Newmont Cuts Costs at Conga - Analyst Blog

March 15 2012 - 12:57PM

Zacks

Gold miner Newmont Mining Corporation (NEM)

announced that it will be cutting costs at its Conga gold and

copper project in Peru. The company has halted the project since

November 2011 due to protests by the farmers and local Government

officials. The protestors are of the idea that the mine will

replace the existing alpine lakes with artificial reservoirs,

thereby causing pollution.

The investment in the project is estimated to be $4.8 billion

and its halt was costing the company around $2 million each day.

Further, Newmont took adequate measures to slash costs and

announced the termination of contract with 6000 people. The company

is considering revising the project’s costs.

Newmont is waiting for the government’s environmental impact

study of the project, scheduled in the first week of April 2012,

after which Newmont expects to restart the project. Though the

company has completed all the legal requirements, Newmont has

undertaken this additional process.

In February 2012, Newmont reported earnings of $1.17 per share

in the fourth quarter of 2011 compared with $1.16 per share in the

prior-year quarter and missed the Zacks Consensus Estimate of $1.25

per share.

Total revenue was $2.77 billion, up 9% year over year from

$2.548 billion. It missed the Zacks Consensus Estimate of $2.78

billion. Newmont reported attributable gold and copper production

of 1.3 million ounces and 47 million pounds, respectively, in the

quarter at costs applicable to sales of $602 per ounce, and $1.58

per pound on a co-product basis.

For fiscal 2012, the company expects attributable gold

production of approximately 5.0 million to 5.2 million ounces and

copper production of 150 to 170 million pounds. Costs applicable to

sales are expected to be between $625 and $675 per ounce for gold.

Costs applicable to copper sales are expected to be between $1.80

and $2.20 per pound of copper.

The company currently plans to spend $3.0 to $3.3 billion in

attributable capital expenditures in 2012, or $4.0 to $4.3 billion

on a consolidated basis. Approximately 60% of 2012 consolidated

capital expenditures are expected to be related to major project

initiatives, including further development of the Akyem project in

Ghana, Tanami Shaft, the Conga project in Peru, while the remaining

40% is expected to be for growth and sustaining capital.

Currently, the company retains a Zacks #3 Rank, which translates

into a short-term (1 to 3 months) Hold rating and we have

recommended the shares of the company as “Neutral” for the

long-term (more than 6 months). Newmont competes with

AngloGold Ashanti Ltd. (AU), Barrick Gold

Corporation (ABX) and Gold Fields Ltd.

(GFI).

BARRICK GOLD CP (ABX): Free Stock Analysis Report

ANGLOGOLD LTD (AU): Free Stock Analysis Report

GOLD FIELDS-ADR (GFI): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

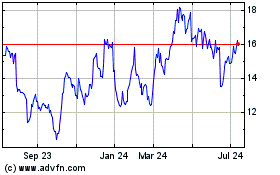

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

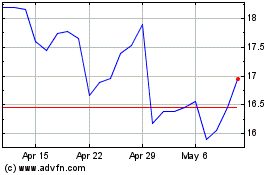

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jul 2023 to Jul 2024