Optimized Portfolio Focused on Maximizing

Value

Differentiated Asset Base for Long-Term

Sustainable Growth

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent energy company with over 20 years of successful

operations across Latin America, announces its 2025 Work Program

(the “Program”), approved by the Board of Directors.

The Program is designed to deliver increasing value to its

shareholders through disciplined capital allocation, operational

excellence, and sustainable growth. The Program integrates and

responds to the following key principles of GeoPark’s “North Star”

strategy:

- Highly Profitable, Dependable and Sustainable - More

than $400 million of annual EBITDA generation (EBITDA margin >

50%); ROACE1 > 30% - Underpinned by operational excellence and a

comprehensive sustainability strategy - Decreasing environmental

footprint: 35-40% carbon intensity reduction vs 2020

- Focused on Growth Through Big Assets, Big Basins and Big

Plays - Distinctive Assets: Llanos 34, CPO-5, Vaca Muerta -

Differentiated Basins: Conventional and unconventional -

Diversified Footprint: Colombia, Argentina, Brazil

- Near Term Performance, Long Term Vision and Targets -

Target 70,000 boepd mid-term (2028), 100,000 boepd long-term (2030)

- Strong organic footprint leveraged by accretive inorganic

opportunities

- Financial Flexibility and Stewardship - Net Debt to

EBITDA 1.5-2.1x @ $70-80/bbl - Strong cashflow generation ($120-180

million ending cash) - Diversified financing sources available;

proactive hedging strategy

- Competitive Shareholder Returns while Driving Sustainable

Growth Maintain an annual dividend of $30 million

2025 Work Program Guidance ($70-80/bbl Brent)

The table below provides the main highlights of the 2025 work

program:

2025 Work Program

$70-80/bbl Brent

Average Production

35,000 boepd (± 2,500 boepd)2

Capital Expenditures

$275 – 310 million

Adjusted EBITDA

$350 – 430 million

RRR Target

100%

Lifting Cost

$12 – 14/bbl

Total Wells (Gross)

23 – 31

The $275-310 million CAPEX program will support production of

35,000 boepd (± 2,500 boepd range) across Colombia (26,000 boepd),

Vaca Muerta (7,400 boepd), Ecuador (1,000 boepd) and Brazil (600

boepd). The production mix is expected to be approximately 97% oil

and 3% natural gas, with 22% unconventional and 78%

conventional.

The activity set considers drilling 23-31 gross wells (including

10-15 gross exploration and appraisal wells), with approximately

65% to be allocated to development activities and 35% to

exploration and appraisal activities.

- Vaca Muerta - 10-12 wells, $195-220 million: - Mata

Mora Norte Block: Focus on accelerating production and reserves

growth through the continued development of the block and alignment

with critical infrastructure requirements. 7-8 gross development

wells plus necessary infrastructure and facilities expansion to

continue optimizing operations and delivering increased volumes to

market - Confluencia Sur Block: Focus on the continued

de-risking of the block through exploration drilling that continues

the successful 2024 exploration campaign. CAPEX includes 3-4 gross

exploration wells, as well as the net carry consideration of the

committed exploratory activity, which will complete GeoPark’s

obligation in full

- Colombia - 13-19 wells, $80-90 million: - Llanos 34

Block: Focus on maximizing recovery factors in the fields,

managing the decline through an optimization of base production

(waterflooding, pilot polymer flooding project, pump upsizing

projects and workovers) and maximizing economics. 5-7 gross

development, appraisal and injector wells, plus infrastructure and

facilities - CPO-5 Block: Drilling campaign will focus

exclusively on exploration activities, with 2-4 exploration wells

expected. The Indico field has been fully developed, hence

activities will concentrate on managing its production decline

through a workover campaign - Llanos Exploration: Focus on

increasing production and reserves, through the delineation and

development of the new discoveries in the Llanos 123 Block

(Toritos, Saltador and Bisbita) and drilling the first exploration

wells in the Llanos 104 Block. 5-6 gross wells - Putumayo:

The Platanillo field has been shut in due to a high cost structure,

and has no production included in the 2025 guidance. Activities in

the basin will focus on continuing the exploration campaign

initiated in 4Q2024 in the PUT-8 Block. 1-2 gross wells

The North Star strategy envisions achieving an annual Reserves

Replacement Ratio (RRR) ≥100%. This Program aligns with that goal

by driving organic and inorganic growth opportunities.

Lifting Cost is expected to be $12-14/bbl for the consolidated

operation and $7-9/bbl for Vaca Muerta.

Financial Details

Assuming a $70-80/bbl Brent base case, GeoPark expects to

generate an Adjusted EBITDA3 of $350-430 million4 in 2025, over 1.2

times total capital expenditures, and a ROACE above 30%.

The Work Program will be funded primarily with internal cash

generation and debt. At base case prices, the 2025 ending cash

stands at $120-180 million and net debt to EBITDA shows a healthy

leverage ratio of 1.5-2.1x.

Oil hedging plays a crucial role in our financial strategy,

ensuring competitive price realizations and downside price risk

protection. As of December 31, 2024, GeoPark had hedged

approximately 50% of its 2025 estimated average production5.

2025 Shareholder Returns

Supported by the Company’s robust balance sheet and operational

strength, GeoPark expects to continue returning a reliable dividend

payment of approximately $30 million to shareholders in 2025,

representing a 6-7%6 yield at current market prices. This

distribution builds on almost $300 million returned to shareholders

through dividends and buybacks since 2019.

Dividend payments remain subject to Board approval and will

depend on factors such as business performance, financial

condition, and growth plans.

Comprehensive Sustainability Strategy

GeoPark remains committed to operational excellence while

maintaining best-in-class health, safety, and environmental (HSE)

practices.

Within its Greenhouse Gas (GHG) emissions reduction strategy,

GeoPark expects a 35-40% Scope 1 and 2 GHG emissions intensity

reduction by 2025 compared to 2020.

RECONCILIATION OF ADJUSTED EBITDA

Adjusted EBITDA is defined as profit for the period before net

finance costs, income tax, depreciation, amortization, the effect

of IFRS 16, certain non-cash items such as impairments and

write-offs of unsuccessful efforts, accrual of share-based

payments, unrealized results on commodity risk management contracts

and other non-recurring events.

The Company is unable to present a quantitative reconciliation

of the 2025 Adjusted EBITDA which is a forward-looking non-GAAP

measure, because the Company cannot reliably predict certain of the

necessary components, such as write-off of unsuccessful exploration

efforts or impairment loss on non-financial assets, etc. Since free

cash flow is calculated based on Adjusted EBITDA, for similar

reasons, the Company does not provide a quantitative reconciliation

of the 2025 free cash flow forecast.

NOTICE

Additional information about GeoPark can be found in the “Invest

with Us” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release have been rounded for

ease of presentation. Percentages included in this press release

have not in all cases been calculated on the basis of such rounded

amounts, but on the basis of such amounts prior to rounding. For

this reason, certain percentages in this press release may vary

from those obtained by performing the same calculations on the

basis of the amounts in the financial statements. Similarly,

certain other amounts included in this press release may not sum

due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including, drilling campaign, production guidance,

closing of acquisition transaction and production consolidation.

Forward-looking statements are based on management’s beliefs and

assumptions, and on information currently available to the

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various

factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission (SEC).

Oil and gas production figures included in this release are

stated before the effect of royalties paid in kind, consumption and

losses. Annual production per day is obtained by dividing total

production by 365 days.

1

Return on Average Capital Employed.

2

This guidance is subject to the regulatory

closing of the Vaca Muerta acquisition, expected in 1Q2025. For

reference purposes, a delay in the closing impacts the guidance by

approximately 4-6% each quarter.

3

The Company is unable to present a

quantitative reconciliation of the 2024 Adjusted EBITDA which is a

forward-looking non-GAAP measure, because the Company cannot

reliably predict certain of the necessary components, such as

write-off of unsuccessful exploration efforts or impairment loss on

non-financial assets, etc. Since free cash flow is calculated based

on Adjusted EBITDA, for similar reasons, the Company does not

provide a quantitative reconciliation of the 2025 free cash flow

forecast.

4

Assuming a $5-6 Vasconia/Brent

differential and a $3-4 Medanito/Brent differential.

5

Net average production after economic

rights and royalties. GeoPark monitors market conditions on a

continuous basis and may enter into additional commodity risk

management contracts to secure minimum oil prices for its 2025

production and beyond.

6

Calculated as expected shareholder returns

(dividends), divided by GeoPark’s average market capitalization as

of December 31, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250117034618/en/

For further information, please contact: INVESTORS:

Maria Catalina Escobar mescobar@geo-park.com Shareholder

Value and Capital Markets Director

Miguel Bello mbello@geo-park.com Investor Relations

Officer

Maria Alejandra Velez mvelez@geo-park.com Investor

Relations Leader

MEDIA:

Communications Department communications@geo-park.com

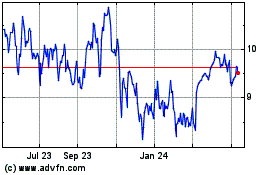

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Dec 2024 to Jan 2025

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Jan 2024 to Jan 2025