UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 2)1

Gildan Activewear Inc.

(Name

of Issuer)

Common Shares

(Title of Class of Securities)

375916103

(CUSIP Number)

Andrew M. Freedman

Olshan Frome Wolosky LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

January 19, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Browning West, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,640,448 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,640,448 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,640,448 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN, IA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Usman Nabi |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,640,448 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,640,448 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,640,448 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

The following constitutes

Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment No. 2”). This Amendment No. 2 amends the Schedule

13D as specifically set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

The Reporting Persons are

severely disappointed by the Issuer’s persistence in focusing on an irrelevant issue under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976, as amended (the “HSR Act”). The Issuer’s seeming attempt to invalidate the Reporting Persons’ valid

requisition for a Special Meeting of Shareholders is intended to distract from the substance of the matter at hand – namely, the

Board’s extremely poor judgment in terminating Glenn Chamandy and hiring Vince Tyra to replace him, its refusal to engage in any

kind of good faith reconsideration of that decision, and its subsequent conduct which is explicable only as being designed to entrench

the Board, contrary to the best interests of the Issuer and its shareholders.

Nevertheless, on January

19, 2024, Browning West Cayman Fund LP (“BW Cayman”) filed, expressly under protest, a Notification and Report Form with the

Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice. Such filing was made under protest on the grounds

that certain acquisitions of Shares during December 2023 were not subject to the filing and waiting period requirements of the HSR Act

because of the Reporting Persons’ good faith belief that BW Cayman is exempt from filing pursuant to 16 C.F.R. § 802.51(b).

On January 21, 2024, the

Reporting Persons issued a press release and open letter (the “January 21 Press Release”), in which the Reporting Persons

emphasized their belief that the Board is now resorting to desperate and egregious entrenchment maneuvers to try and deprive its shareholders

of the opportunity to replace the directors responsible for recent missteps and value destruction with the Reporting Persons’ highly

qualified director candidates at the Special Meeting. In the January 21 Press Release, the Reporting Persons disclose that they were informed

that the Board is seeking to invalidate their requisition for the Special Meeting under Canadian law based on the irrelevant premise that

the Reporting Persons violated the HSR Act. The Reporting Persons believe it is clear that the Board has no respect for corporate democracy

or the Issuer’s shareholders and, despite holders of approximately 35% of the outstanding Shares independently making public statements

of support, the Board’s directors are deploying the Issuer’s corporate machinery for self-serving legal tactics designed to

insulate them from accountability. Despite the Board’s intransigence and clear desire to avoid being held accountable, the Reporting

Persons remain committed to taking all necessary steps, including through the legal and regulatory channels, to protect their investment

and set a strong foundation for long-term value creation for the Issuer.

A copy of the January 21

Press Release is attached hereto as Exhibit 99.1, which is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

| 99.1 | January 21 Press Release. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: January 23, 2024

| |

Browning West, LP |

| |

|

| |

By: |

/s/ Samuel Green |

| |

|

Name: |

Samuel Green |

| |

|

Title: |

Chief Compliance Officer and Chief Financial Officer |

| |

/s/ Usman Nabi |

| |

Usman Nabi |

Exhibit 99.1

Browning West Discloses Gildan Activewear’s Efforts

to Deprive Shareholders of an Opportunity to Reconstitute the Board at a Validly Requisitioned Special Meeting

Issues Letter to Fellow Shareholders Regarding

the Board’s Desperate and Self-Serving Attempt to Avoid Holding Browning West’s Requisitioned Special Meeting

Notes That the Board’s Most Recent Gambit

Coincides with Other Troubling Actions, Including the Initiation of a Campaign to Intimidate and Silence Vocal Shareholders

LOS ANGELES--(BUSINESS WIRE)--Browning West, LP (together

with its affiliates, “Browning West” or “we”), which is a long-term shareholder of Gildan Activewear Inc. (NYSE:

GIL) (TSX: GIL) (“Gildan” or the “Company”) and beneficially owns approximately 5.0% of the Company’s outstanding

shares, today issued an open letter to fellow shareholders in response to the Board of Directors’ (the “Board”) attempt

to invalidate Browning West’s valid requisition for a Special Meeting of Shareholders (the “Special Meeting”).

***

Fellow Shareholders,

You are likely aware that Browning West, a long-term

and significant shareholder of Gildan, recently requisitioned a Special Meeting to provide you the opportunity to vote on a reconstitution

of the Board. We took this step because Gildan’s directors have destroyed substantial value and jeopardized the Company’s

future by abruptly terminating a proven Chief Executive Officer and installing a new leader with a clear track record of value destruction

and no articulated strategy. As we had forewarned in our January 9th letter to shareholders, we are writing to alert

you that the Board is now resorting to desperate and egregious entrenchment maneuvers to try to deprive you of the opportunity to replace

the directors responsible for recent missteps and value destruction with Browning West’s highly qualified director candidates at

a Special Meeting.

This past weekend, Browning West was informed that

the Board is seeking to invalidate our requisition under Canadian law for a Special Meeting based on the false premise that we violated

the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976. Although we would normally just privately address this seemingly flawed

and self-serving allegation, it has become clear to us that the Board has no respect for corporate democracy or the shareholder franchise.

It is obvious that Browning West poses no substantive antitrust concerns to any concerned authority, which is why the Board’s gambit

only reinforces our previously articulated case for removing a majority of directors and specifically: Donald Berg, Maryse Bertrand, Marc

Caira, Shirley Cunningham, Charles Herington, Luc Jobin, Craig Leavitt, and Chris Shackelton. Despite holders of approximately 35% of

Gildan’s outstanding shares independently publicizing their support for Browning West’s campaign, these directors are deploying

Gildan’s corporate machinery on self-serving legal tactics designed to insulate them from accountability. We know that the Board

has hired at least three law firms, two investment banks, a public relations firm, a proxy solicitor, and a private investigator. This

absurd level of expenditure is being borne by shareholders and deployed against our own interests for the simple reason that the Board

presumably knows that if a vote was held today, all eight of our director candidates would be elected. Meanwhile, every day that Gildan

delays the Special Meeting, the value destruction and risk of permanent damage to the business continues under the “leadership”

of the current Board.

It is important to highlight that the Board’s

troubling conduct extends well beyond this latest stunt. In addition to spending the past two weeks publicizing misinformation about Browning

West and Gildan’s founder and former Chief Executive Officer Glenn Chamandy, the Board has been brazenly dismissing our reasonable

requests to set a date for the Special Meeting. We have also received unsolicited feedback that the Board has been actively trying to

silence vocal shareholders by sending them threatening and meritless legal letters. Additionally, it has come to our attention that Gildan

has retained the law firm that Browning West has continuously engaged since the fund’s inception and been using for normal-course

investment fund work as recently as last week. We believe that Gildan retained our legal advisor for activism defense services after we

issued our December 14th letter to the Board and did so without Browning West providing a conflict waiver. This is a deplorable

tactic that poses serious legal and ethical issues, and we are deeply concerned that Browning West’s confidential information has

been shared with Gildan and its advisors.

Although we want you to be aware of the facts pertaining

to the Board’s disturbing actions, rest assured that Browning West is in no way deterred or intimidated. Gildan has been one of

Canada’s greatest value creation case studies, but it is unfortunate that the Board is now turning it into one of Canada’s

greatest corporate governance failures. Despite the Board’s intransigence and clear desire to avoid being held accountable at a

Special Meeting, we are completely committed to taking all necessary steps, including through the legal and regulatory channels, to protect

our investment and set a strong foundation for long-term value creation at Gildan. In our view, the Board’s poor conduct only serves

to validate Browning West’s campaign.

Sincerely,

| Usman S. Nabi |

Peter M. Lee |

***

No Solicitation

This press release is for informational purposes only

and is not a solicitation of proxies. If Browning West determines to solicit proxies in respect of any meeting of shareholders of the

Company, any such solicitation will be undertaken by way of an information circular or as otherwise permitted by applicable Canadian corporate

and securities laws.

Disclaimer for Forward-Looking Information

Certain information in this news release may constitute

“forward-looking information” within the meaning of applicable securities legislation. Forward-looking statements and information

generally can be identified by the use of forward-looking terminology such as “outlook,” “objective,” “may,”

“will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,”

“should,” “plans,” “continue,” or similar expressions suggesting future outcomes or events. Forward-looking

information in this news release may include, but is not limited to, statements of Browning West regarding (i) how Browning West intends

to exercise its legal rights as a shareholder of the Company, and (ii) its plans to make changes at the Board and management of the Company.

Although Browning West believes that the expectations

reflected in any such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ

materially from those contained in the statements including, without limitation, the risks that (i) the Company may use tactics to thwart

the rights of Browning West as a shareholder and (ii) the actions being proposed and the changes being demanded by Browning West, may

not take place for any reason whatsoever. Except as required by law, Browning West does not intend to update these forward-looking statements.

Advisors

Olshan Frome Wolosky LLP is serving as legal counsel,

Goodmans LLP is serving as Canadian legal counsel, and Longacre Square Partners is serving as strategic advisor to Browning West. Carson

Proxy is serving as proxy advisor.

About Browning West, LP

Browning West is an independent investment partnership

based in Los Angeles, California. The partnership employs a concentrated, long-term, and fundamental approach to investing and focuses

primarily on investments in North America and Western Europe.

Browning West seeks to identify and invest in a limited

number of high-quality businesses and to hold these investments for multiple years. Backed by a select group of leading foundations, family

offices, and university endowments, Browning West’s unique capital base allows it to focus on long-term value creation at its portfolio

companies.

Browning West

Longacre Square

Partners

Charlotte Kiaie /

Scott Deveau, 646-386-0091

| browningwest@longacresquare.com | |

Carson Proxy

Christine Carson,

416-804-0825

| christine@carsonproxy.com | |

###

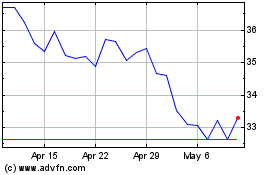

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Apr 2024 to May 2024

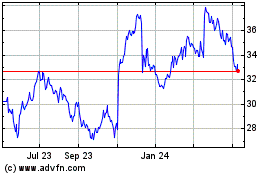

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From May 2023 to May 2024