |

| — | | |

| (52,563 | ) | |

| (2,302 | ) | |

| — | | |

| (2,302 | ) | |

| (54,865 | ) |

| Distributions | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (61 | ) | |

| (61 | ) | |

| (61 | ) |

| Change

in market value of Redeemable Noncontrolling Interest in partially owned properties | |

| — | | |

| — | | |

| 1,513 | | |

| — | | |

| 1,513 | | |

| — | | |

| — | | |

| — | | |

| 1,513 | |

| Change

in fair value of interest rate swap agreement | |

| — | | |

| — | | |

| — | | |

| 1,753 | | |

| 1,753 | | |

| — | | |

| — | | |

| — | | |

| 1,753 | |

| Adjustment

for Noncontrolling Interests ownership in Operating Partnership | |

| — | | |

| (727 | ) | |

| — | | |

| — | | |

| (727 | ) | |

| 727 | | |

| — | | |

| 727 | | |

| — | |

| Net

income | |

| — | | |

| — | | |

| 62,958 | | |

| — | | |

| 62,958 | | |

| 3,252 | | |

| 74 | | |

| 3,326 | | |

| 66,284 | |

| Balance

as of September 30, 2022 | |

$ | 2,268 | | |

$ | 3,648,983 | | |

$ | (838,729 | ) | |

$ | 5,323 | | |

$ | 2,817,845 | | |

$ | 146,426 | | |

$ | 1,111 | | |

$ | 147,537 | | |

$ | 2,965,382 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Consolidated

Statements of Cash Flows

(In

thousands) (Unaudited)

| | |

Nine

Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash

Flows from Operating Activities: | |

| | | |

| | |

| Net

income | |

$ | 36,645 | | |

$ | 98,155 | |

| Adjustments

to reconcile net income to net cash provided by operating activities | |

| | | |

| | |

| Depreciation

and amortization | |

| 143,555 | | |

| 142,002 | |

| Amortization

of deferred financing costs | |

| 2,028 | | |

| 1,739 | |

| Amortization

of lease inducements and above/below-market lease intangibles | |

| 4,055 | | |

| 4,458 | |

| Straight-line

rental revenue, net | |

| (2,756 | ) | |

| (5,359 | ) |

| Amortization

of discount on unsecured senior notes | |

| 824 | | |

| 794 | |

| Amortization

of above market assumed debt | |

| — | | |

| (10 | ) |

| Gain

on extinguishment of debt | |

| (1,763 | ) | |

| — | |

| Gain

on sale of investment properties, net | |

| (13 | ) | |

| (57,375 | ) |

| Equity

in (gain) loss of unconsolidated entities | |

| (1,260 | ) | |

| 452 | |

| Distributions

from unconsolidated entities | |

| 5,707 | | |

| 6,077 | |

| Change

in fair value of derivatives | |

| 185 | | |

| — | |

| Provision

for bad debts | |

| 571 | | |

| 269 | |

| Non-cash

share compensation | |

| 12,290 | | |

| 12,400 | |

| Change

in operating assets and liabilities: | |

| | | |

| | |

| Tenant

receivables | |

| 711 | | |

| (5,927 | ) |

| Other

assets | |

| (3,019 | ) | |

| (1,455 | ) |

| Accounts

payable | |

| 542 | | |

| (125 | ) |

| Accrued

expenses and other liabilities | |

| 7,610 | | |

| 6,258 | |

| Net

cash provided by operating activities | |

| 205,912 | | |

| 202,353 | |

| Cash

Flows from Investing Activities: | |

| | | |

| | |

| Proceeds

from sale of investment properties | |

| 2,553 | | |

| 123,179 | |

| Acquisition

of investment properties, net | |

| (39,282 | ) | |

| (111,587 | ) |

| Investment

in unconsolidated entities, net | |

| (3,671 | ) | |

| (13,349 | ) |

| Returns

of investment in unconsolidated entities | |

| 3,737 | | |

| — | |

| Development

of real estate | |

| (12,672 | ) | |

| — | |

| Escrowed

cash - acquisition deposits/earnest deposits | |

| — | | |

| 360 | |

| Capital

expenditures on investment properties | |

| (31,194 | ) | |

| (29,840 | ) |

| Investment

in real estate loans receivable | |

| (22,272 | ) | |

| (29,618 | ) |

| Repayment

of real estate loans receivable | |

| 41,065 | | |

| 22,441 | |

| Leasing

commissions | |

| (2,588 | ) | |

| (2,766 | ) |

| Lease

inducements | |

| (399 | ) | |

| (500 | ) |

| Net

cash used in investing activities | |

| (64,723 | ) | |

| (41,680 | ) |

| Cash

Flows from Financing Activities: | |

| | | |

| | |

| Net

proceeds from sale of common shares | |

| 65,914 | | |

| 31,446 | |

| Proceeds

from credit facility borrowings | |

| 513,000 | | |

| 239,000 | |

| Repayment

of credit facility borrowings | |

| (306,000 | ) | |

| (251,000 | ) |

| Repayment

of senior unsecured notes | |

| (15,000 | ) | |

| — | |

| Principal

payments on mortgage debt | |

| (36,803 | ) | |

| (15,845 | ) |

| Payment

of debt issuance costs | |

| (3,911 | ) | |

| (67 | ) |

| Dividends

paid - shareholders | |

| (165,491 | ) | |

| (156,854 | ) |

| Distributions

to noncontrolling interests - Operating Partnership | |

| (6,783 | ) | |

| (8,191 | ) |

| Contributions

from noncontrolling interest | |

| 8,171 | | |

| 569 | |

| Distributions

to noncontrolling interests - partially owned properties | |

| (281 | ) | |

| (517 | ) |

| Payments

of employee taxes for withheld stock-based compensation shares | |

| (5,891 | ) | |

| (4,255 | ) |

| Purchase

of OP Units | |

| (72 | ) | |

| (2,323 | ) |

| Net

cash provided by (used in) financing activities | |

| 46,853 | | |

| (168,037 | ) |

| Net

increase (decrease) in cash and cash equivalents | |

| 188,042 | | |

| (7,364 | ) |

| Cash

and cash equivalents, beginning of period | |

| 7,730 | | |

| 9,876 | |

| Cash

and cash equivalents, end of period | |

$ | 195,772 | | |

$ | 2,512 | |

| Supplemental

disclosure of cash flow information—interest paid during the period | |

$ | 66,082 | | |

$ | 57,977 | |

| Supplemental

disclosure of noncash activity—change in fair value of interest rate swap agreements | |

$ | 11,796 | | |

$ | 6,215 | |

| Supplemental

disclosure of noncash activity—conversion of loan receivable in connection to the acquisition of investment property | |

$ | 5,398 | | |

$ | 5,700 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Physicians

Realty Trust

Notes

to Consolidated Financial Statements

Unless

otherwise indicated or unless the context requires otherwise, the use of the words “we,” “us,” “our,”

and the “Company,” refer to Physicians Realty Trust, together with its consolidated subsidiaries, including Physicians Realty

L.P.

Note

1. Organization and Business

Physicians

Realty Trust (the “Trust” or the “Company”) was organized in the state of Maryland on April 9, 2013. As

of September 30, 2023, the Trust was authorized to issue up to 500,000,000 common shares of beneficial interest, par value

$0.01 per share. The Trust filed a Registration Statement on Form S-11 with the Commission with respect to a proposed underwritten

initial public offering (the “IPO”) and completed the IPO of its common shares and commenced operations on July 24,

2013.

The

Trust contributed the net proceeds from the IPO to Physicians Realty L.P, a Delaware limited partnership (the “Operating Partnership”),

and is the sole general partner of the Operating Partnership. The Trust’s operations are conducted through the Operating Partnership

and wholly-owned and majority-owned subsidiaries of the Operating Partnership. The Trust, as the general partner of the Operating Partnership,

controls the Operating Partnership and consolidates the assets, liabilities, and results of operations of the Operating Partnership.

The

Trust is a self-managed REIT formed primarily to acquire, selectively develop, own, and manage health care properties that are leased

to physicians, hospitals, and health care delivery systems.

ATM

Program

In

May 2021, the Trust and the Operating Partnership entered into an At Market Issuance Sales Agreement (the “2021 Sales Agreement”)

with KeyBanc Capital Markets Inc., Credit Agricole Securities (USA) Inc., BMO Capital Markets Corp., and Raymond James & Associates, Inc.

in their capacity as agents for the Company and/or forward sellers and Stifel, Nicolaus & Company, Incorporated in its

capacity as sales agent for the Company (collectively, the “2021 Agents”) and Bank of Montreal, Credit Agricole Corporate

and Investments Bank, KeyBanc Capital Markets Inc., and Raymond James & Associates, Inc. as forward purchasers for the

Company (the “2021 Forward Purchasers”), pursuant to which the Trust may issue and sell, from time to time, its common shares

having an aggregate offering price of up to $500 million through the 2021 Agents (the “2021 ATM Program”). The 2021

Sales Agreement contemplates that, in addition to the issuance and sale of the Trust’s common shares through the 2021 Agents, the

Trust may also enter into one or more forward sales agreements from time to time in the future with each of the 2021 Forward Purchasers.

In

August 2023, the Trust and the Operating Partnership entered into an At Market Issuance Sales Agreement (the “2023 Sales Agreement”)

with BMO Capital Markets Corp., Credit Agricole Securities (USA) Inc., KeyBanc Capital Markets Inc., Raymond James & Associates, Inc.,

Regions Securities LLC and Stifel, Nicolaus & Company, Incorporated as sales agents for the Company and/or forward sellers

(collectively, “2023 Agents”), and Bank of Montreal, Crédit Agricole Corporate and Investment Bank, KeyBanc Capital

Markets Inc., Raymond James & Associates, Inc., Regions Securities LLC and Stifel, Nicolaus & Company, Incorporated

(collectively, “2023 Forward Purchasers”), pursuant to which the Trust may issue and sell, from time to time, its common

shares having an aggregate offering price of up to $600 million through the 2023 Agents (the “2023 ATM Program”). The

2023 Sales Agreement contemplates that, in addition to the issuance and sale of the Trust’s common shares through the 2023 Agents,

the Trust may also enter into one or more forward sales agreements from time to time in the future with each of the 2023 Forward Purchasers.

Upon entry into the 2023 Sales Agreement, we terminated the 2021 ATM Program.

During

the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, the Trust issued and sold common shares through

the 2021 ATM Program as follows (net proceeds in thousands):

| | |

Common

shares sold | | |

Weighted

average

price | | |

Net

proceeds | |

| Quarter

ended March 31, 2023 | |

| 4,400,000 | | |

$ | 15.10 | | |

$ | 65,776 | |

| Quarter

ended June 30, 2023 | |

| — | | |

| — | | |

| — | |

| Quarter

ended September 30, 2023 | |

| — | | |

| — | | |

| — | |

| Year

to date | |

| 4,400,000 | | |

$ | 15.10 | | |

$ | 65,776 | |

As

of September 30, 2023, the Trust has $600.0 million of common shares remaining

available under the 2023 ATM Program. Subsequent to September 30, 2023, in connection

with the Merger Agreement, the Trust suspended the 2023 ATM Program.

Note

2. Summary of Significant Accounting Policies

The

accompanying unaudited consolidated financial statements reflect all adjustments which are, in the opinion of management, necessary for

a fair presentation of the results for the periods ended September 30, 2023 and 2022 pursuant to the instructions to Form 10-Q

and Article 10 of Regulation S-X. All such adjustments are of a normal recurring nature. Certain information and footnote disclosures

normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and

regulations. These financial statements should be read in conjunction with the audited financial statements included in the Trust’s

2022 Annual Report. The Company has consistently applied its accounting policies to all periods presented in these consolidated financial

statements.

Noncontrolling

Interests

The

Company presents the portion of any equity it does not own in entities that it controls (and thus consolidates) as noncontrolling interests

and classifies such interests as a component of consolidated equity, separate from the Company’s total shareholders’ equity,

on the consolidated balance sheets.

Operating

Partnership: Noncontrolling interests in the Company include partnership interests of the Operating Partnership (“OP Units”)

held by other investors. Net income or loss is allocated to noncontrolling interests (limited partners) based on their respective ownership

percentage of the Operating Partnership. The ownership percentage is calculated by dividing the number of OP Units held by the noncontrolling

interests by the total OP Units held by the noncontrolling interests and the Trust. Issuance of additional common shares and OP Units

changes the ownership interests of both the noncontrolling interests and the Trust. Such transactions and the related proceeds are treated

as capital transactions.

As

of September 30, 2023, the Trust held a 96.1% interest in the Operating Partnership. As the sole general partner and the majority

interest holder, the Trust consolidates the financial position and results of operations of the Operating Partnership.

Partially

Owned Properties: The Trust reflects noncontrolling interests in partially owned properties on the consolidated balance sheets for the

portion of consolidated properties that are not wholly owned by the Company. The earnings or losses from those properties attributable

to the noncontrolling interests are reflected as noncontrolling interests in partially owned properties in the consolidated statements

of income.

Redeemable

Noncontrolling Interests - Partially Owned Properties

In

connection with the Company’s acquisitions of the outpatient medical facility, ambulatory surgery center, and hospital located

on the Great Falls Hospital campus in Great Falls, Montana, physicians affiliated with the sellers retained non-controlling interests

which were, at the holders’ option, able to be redeemed at any time after May 1, 2023. Due to the redemption provision, which

was outside of the control of the Trust, the Trust classified the investment in the mezzanine section of its consolidated balance sheets.

On July 14, 2022, the Company disposed of these three properties and removed the related redeemable noncontrolling interests from

its consolidated balance sheets.

Through

a consolidated joint venture with MedProperties Realty Advisors, LLC (“MedProperties”), the Company acquired Calko Medical

Center in Brooklyn, New York. As part of the joint venture, MedProperties can redeem its interest, at its option, at any time after September 9,

2025. Due to the redemption provision, which is outside of the control of the Company, the Company classifies the noncontrolling interests

in the mezzanine section of its consolidated balance sheets. The Company records the carrying amount of the redeemable noncontrolling

interests at the greater of the carrying value or redemption value.

Dividends

and Distributions

On

September 21, 2023, the Trust announced that its Board of Trustees authorized, and the Trust declared, a cash dividend of $0.23 per

common share for the quarter ended September 30, 2023. The dividend was paid on October 17, 2023, to common shareholders and

holders of record of OP Units as of the close of business on October 3, 2023.

Tax

Status of Dividends and Distributions

The

Company’s distributions of current and accumulated earnings and profits for U.S. federal income tax purposes generally are taxable

to shareholders as ordinary income. Distributions in excess of these earnings and profits generally are treated as a non-taxable reduction

of the shareholders’ basis in the shares to the extent thereof (non-dividend distributions) and thereafter as taxable gain.

Any

cash distributions received by an OP Unit holder in respect of its OP Units generally will not be taxable to such OP Unit holder for

U.S. federal income tax purposes, to the extent that such distribution does not exceed the OP Unit holder’s basis in its OP Units.

Any such distribution will instead reduce the OP Unit holder’s basis in its OP Units (and OP Unit holders will be subject to tax

on the taxable income allocated to them by the Operating Partnership in respect of their OP Units when such income is earned by the Operating

Partnership, with such income allocation increasing the OP Unit holders’ basis in their OP Units).

The

Company has elected taxable REIT subsidiary (“TRS”) status for certain of its corporate subsidiaries and, as a result, these

entities will incur both federal and state income taxes on any taxable income of such entities after consideration of any net operating

losses. To date, these income taxes have been de minimis.

Real

Estate Loans Receivable, Net

Real

estate loans receivable consists of nine mezzanine loans, three term loans, and two construction loans

as of September 30, 2023. Generally, each mezzanine loan is collateralized by a pledge of the borrower’s ownership interest

in the respective real estate owner, each term loan is secured by a mortgage on a related outpatient medical facility, and construction

loans are secured by mortgages on the land and the improvements as constructed. The reserve for loan losses was $0.4 million

as of September 30, 2023.

Rental

and Related Revenues

Rental