UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | | | | | | | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| ý | | Definitive Additional Materials |

| o | | Soliciting Material under Rule 14a-12 |

Enhabit, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | | No fee required |

| o | | Fee paid previously with preliminary materials |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On June 18, 2024, Enhabit, Inc. (the “Company”) posted to the Investor Relations section of the Company’s website transcripts of management comments at the Leerink Partners Healthcare Crossroads Conference 2024, held on May 29, 2024, and at the Goldman Sachs 45th Annual Global Healthcare Conference, held on June 11, 2024. The materials are available at https://investors.ehab.com.

TRANSCRIPT

05 - 29 - 2024 / 10:00 A.M. CDT

Enhabit Home Health & Hospice

Leerink Partners Healthcare Crossroads Conference 2024

Enhabit Home Health & Hospice

Leerink Partners Healthcare Crossroads Conference 2024

CORPORATE SPEAKERS:

Crissy Carlisle

Enhabit Home Health & Hospice; Chief Financial Officer

Barbara Jacobsmeyer

Enhabit Home Health & Hospice; President and Chief Executive Officer

PARTICIPANTS:

Analyst

Leerink Partners

PRESENTATION:

Analyst:

Okay, well, great. Good morning, everyone. Thanks for joining us today. I’ve got the team from Enhabit with me. Barb, Crissy, thanks for joining us. I’ll just get into the most recent developments. Is there anything you care to share, offer up around the strategic alternatives process and the outcome of that? And there’s been some stuff filed today, so I don’t know if there’s anything you’d care to share or say.

Barb Jacobsmeyer:

Yeah, what I would say is, hopefully people saw the preliminary proxy and the press release that was published last week went into a lot more detail on the strategic process. So I think clear from all of that that it was a very robust process. As far as kind of the new release this morning that folks may have seen. We’re really confident in the slate that we have. We feel like we have a strong, very experienced board of directors. They have helped us navigate these waters over the last couple of years. So we’re really confident in the future and with the leadership of our board.

Analyst:

Okay, that’s helpful. Everyone else can go read the proxies and the 8-Ks to get the update there. I want to start just with Barb. The evolution of the payer innovation strategy, you guys seemingly started a little bit late in the game when you took over control of the organization, had a much higher Medicare Advantage mix than the peers you have to aggressively get out and contract. And the amount of activity exceeded my expectations. Just where you are in the whole evolution of it, how you feel about how successful this has been?

Barb Jacobsmeyer:

Yeah, well, I do think it was critically, one of the most important things that we did was to develop the team. As you know, not only did we have a higher amount of fee-for-service, but the Medicare Advantage mix that we did have paid us with a significant discount.

And so it was really important to get out there to get more and better contracts. I’ve been very pleased with the results of that team now sitting with 64 agreements. Most of those are regional agreements, but there are two national agreements, the most recent being the national agreement that went into effect January 1 of this year. And obviously the national just brings a much larger addressable market.

Now the contracting is one piece, but the other piece we’ve been really pleased with is the work of the teams in the field, really being able to pivot and focus on not only bringing in those better paying contracted patients, but also using that to be seen as a more fulsome provider to our referral sources so that we can continue to gain therapy for service and frankly help us then stabilize that fee-for-service business that we do have. So pleased with that, continue to have a lot of work though, with the team. Still have about 30 agreements in the pipeline, 28 historic older agreements that were to the renegotiate.

Analyst:

Are the rates that you’re getting “case rate, an episodic rate” maybe talk about how the structure of these rates are different than a per visit contract.

Barb Jacobsmeyer:

Sure. So, historically, before the payer innovation, the majority of them were per visit, and it was about a 40% plus discount. With the payer innovation, we made a concerted effort to say, not going to really take anything, more than a 25% discount. On the episodic agreements, we were with the regionals, we were kind of at a zero to 10% now discount. And on the per visit, around that 20% to 25%, just kind of on averages. I will say one difference that came is the new national agreement that went into effect January has a little bit more layers to it. It is an episodic agreement, but we’ve aligned incentives with us and the payer to really help them be able to move patients out of institutional settings, and therefore our payments a little is better, and we’re able to move patients out of institutional settings.

Analyst:

Can you unpack that a little bit? To make sure I get this. So a larger contract, different layers, national contract, episodic, but it also has…

Barb Jacobsmeyer:

There’s more components to it…

Analyst:

More components…

Barb Jacobsmeyer:

So instead of just having – it was the way, we negotiated it, and I think it was a win for both. And it really aligns their incentives with ours. We want to be paid better, but we also want to help them and where their pain points are. And that is having a timely and efficient movement of patients in institutional settings home.

Analyst:

Okay. Okay, makes sense. So you’ve got 30-ish additional contracts sort of in the pipeline, various stages of negotiation, constantly learning and applying those learnings to these contracts.

When you’re done with these 30, well, does the 30 include like recontracting? No, these are all new.

Barb Jacobsmeyer:

All new. So how we build that pipeline is we really work with the business development teams in the field and say, what would be a significant help for you? What contract would help you to be seen as a better provider to your referral sources? And they really feed up to us because some of these are seems small because they’re at a regional level, but they can be meaningful at that local branch. And so that’s how we’ve built our pipeline over the last couple of years and continue to build it.

Analyst:

Okay.

Crissy Carlisle:

And what I would say, we’ve reached the point now where we are beginning to renegotiate historic contracts. So this historic contracts that again, we were gifted when we became the management team. We’re now converting them and having the discussions to make them pay your innovation contracts by showing the quality we delivered over that time period.

Analyst:

Okay. What’s the most resistance that you meet when you’re sitting with a payer trying to move on these contracts?

Barb Jacobsmeyer:

I would say the most resistance is when you find that they’re siloed within their negotiating departments. So if it is the group that handles just home health, frankly what we’ve learned is that they bonus or incentive to keep their unit cost in place. And so if they’re not talking across the hall with those that are focused on emergency room visit costs, acute care utilization costs, that’s where we see the barrier. Because then all they see is, well, if I pay you more, my unit cost goes up and can’t really understand well, but that unit cost going up can significantly help that unit cost and that’s the biggest barrier. And so, that’s what we have to work through, which is why some of these take the amount of time that they’ve taken.

Analyst:

Yeah. Okay, so once we get fast forward a year from now, I don’t know what it’s going to look like in a year from now. You don’t know. But like do you think that like the mix is, I mean, you’re down to sort of like peer levels now in terms of your fee-for-service MA split, do you think that, I mean, it’s going to continue to go lower fee-for-service? I don’t really know where the question’s going to go here, but do you think that like you’re done through like the majority of the contracting you need to do or is there more work to do after these 30 contracts?

Barb Jacobsmeyer:

I think after we get through these 30 and the 28 renegotiating. Because on the renegotiations we’re either going to win at the renegotiation or we will walk away. At some point, what we have told our teams in the field is at some point, we don’t want them to have to think so hard when they get the referrals. We want anything that they’re contracted for that they can simply say yes to. That’s our ultimate goal for them.

Analyst:

Got it. When you were at your prior employer, you worked really hard on an MA strategy. And I’m thinking about like Enhabit. Enhabit was taking it, they had outsized exposure to the referrals that you were getting from Encompass. What does that look like today in terms of the mix that you have coming from the old parent company? Is it something you share?

Barb Jacobsmeyer:

We don’t share because it’s harder to get that data, right. When all of our data was together, it was easier to know. Like what we don’t know today is that denominator, what number of patients from the IRFs are going home with home health, so that we know what that we’re getting. What I would say is that the last three quarters, we have seen those numbers stabilize. We do feel that us getting on more contracts has helped us really kind of firm up the relationship now so that we can at least stabilize those referrals, because that was a missing piece as well for them as they saw more MA, and we couldn’t service that. That doesn’t really help us to be seen as kind of the preferred provider.

Analyst:

Okay. On the operational side of this, there was an awful lot of work that you guys have undertaken to prioritize in terms of preferred economics of each of these payers. Do you want to just talk about the process that you put into place internally to, aye, no, maybe, like how you’re kind of working through at the field level?

Barb Jacobsmeyer:

Yeah. So at the field level, what we’ve given them now is the resources to kind of have what we call kind of a red yielding reports, right. So that if I’m in the field and I’m getting these referrals and I only have so much capacity, right. And so what we’ve said to the field is, we know this is tough. There’s a patient on the other side of this. But to be good stewards of our resources, we need you to be smart making these decisions.

And so at the field level, they know, obviously, all green contracts, you just accept immediately. The yellow contracts and the red contracts, you kind of look at, well, where are they coming from? Right. If they’re coming from a referral source that only wants to send those, it’s going to be hard to prioritize those. But if they’re coming from referral sources that we know we have a good collaborative working relationship with, then we take them.

The other thing that we look at is, what is the productivity of our staff, right. Until at a certain branch, we get on more and better contracts, it may be with their salaried staff you need to fill. You’d rather have productive staff. So you may take a

yellow or red, just simply because, well, it’s better than having my staff be unproductive. And so that’s kind of the thought process. But we do have the information out at the field level for them to make those decisions.

Analyst:

Do you ever feel like there’s risk that you deflect some of the volume in that sort of yellow category, that people get a little nervous like, I’m only going to take the green? I’m trying to think of like, what’s the downside risk of that initiative?

Barb Jacobsmeyer:

Yeah, so that’s again, why they need to know the referral source right. If I’m at a referral source and again, and I think our teams have done a really good job making sure that they can articulate that we want to be seen as a full service provider to those referral sources. It’s why we’re asking the referral sources, what contracts should we be going after? We want them to know we want to work on their behalf to be able to serve more of their patients.

Analyst:

Got it. When I think of the referral sources, what’s your mix of institutional versus community today?

Barb Jacobsmeyer:

So, historically, and I would say still pretty close today, we’re about a third acute care hospitals, a third more of that kind of sub-acute, your IRFs or SNFs, or LTACHs, and then a third community directly from the physicians. I do see, over time, we could potentially start getting higher at those institutional, because again, our hope is that we continue to negotiate better agreements, particularly focused on those patients needing to get moved out of the hospital.

Analyst:

In that institutional, the sub-acute, as you said, has the rate of growth of Medicare Advantage been greater there than community or acute? I get the feeling that there has been more growth in patients that are going into those facilities.

Barb Jacobsmeyer:

I actually would say, we have probably seen more of it on the community side, because a lot of our focus on the community side had been more in your, like senior apartment settings, ALFs those settings. But what you find is you have one really strong salesperson of a payer go in and provide a great lunch, and the next thing you know, the building has – the majority of people in the building have signed up. So we’ve actually seen that shift, I would say, more in our community faster than we have even on the sub-acute.

Analyst:

Okay, labor, just – let’s talk about just your labor agenda. You’ve worked really hard to recruit and retain and improve retention. Any metrics to share around where you are today and your level of satisfaction?

Barb Jacobsmeyer:

So we have been really pleased with that. We’ve been able to increase our candidate pool by about 30% this year over last year in the first quarter. I think a lot of that has become of the branding and people getting to recognize the Enhabit brand. We do have now eliminated all contract labor, so we have enough nurses now in the field that have eliminated all of that. Continue on the recruitment and retention side, I would say now that we have our own data warehouse and we’re able to get more of our data to look at in greater depth.

One of the things we’re focused on now is how do we do the right hire upfront? Because what we do see is with our turnover today, it does tend to be folks within that first six to nine months. Once somebody’s with us a year or two, our retention is really strong. And so it’s really using the data to say, what are the most successful? Is it a certain nurse coming from a certain setting so that we can start drilling down? Now our candidate pool has increased. How can we be smarter on the selection side upfront so that we can continue to improve that retention?

Analyst:

Cost per visit, I don’t know, Crissy, do you want to just sort of talk about how that’s been trending? And I guess, the corollary to this too is, visits per episode and opportunities there to invest in some technology or optimization opportunities.

Crissy Carlisle:

Yeah. So I’ll take the cost per visit question and maybe ask Barb to compliment that with some of the VPE initiatives we have underway. Our cost per visit, we’re really pleased with the way our teams are managing the costs in the field. 90% of our cost per visit is labor. And so their ability to manage that, we did a great job, as we just talked about with our labor initiatives in 2023 and really building up our clinical staff through that increased candidate pool, increased retention. And doing so has allowed us to be more productive, which allows us to offset some of the merit increases it’s allowed us to eliminate contract labor by the end of 2023. That was worth about $6 million in 2023, with the majority of that being in the first half of that year.

And then right now to continue to manage that, we’re looking at our optimization. And so when we say optimization, what we really mean is sending an RN to do an RN’s work. So having that clinician work at the top of their license right now we’re at about a 32% optimization rate, meaning that about 32% of the time an RN will go to do something an LPN could do.

And there’s a 13 – on average, about a $13 difference in the cost per visit when an RN goes versus an LPN. So in those markets where we have our nurses fully productive, we’re looking actively to add more LPNs to optimize our clinical mix, which allows us to be more efficient and further push that cost per visit down.

So right now we’ve got a guidance consideration out for the year of 2% to 3% increase. If you think about it merit increase wise, we’re probably average about 3%. And there’s likely to be some markets where we have to get a little bit something above that just to remain competitive. Q1, we were at a little over 2%. So we like where we’re headed. We like the initiatives we have underway and feel good about that 2% to 3% increase.

Barb Jacobsmeyer:

And then on visits per episode, we rolled out Medalogix’s Pulse to all the branches last year, and now really the focus is on the leaders knowing how to use their dashboards to say, if I look this morning at my caseload of patients as a branch, which of them are at very low risk versus low risk versus high risk of read mission? And do my visits – my visits look like they complement that, or do I see overutilization or potential overutilization for my very low risk patients? And how do I move those appropriately, particularly to new starts of care, so that we can manage those visits per episode and actually gain more through the clinical workforce we have today? We are complementing that in a few markets right now with some virtual visits and seeing how that’s going to help to determine if we want to build that out as well.

Analyst:

Any targets around visits per episode where you are today, where you could – I mean, you’re certainly operating at a structurally higher level than your peer group.

Barb Jacobsmeyer:

When we piloted the Mealogix’s Pulse, what we saw in those 17 branches was a 5% reduction in the visits per episode with no change in our quality. And obviously that’s an important thing for us. With that being our biggest value proposition to the payers, we can’t afford to negatively impact that. So we feel that conservatively, 5% makes sense in the long range to look for as an initial savings.

So it’s really not a targeted number for visits per episode. It really is about 1% decline at a branch level, because if I’m a branch with a high neuro mix, I’m going to have higher visits per episode because of all the disciplines. So it’s really looking at that branch level how can I lower theirs based compared to their baseline.

Analyst:

Okay. Maybe round out some of the operational home health questions. Just volumes have stabilized mostly, mix is stabilizing. You’ve got some underlying solid unit cost trends, cost per visit – visit per episode moving in the right

direction. Where is the single largest area to drive earnings growth in the next 12 to 24 months and compartmentalize anything that happens on the regulatory front?

Barb Jacobsmeyer:

Right. I would say definitely our focus on the visits per episode and being able to grow with the clinical – so it’s not like we’re not going to add clinical workforce, but even grow more with the clinical workforce that we have is certainly an area of great focus for us because we do believe that now that we’re on more payers, we can accept more and grow more. We wanted to be careful how much we were growing in those really low paying agreements. So now that we have more payers, it’s how do we use the clinical workforce to grow within that.

Analyst:

Okay, the proposed rule, we’re going to get that out in the next month or so. I think anyone that spent any time around the industry knows that CMS is intent on following the spirit of the law and the statute and implementing various layers of behavioral adjustments. There’s more that they have to implement that they delayed last year. Then you’ve got the permanent cut that is ballooned to a very large amount that continued to grow. I don’t know, what’s sort of the internal expectation as we head into this proposed rule?

Crissy Carlisle:

Well, I think they definitely signaled last year that they would come back for the other half of the permanent cut that we didn’t get last year. I think the question will be what sort of market basket are they going to put with that in the proposed rule. Certainly, as you mentioned, what hangs out there is those clawbacks, the temporary clawbacks that is a huge number now.

So far they have not put any language in a proposed rule regarding those. It will be interesting to see is anything introduced in the proposed rule this time. And obviously there will be a lot of focus for the industry on trying to eliminate those temporary cuts because there was a well-attended Senate finance hearing last fall. They talked about, yes, the number of locations may still be out there, but there are providers that are having to shrink geographic areas to be able to have a margin that’s sustainable. And so, it’s have we created and will we create enough noise to make an impact on those temporary adjustments.

Analyst:

I know this is a difficult question to answer, and I’m afraid I’m not going to get it answered. But like, let’s just say that you’re in a multi-year cycle of generally just flat fee for service rates and you have some volume mix tilted more MA, less fee for service. Can you grow earnings in a timeframe where you don’t have pricing to cover the cost inflation?

Barb Jacobsmeyer:

I think there are two things we’d have to focus on. One is getting to the point that we’ve moved everything over to a payer innovation that’s not fee for service, right? So that’s the opportunity for us. I guess if you look historically, it’s probably better for us that we actually have more to move over into those, so that you can try to negate some of that pricing impact from that perspective. And then obviously the continued focus on things like productivity, optimization and visits per episode, those are your greatest tools in the toolbox to mitigate that.

Analyst:

Yeah. Somebody once told me that home health, 100% of costs are actually variable at the end of the day. So I think there’s an element of truthfulness to that. Can we spend just a minute on hospice? I was trying to balance the time to align with the percentage of earnings that you had, the internet price, organization, it’s been I think you said one time, Crissy, it’s been a journey. How do you feel about the progress there? A lot of investments on business development, your sales, marketing teams, it was a decent first quarter from what I could tell. So just any update on how you feel about those investments and the progress?

Barb Jacobsmeyer:

Yeah. So as you said, it’s been a journey. It was most important for us to stabilize the workforce and remove the capacity constraints. It made no sense to add business development teams when they were selling to say no. And so I think we did a

really good job on getting all the positions still at a clinical level, putting in that case management model, which has really helped us from a recruitment and retention standpoint.

And now it is fully focused on business development and not only adding the resources from business development, but also making sure that we are complementing and looking at our referral sources so that we can make sure that we balance that length of stay. I think we did overcorrect early on to try to alleviate any sort of cap exposure and really ended up kind of impacting having more short length of stay, which is why we saw kind of admissions going, but not census. As we noted in the first quarter call, we did see sequential census improvement throughout the first quarter that persisted into April. So I think all the work that we’ve done and now adding the business development resources is certainly paying off.

Analyst:

So more stable length of stay trends throughout the first quarter and given the length of stay you have that hopefully persist to the next quarter.

Barb Jacobsmeyer:

That’s right.

Analyst:

Okay. What was I going to say around hospice? I mean, given that it’s not a significant piece of the overall earnings stream today, does it become more of a distraction than an opportunity? Or how are those conversations evolving internally?

Barb Jacobsmeyer:

Yeah, I think it is still an opportunity. I mean, first of all, we certainly have a lot more stable rate environment for hospice, and so it is good to be able to see that we continue to get some positive rate updates. I also think it’s been part of our de novo strategy because we do believe where we have home health, if possible at hospice, it just makes sense. And so it continues to be a strategy for us to build on the hospice.

Analyst:

When you say it makes sense where you have home health to have hospice, can you elaborate a little bit more on that? Is that – we think there’s a cross referral opportunity there or there’s business development? It’s two people could be doing one person’s job. I mean, where is the opportunity?

Barb Jacobsmeyer:

The opportunity is first, brand recognition, both from a referral development as well as a recruitment and retention. So, just having that name in the market and being able to build off of that. But it also helps from a standpoint. About 20%, 25% of our patients do come from a home health. And so, it makes sense that, especially where we have significant size and census for home health to have hospice. You already have a referral stream there and so just kind of that combination helps both.

Analyst:

Okay. Make sense. On the – going through my model, in my head, I’m now down to the corporate line and there’s been some progress, I see evident in the first quarter. Crissy, do you just want to talk a little bit about some of the steps you guys took to step into 2024. And actively I mean, there’s been all the transition costs that kind of obscured things.

Crissy Carlisle:

Sure. So in 2023, that’s really the first full year that we had to be a standalone company. Those original cost estimates were $26 million to $28 million for standalone costs, we actually came in around $23 million to $24 million. So very proud of what we were able to achieve there. Effective about the middle of March of this year, we are now officially off the transition services agreement with Encompass Health. So everything is ours.

The last thing to transition was part of the IT network for our PeopleSoft financial system. So there should be a little bit of no double dipping going forward with that. From first quarter, we were about $27 million of corporate costs. I think that $27 million to $28 million is a good run rate going forward. We do want to make sure that our clinicians in the field are well supported and feel well supported by the home office team. But again, I feel comfortable with those numbers given the initiatives that we took in 2023 with cost savings and other restructurings in order to maximize our efforts there.

Analyst:

Last year things have been – you guys had to operate a little bit more on the defensive. You’ve had to respond with some active efforts with your bank agreement and your syndicate haven’t been as active on M&A. How do you think about returning a little bit more offensive to begin to grow?

Crissy Carlisle:

We continue to believe that growth is a very important part of the long-term strategy. We continue to diligence opportunities we see in the market. We remain interested and certainly want to be returning to that mode. And if a quality asset were to come to market, kind of these onesie-twosies, we certainly take a long, hard look at it. We continue to believe that some of the challenges we’ve talked about here today, the Medicare reimbursement uncertainty and the shift in Medicare Advantage, those we continue to believe will drive some of the mom and pops to the market. And then it’s a matter of can seller and buyer agree on the same multiple for that deal.

At the same time having said all of that, we acknowledge where we are with our credit agreement and our leverage, and the current priority will remain to delever for the time being. We’re really pleased with the fact that we have stabilized EBITDA and that combined with the required amortization on our term loan will allow us to delever in 2024. In addition, we continue to generate very strong free cash flow. And as we use that to continue to reduce debt, that in turn reduces interest expense, which in turn increases free cash flow. So we’re excited about the cycle that we’re going to be in, in 2024.

Analyst:

Remind me, the amortization – the quarterly amortization. And I presume that there’s also like an M&A basket that you have as well.

Crissy Carlisle:

Yeah. So right now it’s very limited on the M&A side. They want everything going to them, which is fair, I believe. But I would say that the required amortization is $20 million per year.

Analyst:

Yeah. No, quarterly, it’s just – it’s all at annual.

Crissy Carlisle:

It’s $5 million a quarter, $20 million for the year.

Analyst:

Okay. All right. Well, final question for me is I want to know what you’re most excited about.

Barb Jacobsmeyer:

Well, I would say I’m most excited about our team has done a phenomenal job of keeping their head down and doing a really good job. And so because of that, we’ve seen the results on the build of the clinical workforce and the payer innovation. So I’m excited, and I think we saw it in the fourth quarter, we saw it again in the first quarter that the strategies we put in place are making an impact and so I’m most excited to have the year continue to progress.

Crissy Carlisle:

I’m excited about, again, just like Barb, the success that we’re seeing, the stabilization of EBITDA and what that will mean to our leverage, to our performance, to our earnings, to our free cash flow. And the efficacy of home care is undeniable. And so to be in this industry and to have the opportunity to take care of that and take care of our patients and to provide them the high quality care they deserve, that’s exciting to us.

Analyst:

Well, great. Well, guys, we’re just about out of time, so why don’t we just go ahead and end there?

Barb Jacobsmeyer:

All right.

Analyst:

Thank you so much for joining us today.

Crissy Carlisle:

Thank you.

Barb Jacobsmeyer:

Thank you. All right. Thank you, Steve.

TRANSCRIPT

06 - 11 - 2024 / 10:00 A.M. EDT

Enhabit Home Health & Hospice

Goldman Sachs 45th Annual Global Healthcare Conference

Enhabit Home Health & Hospice

Goldman Sachs 45th Annual Global Healthcare Conference

CORPORATE SPEAKERS:

Crissy Carlisle

Enhabit Home Health & Hospice; Chief Financial Officer

Barbara Jacobsmeyer

Enhabit Home Health & Hospice; President and Chief Executive Officer

PARTICIPANTS:

Jamie Perse

Goldman Sachs; Equity Research Analyst

PRESENTATION:

Jamie Perse:

All right. Good morning, everyone. We're going to get started with our next session. I'm Jamie Perse, the health care provider analyst at Goldman Sachs. We've got Enhabit Home Health & Hospice. And with us, Barb Jacobsmeyer, President and CEO and Crissy Carlisle, CFO. I think you guys were going to start with some opening comments. So, I'll turn it over to Barb.

Barb Jacobsmeyer:

Okay. Great. Thank you. Yes, I just have a few things to cover this morning. Okay. So, our last few quarters we've seen the success of the strategies that we had put in place. And so, when we look at our 2024 priorities, it's really been focusing on stabilizing that Medicare fee-for-service mix and our growth for home health really coming as a result of adding more of the frontline clinicians as well as having more of the payer contracts to be able to offer to our referral sources.

For hospice, it's really been, if you think last year, the focus was on stabilizing the capacity for our clinicians in the field, and we put that case management model in place, which has helped us with the recruitment and retention so that we could really turn the focus now on business development, growing that census and gaining that operating leverage in the hospice fixed cost structure. And then de novos, we talked about real -- each year. Last year, we were able to add 8 of those 10 with the other two opened so far this year because we were ready, but the licensing surveyors had not been out to license those. And then continue on our people strategy, which has been very successful for us as we look to add more of the full-time nurses and now also focusing on therapy to increase the clinician count in the field.

When we talk about the stabilization of the traditional Medicare, our home health business historically had a really high mix of Medicare business. A lot of that was because of the collaboration efforts with the Encompass Health (inaudible) at the time. We do anticipate our mix shift to more follow industry levels going forward. That growth in Medicare Advantage elections really increase the relevance of a home health provider being seen as a full-service provider to referral sources. So, when you think of between 2020 and 2023 enrollment, Medicare Advantage increased 29%. And so, a referral source really looking at a provider saying, I need you to take care of all of my patients, not just one subset of patients.

Payer innovation strategy has really had a lot of success. When you look at Quarter 1 of last year, only 6% of our non-Medicare visits were in those payer innovation, those better paying contracts. That has improved to 38% in Quarter 1 of this year. And that's really helped driving that increase in our non-Medicare revenue per visit. Looking back at 2022, that was around $136 a visit. In the first quarter of this year, we realized $145 a visit.

So, we think about home health, really, again, it's about our increased clinical capacity and using those favorable contracts to be able to grow. When you look at those percent of total admissions, the purple is the fee-for-service Medicare, and the orange is the payer innovation admissions. So again, Quarter 1 of last year, only 58% were in those better paying groups. That left 42% of those admissions in really the less than desirable payment contracts. That improved in Quarter 1 of this year to 71%. So, the more and more we can move to those payer innovation contracts, the more that also helps us offset any impact on that fee-for-service Medicare.

And so, we'll use the continued growth in our contracts. We now have 64 new contracts since our spin. We still have a pipeline of 30 new agreements and 28 historic agreements that we are working to renegotiate. So, using those agreements, our staff and then utilizing technology like Medalogix Pulse really to help us manage those visits per episode so that we can see more patients with our clinical capacity we have today.

Hospice, as I mentioned, was really about stabilizing the clinical staff. So, putting that new staffing model in place in 2023 was critical to not only eliminating all the capacity constraints, but also the success in the recruitment and retention, so we could eliminate all the contract labor. And now the focus has really turned to building out those sales teams. And in addition to that, we've added admission departments regionally so that we can be more centralized in how we are handling that referral to admission process and being as timely as possible to give an answer to our referral sources.

Our de novo strategy, again, we've opened 15 de novos since 2022 and continue on our goal of 10 de novos each year. A little bit more hospice than home health as we would like, where possible to have hospice where we have home health.

And then again, our focus on our people strategy. This is something we've been really successful with. We just, in the first quarter, did our employee engagement survey, and we saw our Net Promoter Score in that top 25% of health care. So really pleased in the engagement of our employees. And it's why I think we've done such a great job earning recognitions over the years as being a top place to work.

So, we're very confident of the long-term outlook for Enhabit. Again, the demographics haven't changed. That aging population continues to grow. We're going to see a 5% CAGR in that addressable market of that aging population. We continue to be the lowest cost setting for health care, about 10x lower cost than your other care settings. So as everyone is working to manage those resources and those costs, home health and hospice is a great place to turn. And 77% of those age 50 or over has said, I would like to age in place. I'd like to age in what I call home, and again, home care being the place of choice for the care if and when possible.

So, for Enhabit, our longer-term outlook, when we look at, again, the new payer innovation contracts, the staffing that we've had in place, we have seen some nice growth over these past few quarters. So, we expect to continue to grow at a mid- to high single digits over the next three years, again, with our ability to serve more referrals through those contracts and the clinical capacity that we have increased.

For hospice, we have seen sequential monthly growth in our census this year. So, this kind of shows by month where we've been each month growing our census, so we do expect hospice volumes to grow at a mid- to high single digits over the next three years, again, leveraging the investment that we put in the case management model and the build-out of our business development teams.

Crissy Carlisle:

Then in regard to free cash flow, we continue to generate a significant amount of free cash flow each year. That free cash flow allows us to fund operations, service our debt and grow our business. In regard to funding our operations, we've only drawn on our revolver onetime post-[span], and that was the fourth quarter of 2022 when we executed three acquisitions and had a $15 million deferred payroll tax payment related to COVID relief efforts. Those stacked payments were well over $50 million. And even then, we only drew $20 million on the revolver, and we've already repaid $10 million of that.

For servicing our debt, our current free cash flow priority remains de-levering, and we recognize where we are with our leverage. We believe that the stabilization of EBITDA as well as the $20 million of required amortization on our term loan will help us to delever in 2024. I think in regard to growing our business, we believe that growth through new locations is a very important part of our strategy.

As Barb already mentioned, we have a strategy to open ten de novo locations per year. That's about a $2 million to $3 million minimal investment in those locations. We can build off the existing brand recognition where we already have home health as well as co-locate, which helps with some of the real estate related costs of the double location.

We do continue to diligence opportunities that come our way. But having said that, we also, at the same time, acknowledge where we are with our credit agreement and our leverage and pay very close attention to any strategic opportunities in new markets, specifically in [CON]-type states where we would have to go in through an acquisition.

I would also point out that we're always evaluating our capital structure and working with our financial advisers as well as our banking partners to evaluate opportunities to improve that capital structure.

Jamie Perse:

Okay. Great. Well, thank you for that helpful overview. There's a number of things going on with the company. I'm going to focus mostly on fundamentals, but maybe one kind of corporate question to start. You sent a letter to shareholders last night. You've just come through this strategic review. I guess I'd ask it in this way, having gone through these processes and still very much in it, has anything changed in terms of your assessment on what you need to do to create shareholder value or key priorities? I mean you just laid out the 2024, but beyond that, more broadly, key priorities to address some of the concerns out there and create shareholder value?

Barb Jacobsmeyer:

Sure. I would say that remind folks that we've been a stand-alone company for seven quarters. So, we're still relatively new. We -- I feel that have been very confident in the strategy that we have established. Our Board helps and pushes us. We have a lot of expertise and skills with our Board. For example, things with payer innovation, technology, HR, things that really help us think differently as we're developing our strategies. And as we've shown, we've had a couple of quarters here in a row that we've been able to show that those strategies do work. They take time. But we don't see any shift in our strategy. We feel that what we're doing is working, and again feel that between the clinical capacity and the payer contracts, in particular, that we'll continue to see the progress that we've been making.

Jamie Perse:

Okay. Great. I guess one of the biggest challenges you guys have faced has been just this mix shift from Medicare fee-for-service to Medicare Advantage, and the lower payments that come with that. At a high level, I mean, you guys have characterized it as once you get to industry average mix, that will stabilize and you're now at the industry average mix.

I guess my question is, I've never really understood beyond the IRF Encompass headwind, why you'd be losing Medicare volume at the level of the referral source? So, you've been adding incremental MA payers. Presumably, that increases your partnership, the value you can offer to your referral sources. Why is it that Medicare volumes at the referral source level have been kind of under pressure?

Barb Jacobsmeyer:

Well, it's for two reasons. One, we certainly -- everyone is seeing that shift right to Medicare Advantage. If you remember back even before the spin, there were data points that CMS was saying that Medicare beneficiaries, 50% would choose an MA plan by the year 2030. And actually, we hit that already last year. So, there has been a more drastic shift to Medicare Advantage than I think anyone anticipated. And how that impacts us, and we heard it loud and clear from our business development team members, is that everyone is wanting that fee-for-service mix.

So, when you go to a referral source and at the time, if someone only had a 20%, 25% of their patients in an MA plan, then maybe they were okay giving more of their fee-for-service to a certain provider. But when they started seeing that being more 50-50 and a provider would come in, and this is what our business development teams would say, I go to a referral source and they say, I can't have you coming in saying you only can service one or two types of patients. I need you to be able to service all my patients.

And so, it's been critical for us to be seen as that full-service provider to be able to service more of them. And you're right, we've seen the progress of getting on the contracts, but I would say that it was very important that we had the new national agreement in May of last year and then really important to add the new national agreement in January of this year because that is a faster, more addressable market that we can serve with those providers.

Jamie Perse:

And I guess just at the level of the sales force and how they're approaching these referral sources, and again, that process of competing for referrals. Has anything changed in the incentive structure for your team in terms of targeting Medicare patients or being accommodated trying to build volume with some of your payers? And anything that has changed on that front?

Barb Jacobsmeyer:

Sure. I would say a couple of things have changed. One, in how we look at the market. So, we do spend a lot of time. There's a team in Dallas that helps the business development team look at Medicare claims data, look at the MA data, and

say, for example, if you're in a market that we've just signed a group of contracts, where are those patients today? Who are the referral sources that are servicing them? And what does their Medicare mix look like?

So, as we're helping to develop and redevelop books of business for our sales team members that we're really having them spend time concentrated in an area that not only can we service these new contracts, but there's also a healthy mix of fee-for-service business. That does change. Give you an example, if it's a salesperson that has historically gone into like a senior apartment setting, it may be that has been a great place to be for years. But if there's been a really strong salesperson for one of the MA plans in there, you can see the dynamics change in that building rapidly.

And so, it's important for us to always be assessing and reassessing. And then for the sales team, yes, they are -- we have structured it for our sales team where there's tiers, and they get credit based on tiers of the types of the referrals that they receive and the admissions that come in. We will tier so that they -- it's not only about what the contract pays, but it's also about the back end. So, a contract can look really good as far as what they'll reimburse us. But if we find that it's very cumbersome and we get denials on the back end and there's a lot of administrative work, a payer could move from being a Tier 1 to a Tier 3 or 4 depending on that entire process from referral submission to payments. And so, they are tiered by that.

Jamie Perse:

And is Medicare fee-for-service kind of top tier?

Barb Jacobsmeyer:

Medicare fee-for-service is top tier. We do have some of those regional agreements, though, that now pay us the same. And so, they would be in that same top tier as fee-for-service Medicare.

Jamie Perse:

Okay. And I think we're all looking for signs of stabilization and you've got some maybe early data points that the fee-for-service business has stabilized. You talked about the 3% sequential increase. I think looking back, and this is not apples-to-apples because this is episodic and non-episodic, but two of the four prior years were up [4Q than] 1Q. I'm just trying to get a sense of what normal seasonality looks like, and if this 3% sequential admissions increase in fee for services, how much confidence that gives you in stabilization and the outlook from here?

Barb Jacobsmeyer:

Sure. So, you're right. Last year, we also saw that sequential from Q4 to Q1, it was about 1.9%, I think, if I remember right. And so, we were pleased to see that be a 3.4%, some seasonality with that. But again, we continue to monitor that. It's really at a local level. We have three of our regions, six total regions for home health; three regions where they have completely stabilized, not losing Medicare fee-for-service year-over-year. The three regions that have struggled. And so, we've worked with the sales team on what are the best practices, what are they scripting, how are they building out their book of business, what are things that we can learn from those that have been really successful to share with the other regions that are still struggling.

Jamie Perse:

Okay. Let's go to the payer innovation side of things. You guys have you signed a little bit over 60 new contracts, a couple of them be national agreements that have really shifted the value proposition to the referral sources. I guess, first, it seems like the first contract was probably the hardest, and it got easier from there as you go. First you're negotiating now from a relatively better position. And two, you've built this muscle, you've been through the process a number of times. So, talk to us about how the dynamics and the negotiating process with payers has changed? And if that's leading to kind of better outcomes and more recent contracts have yet to come?

Barb Jacobsmeyer:

Sure. So well, there definitely was a complete shift when we developed the payer innovation strategy. Prior, the company had a strategy where it was just basically just contract terms. And again, we all know that those discount rates were not ones that were sustainable. And so, we really did restructure it that it is a complete value discussion, bringing the metrics, showing particularly those readmission rates because that can make a meaningful difference for a payer, challenging them to go back and look at their own member database and see what are your readmissions so that you can compare it to what we've done.

So, you're right, those first few discussions really helped us build out kind of our presentation. I would say on the regional side, it does feel like there's a quicker cadence to getting across the finish line. I think because sometimes you can have more of the decision-makers around the table at the very beginning. It still is incredibly long to get that negotiation at a national level. Those have taken upwards of 12 to 18 months. And again, I think that's because you're working with one group and then they have to go to their economic group. And so, there's just a lot of layers at the national, but we certainly have refined over time those data points, and I think that's helped us to be able to get the better rates that we're getting.

Jamie Perse:

In terms of getting to a point where you can offer kind of -- you can cover all the patients that these referral sources might have. Now another roughly 60 targets. Some of those are renewals, some of those are new contracts that you need to add. How close are we to getting to point where you feel like you can compete for the majority of the business in these market?

Barb Jacobsmeyer:

Well, I think we are back at the table renegotiating with the other large national agreement that went into place in 2021. That's an important part of our strategy on either we're going to be successful with that, or at the same time, we're working with our teams to move away as much as possible so that if and when we have to make a decision to walk away, we have very little risk to that. And that's kind of where we're approaching it now with even these regional renegotiation ones. If we're in a market that we have good coverage absent them, frankly, if we can't get a better agreement renegotiated it is easier for our sales team to say we're not in network than to be in network and hesitate to take it.

So, I keep telling our team members in the field, my goal is within the next year or so, that they don't even think so hard, that the only thing they have that they can accept is what they want to accept. And so, we really want them to not have to be putting so much brain power into making decisions on referrals as they come in, but to be in a place that we are contracted in servicing those that are willing to pay for high quality.

Jamie Perse:

And in terms of the cadence of getting these remaining contracts in place. Any color? I recognize that the nationals will be on a slightly different time line than some of the regionals, but there's a lot more of the regional plans. So, any thoughts on just how we should think about getting through this -- 61?

Barb Jacobsmeyer:

I think it is -- even within the regionals, there's a big range. Some of them work in parallel that when you're negotiating and reviewing contracts and reviewing the terms of the contracts, they're working in parallel to credential your locations. Others wait until you're done with all the negotiations before they credential. So, it's really, really hard to say because it can be, again, from three to four months up to a year. But I would also say is that this is not the list that then we're done. We are constantly getting feedback from our business development teams letting us know there may be what feels to us a very small agreement. But if it is an important agreement for a large referral source then we add it to our list. And so, it feels like there's always new plans coming up and they may be small at this point, but if it's meaningful in that market or to that referral source then we're going to add them to our list. So, the list we have, we'll continue to add based on feedback from the field.

Jamie Perse:

Okay. And obviously, you've had pressure on the fee-for-service side. The MA side has had tremendous growth in volume. You just presented mid- to high single-digit volume growth outlook for admissions. I guess, first, just a clarification is that -- is the base 2023, so it includes 2024? And just -- why is that the right number? Why do you have confidence in that outlook?

Crissy Carlisle:

Yes, the base is 2023. Think of it kind of as a three-year CAGR. And we're confident based off of the trajectory that we're seeing predominantly in the non-Medicare business, right, Medicare beneficiaries continue to choose Medicare Advantage. And as we continue to not only grow the number of contracts we have, but also to improve those rates, it's to our advantage to continue to shift into, again, what we refer to as payer innovation contracts. We're very confident between that and the success we're having with those contracts as well as just the demographic trends themselves, that the mid- to high single digits is the right number.

Jamie Perse:

And you said it's a CAGR-ed. Are you saying you can be mid- to high single digits each of the three years? Or in three years looking back retrospectively?

Crissy Carlisle:

Three years looking back, it will be in that mid- to high single digits.

Jamie Perse:

Sort of an accelerator.

Crissy Carlisle:

That's right.

Jamie Perse:

Okay. Maybe moving to hospice. You've stabilized sort of the labor piece there, case management model. I guess what has that done for you over the last (inaudible) so what do you expect going forward? You gave a few data points on April and May and the progress you're seeing month-over-month. But what's your confidence level in that continuing as a function of the labor you (inaudible)?

Barb Jacobsmeyer:

So, I think that the patients are certainly there. It has been a journey, right? I think there's a lot of folks that have wondered why couldn't you be building out business development while you were doing the case management model. And a lot of it was because the sales team and the business development team want to say yes, right? It's very discouraging to say, yes, today, no tomorrow and they just feel like they can't be out or committed to the referral sources. So, it was important that we had that stabilization and that we eliminate those capacity constraints.

When we knew we had done that, we did hire three new VPs midyear last year. Those three VPs of business development all came from competitors with deep hospice experience. That part has been important as they have now started to add the direct salespeople in the field as well as helping us build out, again, our book of business there. We, I think, had overcorrected. We had tried to make sure that we didn't have a lot of cap exposure. And I think, unfortunately, while we really eliminated the majority of our cap exposure, I think we overcorrected and really spent a lot of time with referral sources that had very short length-of-stay patients.

We need to find a balance to that. And so that's really been the focus now is to say, yes, we want to be seen as a good provider to the acute care hospitals to the facilities but we also need to make sure that we're out there with the physicians and the other referral sources that have those patients that we can have that balance because, frankly, that's how we will continue the traction and growing the census.

Jamie Perse:

And I guess this touches on both businesses, but you've talked about clinical efficiency and trying to get your teams to operate at the top of their license, you provided some data points on that. It seems like there's room to grow there. Just give us a sense of where you are in some of the other key labor initiatives as well as hiring, just the environment you (inaudible) across both businesses?

Barb Jacobsmeyer:

Well, I'll talk about the labor environment and then the efficiency. On the labor environment, we, again, have done a great job on the recruitment and the retention. I will say though, now that we have our own data and our own data warehouse, we've challenged ourselves to look at the data on our hiring and our retention. We were able to see that last year, half of our nurses that left us left in the first six months of employment. And so, it really begs the question -- obviously, there's room for improvement on onboarding, but it begs the question on are we hiring the right individuals in the beginning.

We did see more and more candidates coming from facilities that frankly were burned out on high volumes of patients that they were having to care for. But what you find is if they've never had exposure to caring for people in the home, it is a

very different environment. And so, what we're really working now is to say, what does that picture look like of the right candidate so that we can be more selective?

We saw in the first quarter, a 30% increase in our nursing candidate pool. That to me tells us then that we can be more selective now so that we can have that greater success of retention. We see that when nurses and therapists are with us a year or longer, they stay. It's really making sure that we're doing the right hiring and the right onboarding. So that's kind of from the labor front.

On the efficiency front, it really is about using the tools that we have. So, for home health, using not only Medalogix Pulse to determine the right care plan, but now the leader is seeing a dashboard of their patients and saying, if I'm a leader and I look at my dashboard this morning, and I have my low risk, my medium and my high-risk patients, if I notice that they all have the same visit scheduled, that's a problem. My high-risk patients should have more visits scheduled.

My low risk should not have the same. So, we've really talked to them that their most precious resource is their clinical resource. We have to use it wisely. So, if I have a very low-risk patient, and maybe I can make a virtual visit or a phone call, and I can use that visit to do a new start of care. So that's the tools that we're using to increase that efficiency on the home health side as well as our optimization, which is the work at the top of your license. So, it's really important for us. Most of our clinicians are salaried, so we need to make sure, for example, that our RNs at that local level are fully productive and then add an LPN so that we can work on those optimization goals.

On the hospice side, it's really using Muse, another tool from Medalogix -- but the Muse to really help us see where is that patient in their journey? Where are they? And are they getting close to transition? We want to be out there as much as possible in that last week of life. But it's understanding, again, if I'm the case manager, the nurse case manager, I look at my patients today and say, where -- instead of just thinking about visits, where do I need to be? Where maybe can I make a phone call? How do I manage my patients so that they're getting the best care for what they need today?

Jamie Perse:

Okay. And a similar question on the outlook you provided on the hospice side, mid- to high single digits. I guess what's the timing in terms of getting there sustainably? I assume it's also a CAGR of 2023, and it will ramp. But I guess what data points can we look at externally as leading indicators? Is it all about the labor growth and adding clinical capacity? Just give us (inaudible) confidence there.

Crissy Carlisle:

That's right. The big driving factor is the fact that we no longer have any clinical capacity issues in our hospice segment. And then as we continue to build out our business development team and able to increase the admissions and regain some of the lost referral sources, that's what's going to drive it. And you can see the trend that we've had every month in 2024 that was included in the slides that we just showed, and seeing that ramp up in the ADC or average daily census.

Jamie Perse:

Okay. I guess going to the -- you've just come off all the TSAs with Encompass. I guess just on the P&L, can you talk about the cadence for the balance of the year, in particular, the cost piece as you've rolled off those TSAs. What efficiencies can you drive from that perspective? And what's the change from 1Q kind of fully roll off the TSA?

Crissy Carlisle:

Yes. So, the dollars in the TSA for the first quarter were only $100,000. As we've noted previously, all that was remaining by the time we got to the first quarter was just the people saw -- financials as part of the transition and that happened early to mid-March of this year. So, the payment to Encompass was only (inaudible) so you're not talking about a lot of TSA-related dollars.

Our goal, of course, is to ensure we have the infrastructure in (inaudible) our clinical team so that they can provide the best patient care and focus on patient care within the field.

I think it's fair to say that we're at a run rate of about $27 million to $28 million of home office costs per quarter. Going forward, I think our teams have done a good job of managing the stand-alone cost. You may recall that, at the time of the spin, we were talking about a $26 million to $28 million addition per year. And based on our efforts, we've ended up around 23 to 24 of those stand-alone costs. So, a good job analyzing that and minimizing it to the best that we could. But again, I think that, that $27 million to $28 million per quarter is a good run rate.

Jamie Perse:

Okay. And your margin outlook for the year, the implied midpoint is consistent with 1Q. I guess just talk us through puts and takes relative to that. What are some of the headwinds that you're offsetting? And what are the opportunities to kind of improve margins longer term?

Crissy Carlisle:

The biggest headwind we face is certainly no big secret, right? It's Medicare reimbursement. It's not adequate to cover the inflationary cost that we're experiencing, especially with wages. I think that the payer innovation contracts and the improved rates we're seeing, those improved rates dropped to the bottom line, right, the cost to treat that patient, whether they're traditional Medicare or Medicare Advantage is the same. And so that's going to be the margin difference is our success in continuing to get improved rates as well as shifting into the payer innovation contract.

Jamie Perse:

Okay. And on the cost per day or cost per visit, these have come down to 3% type of range. I know some of that's contract labor coming out, but how should we think about the next one to two years? Are those levels may be adjusted for contract labor, just give us how to think about that?

Crissy Carlisle:

Yes. I think that, again, the 3% wage seems to be a normalized level. When we talk about 3%, remember that on the cost per visit side, so for home health, 90% of our cost is labor and benefits. And we feel good about kind of a 3% merit cycle each year for right now based on what we know. There will be pockets, we expect there to be pockets geographically where we may have to make some market increases. But again, we think that through the optimization of our staff and some of the use of Medalogix Pulse in that right care plan sizing that we can continue to offset some portion of that.

Barb Jacobsmeyer:

Okay. That only helps us then help drive that productivity -- and really logistically keep clinicians in a smaller geography. And so that not just helps how many visits they can get, and so that growth also helps us on that productivity and optimization side.

Jamie Perse:

Okay. And I think the claim that you guys are presenting as you're pretty close to stabilization of these pieces in place, and here, we should start to see more consistent acceleration in volumes and (inaudible) kind of that guidance today. How should we think about that translating revenue growth and longer-term margin potentially? I think back to the IPO, and I think that mid-teen-ish type of EBITDA margins, a lot's changed since then in terms of mix profile of the business, but how should we think about the next phase? And if you are able to execute on these objectives, what that means in terms of growth outlook and margins over the next (inaudible)?

Crissy Carlisle:

And again, I think it comes down to Medicare reimbursement and the uncertainty that we have there and what they come out with, and we'll know soon enough what the proposed rule says later this month or early part of July. And then our ability to continue the payer innovation strategy. And again, we've demonstrated our success there and have no reason to believe that will not continue. And then again, optimizing our clinical staff.

Jamie Perse:

And I guess closing with one last one just on the capital position. You've presented 70%-ish type of free cash flow conversion. I guess, one, is that sustainable right away to think about free cash flow conversion. And then two, just the cadence to improving the balance sheet position leverage. Some of that's just a math exercise. But I guess what else can you do to kind of accelerate and prioritize getting back to both capital position?

Barb Jacobsmeyer:

Yes. I tend to think of our free cash flow conversion more in that 50% range. I think some of what we saw in the first quarter was timing of working capital. Payroll and receivables sometimes make a big difference in that. So, I tend to think of it again more as 50%. So, if you use that 50% free cash flow conversion and think about $20 million of required

amortization on our term loan, and $2 million to $3 million per year on de novos, the rest is up for grabs, and priority right now would be repayment on the revolver to continue to delever. We do, as I mentioned, continue to diligence acquisition opportunities. And if we saw something strategically, we'd certainly consider it, but that remains the priority right now.

Jamie Perse:

Great. Well, I think with that, we're out of time. Thank you, Barb and Crissy for joining us.

Barb Jacobsmeyer:

Thank you.

Crissy Carlisle:

Thank you.

About Enhabit Home Health & Hospice

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what’s possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 255 home health locations and 112 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

Forward-Looking Statements

Statements contained in this communication which are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All forward-looking information speaks only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from our present expectations include, but are not limited to, our ability to execute on our strategic plans, regulatory and other developments impacting the markets for our services, changes in reimbursement rates, general economic conditions, changes in the episodic versus non-episodic mix of our payers, the case mix of our patients, and payment methodologies, our ability to attract and retain key management personnel and health care professionals, potential disruptions or breaches of our or our vendors’, payors’, and other contract counterparties’ information systems, the outcome of litigation, our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures, our ability to successfully integrate technology in our operations, our ability to control costs, particularly labor and employee benefit costs, and impacts resulting from the announcement of the conclusion of the strategic review process. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this communication are described in reports filed with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, copies of which are available on the Company’s website at http://investors.ehab.com and free of charge through the website maintained by the SEC at www.sec.gov. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this communication.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A and other documents with the SEC in connection with its solicitation of proxies from the Company’s stockholders for the Company’s 2024 annual meeting of stockholders. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING YELLOW PROXY CARD, AND ALL OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the definitive proxy statement, an accompanying YELLOW proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge by clicking the “SEC Filings” link in the “Investors” section of the Company’s website,

http://investors.ehab.com, or by contacting InvestorRelations@ehab.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Investor relations contact

Crissy Carlisle

investorrelations@ehab.com

469-860-6061

Media contact

Erin Volbeda

media@ehab.com

972-338-5141

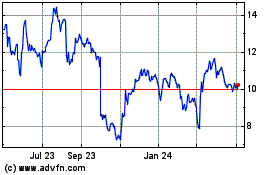

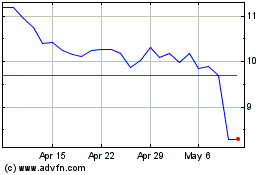

Enhabit (NYSE:EHAB)

Historical Stock Chart

From May 2024 to Jun 2024

Enhabit (NYSE:EHAB)

Historical Stock Chart

From Jun 2023 to Jun 2024