false

0000043196

0000043196

2024-01-30

2024-01-30

0000043196

gtn:ClassACommonStockNoParValueCustomMember

2024-01-30

2024-01-30

0000043196

gtn:CommonStockNoParValueCustomMember

2024-01-30

2024-01-30

`

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 30, 2024

Gray Television, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Georgia

|

001-13796

|

58-0285030

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4370 Peachtree Road, NE, Atlanta, Georgia

|

|

30319

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

404-504-9828

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock (no par value)

|

GTN.A

|

New York Stock Exchange

|

|

common stock (no par value)

|

GTN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

On January 30, 2024, Gray Television, Inc. (the “Company”) issued a press release (the “Press Release”) that disclosed, among other things, updates to certain previously announced guidance for the fourth quarter of 2023, based on preliminary information available to date. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated into this Item 2.02 by reference.

The information set forth under this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

The Press Release also announced (i) that the Company is proposing, subject to market and other conditions, to refinance certain of its existing senior credit facilities and (ii) the Company's anticipated proceeds from the sale of Broadcast Music, Inc. The Press Release attached hereto as Exhibit 99.1 is incorporated into this Item 7.01 by reference.

The information set forth under this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Gray Television, Inc.

|

|

| |

|

|

|

January 30, 2024

|

By:

|

/s/ James C. Ryan

|

|

| |

|

Name:

|

James C. Ryan

|

|

| |

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

|

Exhibit 99.1

NEWS RELEASE

Gray Announces Proposed Refinancing of Senior Credit Facilities, Updates Guidance

for Fourth Quarter 2023, and Announces Anticipated Proceeds from Sale of BMI

Atlanta, Georgia – January 30, 2024. . . Gray Television, Inc. (“Gray,” “we,” “us” or “our”) (NYSE: GTN) announced today that it is proposing, subject to market and other conditions, to refinance certain of its existing senior credit facilities (the “Senior Credit Facilities”). Gray also announced updates to certain of its previously announced guidance for the fourth quarter of 2023, based on preliminary information available to date.

Refinancing. Today, Gray commenced a process through which it expects to amend certain terms of its $1.19 billion term loan and $500 million revolving credit facility due 2026, including extending the maturity of its $1.19 billion term loan from January 2026 to July 2029 and its $500 million revolving credit facility from January 2026 to December 2027. We cannot provide any assurance about the timing, terms, or interest rate associated with the planned financing, or that the financing transactions will be completed.

Updated Guidance. Gray initially issued guidance for fourth quarter 2023 on November 8, 2023. While Gray is continuing the process of finalizing its financial results for the fourth quarter of 2023, Gray provides the following updates to its guidance on its estimated results of operations representing the most current information and estimates available to Gray as of the date of this release.

|

Selected operating data:

|

|

Low End

Guidance for

the Fourth

Quarter of

2023

|

|

|

% Change From Previous Guidance for the

Fourth

Quarter of

2023

|

|

|

High End

Guidance for

the Fourth

Quarter of

2023

|

|

|

% Change From Previous Guidance for the

Fourth

Quarter of

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING REVENUE:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting Revenue (less agency commissions)

|

|

$ |

830 |

|

|

|

1 |

%

|

|

$ |

835 |

|

|

|

0 |

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue (less agency commissions)

|

|

$ |

860 |

|

|

|

1 |

%

|

|

$ |

865 |

|

|

|

0 |

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(before depreciation, amortization and gain on disposal of assets):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting

|

|

$ |

600 |

|

|

|

-1 |

%

|

|

$ |

605 |

|

|

|

-1 |

%

|

|

Production companies

|

|

$ |

26 |

|

|

|

0 |

%

|

|

$ |

28 |

|

|

|

0 |

%

|

|

Corporate and administrative

|

|

$ |

30 |

|

|

|

-14 |

%

|

|

$ |

35 |

|

|

|

-13 |

%

|

As of December 31, 2023, we currently expect to report approximately:

| |

•

|

$21 million of cash on hand

|

| |

•

|

$2,660 million principal amount of secured debt; and

|

| |

•

|

$6,210 million principal amount of total debt (excluding unamortized deferred financing costs and premium).

|

We currently anticipate that we will record a pre-tax, non-cash impairment of $21 million for certain investments made prior to calendar year 2023. In addition, we anticipate that our total leverage ratio, as defined under our Senior Credit Facility, measured on a trailing eight quarter basis, netting all cash on hand, and giving pro forma effect for all acquisitions completed through the date of this release, will be between 5.60 times and 5.65 times as of December 31, 2023.

We have not yet completed our normal financial closing and review process; therefore, these estimates are subject to change upon finalization. As a result, our actual results may be different and such differences could be material. Investors should exercise caution in relying on the information contained herein and should not draw any inferences from this information regarding financial or operating data that is not presented below.

Anticipated BMI Proceeds. We expect to receive approximately $110 million in pre-tax cash proceeds upon the closing of the previously announced sale of Broadcast Music, Inc. (“BMI”) to a shareholder group led by New Mountain Capital, LLC. Gray’s equity ownership in BMI began decades ago and has increased through various acquisitions of other broadcast stations and companies over the years. We understand that BMI’s sale remains subject to customary regulatory and other approvals and is currently expected to close by the end of the first quarter 2024. We intend to use the proceeds for general corporate purposes, which may include the repayment of debt.

About Gray:

Gray Television, Inc. is a multimedia company headquartered in Atlanta, Georgia. Gray is the nation’s largest owner of top-rated local television stations and digital assets in the United States. Its television stations serve 113 television markets that collectively reach approximately 36 percent of US television households. This portfolio includes 80 markets with the top-rated television station and 102 markets with the first and/or second highest rated television station. Gray also owns video program companies Raycom Sports, Tupelo Media Group, and PowerNation Studios, as well as the studio production facilities Assembly Atlanta and Third Rail Studios. Gray owns a majority interest in Swirl Films. For more information, please visit www.gray.tv.

Cautionary Statements for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act

This press release contains certain forward-looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements are statements other than those of historical fact, and may be identified by words such as “estimates,” “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties, which in some instances are beyond Gray’s control, include Gray’s current expectations and beliefs of operating results for the fourth quarter of 2023 or other periods, Gray’s ability to complete its proposed refinancing of its Credit Facilities and receive the anticipated proceeds from the sale of BMI, on the terms and within the timeframe currently contemplated, and other future events. Gray is subject to additional risks and uncertainties described in Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations sections contained therein, which reports are made publicly available via its website, www.gray.tv. Any forward-looking statements in this communication should be evaluated in light of these important risk factors. This press release reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this communication beyond the date hereof, whether as a result of new information, future events or otherwise.

Gray Contacts:

Jim Ryan, Executive Vice President and Chief Financial Officer, 404-504-9828

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, 404-266-8333

v3.24.0.1

Document And Entity Information

|

Jan. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Gray Television, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 30, 2024

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, File Number |

001-13796

|

| Entity, Tax Identification Number |

58-0285030

|

| Entity, Address, Address Line One |

4370 Peachtree Road

|

| Entity, Address, City or Town |

Atlanta

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30319

|

| City Area Code |

404

|

| Local Phone Number |

504-9828

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000043196

|

| ClassACommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock (no par value)

|

| Trading Symbol |

GTN.A

|

| Security Exchange Name |

NYSE

|

| CommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

common stock (no par value)

|

| Trading Symbol |

GTN

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_ClassACommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_CommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

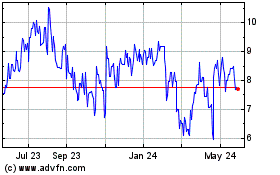

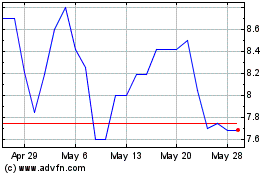

Gray Television (NYSE:GTN.A)

Historical Stock Chart

From Apr 2024 to May 2024

Gray Television (NYSE:GTN.A)

Historical Stock Chart

From May 2023 to May 2024