The European Equity Fund, Inc. (NYSE: EEA) and The New Germany Fund, Inc. (NYSE: GF) Announce a Discount Management Program

July 20 2010 - 5:05PM

Business Wire

The European Equity Fund, Inc. (NYSE: EEA) and The New

Germany Fund, Inc. (NYSE: GF) (each a "Fund" and, collectively,

the "Funds") announced today that after consideration of the votes

received on a stockholder proposal presented at each Fund's Annual

Meeting of Stockholders and in an effort to reduce the Funds'

market discounts, the Board of Directors has authorized a Discount

Management Program (the "Program"). The Board approved a series of

up to four, consecutive, semi-annual tender offers each for up to

5% of the Funds´ outstanding shares at a price equal to 98% of net

asset value ("NAV"). A Fund will conduct a tender offer if its

shares trade at an average discount to NAV of more than 10% during

the applicable twelve-week measurement period. The first

measurement period will commence on September 1, 2010. The Program

also provides for the continuation of share repurchases by each

Fund such that EEA and GF are authorized to repurchase up to

600,000 and 950,000 shares, respectively, during the period August

1, 2010 - July 31, 2011. Under the terms of the previous repurchase

program, EEA and GF repurchased 507,692 and 742,430 shares,

respectively, from November 1, 2009 through July 16, 2010.

Repurchases will be made from time to time when they are believed

to be in the best interests of a Fund.

EEA also announced that with the Fund's outperformance of its

benchmark in 2009 and the first half of 2010 by a total of 4.85%

the current partial management and advisory fee waivers totalling

0.35% per annum would expire on August 31, 2010.

For more information on GF or EEA, including the most recent

month-end performance, visit www.dws-investments.com or call (800)

349-4281.

The European Equity Fund, Inc. is a diversified, closed-end

investment company seeking long-term capital appreciation through

investment primarily (normally at least 80% of its assets) in

equity and equity-linked securities of companies domiciled in

European countries utilizing the Euro currency. Investing in

foreign securities, particularly those of emerging markets,

presents certain risks, such as currency fluctuations, political

and economic changes, and market risks. Any fund that concentrates

in a particular segment of the market will generally be more

volatile than a fund that invests more broadly.

The New Germany Fund, Inc. is a diversified, closed-end

investment company seeking capital appreciation primarily through

investment in the Mittelstand – an important group of

small and mid-cap German companies. The Fund may invest up

to 35% of its assets in large cap German companies, and up to 20%

in other Western European companies. Investing in foreign

securities, particularly those of emerging markets, presents

certain risks, such as currency fluctuations, political and

economic changes, and market risks. Any fund that concentrates in a

particular segment of the market will generally be more volatile

than a fund that invests more broadly.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and once issued,

shares of closed-end funds are sold in the open market through a

stock exchange. Shares of closed-end funds frequently trade at a

discount to the net asset value. The price of a fund’s shares is

determined by a number of factors, several of which are beyond the

control of the fund. Therefore, a fund cannot predict whether its

shares will trade at, below or above net asset value. There can be

no assurance that the Program will be effective in reducing the

Funds’ market discounts.

Investments in funds involve risk. Additional risks are

associated with international investing, such as government

regulations and differences in liquidity which may increase the

volatility of your investment. Foreign security markets generally

exhibit greater price volatility and are less liquid than the US

market. Additionally, this fund focuses its investments in certain

geographical regions, thereby increasing its vulnerability to

developments in that region and potentially subjecting the fund’s

shares to greater price volatility. Some funds have more risk than

others. These include funds that allow exposure to or otherwise

concentrate investments in certain sectors, geographic regions,

security types, market capitalization or foreign securities (e.g.,

political or economic instability, which can be accentuated in

emerging market countries).

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

NOT FDIC/ NCUA INSURED • MAY

LOSE VALUE • NO BANK GUARANTEE

NOT A DEPOSIT • NOT INSURED BY

ANY FEDERAL GOVERNMENT AGENCY

DWS Investments is part of Deutsche Bank’s Asset Management

division and, within the US, represents the retail asset management

activities of Deutsche Bank AG, Deutsche Bank Trust Company

Americas, Deutsche Investment Management Americas Inc. and DWS

Trust Company. R-18308-1 (7/10)

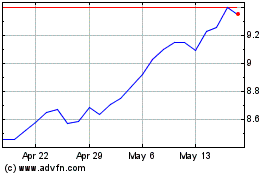

European Equity (NYSE:EEA)

Historical Stock Chart

From May 2024 to Jun 2024

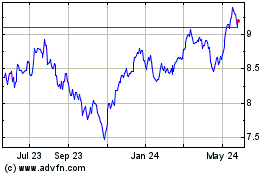

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2023 to Jun 2024