Current Report Filing (8-k)

October 28 2020 - 6:08AM

Edgar (US Regulatory)

false

0001474735

0001474735

2020-10-28

2020-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2020

Generac Holdings Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-34627

|

|

20-5654756

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

S45 W29290 Hwy 59

|

|

|

|

Waukesha, Wisconsin

|

|

53189

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(262) 544-4811

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

GNRC

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 28, 2020, Generac Holdings Inc. (the “Company,” “we,” “us” or “our”) issued a press release (the “Press Release”) announcing its financial results for the third quarter ended September 30, 2020. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K (including the exhibits) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Discussion of Non-GAAP Financial Measures

In the Press Release, we present certain financial information, specifically Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales, which are not in accordance with generally accepted accounting principles (“U.S. GAAP”). We present Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales in the Press Release because these metrics assist us in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Our management uses Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales:

|

|

●

|

for planning purposes, including the preparation of our annual operating budget and developing and refining our internal projections for future periods;

|

|

|

●

|

to evaluate the effectiveness of our business strategies and as a supplemental tool in evaluating our performance against our budget for each period;

|

|

|

●

|

in communications with our board of directors and investors concerning our financial performance;

|

|

|

●

|

to evaluate prior acquisitions in relation to the existing business; and

|

|

|

●

|

to evaluate comparative net sales performance in prior and future periods.

|

We also use Adjusted EBITDA as a benchmark for the determination of the bonus component of compensation for our senior executives under our management incentive plans.

We believe that the disclosure of Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales offers additional financial metrics which, when coupled with U.S. GAAP results and the reconciliation to U.S. GAAP results, provide a more complete understanding of our results of operations and the factors and trends affecting our business for securities analysts, investors and other interested parties in the evaluation of our company. We believe Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales are useful to investors for the following reasons:

|

|

●

|

Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, Core Sales, and similar non-GAAP measures are widely used by investors to measure a company’s operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, tax jurisdictions, capital structures and the methods by which assets were acquired; and

|

|

|

●

|

by comparing our Adjusted EBITDA, Adjusted Net Income, Free Cash Flow, and Core Sales in different historical periods, our investors can evaluate our operating performance excluding the impact of certain items.

|

Item 9.01 Financial Statements and Exhibits

(d)

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the inline XBRL document)

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENERAC HOLDINGS INC.

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Raj Kanuru

|

|

Date: October 28, 2020

|

Title:

|

EVP, General Counsel & Secretary

|

4

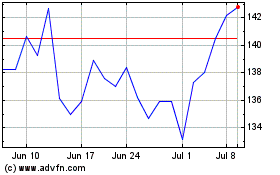

Generac (NYSE:GNRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

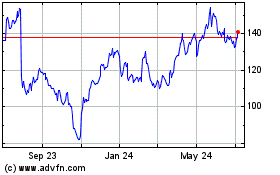

Generac (NYSE:GNRC)

Historical Stock Chart

From Apr 2023 to Apr 2024