ATLANTA, Nov. 7 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray") (NYSE:GTN) today announced results from operations for the

three months ("third quarter") and nine months ended September 30,

2005 as compared to the three months and nine months ended

September 30, 2004. Significant items to note for the three months

ended September 30, 2005: Change from Same Period of Three Months

Ended September 30, 2005 Prior Year Net local broadcast advertising

Increased 7% or $2.8 million revenue, excluding political

advertising revenue, of $41.9 million Net political advertising

revenue Decreased $11.5 million reflecting of $448,000 the

"off-year" of the political election cycle As of September 30, 2005

December 31, 2004 Cash on Hand $4.1 million $50.6 million Total

Debt(1) $633.0 million $655.9 million Comments on Results of

Operations for the Three Months Ended September 30, 2005: Revenues.

Total revenues for the three months ended September 30, 2005

decreased 13% to $75.1 million as compared to the same period of

the prior year. - Local broadcasting advertising revenues,

excluding political advertising revenues, increased 7% to $41.9

million from $39.1 million. Approximately 32%, or $885,000, of this

increase is attributable to results from Gray's launch of six UPN

second channels in six of its existing television markets since

June 30, 2004, results of WCAV, Charlottesville, VA which began

operations in August 2004 and the acquisition of KKCO, Grand

Junction, CO on January 31, 2005 offset in part by the sale of the

Company's satellite uplink operations on December 31, 2004. We

attribute the remaining approximate 5% increase in non-political

local broadcasting advertising revenues primarily to a moderate

increase in demand for commercial time by local advertisers at the

stations continuously operated by Gray since January 1, 2004.

National broadcasting advertising revenues decreased 4% to $17.2

million from $17.9 million. Political advertising revenues

decreased to $448,000 from $12.0 million reflecting the cyclical

influence of the 2004 Presidential election. In addition, in the

2004 period Gray recorded approximately $3.1 million of broadcast

revenue associated with the broadcast of the 2004 Summer Olympics.

There was no such similar Olympic broadcast in the current year.

Network compensation revenue decreased 59% to $1.0 million from

$2.4 million due to lower revenue from renewed network affiliation

agreements. However, under the terms of the affiliation agreements,

Gray's cash payments received or receivable in excess of revenue

recognized in accordance with generally accepted accounting

principles approximated $949,000 for the three months ended

September 30, 2005. In the same period of the prior year, the

network compensation revenue and the related cash payments received

or receivable were approximately equal in their respective amounts.

Total broadcasting revenues decreased 15% to $62.3 million. -

Publishing and other revenues consists primarily of Gray's

newspaper publishing and paging operations. Publishing and other

revenues decreased 1% to $12.8 million from $13.0 million.

Publishing retail advertising revenue increased 5% to $6.1 million

from $5.8 million. Publishing classified revenue was consistent

between the respective periods at approximately $3.5 million.

Publishing circulation revenue decreased 8% to $1.4 million from

$1.5 million. Operating expenses. Operating expenses increased 8%

to $61.4 million from $57.0 million in the same period of the prior

year. - Broadcasting expenses, before depreciation, amortization

and loss on disposal of assets increased 4% to $40.0 million from

$38.3 million. Approximately 72%, or $1.2 million, of this increase

is attributable to operating expenses relating to Gray's launch of

six UPN second channels in six of its existing television markets

since June 30, 2004, expenses of WCAV, Charlottesville, VA which

began operations in August 2004 and expenses of KKCO, Grand

Junction, CO acquired on January 31, 2005, offset, in part, by the

sale of the Company's satellite uplink operations on December 31,

2004. We attribute the remaining increase to routine increases in

payroll and benefits costs. - Publishing and other expenses

including paging expense, before depreciation, amortization and

loss on disposal of assets, increased 7% to $10.0 million from $9.3

million. The increase in expense was primarily due to increased

transportation, payroll and other professional services expenses

primarily reflecting costs associated with the expansion of

deliveries of the Sunday edition of the Gwinnett Daily Post which

was initiated in August of 2004. - Corporate and administrative

expenses, before depreciation, amortization and loss on disposal of

assets increased 62% to $4.7 million in the three months ended

September 30, 2005 as compared to $2.9 million for the same period

in 2004. Legal and other professional service fees increased

approximately $1.7 million over the third quarter of 2004. Of this

increase, $1.6 million is attributable to professional services

associated with Gray's previously announced proposed spin-off of

its publishing and paging businesses. The prior period did not

include similar expenses. Upon consummation of the spin-off

transactions, Triple Crown Media will distribute cash to Gray

approximating 75% of the professional service costs and expenses

incurred by Gray related to the spin-off transactions. In addition,

auditing service fees increased in the third quarter of 2005 by

approximately $230,000 which was offset by a decrease in consulting

fees of $253,000. Comments on Results of Operations for the Nine

Months Ended September 30, 2005: Revenues. Total revenues for the

nine months ended September 30, 2005 decreased 7% to $227.9 million

as compared to the same period of the prior year. - Local

broadcasting advertising revenues, excluding political advertising

revenues, increased 6% to $126.0 million from $118.4 million.

Approximately 33%, or $2.5 million, of this increase is

attributable to results from Gray's launch of six UPN second

channels in six of its existing television markets since June 30,

2004, results of WCAV, Charlottesville, VA which began operations

in August 2004 and the acquisition of KKCO, Grand Junction, CO on

January 31, 2005 offset in part by the sale of the Company's

satellite uplink operations on December 31, 2004. We attribute the

remaining approximate 4% increase in non-political local

broadcasting advertising revenues to a moderate increase in demand

for commercial time by local advertisers at the stations

continuously operated by Gray since January 1, 2004. National

broadcasting advertising revenues decreased 3% to $51.3 million

from $52.9 million. Political advertising revenues decreased to

$1.4 million from $20.9 million reflecting the cyclical influence

of the 2004 Presidential election. In addition, in the 2004 period

Gray recorded approximately $3.0 million of broadcast revenue

associated with the broadcast of the 2004 Summer Olympics. There

was no such similar Olympic broadcast in the current year. Network

compensation revenue decreased 45% to $4.0 million from $7.3

million due to lower revenue from renewed network affiliation

agreements. However, under the terms of the affiliation agreements,

Gray's cash payments received or receivable in excess of revenue

recognized in accordance with generally accepted accounting

principles approximated $2.1 million for the nine months ended

September 30, 2005. In the same period of the prior year, the

network compensation revenue and the related cash payments received

or receivable were approximately equal in their respective amounts.

Total broadcasting revenues decreased 9% over the same period of

the prior year to $188.6 million. - Publishing and other revenues

consists primarily of Gray's newspaper publishing and paging

operations. Total publishing and other revenues which includes the

results of the paging operations increased 3%. Publishing revenues

increased 5% to $34.1 million from $32.6 million. Publishing retail

advertising revenue increased 6% to $18.3 million from $17.3

million. Publishing classified revenue increased 7% to $10.7

million. Publishing circulation revenue decreased 9% to $4.1

million. Operating expenses. Operating expenses increased 8% to

$178.4 million from $165.7 million in the same period of the prior

year. - Broadcasting expenses, before depreciation, amortization

and loss on disposal of assets increased 5% to $118.3 million from

$112.8 million. Approximately 58%, or $3.2 million, of this

increase is attributable to operating expenses relating to Gray's

launch of six UPN second channels in six of its existing television

markets since June 30, 2004, expenses of WCAV, Charlottesville, VA

which began operations in August 2004 and expenses of KKCO, Grand

Junction, CO acquired on January 31, 2005, offset, in part, by the

sale of the Company's satellite uplink operations on December 31,

2004. We attribute the remaining increase to routine increases in

payroll and benefits costs. - Publishing and other expenses

including paging expense, before depreciation, amortization and

loss on disposal of assets, increased 8% to $29.3 million from

$27.3 million. The increase in expenses was due to increased

payroll, newsprint, other professional and transportation expenses

of the publishing operations primarily reflecting costs associated

with the expansion of deliveries of the Sunday edition of the

Gwinnett Daily Post which was initiated in August of 2004. -

Corporate and administrative expenses, before depreciation,

amortization and loss on disposal of assets increased 54% to $11.4

million from $7.4 million in the nine months ended September 30,

2005 as compared to the same period in 2004. Legal and other

professional service fees increased approximately $3.4 million over

the same period of 2004 and such increase is primarily attributable

to an increase of $2.8 million in professional services associated

with Gray's proposed spin-off of its publishing and paging

businesses. In addition, audit fees increased approximately

$655,000 over the comparable period of 2004. Upon consummation of

the spin-off transactions, Triple Crown Media will distribute cash

to Gray approximating 75% of the professional service costs and

expenses incurred by Gray related to the spin-off transactions.

Balance Sheet: Gray's cash balance was $4.1 million at September

30, 2005 compared to $50.6 million at December 31, 2004. The

decrease in cash reflects $39.3 million of net cash generated by

Gray's operations during the nine months of 2005 compared to $82.5

million for the first nine months of 2004. The 2005 net cash

generated from operations was offset by the return of $18.3 million

of capital to Gray's common and preferred shareholders through the

payment of dividends of $12.6 million and the purchase of $5.7

million of its common stock. Gray also used $13.9 million in the

purchase of KKCO-TV and $23.5 million to retire a portion of Gray's

9.25% Senior Subordinated Notes. Total debt outstanding at June 30,

2005 and December 31, 2004 was $633.0 million and $655.9

million(1), respectively. Reclassifications: Portions of prior year

publishing revenue and expense in the accompanying condensed

consolidated financial statements have been reclassified to conform

to the 2005 presentation. For the three months and nine months

ended September 30, 2004, $293,000 and $1.0 million, respectively,

of publishing revenue and expense that was previously recognized

separately has been presented on a net basis. Gray Television, Inc.

(in thousands, except per share data and percentages) Three Months

Ended Selected operating data: September 30, 2005 2004 % Change

OPERATING REVENUES Broadcasting (less agency commissions) $62,281

$73,658 (15)% Publishing and other 12,837 12,965 (1)% TOTAL

OPERATING REVENUES 75,118 86,623 (13)% EXPENSES Operating expenses

before depreciation, amortization and loss on disposal of assets:

Broadcasting 40,019 38,311 4 % Publishing and other 9,999 9,337 7 %

Corporate and administrative 4,672 2,884 62 % Depreciation 6,855

6,088 13 % Amortization of intangible assets 159 232 (31)%

Amortization of restricted stock awards 98 134 (27)% (Gain) loss on

disposal of assets, net (446) 17 (2724)% TOTAL EXPENSES 61,356

57,003 8 % Operating income 13,762 29,620 (54)% Miscellaneous

income, net 256 193 33 % Interest expense (11,122) (10,418) 7 %

Loss on early extinguishment of debt 0 0 NA INCOME BEFORE INCOME

TAX EXPENSE 2,896 19,395 (85)% Income tax expense 1,153 7,613 (85)%

NET INCOME 1,743 11,782 (85)% Preferred dividends 815 815 0 % NET

INCOME AVAILABLE TO COMMON STOCKHOLDERS $928 $10,967 (92)% Diluted

per share information: Net income per share available to common

stockholders $0.02 $0.22 (91)% Weighted average shares outstanding

48,920 50,322 (3)% Political revenue (less agency commission) $449

$11,967 (96)% Revenue related to Olympic broadcast (less agency

commission) $- $3,061 (100)% Gray Television, Inc. (in thousands,

except per share data and percentages) Nine Months Ended Selected

operating data: September 30, 2005 2004 % Change OPERATING REVENUES

Broadcasting (less agency commissions) $188,578 $206,802 (9)%

Publishing and other 39,314 38,148 3 % TOTAL OPERATING REVENUES

227,892 244,950 (7)% EXPENSES Operating expenses before

depreciation, amortization and loss on disposal of assets:

Broadcasting 118,298 112,762 5 % Publishing and other 29,339 27,262

8 % Corporate and administrative 11,400 7,420 54 % Depreciation

18,557 17,760 4 % Amortization of intangible assets 576 751 (23)%

Amortization of restricted stock awards 294 323 (9)% (Gain) loss on

disposal of assets, net (107) (605) (82)% TOTAL EXPENSES 178,357

165,673 8 % Operating income 49,535 79,277 (38)% Miscellaneous

income, net 709 600 18 % Interest expense (33,547) (31,353) 7 %

Loss on early extinguishment of debt (4,770) 0 NA INCOME BEFORE

INCOME TAX EXPENSE 11,927 48,524 (75)% Income tax expense 4,716

19,042 (75)% NET INCOME 7,211 29,482 (76)% Preferred dividends

2,444 2,458 (1)% NET INCOME AVAILABLE TO COMMON STOCKHOLDERS $4,767

$27,024 (82)% Diluted per share information: Net income per share

available to common stockholders $0.10 $0.54 (81)% Weighted average

shares outstanding 48,939 50,471 (3)% Political revenue (less

agency commission) $1,429 $20,923 (93)% Revenue related to Olympic

broadcast (less agency commission) $- $3,061 (100)% Guidance for

the Fourth Quarter of 2005 Since the previously announced proposed

spin-off of our publishing and paging businesses is currently

anticipated to be consummated before December 31, 2005, we have

focused our comments on fourth quarter and full year 2005 guidance

on our television broadcast operations. We currently anticipate

that Gray's broadcasting results of operations for the three months

and year ended December 31, 2005 will approximate the ranges

presented in the tables below. Three Months Ended December 31, 2005

% 2005 % Guidance Change Guidance Change Low Range From High From

Actual Selected operating data: 2004 Range 2004 2004 Dollars in

millions OPERATING REVENUES Broadcasting operating revenues (less

agency commissions) $68.0 -21 % $69.0 -20 % $86.5 OPERATING

EXPENSES Broadcasting operating expenses before depreciation,

amortization and other expenses: $41.3 -9 % $41.5 -9 % $45.5 Other

Selected Data Broadcast political revenues (less agency

commissions) $1.1 -95 % $1.2 -94 % $20.8 Year Ended December 31,

2005 % 2005 % Guidance Change Guidance Change Low Range From High

From Actual Selected operating data: 2004 Range 2004 2004 Dollars

in millions OPERATING REVENUES Broadcasting operating revenues

(less agency commissions) $256.6 -13 % $257.6 -12 % $293.3

OPERATING EXPENSES Broadcasting operating expenses before

depreciation, amortization and other expenses: $159.6 1 % $159.8 1

% $158.3 Other Selected Data Broadcast political revenues (less

agency commissions) $2.5 -94 % $2.6 -94 % $41.7 Broadcast revenue

related to Olympic broadcast (less agency $0 -100 % $0 -100 % $3.1

commissions) The above guidance for broadcasting revenue reflects

the cyclical impact of political advertising spending. The above

guidance for broadcasting revenue also includes the impact of

Gray's launch of six UPN second channels in six of its existing

television markets since June 30, 2004, results of WCAV,

Charlottesville, VA which began operations in August 2004 and the

acquisition of KKCO, Grand Junction, CO on January 31, 2005 offset

in part by the sale of the Company's satellite uplink operations on

December 31, 2004. For television stations continuously operated

since January 1, 2004, Gray currently anticipates that its local

revenue, excluding political revenue, will increase approximately

7% over the fourth quarter of 2004 and approximately 5% for the

full year 2005 compared to 2004. The increase in the fourth quarter

reflects in part the relative lack of political advertising in the

fourth quarter of 2005 compared to 2004. National revenue,

excluding political revenue, is currently expected to increase

approximately 3% over the fourth quarter of 2004 and decline

approximately 3% for the full year 2005 compared to 2004 for the

same stations. During the fourth quarter of 2005 Gray currently

anticipates recognizing network revenue of approximately $1

million. Under the same network affiliation agreements, the related

cash payments to be received by Gray are currently estimated to

approximate $1.9 million for the fourth quarter of 2005. For the

full year of 2005 Gray currently anticipates recognizing network

revenue of approximately $5 million while the related cash payments

to be received by Gray are currently estimated to approximate $8

million. During 2004 the amounts recorded as network revenue and

the corresponding cash payments were approximately equal in amount.

The above guidance for broadcasting operating expense before

depreciation, amortization, and other expenses also includes the

current period impact of Gray's launch of six UPN second channels

in six of its existing television markets since June 30, 2004,

results of WCAV, Charlottesville, VA which began operations in

August 2004 and the acquisition of KKCO on January 31, 2005 offset

in part by the sale of the Company's satellite uplink operations on

December 31, 2004. For television stations continuously operated

since January 1, 2004, Gray currently anticipates that operating

expenses before depreciation, amortization, and other expenses will

decrease approximately 11% from the fourth quarter of 2004 and that

for the year ended December 31, 2005 such expenses will be

approximately 2% below the full year results for 2004. These

expense declines are reflective of lower national sales

representative commissions and employee incentive bonus

compensation each due to the lower political revenue in 2005

compared to 2004. Also included within the broadcast operating

expense estimates presented above, we currently estimate that

non-cash 401(k) plan expense will approximate $475,000 for the

three months ended December 31, 2005 compared with $1.0 million for

the same period of 2004. For the full year 2005, broadcast non-cash

401(k) plan expense is currently estimated to approximate $1.9

million compared with $2.2 million for 2004. Conference Call

Information Gray Television, Inc. will host a conference call to

discuss its third quarter operating results on November 7, 2005.

The call will begin at 1:00 PM Eastern Time. The live dial-in

number is 1-877-888-3855 and the reservation number is T032801. The

call will be webcast live and available for replay at

http://www.gray.tv/. The taped replay of the conference call will

be available at 1-888-509-0081 until November 21, 2005. For

information contact: Bob Prather Jim Ryan President and Chief

Operating Senior V. P. and Chief Officer Financial Officer (404)

266-8333 (404) 504-9828 Web site: http://www.gray.tv/

Reconciliations: Reconciliation of Net Income to the Non-GAAP term

"Adjusted Media Cash Flow" ($ in thousands): Three Months Ended

Nine Months Ended September 30, September 30, 2005 2004 2005 2004

Net income $1,743 $11,782 $7,211 $29,482 Add (subtract): Income tax

expense 1,153 7,613 4,716 19,042 Loss on early extinguishment of

debt 0 0 4,770 0 Interest expense 11,122 10,418 33,547 31,353

Miscellaneous (income) expense, net (256) (193) (709) (600) Loss

(gain) on disposal of assets, net (446) 17 (107) (605) Amortization

of restricted stock awards 98 134 294 323 Amortization of

intangible assets 159 232 576 751 Depreciation 6,855 6,088 18,557

17,760 Amortization of program license rights 2,961 2,800 8,618

8,315 Common Stock contributed to 401(k) Plan excluding corporate

401(k) contributions 545 476 1,658 1,384 Network compensation

revenue recognized (986) n/a (4,036) n/a Network compensation per

network affiliation agreement 1,935 n/a 6,097 n/a Payments on

program broadcast (2,904) (2,765) (8,572) (8,164) obligations

Adjusted Media Cash Flow $21,979 $36,602 $72,620 $99,041 Adjusted

Media Cash Flow is non-GAAP term the Company uses as a measure of

performance. Adjusted Media Cash Flow is used by the Company to

approximate the amount used to calculate key financial performance

covenants including, but not limited to, limitations on debt,

interest coverage, and fixed charge coverage ratios as defined in

the Company's senior credit facility and/or subordinated note

indenture. Adjusted Media Cash Flow is defined as operating income,

plus depreciation and amortization (including amortization of

program broadcast rights), non-cash compensation and (gain) loss on

disposal of assets, and cash payments received or receivable under

network affiliation agreements less payments for program broadcast

obligations and less network compensation revenue. Accordingly, the

Company has provided a reconciliation of Adjusted Media Cash Flow

to net income. Notes (1) Total debt as of September 30, 2005 and

December 31, 2004 does not include $832,000 and $1.0 million,

respectively, of unamortized debt discount on Gray's 91/4% Senior

Subordinated Notes due March 2011. The Company Gray Television,

Inc. is a communications company headquartered in Atlanta, Georgia,

and currently owns 31 television stations serving 27 television

markets. The stations include 16 CBS affiliates, eight NBC

affiliates and seven ABC affiliates. Gray Television, Inc. has 23

stations ranked #1 in local news audience and 22 stations ranked #1

in overall audience within their respective markets based on the

average results of the 2004 Nielsen ratings reports. The TV station

group reaches approximately 5.5% of total U.S. TV households. Gray

also owns five daily newspapers, four in Georgia and one in

Indiana. Cautionary Statements for Purposes of the "Safe Harbor"

Provisions of the Private Securities Litigation Reform Act The

following comments on Gray's current expectations of operating

results for the fourth quarter and full year of 2005 are "forward

looking" for purposes of the Private Securities Litigation Reform

Act of 1995. Actual results of operations are subject to a number

of risks and may differ materially from the current expectations

discussed in this press release. See Gray's Annual Report on Form

10-K for a discussion of risk factors that may affect its ability

to achieve the results contemplated by such forward looking

statements. DATASOURCE: Gray Television, Inc. CONTACT: Bob Prather,

President and Chief Operating Officer, +1-404-266-8333, or Jim

Ryan, Senior V.P. and Chief Financial Officer, +1-404-504-9828,

both of Gray Television, Inc. Web site: http://www.gray.tv/

Copyright

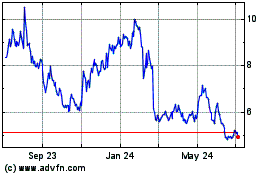

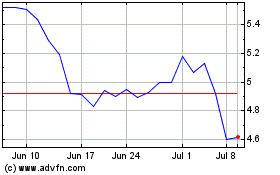

Gray Television (NYSE:GTN)

Historical Stock Chart

From May 2024 to Jun 2024

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jun 2023 to Jun 2024