ATLANTA, March 16 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray" or the "Company") (NYSE:GTN) today announced results from

operations for the three months ("fourth quarter") and year ended

December 31, 2005 as compared to the three months and year ended

December 31, 2004. Significant items to note for the three months

ended December 31, 2005: Three Months Ended Change from Same Period

December 31, 2005 of Prior Year Net local broadcast advertising

Increased 15% or $6.4 million revenue, excluding political

advertising revenue, of $48.6 million Net political advertising

revenue of Decreased $19.4 million reflecting $1.4 million the

"off-year" of the political election cycle As of December 31, 2005

December 31, 2004 Cash on Hand $9.3 million $50.6 million Total

Debt(1) $792.5 million $655.9 million Comments on Results of

Operations for the Three Months Ended December 31, 2005: Revenues.

-- Local broadcasting advertising revenues, excluding political

advertising revenues, increased 15% to $48.6 million from $42.2

million. - Since September 30, 2004, the Company has launched UPN

second channels in three of its existing television markets,

acquired television stations KKCO, Grand Junction, CO on January

31, 2005, WSWG, Albany GA on November 10, 2005 and WSAZ, Charleston

- Huntington, WV on November 30, 2005 and sold the Company's

satellite uplink operations on December 31, 2004. - These

transactions described above account for approximately one- third,

or $2.1 million of the Company's overall increase in local

broadcasting advertising revenues, excluding political advertising

revenues. - For the stations and second channels continuously

operated since September 30, 2004 local broadcasting advertising

revenues, excluding political advertising revenues increased 10% or

$4.2 million due to increased demand for commercial time by local

advertisers. -- National broadcasting advertising revenues

increased 9% to $19.6 million from $17.9 million. - The

transactions discussed above account for approximately $0.8 million

of this increase. - National advertising for the stations and

second channels continuously operated since September 30, 2004

increased approximately 5% or $0.8 million due to increased demand

for commercial time by national advertisers. -- Political

advertising revenues decreased to $1.4 million from $20.8 million

reflecting the cyclical influence of the 2004 Presidential

election. -- Network compensation revenue decreased to $1.1 million

from $2.6 million due to lower revenue from renewed network

affiliation agreements. However, under the terms of the affiliation

agreements, Gray received cash payments of approximately $0.9

million in excess of revenue recognized in accordance with

generally accepted accounting principles for the three months ended

December 31, 2005. In the same period of the prior year, the

network compensation revenue and the related cash payments received

were approximately equal in their respective amounts. -- Total

broadcasting revenues decreased 16% to $73.0 million. Operating

expenses. Operating expenses decreased 0.5% to $55.5 million from

$55.8 million in the same period of the prior year. -- Broadcasting

expenses, before depreciation, amortization and loss on disposal of

assets decreased 4% to $43.6 million from $45.5 million. - For the

stations and second channels continuously operated since September

30, 2004 broadcast expenses decreased approximately 7%, or $3.4

million. This decrease in existing broadcast expenses was due

primarily to reduced payroll expenses, including station incentive

bonus expense, reduced commissions to national sales

representatives reflecting the lower political revenue discussed

above and reduced legal and consulting services. - The three new

UPN second channels and the newly acquired stations (KKCO, WSWG and

WSAZ) incurred approximately $2.0 million in operating expenses for

the fourth quarter of 2005. -- Corporate and administrative

expenses, before depreciation, amortization and loss on disposal of

assets decreased 32% to $2.9 million in the three months ended

December 31, 2005 as compared to $4.2 million for the same period

in 2004. Legal and other professional service fees decreased

approximately $487,000 over the fourth quarter of 2004. In

addition, payroll and benefits costs decreased in the fourth

quarter of 2005 by approximately $179,000. Comments on Results of

Operations for the Year Ended December 31, 2005: Revenues. -- Local

broadcasting advertising revenues, excluding political advertising

revenues, increased 9% to $174.6 million from $160.6 million. -

Since January 1, 2004 the Company has launched UPN second channels

in six of its existing television markets, built television station

WCAV in Charlottesville, VA which commenced broadcast operations in

August, 2004, acquired television stations KKCO, Grand Junction, CO

on January 31, 2005, WSWG, Albany GA on November 10, 2005 and WSAZ,

Charleston - Huntington, WV on November 30, 2005 and sold the

Company's satellite uplink operations on December 31, 2004. - These

transactions described above account for approximately one- third,

or $5.0 million of the Company's overall increase in local

broadcasting advertising revenues, excluding political advertising

revenues. - For the stations continuously operated since January 1,

2004 local broadcasting advertising revenues, excluding political

advertising revenues increased 6% or $9.0 million due to increased

demand for commercial time by local advertisers. -- National

broadcasting advertising revenues of $70.8 million were consistent

between the years ended December 31, 2005 and 2004. - The

transactions discussed above account for approximately $1.6 million

of the total national broadcasting advertising. - National

advertising for the stations and second channels continuously

operated since January 1, 2004 decreased approximately 2% or $1.6

million due to decreased demand for commercial time by national

advertisers. -- Political advertising revenues decreased to $2.9

million from $41.7 million reflecting the cyclical influence of the

2004 Presidential election. -- In addition, in the 2004 period Gray

recorded approximately $3.0 million of broadcast revenue associated

with the broadcast of the 2004 Summer Olympics. There was no such

similar Olympic broadcast in the current year. -- Network

compensation revenue decreased to $5.1 million from $10.0 million

due to lower revenue from renewed network affiliation agreements.

However, under the terms of the affiliation agreements, Gray

received cash payments of approximately $2.8 million in excess of

revenue recognized in accordance with generally accepted accounting

principles for the year ended December 31, 2005. In the same period

of the prior year, the network compensation revenue and the related

cash payments received were approximately equal in their respective

amounts. -- Total broadcasting revenues decreased 11% over the same

period of the prior year to $261.6 million. Operating expenses.

Operating expenses increased 4% to $200.7 million from $192.9

million in the same period of the prior year. -- Broadcasting

expenses, before depreciation, amortization and loss on disposal of

assets increased 2% to $161.9 million from $158.3 million. - For

the stations continuously operated since January 1, 2004 broadcast

expenses decreased approximately 1%, or $1.8 million. This decrease

in existing broadcast expenses was due primarily to reduced payroll

expenses, including station incentive bonus expense, reduced

commissions to national sales representatives reflecting the lower

political revenue discussed above and reduced legal and consulting

services. - The six new UPN second channels, WCAV and the newly

acquired stations (KKCO, WSWG and WSAZ) incurred approximately $8.5

million in operating expenses for the year ended December 31, 2005.

-- Corporate and administrative expenses, before depreciation,

amortization and loss on disposal of assets decreased 1% to $11.5

million from $11.7 million in the year ended December 31, 2005 as

compared to the same period in 2004. Balance Sheet: Gray's cash

balance was $9.3 million at December 31, 2005 compared to $50.6

million at December 31, 2004. The decrease in cash reflects $50.5

million of net cash generated by Gray's operations during the year

of 2005 compared to $102.7 million for the prior year. The 2005 net

cash generated from operations was offset by the return of $21.9

million of capital to Gray's common and preferred shareholders

through the payment of $14.9 million of dividends and the purchase

of $7.0 million of its common stock. Gray also used a total of

$17.0 million in the purchase of KKCO-TV and WSWG-TV and $23.5

million to retire a portion of Gray's 9.25% Senior Subordinated

Notes. Total debt outstanding at December 31, 2005 and 2004 was

$792.5 million and $655.9 million(1), respectively. In connection

with the spinoff of the publishing and wireless businesses, Gray

adjusted the conversion price of the series C preferred stock from

$14.39 per share to $13.07 per share. The modification of the

conversion price resulted in a non-cash deemed dividend to the

preferred shareholders of approximately $2.4 million as of December

30, 2005. Reclassifications: Prior year operating results of the

publishing and wireless segments in the accompanying condensed

consolidated financial statements have been reclassified to conform

to the 2005 presentation which reflects the results of those

operations in income (loss) from discontinued operations, net of

income taxes. Gray Television, Inc. (in thousands, except per share

data and percentages) Selected operating Three Months Ended Year

Ended data: December 31, December 31, % % 2005 2004 Change 2005

2004 Change Revenues (less agency commissions) $72,975 $86,470

(16)% $261,553 $293,273 (11)% Expenses: Operating expenses before

depreciation, amortization and (gain) loss on disposal of assets,

net. 43,607 45,543 (4)% 161,905 158,305 2 % Corporate and

administrative 2,867 4,242 (32)% 11,505 11,662 (1)% Depreciation

7,132 5,498 30 % 24,456 21,955 11 % Amortization of intangible

assets 458 223 105 % 1,034 920 12 % Amortization of restricted

stock awards 97 189 (49)% 391 512 (24)% (Gain) loss on disposal of

assets, net 1,309 68 1825 % 1,401 (496) (382)% Total expenses

55,470 55,763 (1)% 200,692 192,858 4 % Operating income 17,505

30,707 (43)% 60,861 100,415 (39)% Other income (expense):

Miscellaneous income (expense), net (150) 418 (136)% 558 979 (43)%

Interest expense (13,002) (10,621) 22 % (46,549) (41,972) 11 % Loss

on early extinguishment of debt (1,773) - 0 - NA (6,543) - 0 - NA

Income from continuing operations before income tax expense 2,580

20,504 (87)% 8,327 59,422 (86)% Income tax expense 1,450 7,632

(81)% 3,723 22,905 (84)% Income (loss) from continuing operations

1,130 12,872 (91)% 4,604 36,517 (87)% Income (loss) from operations

of discontinued publishing and wireless operations net of income

tax expense of $810, $1,290, $3,253, and $5,059, respectively

(4,979) 1,932 (358)% (1,242) 7,768 (116)% Net income (loss) (3,849)

14,804 (126)% 3,362 44,285 (92)% Preferred dividends 814 814 0 %

3,258 3,272 (0)% Deemed non-cash preferred stock dividend 2,390 - 0

- NA 2,390 - 0 - NA Net income (loss) available to common

stockholders $(7,053) $13,990 (150)% $(2,286) $41,013 (106)%

Diluted per share information: Income (loss) from continuing

operations available to common stockholders $(0.05) $0.24 $(0.02)

$0.66 Income (loss) from discontinued operations, net of tax (0.10)

0.04 (0.03) 0.16 Net income (loss) available to common stockholders

$(0.15) $0.28 (154)% $(0.05) $0.82 (106)% Weighted average shares

outstanding 48,630 49,280 (1)% 48,649 50,170 (3)% Political revenue

(less agency commission) $1,433 $20,783 (93)% $2,862 $41,706 (93)%

Revenue related to Olympic broadcast (less agency commission) $- $-

NA $- $3,061 (100)% Guidance for the First Quarter of 2006 We

currently anticipate that Gray's broadcasting results of operations

for the three months ended March 31, 2006 will approximate the

ranges presented in the tables below. The guidance below for the

period ended March 31, 2006 does not include an estimated $175,000

to $200,000 of non-cash expense currently anticipated in connection

with the Company's adoption on January 1, 2006 of Statement of

Financial Accounting Standard No. 123, (revised 2005) which relates

to new accounting rules for expensing awards for employee stock

options and/or restricted stock. "As Reported" Results Three Months

Ended March 31, % % Change Change Selected 2006 From 2006 From

operating data: Guidance Actual Guidance Actual Actual Low Range

2005 High Range 2005 2005 Dollars in millions OPERATING REVENUES

Revenues (less agency commissions) $66.5 +14% $67.5 +16% $58.3

OPERATING EXPENSES before depreciation, amortization and other

expenses: Broadcasting operating expenses $44.8 +16% $45.0 +16%

$38.7 Corporate expense $3.2 +23% $3.5 +35% $2.6 Other Selected

Data: Broadcast political revenues (less agency commissions) $1.4

367% $1.6 433% $0.3 Pro Forma Results Three Months Ended March 31,

% % Pro Forma Change Pro Forma Change Pro Forma Selected 2006 From

2006 From for WSAZ operating data: Guidance Pro Forma Guidance Pro

Forma & WNDU Low Range 2005 High Range 2005 2005 Dollars in

millions OPERATING REVENUES Broadcasting operating revenues (less

agency commissions) $69.0 +4% $70.0 +5% $66.6 OPERATING EXPENSES

before depreciation, amortization and other expenses: Broadcasting

Operating expenses $46.7 +6% $47.0 +7% $44.1 Corporate expense $3.2

+23% $3.5 +35% $2.6 Other Selected Data: Broadcast political

revenues (less agency commissions) $1.5 275% $1.7 325% $0.4 Pro

Forma information presents certain operating results of WSAZ and

WNDU as if each station had been acquired on January 1, 2005.

Comments on Guidance for the "As Reported Basis" The above guidance

for broadcasting revenue reflects the cyclical impact of political

advertising spending. The above first quarter 2006 guidance for

broadcasting revenue also includes the impact of Gray's launch of

second channels in eight of its existing television markets since

January 1, 2005 and the acquisition of television stations KKCO,

Grand Junction, CO on January 31, 2005, WSWG, Albany GA on November

10, 2005, WSAZ, Charleston - Huntington, WV on November 30, 2005

and WNDU, South Bend, IN on March 3, 2006. Collectively these

transactions account for approximately $7.4 million of the overall

increase in first quarter broadcast revenue in comparison to the

first quarter of 2005. For television stations and secondary

channels continuously operated since January 1, 2005, Gray

currently anticipates that its local revenue, excluding political

revenue, will increase approximately 7% over the first quarter of

2005. National revenue, excluding political revenue, is currently

expected to decrease approximately 4% over the first quarter of

2005 for those same stations. Also, during the first quarter of

2005 Gray currently anticipates recognizing network revenue of

approximately $0.2 million. Under the same network affiliation

agreements, the related cash payments to be received by Gray are

currently estimated to approximate $0.5 million for the first

quarter of 2006. The above first quarter 2006 guidance for

broadcasting operating expense before depreciation, amortization,

and other expenses also includes the current period impact of

Gray's launch of second channels and the acquisition of several

television stations as discussed above. Collectively these

transactions account for approximately $4.7 million of the overall

increase in first quarter broadcast operating expense before

depreciation, amortization, and other expenses in comparison to the

first quarter of 2005. For television stations and secondary

channels continuously operated since January 1, 2005, Gray

currently anticipates that operating expenses before depreciation,

amortization, and other expenses will increase approximately 4%

from the first quarter of 2005. This expense increase reflects

routine increases in payroll and benefit costs. Also included

within the broadcast operating expense estimates presented above,

we currently estimate that non-cash 401(k) plan expense will

approximate $550,000 for the three months ended March 31, 2006

compared with $500,000 for the same period of 2005. Conference Call

Information Gray Television, Inc. will host a conference call to

discuss its fourth quarter operating results on March 16, 2006. The

call will begin at 1:00 PM Eastern Time. The live dial-in number is

1-800-289-0529 and the confirmation code is 6184459. The call will

be webcast live and available for replay at http://www.gray.tv/.

The taped replay of the conference call will be available at

1-888-203-1112, Confirmation Code: 6184459 until April 16, 2006.

For information contact: Web site: http://www.gray.tv/ Bob Prather

Jim Ryan President and Chief Operating Officer Senior V. P. and

Chief Financial Officer (404) 266-8333 (404) 504-9828

Reconciliations: Reconciliation of Net Income to the Non-GAAP term

"Adjusted Broadcast Cash Flow" ($ in thousands): Three Months Ended

Year Ended December 31, December 31, 2005 2004 2005 2004 Net income

(loss) $ (3,849) $14,804 $3,362 $ 44,285 Add (subtract): (Income)

loss from discontinued operations, net 4,979 (1,932) 1,242 (7,768)

Income tax expense 1,450 7,632 3,723 22,905 Loss on early

extinguishment of debt 1,773 - 0 - 6,543 - 0 - Interest expense

13,002 10,621 46,549 41,972 Miscellaneous (income) expense, net 150

(418) (558) (979) Loss (gain) on disposal of assets, net 1,309 68

1,401 (496) Amortization of restricted stock awards 97 189 391 512

Amortization of intangible assets 458 223 1,034 920 Depreciation

7,132 5,498 24,456 21,955 Amortization of program license rights

2,959 2,822 11,577 11,137 Common Stock contributed to 401(k) Plan

excluding corporate 401(k) contributions 476 998 1,912 2,177

Network compensation revenue recognized (1,060) n/a (5,095) n/a

Network compensation per network affiliation agreement 1,935 n/a

8,031 n/a Payments on program broadcast obligations (2,880) (2,891)

(11,452) (11,055) Adjusted Broadcast Cash Flow $ 27,931 $37,614 $

93,116 $125,565 Adjusted Broadcast Cash Flow is non-GAAP term the

Company uses as a measure of performance. Adjusted Broadcast Cash

Flow is used by the Company to approximate the amount used to

calculate key financial performance covenants including, but not

limited to, limitations on debt, interest coverage, and fixed

charge coverage ratios as defined in the Company's senior credit

facility and/or subordinated note indenture. Adjusted Broadcast

Cash Flow is defined as operating income, plus depreciation and

amortization (including amortization of program broadcast rights),

non-cash compensation and (gain) loss on disposal of assets and

cash payments received or receivable under network affiliation

agreements less payments for program broadcast obligations, less

network compensation revenue and less income (loss) from

discontinued operations, net of income taxes. Accordingly, the

Company has provided a reconciliation of Adjusted Broadcast Cash

Flow to net income. Notes (1) Total debt as of December 31, 2005

and December 31, 2004 does not include $811,000 and $1.0 million,

respectively, of unamortized debt discount on Gray's 91/4% Senior

Subordinated Notes due March 2011. The Company Gray Television,

Inc. is a television broadcast company headquartered in Atlanta,

GA. Gray operates 36 television stations serving 30 markets. Each

of the stations are affiliated with either CBS (17 stations), NBC

(10 stations), ABC (8 stations), or Fox (1 station). In addition,

Gray currently operates eleven digital multi-cast television

channels which are currently affiliated with either UPN or Fox in

certain of its existing markets. Cautionary Statements for Purposes

of the "Safe Harbor" Provisions of the Private Securities

Litigation Reform Act The following comments on Gray's current

expectations of operating results for the first quarter of 2006 are

"forward looking" for purposes of the Private Securities Litigation

Reform Act of 1995. Actual results of operations are subject to a

number of risks and may differ materially from the current

expectations discussed in this press release. See Gray's Annual

Report on Form 10-K for a discussion of risk factors that may

affect its ability to achieve the results contemplated by such

forward looking statements. DATASOURCE: Gray Television, Inc.

CONTACT: Bob Prather, President and Chief Operating Officer,

+1-404-266-8333, or Jim Ryan, Senior V. P. and Chief Financial

Officer, +1-404-504-9828, both of Gray Television, Inc. Web site:

http://www.gray.tv/

Copyright

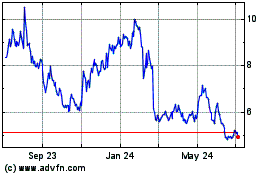

Gray Television (NYSE:GTN)

Historical Stock Chart

From May 2024 to Jun 2024

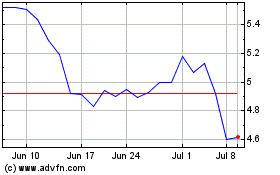

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jun 2023 to Jun 2024