Use these links to rapidly review the document

Table of Contents

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-235347

The information contained in this preliminary prospectus supplement and the accompanying prospectus is not complete and

may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 4, 2019

PROSPECTUS SUPPLEMENT

(to Prospectus dated December 4, 2019)

10,000,000 Shares

Everi Holdings Inc.

Common Stock

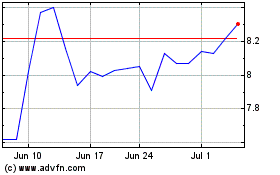

We are offering 10,000,000 shares of our common stock, par value $0.001 per share. Our common stock is listed on the New York Stock Exchange under the symbol

"EVRI." On December 3, 2019, the last reported sale price of our common stock on the New York Stock Exchange was $12.98 per share.

Investing in our common stock involves a high degree of risk. Please read "Risk Factors" beginning on page S-10 of this prospectus supplement, on page 3 of the accompanying

prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense. No gaming or regulatory agency has approved or disapproved of

these securities, or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

Public Offering Price

|

|

$

|

|

|

$

|

|

|

|

Underwriting Discounts and Commissions(1)

|

|

$

|

|

|

$

|

|

|

|

Proceeds to us before expenses

|

|

$

|

|

|

$

|

|

|

-

(1)

-

See "Underwriting."

Delivery of the shares of common stock is expected to be made on or

about , 2019. We have granted the underwriters an option for a period of

30 days to purchase up to an additional 1,500,000 shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us

will be $ , and the total proceeds to us, before expenses, will be $ .

Joint Book-Running Managers

|

|

|

|

|

Jefferies

|

|

Stifel

|

Joint Lead Managers

|

Craig-Hallum Capital Group

|

|

Raymond James

|

Co-Manager

|

SunTrust Robinson Humphrey

|

Prospectus Supplement dated , 2019

Table of Contents

TABLE OF CONTENTS

Table of Contents

IMPORTANT NOTICE ABOUT INFORMATION IN THIS

PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of shares of our common stock.

The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of shares of our common stock. Generally, when we refer only to the

"prospectus," we are referring to both parts combined. If the information about this offering of shares of our common stock varies between this prospectus supplement and the accompanying prospectus,

you should rely on the information in this prospectus supplement.

Any

statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this

prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes

that statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Incorporation of Certain Information by Reference" in this prospectus

supplement.

We

have not, and the underwriters have not, authorized anyone else to make additional representations or to provide you with information other than information provided or incorporated by reference in

this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by or on behalf of us relating to this offering. Neither we nor the underwriters take responsibility

for, or provide assurances as to the reliability of, any other information that others may give you or representations that others may make. We are offering to sell shares of our common stock, and

seeking offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the

accompanying prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference herein is

accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

i

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange

Act, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide our current expectations and forecasts about future events.

These

forward-looking statements include, among other things, statements regarding the following matters: the timing of the offering contemplated by this prospectus supplement; the recurring nature of

our revenues; trends in gaming establishment and patron usage of our products; benefits realized by using our products and services; product development, including the release of new game features and

additional game and system releases in the future; regulatory approvals; gaming regulatory, card association, and statutory compliance; the implementation of new or amended card association and

payment network rules; consumer collection activities; future competition; future tax liabilities; future goodwill impairment charges; international expansion; resolution of litigation; dividend

policy; new customer contracts and contract renewals; future results of operations (including revenue, expenses, margins, earnings, cash flow and capital expenditures); expected key improvements in

free cash flow; expectations regarding our improved credit profile; future interest rates and interest expense; future borrowings; and future equity incentive activity and compensation expense.

In

some cases these statements are identifiable through the use of words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "project," "target," "can," "could," "may," "will,"

"should," "would," "likely," and similar expressions. In addition, any statements that refer to projections of our future financial performance, our anticipated growth, and trends in our business and

other characterizations of future events or circumstances are forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. These forward-looking

statements are not a guarantee of future performances and are subject to assumptions and involve known and unknown risks, uncertainties and other important factors that could cause the actual results,

performance or achievements of the Company, or industry results, to differ materially from any future results, performance, or achievement implied by such forward-looking statements. These risks,

uncertainties and important factors include, but are not limited to, market and economic forces; our substantial leverage; our ability to compete in the gaming industry, manage competitive pressures,

navigate gaming market contractions, and continue operating in Native American gaming markets; expectations regarding our existing and future installed base and win per day, our product portfolio, and

development and placement fee arrangements; expectations regarding customers', gaming establishments', and patrons' preferences and demands for future gaming offerings; our ability to comply with the

Europay, MasterCard, and Visa global standard for cards equipped with security chip technology; changes in gaming regulatory, card association, and statutory requirements, as well as regulatory and

licensing difficulties; our ability to maintain our current customers; uncertainty of the timing and closing of acquisitions, if any; and our ability to successfully access the capital markets to

raise funds.

No

assurance can be given that the actual future results will not differ materially from the forward-looking statements that we make for a number of reasons including those described above and in the

"Risk Factors" section of our Annual Report on Form 10-K for the year ended

December 31, 2018 and in our subsequently filed quarterly reports on Form 10-Q. For information on the documents we are incorporating by reference and how to obtain a

copy, please see the "Incorporation of Certain Information by Reference" section in this prospectus supplement. Unless required by law, we undertake no obligation to publicly update or revise any

forward-looking statements to reflect new information or future events or otherwise.

You

should read this prospectus supplement and the accompanying prospectus with the understanding that our actual future results may be materially different from what we expect.

ii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement. This summary does not contain all of the

information that you should consider before deciding whether to invest in our common stock. You should read this entire prospectus supplement carefully, including the "Risk Factors" section, the

accompanying prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, prior to making an investment decision. References in this

prospectus supplement to "we," "us," "our," the "Company," and "Everi" refer to Everi Holdings Inc. unless otherwise stated or the context otherwise requires.

Our Business

Everi is a leading supplier of entertainment and technology solutions for the casino, interactive, and gaming industry. With a focus on both customers and

players, Everi develops games and gaming machines, gaming systems and services, and is the provider of core financial products and services, player loyalty tools and applications, and intelligence and

regulatory compliance solutions. Everi reports its results of operations based on two operating segments: Games and FinTech.

Our

Games segment provides gaming operators products and services, including: (a) gaming machines primarily comprised of Class II, or bingo style, and Class III, or casino style,

slot machines, including TournEvent® terminals that allow operators to switch from in-revenue gaming to out-of-revenue tournaments;

(b) system software, licenses, and ancillary equipment, and maintenance, including managing the central determinant system for the video lottery terminals ("VLTs") installed in the State of New

York and also providing similar technology in certain tribal jurisdictions; and (c) business-to-consumer ("B2C") and business-to-business ("B2B") interactive activities. See the section titled

"Regulation" found in Item 1 of our Annual Report on Form 10-K for the year ended December 31, 2018 for a description of Class I, Class II, and Class III

designations and related regulatory oversight.

As

of September 30, 2019, we operated 14,272 gaming machines in our installed base, including both Class II and Class III gaming units, of which approximately 30.8% were premium

game units. Of the premium game units, 866 were wide-area progressive ("WAP") units. For the nine months ended September 30, 2019, the average daily win per unit of the gaming machines in our

installed base, inclusive of the premium game units, was $32.68. Our gaming machines, which include access to use certain third-party licensed brands, are either placed under revenue participation or

fixed fee lease arrangements or sold to casino customers. For the nine months ended September 30, 2019, 3,569 gaming machines were sold, reflecting a 7.0% increase in unit sales over such

period.

Our

FinTech segment provides gaming operators cash access and other FinTech related products and services, including: (a) access to cash at gaming facilities via Automated Teller Machine

("ATM") cash withdrawals, credit card cash access transactions, point of sale ("POS") debit card cash access transactions, and check verification and warranty services; (b) equipment that

provides cash access and efficiency-related services; (c) self-service enrollment, loyalty, and marketing equipment and services; (d) products and services that improve credit decision

making, automate cashier operations, and enhance patron marketing activities for gaming establishments; (e) compliance, audit, and data solutions; and (f) online payment processing

solutions for gaming operators in states that offer intrastate, Internet-based gaming, and lottery activities.

For

the nine months ended September 30, 2019, more than 70% of total revenues were of a recurring nature, primarily from our gaming operations, cash access services and information services and

other. Within the Games segment, our gaming operations installed base of gaming units under placement and revenue participation arrangements generated 35.7% of total consolidated revenues for the nine

months

S-1

Table of Contents

ended

September 30, 2019. Approximately 30% of our total units in the installed base are placed under multi-year machine placement agreements. Within the FinTech segment, our cash access

services generated 31.9% of total consolidated revenues for the nine months ended September 30, 2019. We have multi-year contracts with casinos for our cash access services, with a typical

contractual term three to five years. During the last contract renewal cycle for our cash access services, 100% of our top 30 customers renewed contracts. The average life of these customer

relationships is 11 years. Approximately 67% of our fully-integrated, ticket redemption kiosk placements are at least three years old. Within the FinTech segment, information systems and other

revenues from software and services contracts and subscriptions generated 8.6% of consolidated revenues for the nine months ended September 30, 2019. Gaming equipment and systems sales and

FinTech equipment sales comprised of 17.4% and 6.4%, respectively, for the nine months ended September 30, 2019.

Everi

was formed as a Delaware limited liability company on February 4, 2004 and was converted to a Delaware corporation on May 14, 2004. Our principal executive offices are located at

7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113. Our telephone number is (800) 833-7110. Our website address is www.everi.com. Except for the documents incorporated by

reference in this prospectus as described under the heading "Incorporation of Certain Information by Reference," the information and other content contained on our website are not incorporated by

reference and do not constitute part of this prospectus and should not be relied upon in connection with making any investment in our securities.

Recent Developments

Proposed Amendment to the Credit Facility

We are currently in discussions to amend (the "Proposed Amendment") our credit agreement, dated May 9, 2017, among Everi Payments Inc., as

borrower, Everi Holdings, Inc., as a guarantor, the lenders party thereto and Jefferies Finance LLC, as administrative agent, collateral agent, swing line lender, letter of credit

issuer, sole lead arranger and sole bookrunner (as amended, the "Credit Agreement"). The Credit Agreement provides for: (i) a $35.0 million, five-year senior secured revolving credit

facility (the "Revolving Credit Facility") and (ii) an initial $820.0 million, seven-year senior secured term loan facility (the "Term Loan Facility," and together with the Revolving

Credit Facility, the "Credit Facilities").

The

interest rates on (i) the outstanding principal amount of the Term Loan Facility are (x) the Adjusted Eurodollar Rate + 3.00% for Eurodollar Rate Loans (with a 1.00%

LIBOR floor) and (y) the Base Rate + 2.00% for Base Rate Loans and (ii) the outstanding principal amount of the Revolving Credit Facility are (x) the Adjusted

Eurodollar Rate + 4.50% for Eurodollar Rate Loans (with a 1.00% LIBOR floor) and (y) the Base Rate + 3.50% for Base Rate Loans. The maturity date of the Revolving

Credit Facility is May 9, 2022, and the maturity date of the Term Loan Facility is May 9, 2024. At September 30, 2019, we had $782.0 million of borrowings outstanding under

the Term Loan Facility and no borrowings outstanding under the Revolving Credit Facility. We had $35.0 million of additional borrowing availability under the Revolving Credit Facility as of

September 30, 2019.

The

Proposed Amendment would provide, among other things, (i) a reduction in the applicable margins for the interest rates payable in respect of the Term Loan Facility and (ii) the

addition of a prepayment premium applicable to the repriced Term Loan Facility of 1.00% of the principal amount thereof that is repaid in respect of (a) any voluntary prepayment or mandatory

prepayment with proceeds of debt that has a lower effective yield than the repriced Term Loan Facility or (b) any amendment to the repriced Term Loan Facility that reduces the interest rate

thereon, in each case, to the extent occurring within six months after the closing date of the Proposed Amendment. No other changes are expected to be made to the pricing, debt repayment terms,

maturity dates and/or financial covenants, in each case, applicable to the Credit Facilities pursuant to the Proposed Amendment. The consummation of the Proposed Amendment is subject to certain

conditions precedent, including the consummation of this offering on terms and conditions

S-2

Table of Contents

satisfactory

in all respects to us. We can provide no assurance that the Proposed Amendment will be consummated on the terms described above or at all.

Corporate Information

Our principal executive offices are located at 7250 S. Tenaya Way, Suite 100, Las Vegas, Nevada 89113. Our telephone number is (800) 833-7110,

and our website address is www.everi.com. Information on or connected to our website is not a part of or incorporated by reference into this prospectus supplement.

S-3

Table of Contents

Selected Historical Financial and Operating Data

The table below sets forth selected financial and operating data as of and for the nine months ended September 30, 2019 and 2018, and as of and for the

years ended December 31, 2018, 2017 and 2016. The data set forth below are qualified in their entirety by and should be read in conjunction with our consolidated financial statements and

related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our

Annual Report on Form 10-K for the year ended December 31,

2018 and our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2019, each of which is incorporated by reference into this prospectus supplement. Historical results are not necessarily indicative of results that may be

expected for any future period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30,

|

|

Year Ended December 31,

|

|

|

Selected financial data

($ in thousands)

|

|

2019

|

|

2018

|

|

2018

|

|

2017

|

|

2016

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Revenues(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Games total revenues

|

|

$

|

206,079

|

|

$

|

192,004

|

|

$

|

258,978

|

|

$

|

222,777

|

|

$

|

213,253

|

|

|

FinTech total revenues

|

|

|

181,971

|

|

|

158,009

|

|

|

210,537

|

|

|

752,171

|

|

|

646,203

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

388,050

|

|

$

|

350,013

|

|

$

|

469,515

|

|

$

|

974,948

|

|

$

|

859,456

|

|

|

Net income (loss)

|

|

$

|

20,661

|

|

$

|

8,153

|

|

$

|

12,356

|

|

$

|

(51,903

|

)

|

$

|

(249,479

|

)

|

|

Adjusted EBITDA(2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Games Adjusted EBITDA

|

|

$

|

102,417

|

|

$

|

97,143

|

|

$

|

126,745

|

|

$

|

115,986

|

|

$

|

116,011

|

|

|

FinTech Adjusted EBITDA

|

|

|

87,629

|

|

|

78,669

|

|

|

103,643

|

|

|

96,850

|

|

|

82,003

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjusted EBITDA

|

|

$

|

190,046

|

|

$

|

175,812

|

|

$

|

230,388

|

|

$

|

212,836

|

|

$

|

198,014

|

|

|

Free Cash Flow(2)

|

|

$

|

39,294

|

|

$

|

26,691

|

|

$

|

24,790

|

|

$

|

13,858

|

|

$

|

11,009

|

|

|

Selected Games operating data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units sold(3)

|

|

|

3,569

|

|

|

3,336

|

|

|

4,513

|

|

|

3,647

|

|

|

2,954

|

|

|

Units installed at end of period

|

|

|

14,272

|

|

|

14,116

|

|

|

13,999

|

|

|

13,296

|

|

|

13,264

|

|

|

Premium units at end of period(4)

|

|

|

4,395

|

|

|

2,840

|

|

|

2,859

|

|

|

2,532

|

|

|

1,851

|

|

|

As percentage of total units installed

|

|

|

30.8

|

%

|

|

20.1

|

%

|

|

20.4

|

%

|

|

19.0

|

%

|

|

14.0

|

%

|

|

Proprietary units in installed base(5)

|

|

|

13,697

|

|

|

13,498

|

|

|

13,390

|

|

|

12,533

|

|

|

11,931

|

|

|

Approximate daily win per unit(6)

|

|

$

|

32.68

|

|

$

|

29.13

|

|

$

|

28.95

|

|

$

|

27.00

|

|

$

|

27.79

|

|

|

Selected FinTech operating data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aggregate dollar amount processed (in billions)

|

|

$

|

22.7

|

|

$

|

20.9

|

|

$

|

27.9

|

|

$

|

25.3

|

|

$

|

21.6

|

|

|

Number of transactions completed (in millions)

|

|

|

86.2

|

|

|

80.7

|

|

|

107.6

|

|

|

99.6

|

|

|

87.4

|

|

-

(1)

On

January 1, 2018, we adopted ASC 606, which primarily impacted our FinTech segment, using the modified retrospective method, which resulted in

the recording of an immaterial cumulative adjustment in the amount of approximately $4.4 million to accumulated deficit as of the adoption date. Prior to such adoption, we reported costs and

expenses related to our cash access services as a cost of revenues. Under ASC 606, such costs are reflected as reductions to gaming operations revenues on a net basis of presentation. In addition, we

previously reported certain costs incurred in connection with our WAP platform, consisting primarily of the jackpot expenses, as cost of revenues. Our prior period results were not recast to reflect

the new revenue recognition standard under the modified retrospective method. FinTech total revenues on a comparable basis to retrospectively reflect net versus gross reporting of revenues under ASC

606 were $188.5 million and $169.8 million for the year ended December 31, 2017 and 2016, respectively.

(2)

For

a reconciliation of net income to Adjusted EBITDA and to Free Cash Flow, see "Non-GAAP Financial Information."

S-4

Table of Contents

-

(3)

-

Unit

sales is the total electronic gaming machines sold in a period excluding those units that have a non-standard gross margin. Our methodology for

computation of this metric may vary from other equipment suppliers.

-

(4)

-

Premium

game units include electronic gaming machines that have content that is generally not for sale, are wide-area progressive units or have unique

game play functions and features that have generated a premium daily win per unit. Our methodology for computation of this metric may vary from other equipment suppliers.

-

(5)

-

Proprietary

units excluded third-party Class III game units of 305 units at September 30, 2019, 618 units at September 30, 2018,

609 units at December 31, 2018, 763 units at December 31, 2017 and 1,333 units at December 31, 2016.

-

(6)

-

Daily

Win Per Unit is computed as 1) the net revenue earned from units placed under fixed fee or revenue participation agreements and other

similar items, divided by 2) the average number of units installed during the reporting period, and by 3) the number of calendar days in the reporting period. The estimated wide-area

progressive jackpot liability is excluded from this computation. Our methodology for computation of this metric may vary from other equipment suppliers.

Non-GAAP Financial Information

In order to enhance investor understanding of the underlying trends in our business, our cash balance and cash available for our operating needs, and to

provide for better comparability between periods in different years, we are providing in this prospectus supplement Adjusted EBITDA and Free Cash Flow, which are not measures of our financial

performance or position under United States Generally Accepted Accounting Principles ("GAAP"). Accordingly, Adjusted EBITDA and Free Cash Flow should not be considered in isolation or as a substitute

for measures prepared in accordance with GAAP. These measures should be read in conjunction with our net earnings, operating income, basic and diluted earnings per share, and cash flow data prepared

in accordance with GAAP.

We

define Adjusted EBITDA as earnings before interest, loss on extinguishment of debt, taxes, depreciation and amortization, non-cash stock compensation expense, accretion of contract rights, non-cash

goodwill impairment charges, separation costs related to the Company's former CEO, non-cash write-down of note receivable and warrant, loss on the sale of aircraft, manufacturing relocation costs, the

non-cash write-off of certain inventory and fixed assets, non-cash adjustment to certain purchase accounting liabilities and non-recurring professional fees and acquisition costs. We present Adjusted

EBITDA as we use this measure to manage our business and consider this measure to be supplemental to our operating performance. We also make certain compensation decisions based, in part, on our

operating performance, as measured by Adjusted EBITDA; and our current credit facility and existing senior unsecured notes require us to comply with a consolidated secured leverage ratio that includes

performance metrics substantially similar to Adjusted EBITDA.

We

define Free Cash Flow as Adjusted EBITDA less cash paid for interest, cash paid for capital expenditures, cash paid for placement fees, and cash paid for taxes net of refunds. We present Free Cash

Flow as a measure of performance and believe it provides investors with another indicator of our operating performance. It should not be inferred that the entire Free Cash Flow amount is available for

discretionary expenditures.

S-5

Table of Contents

A

reconciliation of the Company's net income per GAAP to Adjusted EBITDA and Free Cash Flow for the nine months ended September 30, 2019 and 2018 is provided below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended

September 30, 2019

(unaudited)

|

|

Nine months ended

September 30, 2018

(unaudited)

|

|

|

|

Games

|

|

FinTech

|

|

Total

|

|

Games

|

|

FinTech

|

|

Total

|

|

|

Net income

|

|

|

|

|

|

|

|

$

|

20,661

|

|

|

|

|

|

|

|

$

|

8,153

|

|

|

Income tax benefit

|

|

|

|

|

|

|

|

|

(2,747

|

)

|

|

|

|

|

|

|

|

(2,310

|

)

|

|

Loss on extinguishment of debt

|

|

|

|

|

|

|

|

|

—

|

|

|

|

|

|

|

|

|

166

|

|

|

Interest expense, net of interest income

|

|

|

|

|

|

|

|

|

60,130

|

|

|

|

|

|

|

|

|

62,589

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

$

|

8,729

|

|

$

|

69,315

|

|

$

|

78,044

|

|

$

|

5,914

|

|

$

|

62,684

|

|

$

|

68,598

|

|

|

Plus: depreciation and amortization

|

|

|

83,927

|

|

|

13,278

|

|

|

97,205

|

|

|

80,280

|

|

|

12,493

|

|

|

92,773

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

92,656

|

|

$

|

82,593

|

|

$

|

175,249

|

|

$

|

86,194

|

|

$

|

75,177

|

|

$

|

161,371

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock compensation expense

|

|

|

1,895

|

|

|

4,246

|

|

|

6,141

|

|

|

2,075

|

|

|

4,042

|

|

|

6,117

|

|

|

Accretion of contract rights

|

|

|

6,539

|

|

|

—

|

|

|

6,539

|

|

|

6,299

|

|

|

—

|

|

|

6,299

|

|

|

Adjustment of certain purchase accounting liabilities

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(550

|

)

|

|

(550

|

)

|

|

Write-off of inventory and fixed assets

|

|

|

843

|

|

|

—

|

|

|

843

|

|

|

2,575

|

|

|

—

|

|

|

2,575

|

|

|

Asset acquisition expense and other non- recurring professional fees

|

|

|

484

|

|

|

790

|

|

|

1,274

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

102,417

|

|

$

|

87,629

|

|

$

|

190,046

|

|

$

|

97,143

|

|

$

|

78,669

|

|

$

|

175,812

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

|

|

|

|

|

|

|

(52,077

|

)

|

|

|

|

|

|

|

|

(54,930

|

)

|

|

Cash paid for capital expenditures

|

|

|

|

|

|

|

|

|

(81,642

|

)

|

|

|

|

|

|

|

|

(78,545

|

)

|

|

Cash paid for placement fees

|

|

|

|

|

|

|

|

|

(17,102

|

)

|

|

|

|

|

|

|

|

(15,300

|

)

|

|

Cash paid for income taxes, net of refunds

|

|

|

|

|

|

|

|

|

69

|

|

|

|

|

|

|

|

|

(346

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow

|

|

|

|

|

|

|

|

$

|

39,294

|

|

|

|

|

|

|

|

$

|

26,691

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-6

Table of Contents

A

reconciliation of the Company's net income per GAAP to Adjusted EBITDA and Free Cash Flow for the year ended December 31, 2018, 2017 and 2016 is provided below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, 2018

|

|

Year ended December 31, 2017

|

|

Year ended December 31, 2016

|

|

|

|

Games

|

|

FinTech

|

|

Total

|

|

Games

|

|

FinTech

|

|

Total

|

|

Games

|

|

FinTech

|

|

Total

|

|

|

Net income (loss)

|

|

|

|

|

|

|

|

$

|

12,356

|

|

|

|

|

|

|

|

$

|

(51,903

|

)

|

|

|

|

|

|

|

$

|

(249,479

|

)

|

|

Income tax (benefit) provision

|

|

|

|

|

|

|

|

|

(9,710

|

)

|

|

|

|

|

|

|

|

(20,164

|

)

|

|

|

|

|

|

|

|

31,696

|

|

|

Loss on extinguishment of debt

|

|

|

|

|

|

|

|

|

166

|

|

|

|

|

|

|

|

|

51,750

|

|

|

|

|

|

|

|

|

—

|

|

|

Interest expense, net of interest income

|

|

|

|

|

|

|

|

|

83,001

|

|

|

|

|

|

|

|

|

102,136

|

|

|

|

|

|

|

|

|

99,228

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

$

|

3,071

|

|

$

|

82,742

|

|

$

|

85,813

|

|

$

|

8,952

|

|

$

|

72,867

|

|

$

|

81,819

|

|

$

|

(166,243

|

)

|

$

|

47,688

|

|

$

|

(118,555

|

)

|

|

Plus: depreciation and amortization

|

|

|

110,157

|

|

|

16,313

|

|

|

126,470

|

|

|

97,487

|

|

|

19,300

|

|

|

116,787

|

|

|

120,974

|

|

|

23,659

|

|

|

144,633

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

113,228

|

|

$

|

99,055

|

|

$

|

212,283

|

|

$

|

106,439

|

|

$

|

92,167

|

|

$

|

198,606

|

|

$

|

(45,269

|

)

|

$

|

71,347

|

|

$

|

26,078

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock compensation expense

|

|

|

2,317

|

|

|

4,934

|

|

|

7,251

|

|

|

1,728

|

|

|

4,683

|

|

|

6,411

|

|

|

1,642

|

|

|

5,091

|

|

|

6,733

|

|

|

Goodwill impairment

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

146,299

|

|

|

—

|

|

|

146,299

|

|

|

Accretion of contract rights

|

|

|

8,421

|

|

|

—

|

|

|

8,421

|

|

|

7,819

|

|

|

—

|

|

|

7,819

|

|

|

8,692

|

|

|

—

|

|

|

8,692

|

|

|

Separation costs for former CEO

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

4,687

|

|

|

4,687

|

|

|

Write-down of note receivable and warrant

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

4,289

|

|

|

—

|

|

|

4,289

|

|

|

Write-off of inventory and fixed assets

|

|

|

2,575

|

|

|

—

|

|

|

2,575

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Loss on sale of aircraft

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

878

|

|

|

878

|

|

|

Manufacturing relocation costs

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

358

|

|

|

—

|

|

|

358

|

|

|

Adjustment of certain purchase accounting liabilities

|

|

|

—

|

|

|

(550

|

)

|

|

(550

|

)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Non-recurring professional fees

|

|

|

204

|

|

|

204

|

|

|

408

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

126,745

|

|

$

|

103,643

|

|

$

|

230,388

|

|

$

|

115,986

|

|

$

|

96,850

|

|

$

|

212,836

|

|

$

|

116,011

|

|

$

|

82,003

|

|

$

|

198,014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

|

|

|

|

|

|

|

(81,609

|

)

|

|

|

|

|

|

|

|

(89,008

|

)

|

|

|

|

|

|

|

|

(93,420

|

)

|

|

Cash paid for capital expenditures

|

|

|

|

|

|

|

|

|

(103,031

|

)

|

|

|

|

|

|

|

|

(96,490

|

)

|

|

|

|

|

|

|

|

(80,741

|

)

|

|

Cash paid for placement fees

|

|

|

|

|

|

|

|

|

(20,556

|

)

|

|

|

|

|

|

|

|

(13,300

|

)

|

|

|

|

|

|

|

|

(11,312

|

)

|

|

Cash paid for income taxes, net of refunds

|

|

|

|

|

|

|

|

|

(402

|

)

|

|

|

|

|

|

|

|

(180

|

)

|

|

|

|

|

|

|

|

(1,532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow

|

|

|

|

|

|

|

|

$

|

24,790

|

|

|

|

|

|

|

|

$

|

13,858

|

|

|

|

|

|

|

|

$

|

11,009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-7

Table of Contents

The Offering

|

|

|

|

|

Issuer

|

|

Everi Holdings Inc.

|

|

Common stock offered by us

|

|

10,000,000 shares (or 11,500,000 shares, if the underwriters exercise in full their option to purchase additional shares as

described below).

|

|

Option to purchase additional shares

|

|

We have granted the underwriters an option to purchase up to an additional 1,500,000 shares. The underwriters may exercise

this option at any time within 30 days from the date of this prospectus supplement. See "Underwriting."

|

|

Common stock outstanding after giving effect to this offering

|

|

82,957,850 shares (or 84,457,850 shares if the underwriters exercise their option to purchase additional shares in

full).

|

|

Use of proceeds

|

|

We estimate that our net proceeds from this offering will be approximately

$ (or approximately $ if the underwriters exercise their option to

purchase additional shares in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to refinance a portion of our existing

indebtedness in one or more transactions, which may include the repayment of certain outstanding borrowings under the Term Loan Facility and/or the redemption and/or repurchase of a portion of our outstanding 7.50% Senior Unsecured Notes due 2025

(the "2025 Notes"). Pending the deployment of the net proceeds for such refinancing transactions, we may invest the net proceeds in short-term, interest-bearing, investment-grade securities.

|

|

Dividend policy

|

|

We do not currently intend to pay dividends on our common stock. We plan to retain any earnings for use in the operation of

our business and to fund future growth.

|

|

Listing

|

|

Our common stock is listed on the New York Stock Exchange under the trading symbol "EVRI."

|

|

Risk factors

|

|

You should read the section titled "Risk Factors" beginning on page S-10 of, and the other information included or

incorporated by reference in, this prospectus supplement for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest in our common stock.

|

The

number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 82,957,850 shares of common stock outstanding as of December 2, 2019 and,

except as otherwise indicated, all information in this prospectus supplement:

-

§

-

reflects the offering price of $ per share of common stock;

-

§

-

assumes no exercise of the underwriters' option to purchase 1,500,000 additional shares

of common stock in this offering;

S-8

Table of Contents

-

§

-

does not include 700,000 shares of common stock issuable upon exercise of warrants

outstanding as of such date; and

-

§

-

does not include 15,464,190 shares of common stock reserved for issuance under our stock

incentive plans, of which (1) 12,009,391 shares of common stock are issuable upon exercise of options awarded and outstanding under the plans as of such date, and (2) 3,454,799 shares of

common stock are issuable upon vesting of restricted stock units awarded and outstanding under the plans as of such date.

S-9

Table of Contents

RISK FACTORS

Investing in our common stock involves risks. Our business is influenced by many factors that are difficult to predict and beyond our control and that involve

uncertainties that may materially affect our results of operations, financial condition or cash flows, or the value of our common stock. These risks and uncertainties include those described below, as

well as in the risk factors and other sections of the documents that are incorporated by reference in this prospectus supplement, including "Item 1A. Risk Factors" in our

Annual Report on Form 10-K for the year ended December 31,

2018 and in our subsequently filed quarterly reports on Form 10-Q. You should carefully consider these risks and uncertainties and all of the information contained or

incorporated by reference in this prospectus supplement and the accompanying prospectus before you invest in our common stock.

Risks Related to This Offering and Ownership of Our Common Stock

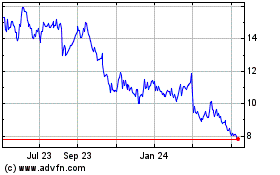

The market price of and trading volume of our shares of common stock may be volatile.

The market price of our shares of common stock has fluctuated substantially and may continue to fluctuate in response to many factors which are beyond our

control, including:

-

§

-

fluctuations in our operating results, including results that vary from expectations of

management, analysts and investors;

-

§

-

announcements of strategic developments, acquisitions, financings and other material

events by us or our competitors;

-

§

-

the sale of a substantial number of shares of our common stock held by existing security

holders in the public market; and

-

§

-

general conditions in the gaming industry.

The

stock markets in general may experience extreme volatility that may be unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the

trading price of

our common stock, make it difficult to predict the market price of our common stock in the future and cause the value of our common stock to decline.

Because we do not currently intend to pay dividends on our common stock, stockholders will benefit from an

investment in our common stock only if it appreciates in value.

We do not currently anticipate paying any dividends on shares of our common stock. Any determination to pay dividends in the future will be made by our board

of directors and will depend upon results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable law, and other factors our board of directors deems

relevant. Accordingly, realization of a gain on stockholders' investments will depend on the appreciation of the price of our common stock. There is no guarantee that our common stock will appreciate

in value or even maintain the price at which stockholders purchased their shares.

We might require additional capital to support business growth, and this capital might not be available on

favorable terms, or at all.

Our operations or expansion efforts may require substantial additional financial, operational, and managerial resources. While we believe we have sufficient

liquidity to fund our working capital and other operating requirements, we may raise additional funds for acquisitions or to expand our operations. If we obtain additional funding in the future, we

may seek debt financing or obtain additional equity capital. Additional capital may not be available to us, or may only be available on terms that adversely affect our existing stockholders, or that

restrict our operations. For example, if we raise additional funds through issuances of equity or convertible debt securities, our existing stockholders could suffer dilution, and any new equity

securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock.

S-10

Table of Contents

Current and future economic, capital and credit market conditions could adversely affect our ability to

service or refinance our indebtedness and to make planned expenditures.

Our ability to make payments on, and to refinance, our indebtedness and to fund planned or committed capital expenditures and investments depends on our

ability to generate cash flow in the future, borrow under our senior secured revolving credit facility or incur new indebtedness. If regional and national economic conditions deteriorate, we could

experience decreased revenues from our operations attributable to decreases in consumer spending levels and could fail to generate sufficient cash to fund our liquidity needs or fail to satisfy the

financial and other restrictive covenants in our debt instruments. We cannot assure you that our business will generate sufficient cash flow from operations or continue to receive distributions from

our affiliates or subsidiaries. We cannot assure you that future borrowings will be available to us under our senior secured revolving credit facility in an amount sufficient to enable us to pay our

indebtedness or to fund our other liquidity needs. We cannot assure you that we will be able to access the capital markets in the future to borrow additional indebtedness on terms that are favorable

to us.

Our

ability to timely refinance and replace our indebtedness in the future will depend upon the economic and credit market conditions discussed above. If we are unable to refinance our indebtedness on

a timely basis, we might be forced to seek alternate forms of financing, dispose of certain assets or minimize capital expenditures and other investments. There is no assurance that any of these

alternatives would be available to us, if at all, on satisfactory terms, or on terms that would not require us to breach the terms and conditions of our existing or future debt agreements.

If securities or industry analysts do not publish or cease publishing research or reports about our business

or publish negative reports, our stock price could decline.

The trading market for our common stock relies in part on the research and reports that industry or securities analysts publish about us or our business. If

one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or

trading volume to decline. Moreover, if one or more of the analysts who cover our company downgrades our common stock or if our operating results do not meet their expectations, our stock price could

decline.

We conduct our business in an industry that is subject to high taxes and may be subject to higher taxes in

the future.

In gaming jurisdictions in which we conduct our business, state and local governments raise considerable revenues from taxes based on casino revenues and

operations. From time to time, state and local

governments have increased gaming taxes and such increases could significantly impact the profitability of our customers and our business.

In

addition, from time to time, federal, state and local legislators and officials have proposed changes in tax laws, or in the administration of such laws, affecting the gaming industry. Further,

worsening economic conditions could intensify the efforts of state and local governments to raise revenues through increases in gaming taxes and/or similar taxes. It is not possible to determine with

certainty the likelihood of changes in tax laws in these jurisdictions or in the administration of such laws. Such changes, if adopted, could adversely affect our business, financial condition,

results of operations or prospects. Any material increase, or the adoption of additional taxes or fees, could adversely affect our future financial results.

We are subject to extensive governmental gaming regulation, which may harm our business.

Our ability to conduct both our gaming and cash access businesses, expand operations, develop and distribute new games, products and systems, and expand into

new gaming markets is also subject to significant federal, state, local, Native American and foreign regulations which vary from jurisdiction to jurisdiction. In the United States and many other

countries, gaming must be expressly authorized by law.

S-11

Table of Contents

Once

authorized, such activities are subject to extensive and evolving governmental regulation. The gaming laws, regulations and ordinances generally concern the antecedents, acumen, financial

stability and character of our owners, officers and directors, as well as those persons financially interested or involved in our companies; dictate the technical standards and regulations of our

electronic player terminals, gaming systems and certain other products; set forth the process and manner by which the various city, county, state, provincial, federal, tribal, and foreign government

agencies (collectively, "Gaming Authorities") issue such licenses, findings of suitability and product approvals. In addition, the suspension, revocation, nonrenewal or limitation of any of our

licenses or product approvals, or the inability to obtain or maintain requisite license or product approvals could have a material adverse effect on our business operations, financial condition, and

results of operations and our ability to maintain key employees. The Gaming Authorities may deny, limit, condition, suspend or revoke a gaming license or related approval for violations of applicable

gaming laws and regulations and may impose substantial fines and take other actions, any one of which could have a significant adverse effect on our business, financial condition and results of

operations.

Further,

changes in existing gaming laws or regulations or new interpretations of existing gaming laws may hinder or prevent us from continuing to operate in those jurisdictions where we currently do

business, which could harm our operating results. In particular, the enactment of unfavorable legislation or government efforts affecting or directed at manufacturers or gaming operators, such as

referendums to increase gaming taxes or requirements to

use local distributors, or uncertainty as to the means and manner in which existing gaming laws may be interpreted and applied, either singly or together, could have a negative impact on our

operations.

In

May 2018, the United States Supreme Court struck down the Professional and Amateur Sports Protection Act ("PASPA") as unconstitutional, which led many states to quickly propose and, in some

instances, pass legislation authorizing sports betting. Consequently, gaming regulators, many of our operator customers, and many of our competitors dedicated resources to service this new market, as

did we. However, in January 2019, the Office of Legal Counsel of the Department of Justice ("OLC") published an opinion (the "2019 Opinion") reversing its prior 2011 opinion interpreting the

Interstate Wire Act of 1961 (the "Wire Act"). The 2019 Opinion now indicates that the Wire Act is applicable to any wire communication across state lines and specifically indicates that the Unlawful

Internet Gambling Enforcement Act ("UIGEA") does not modify the Wire Act, violations of which may be subject to criminal prosecution. The specific comment regarding UIGEA implicates UIGEA's carve out

for "unlawful Internet gambling" and "intermediate routing" (i.e., the ancillary crossing of state lines of transmissions between intra-state communications points). In reliance on the prior

2011 opinion, several states legalized online gaming, and the proposed legislation in many jurisdictions, in response to the May 2018 PASPA decision, included online sports betting. The impact of the

2019 Opinion is currently unclear, and may implicate lottery, land-based, and online gaming as well as banks and payment processors that service these market segments. The New Hampshire Lottery

Commission and certain of its service providers challenged the 2019 Opinion in federal district court. Although the federal district court "set aside" the 2019 Opinion pursuant to the Administrative

Procedure Act, the court stated that the effects of its decision under the Declaratory Judgment Act were limited to the parties in the case. The Department of Justice has appealed the decision. In

light of the decision, the Deputy Attorney General of the United States delayed enforcement of the 2019 Opinion through the later of December 31, 2019 or 60 days after the final

resolution of the case. At this stage, the full effect of the 2019 Opinion and the New Hampshire decision remain uncertain. Interpretations and resultant enforcement of the Wire Act as may relate to

intermediate routing transactions could negatively impact our Wide Area Progressive games business as well as our FinTech cash access business and our interactive real money gaming business.

Moreover,

in addition to the risk of enforcement action, we are also at risk of loss of business reputation in the event of any potential legal or regulatory investigation, whether or not we are

ultimately accused of or found to have committed any violation.

S-12

Table of Contents

Many of the financial services that we provide are subject to extensive rules and regulations, which may harm

our business.

Our Central Credit gaming patron credit bureau and check verification and warranty services are subject to the Fair Credit Reporting Act ("FCRA"), the Fair and

Accurate Credit Transactions Act ("FACTA"), and similar state laws. The collection practices that are used by our third-party providers and us may be subject to the Fair Debt Collection Practices Act

("FDCPA") and applicable state laws relating to debt collection. All of

our cash access services and patron marketing services are subject to the privacy provisions of state and federal law, including the Gramm-Leach-Bliley Act. Our POS debit card cash access transactions

and ATM withdrawal services are subject to the Electronic Fund Transfer Act. Our ATM services are subject to the applicable state banking regulations in each jurisdiction in which we operate

ATMs. Our ATM services may also be subject to state and local regulations relating to the imposition of daily limits on the amounts that may be withdrawn from ATMs, the location of ATMs, our

ability to surcharge cardholders who use our ATMs, and the form and type of notices that must be disclosed regarding the provision of our ATM services. The cash access services we provide are subject

to record keeping and reporting obligations under the Bank Secrecy Act and the USA PATRIOT Act of 2001. We are required to file SARs with respect to transactions completed at all gaming establishments

where we provide our cash access services through a gaming establishment's cashier or financial services center. If we are found to be noncompliant in any way with these laws, we could be subject to

substantial civil and criminal penalties. In jurisdictions in which we serve as a check casher, we are subject to the applicable state licensing requirements and regulations governing check cashing

activities. We are also subject to various state licensing requirements and regulations governing money transmitters. We may be required to obtain additional licenses from federal or state financial

authorities in connection with our products and services. There can be no assurance that we will be able to obtain any such licenses, and, even if we were able to do so, there could be substantial

costs and potential product changes involved in maintaining such licenses, which could have a material and adverse effect on our business.

We

are subject to formal or informal audits, inquiries, examinations, or reviews from time to time by the regulatory authorities that enforce these financial services rules and regulations. Although

we have a compliance program that covers the laws and regulations that apply to our business, in the event that any regulatory authority determines that the manner in which we provide cash access,

patron marketing, or gaming patron credit bureau services is not in compliance with existing rules and regulations, or the regulatory authorities adopt new rules or regulations that prohibit or

restrict the manner in which we provide cash access, patron marketing, or gaming patron credit bureau services, then these regulatory authorities may force us to modify the manner in which we operate

or force us to stop processing certain types of cash access transactions or providing patron marketing or gaming patron credit bureau services altogether. We may also be required to pay substantial

penalties and fines if we fail to comply with applicable rules and regulations. For example, if we fail to file currency transaction reports ("CTRs") or suspicious activity reports ("SARs") on a

timely basis or if we are found to be noncompliant in any way with either the Bank Secrecy Act or the USA PATRIOT Act of 2001, we could be subject to substantial civil and criminal penalties. In

addition, our failure to comply with applicable rules and regulations could subject us to private litigation.

Gaming and financial services laws and regulations are subject to change and uncertain application.

Gaming and financial services laws and regulations are subject to change and evolving interpretations and application, including through legislative

amendments, new and proposed regulations, executive orders, and agency interpretations, and it can be difficult to predict how they may be applied to our business. We may not be able to respond

quickly or effectively to regulatory, legislative and other developments, and these changes may in turn impair our ability to offer our existing or proposed products and services and/or increase our

expenses in providing these products and services.

S-13

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds to us from the sale of our common stock offered hereby will be approximately $ (or approximately

$ if the underwriters exercise their option to purchase additional shares in full), after deducting estimated underwriting discounts and commissions and

estimated offering expenses

payable by us. We intend to use the net proceeds of this offering to refinance a portion of our existing indebtedness in one or more transactions, which may include the repayment of certain

outstanding borrowings under the Term Loan Facility and/or the redemption and/or repurchase of a portion of our outstanding 2025 Notes. Pending the deployment of the net proceeds for such refinancing

transactions, we may invest the net proceeds in short-term, interest-bearing, investment-grade securities.

As

of September 30, 2019, we had (i) $782.0 million of borrowings outstanding under the Term Loan Facility and (ii) no borrowings outstanding under the Revolving Credit

Facility. The interest rates on (a) the outstanding principal amount of the Term Loan Facility are (x) the Adjusted Eurodollar Rate + 3.00% for Eurodollar Rate Loans (with

a

1.00% LIBOR floor) and (y) the Base Rate + 2.00% for Base Rate Loans and (b) the outstanding principal amount of the Revolving Credit Facility are (x) the Adjusted

Eurodollar Rate + 4.50% for Eurodollar Rate Loans (with a 1.00% LIBOR floor) and (y) the Base Rate + 3.50% for Base Rate Loans. Pursuant to the Proposed 2019

Repricing Amendment, we expect to reduce the interest rate payable on the Term Loan Facility. The maturity date of the Revolving Credit Facility is May 9, 2022, and the stated date of the Term

Loan Facility is May 9, 2024. We are currently in discussions to amend our Credit Agreement. See "Summary — Recent Developments — Proposed

Amendment to Credit Facility."

As

of September 30, 2019, we had $375.0 million aggregate principal amount of 2025 Notes outstanding. Interest on the 2025 Notes accrues at a rate of 7.50% per annum and is payable

semi-annually in arrears on each June 15 and December 15. The 2025 Notes will mature on December 15, 2025.

The

Underwriters and/or their affiliates may be holders of our outstanding 2025 Notes and/or our existing Term Loan Facility and, as a result, may receive a portion of the proceeds from this offering.

See "Underwriting."

S-14

Table of Contents

CAPITALIZATION

The following table sets forth our capitalization as of September 30, 2019:

-

§

-

on an actual basis; and

-

§

-

on an as adjusted basis to give effect to the issuance and sale of our common stock

offered hereby and the application of the estimated net proceeds therefrom as set forth under "Use of Proceeds," after deducting the underwriting discount and estimated offering expenses payable by

us.

This

table should be read in conjunction with, and is qualified in its entirety by reference to, "Use of Proceeds" and our unaudited consolidated financial statements and the accompanying notes in our

Quarterly Report on Form 10-Q for the quarter ended September 30,

2019, which are incorporated by reference into this prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

AS OF

SEPTEMBER 30, 2019

|

|

|

($ in thousands)

|

|

ACTUAL

|

|

AS ADJUSTED(4)

|

|

|

|

(unaudited)

|

|

|

Cash and cash equivalents(1)

|

|

$

|

275,706

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

|

|

|

|