ATLANTA, Nov. 7 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray," "we" or "us") (NYSE:GTN) today announced results from

operations for the three months ("third quarter") and nine months

ended September 30, 2007 as compared to the three months and nine

months ended September 30, 2006. Comments on As Reported Results of

Operations for the Three Months Ended September 30, 2007: For the

three months ended September 30, 2007 and 2006, we did not complete

any acquisitions or disposals of properties; therefore, the

following comments are on our "as reported" results. Revenues. On

an as reported basis, total net revenue for all stations decreased

$7.0 million, or 9%, to $73.6 million due primarily to decreased

political advertising revenues and decreased national advertising

revenues partially offset by increased local advertising revenue in

the current period. On an as reported basis, political advertising

revenues decreased $9.1 million, or 86%, to $1.5 million reflecting

the influence of the 2006 elections. On an as reported basis, local

advertising revenue increased $2.5 million, or 5%, to $50.3 million

and national advertising revenue decreased $0.3 million, or 1%, to

$19.2 million. Operating expenses. On an as reported basis, total

broadcast expenses (before depreciation, amortization and loss on

disposal of assets) increased $2.1 million, or 4%, to $49.6

million. Operation of our digital second channels is attributed for

$0.5 million of the overall increase and reflects the expansion of

the number of digital second channels to 39 as of September 30,

2007. The remaining $1.6 million of the overall increase is

attributable to the operation of our primary channels and reflects

routine increases in payroll. Total aggregate broadcast expenses

(before depreciation, amortization and loss on disposal of assets)

for all the primary channels and all the digital second channels

was approximately equal to management's operating targets for the

three months ended September 30, 2007. On an as reported basis,

corporate and administrative expenses, before depreciation,

amortization and loss on disposal of assets, increased $0.5

million, or 13%, to $3.9 million due primarily to incremental

increases in news research and/or consulting expense, legal expense

and non-cash stock based compensation expense. We recorded non-cash

stock based compensation expense for the three months ended

September 30, 2007 and 2006 of $285,000 and $191,000, respectively.

Comments on Results of Operations for the Nine Months Ended

September 30, 2007: Due to the significance of WNDU to our results

of operations, Gray's pro forma broadcast results for the nine

months ended September 30, 2006 have been presented to include the

results of WNDU as if the station had been acquired on January 1,

2006. The acquisition of WNDU did not significantly affect

corporate and administrative expenses. Therefore, corporate and

administrative expenses are presented on an "as reported" basis.

Revenues. On a pro forma(1) basis, total net revenue for all

stations decreased $9.8 million, or 4%, to $223.0 million due

primarily to decreased political advertising revenues and decreased

national advertising revenues partially offset by increased local

advertising revenue in the current period. On a pro forma(1) basis,

political advertising revenues decreased $12.0 million, or 70%, to

$5.2 million reflecting the influence of the 2006 elections. On a

pro forma(1) basis, local advertising revenue increased $4.8

million, or 3%, to $153.3 million and national advertising revenue

decreased $2.5 million, or 4%, to $56.2 million. Operating

expenses. On a pro forma(1) basis, total broadcast expenses (before

depreciation, amortization and loss on disposal of assets)

increased $7.3 million, or 5%, to $147.4 million. On a pro forma(1)

basis, operation of our digital second channels is attributed for

$2.6 million of the overall increase and reflects the expansion of

the number of digital second channels to 39 as of September 30,

2007. On a pro forma(1) basis, the remaining $4.7 million of the

overall increase is attributable to the operation of our primary

channels and reflects routine increases in payroll, programming and

promotion. On a pro forma(1) basis, total aggregate broadcast

expenses (before depreciation, amortization and loss on disposal of

assets) for all the primary channels and all the digital second

channels was approximately equal to management's operating targets

for the nine months ended September 30, 2007. On an as reported

basis, corporate and administrative expenses, before depreciation,

amortization and loss on disposal of assets, increased $1.4

million, or 14%, to $11.6 million due primarily to incremental

increases in news research and/or consulting expense, legal expense

and non-cash stock based compensation expense. We recorded non-cash

stock based compensation expense during the nine months ended

September 30, 2007 and 2006 of $1,115,000 and $581,000,

respectively. Other Financial Data on an "as reported" basis:

September 30, December 31, 2007 2006 (in thousands) Cash $1,233

$4,741 Total debt(2) 925,000 851,654 Preferred stock - 37,451

Available credit under senior credit facility 100,000 97,000 Nine

Months Ended September 30, 2007 2006 (in thousands) Net cash

provided by operating activities $11,919 $60,444 Net cash used in

investing activities (22,575) (117,085) Net cash provided by

financing activities 7,148 51,483 For the nine months ended

September 30, 2007, we repurchased 647,800 shares of our common

stock for $5.5 million at an average price per share of $8.49. For

the nine months ended September 30, 2006, we repurchased 902,200

shares of our common stock for $5.6 million at an average price per

share of $6.21. The repurchased common stock is held in treasury.

Gray Television, Inc. Selected Operating Data (Unaudited) (in

thousands except for per share data and percentages) As Reported

Three Months Ended September 30, % 2007 2006 Change Revenues (less

agency commissions) $73,585 $80,592 (9)% Operating expenses before

depreciation, amortization and loss on disposal of assets, net:

Broadcast 49,583 47,456 4 % Corporate and administrative 3,932

3,481 13 % Depreciation and amortization of intangible assets

10,156 9,478 7 % Loss on disposals of assets, net 5 221 (98)%

63,676 60,636 5 % Operating income 9,909 19,956 (50)% Other income

(expense): Miscellaneous income, net 177 91 95 % Interest expense

(16,812) (17,542) (4)% Loss on early extinguishment of debt - (237)

Income (loss) before income tax (6,726) 2,268 Income tax expense

(benefit) (2,546) 909 Net income (loss) (4,180) 1,359 Preferred

dividends (includes accretion of issuance cost of $0 and $47,

respectively) - 840 Net income (loss) available to common

stockholders $(4,180) $519 Basic per share information: Net income

(loss) available to common stockholders $(0.09) $0.01 Weighted

average shares outstanding 47,760 48,072 (1)% Diluted per share

information: Net income (loss) available to common stockholders

$(0.09) $0.01 Weighted average shares outstanding 47,760 48,072

(1)% Political revenue (less agency commission) $1,450 $10,595

(86)% Gray Television, Inc. Selected Operating Data (Unaudited) (in

thousands except for per share data and percentages) As Reported

Pro Forma(1) Nine Months Ended Nine Months Ended September 30,

September 30, % % 2007 2006 Change 2007 2006 Change Revenues (less

agency commissions) $223,015 $230,216 (3)% $223,015 $232,801 (4)%

Operating expenses before depreciation, amortization and loss on

disposal of assets, net: Broadcast 147,449 138,058 7 % 147,449

140,195 5 % Corporate and administrative 11,577 10,140 14 % 11,577

10,140 14 % Depreciation and amortization of intangible assets

30,048 26,828 12 % 30,048 27,496 9 % Loss on disposals of assets,

net 122 493 (75)% 122 493 (75)% 189,196 175,519 8 % 189,196 178,324

6 % Operating income 33,819 54,697 (38)% 33,819 54,477 (38)% Other

income (expense): Miscellaneous income, net 984 496 98 % 984 496 98

% Interest expense (50,610) (49,664) 2 % (50,610) (50,089) 1 % Loss

on early extinguishment of debt (22,853) (347) (22,853) (347)

Income (loss) before income tax benefit (38,660) 5,182 (38,660)

4,537 Income tax expense (benefit) (14,021) 2,058 (14,021) 1,823

Net income (loss) (24,639) 3,124 (24,639) 2,714 Preferred dividends

(includes accretion of issuance cost of $439, $91, $439, $91,

respectively) 1,626 2,469 1,626 2,469 Net income (loss) available

to common stockholders $(26,265) $655 $(26,265) $245 Basic per

share information: Net income (loss) available to common

stockholders $(0.55) $0.01 $(0.55) $0.01 Weighted average shares

outstanding 47,728 48,532 (2)% 47,728 48,532 (2)% Diluted per share

information: Net income (loss) available to common stockholders

$(0.55) $0.01 $(0.55) $0.01 Weighted average shares outstanding

47,728 48,543 (2)% 47,728 48,543 (2)% Political revenue (less

agency commission) $5,181 $17,077 (70)% $5,181 $17,157 (70)%

Guidance for the Fourth Quarter of 2007 We currently anticipate

that our broadcasting results of operations for the three months

ending December 31, 2007 (the "fourth quarter") will approximate

the ranges presented in the table below. % % 2007 Change 2007

Change Guidance From Guidance From Selected Low Actual High Actual

Actual operating data: Range 2006 Range 2006 2006 (dollars in

thousands) OPERATING REVENUES: Revenues (less agency commissions)

$82,500 (19)% $84,000 (18)% $101,920 OPERATING EXPENSES: (before

depreciation, amortization and other expenses) Broadcast $52,250

(2)% $53,000 (1)% $53,444 Corporate and administrative $3,800 (23)%

$3,900 (21)% $4,956 OTHER SELECTED DATA: Broadcast political

revenues (less agency commissions) $2,100 $2,200 $25,605 Expense

for non-cash contributions to 401(k) plan $575 $600 $568 Expense

for corporate non-cash stock based compensation $100 $150 $511

Comments on Guidance The total revenue results anticipated for the

fourth quarter of 2007 reflect the incremental decline in political

revenues. Local non-political advertising is currently anticipated

to increase between 5% and 8%. While we anticipate continuing

relative softness in non-political national advertising, we do

expect modest growth in the low to mid-single digit range in the

fourth quarter of 2007 compared to the comparable period in 2006.

Estimates of net political revenue in the fourth quarter do not

include any significant amounts relating to potential political

advertising for the early 2008 primary elections. At present, we

can not predict what impact, if any, political advertising for the

early 2008 primary elections may have on our fourth quarter

results. The total operating costs, before depreciation,

amortization and loss on disposal of assets, anticipated for the

fourth quarter of 2007 will be less than the results for the

comparable period in 2006 reflecting savings on national sales

representatives' commissions due to cyclically lower net political

revenues. Conference Call Information We will host a conference

call to discuss our third quarter operating results on November 7,

2007. The call will begin at 9:30 AM Eastern Time. The live dial-in

number is 1 (800) 839-7875 and the confirmation code is 5491426.

The call will be webcast live and available for replay at

http://www.gray.tv/. The taped replay of the conference call will

be available at 1 (888) 203-1112, Confirmation Code: 5491426 until

December 6, 2007. Reconciliations: Reconciliation of net income

(loss) to the Non-GAAP terms (in thousands): As Reported Three

Months Ended September 30, 2007 2006 Net income (loss) $(4,180)

$1,359 Adjustments to reconcile to Broadcast Cash Flow Less Cash

Corporate Expenses: Depreciation and amortization of intangible

assets 10,156 9,478 Amortization of non-cash stock based

compensation 285 191 Loss on disposals of assets, net 5 221

Miscellaneous (income) expense, net (177) (91) Interest expense

16,812 17,542 Loss on early extinguishment of debt - 237 Income tax

expense (benefit) (2,546) 909 Amortization of program broadcast

rights 3,750 3,628 Common stock contributed to 401(k) plan

excluding corporate 401(k) contributions 550 552 Network

compensation revenue recognized (180) (258) Network compensation

per network affiliation agreement 78 629 Payments for program

broadcast rights (3,821) (3,587) Broadcast Cash Flow Less Cash

Corporate Expenses 20,732 30,810 Corporate and administrative

expenses excluding amortization of non-cash stock based

compensation 3,647 3,290 Broadcast Cash Flow $24,379 $34,100 As

Reported Pro Forma(1) Nine Months Ended Nine Months Ended September

30, September 30, 2007 2006 2007 2006 Net income (loss) $(24,639)

$3,124 $(24,639) $2,714 Adjustments to reconcile to Broadcast Cash

Flow Less Cash Corporate Expenses: Depreciation and amortization of

intangible assets 30,048 26,828 30,048 27,496 Amortization of

non-cash stock based compensation 1,115 581 1,115 581 Loss on

disposals of assets, net 122 493 122 493 Miscellaneous (income)

expense, net (984) (496) (984) (496) Interest expense 50,610 49,664

50,610 50,089 Loss on early extinguishment of debt 22,853 347

22,853 347 Income tax expense (benefit) (14,021) 2,058 (14,021)

1,823 Amortization of program broadcast rights 11,345 10,432 11,345

10,432 Common stock contributed to 401(k) plan excluding corporate

401(k) contributions 1,750 1,679 1,750 1,679 Network compensation

revenue recognized (564) (839) (564) (839) Network compensation per

network affiliation agreement 235 1,677 235 1,677 Payments for

program broadcast rights (11,507) (10,357) (11,507) (10,357)

Broadcast Cash Flow Less Cash Corporate Expenses 66,363 85,191

66,363 85,639 Corporate and administrative expenses excluding

amortization of non-cash stock based compensation 10,462 9,559

10,462 9,559 Broadcast Cash Flow $76,825 $94,750 $76,825 $95,198

Non-GAAP Terms This press release includes the non-GAAP financial

measure of Broadcast Cash Flow and Broadcast Cash Flow Less Cash

Corporate Expenses. These non- GAAP amounts are used by us to

approximate the amount used to calculate a key financial

performance covenant as defined in our senior credit facility.

Broadcast Cash Flow is defined as operating income, plus corporate

expense, depreciation and amortization (including amortization of

program broadcast rights), non-cash compensation and (gain) loss on

disposal of assets and cash payments received or receivable under

network affiliation agreements less payments for program broadcast

obligations, less network compensation revenue and less income

(loss) from discontinued operations, net of income taxes. Corporate

expenses (excluding depreciation, amortization and non-cash stock

based compensation) are deducted from Broadcast Cash Flow to

calculate "Broadcast Cash Flow Less Cash Corporate Expenses." These

non-GAAP terms are used in addition to and in conjunction with

results presented in accordance with GAAP and should be considered

as supplements to, and not as substitutes for, net income (loss)

calculated in accordance with GAAP. Notes (1) The pro forma

presentation gives effect to the results of operations for the

acquisition of television station WNDU, South Bend, IN on March 3,

2006 as if the station had been acquired on January 1, 2006. (2)

Total debt as of December 31, 2006 does not include $653,000 of

unamortized debt discount on our 9.25% Notes. The 9.25% Notes were

redeemed on April 18, 2007. Gray Television, Inc. Gray Television,

Inc. is a television broadcast company headquartered in Atlanta,

GA. We currently operate 36 television stations serving 30 markets.

Each of the stations are affiliated with either CBS (17 stations),

NBC (10 stations), ABC (8 stations) or FOX (1 station). In

addition, we currently operate 40 digital second channels including

1 ABC, 5 Fox, 8 CW and 16 MyNetworkTV affiliates plus 8 local

news/weather channels and 2 "independent" channels in certain of

our existing markets. Cautionary Statements for Purposes of the

"Safe Harbor" Provisions of the Private Securities Litigation

Reform Act The comments on our current expectations of operating

results for the fourth quarter of 2007 and other future events are

"forward looking statements" for purposes of the Private Securities

Litigation Reform Act of 1995. Actual results of operations are

subject to a number of risks and uncertainties and may differ

materially from the current expectations discussed in this press

release. All information set forth in this release is as of

November 7, 2007. We do not intend, and undertake no duty, to

update this information to reflect future events or circumstances.

Information about potential factors that could affect our business

and financial results and cause actual results to differ materially

from those in the forward-looking statements are included under the

captions, "Risk Factors" and "Management's Discussion and Analysis

of Financial Condition and Results of Operations," in our Annual

Report on Form 10-K for the year ended December 31, 2006 which is

on file with the SEC and available at the SEC's website at

http://www.sec.gov/. DATASOURCE: Gray Television, Inc. CONTACT: Bob

Prather, President and Chief Operating Officer, +1-404-266-8333; or

Jim Ryan, Senior V. P. and Chief Financial Officer,

+1-404-504-9828, both of Gray Television, Inc. Web site:

http://www.gray.tv/

Copyright

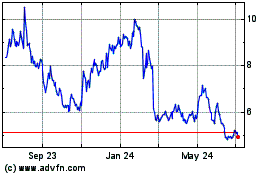

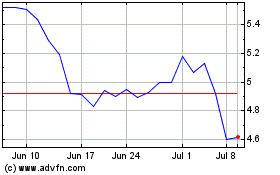

Gray Television (NYSE:GTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gray Television (NYSE:GTN)

Historical Stock Chart

From Dec 2023 to Dec 2024