UPDATE: Sprint To Sell Prepaid-Wireless Service At Wal-Mart

May 13 2010 - 10:07AM

Dow Jones News

Sprint Nextel Corp. (S) will launch a pay-by-the-minute wireless

plan through Wal-Mart Stores Inc. (WMT) as the carrier looks to

further strengthen its prepaid position with the launch of a second

new offering in as many weeks.

Common Cents Mobile will go after consumers who sporadically use

their cellphones. The service, which will launch on Saturday, will

charge 7 cents a minute for calls and the same amount for text

messages.

The service marks the latest prepaid offering by Sprint, which

is looking at the low end to make up for the losses from its more

lucrative contract business. Under Dan Schulman, who joined Sprint

when his Virgin Mobile USA was acquired late last year, the company

has launched multiple brands catering to different markets,

highlighting the growing strength and clout of the prepaid market

in the wireless industry.

Common Cents will benefit from the considerable reach and

influence of Wal-Mart, which plans to carry the service in more

than 700 stores.

Sprint touts an exclusive round-down feature where the amount of

minutes billed per call won't round up to the nearest minute. For

example, a call that goes 1:46 will only cost 7 cents. The basic

phones for the service will cost between $20 and $70. Consumers can

use phone cards or pay online through a credit card or PayPal

account.

"In recent months, consumers seeking no-frills,

pay-by-the-minute plans have been somewhat overlooked with the

popularity of unlimited plans in the market," Schulman said.

Common Cents is part of Wal-Mart's push to offer more

"connected" consumer electronics devices, such as connected Blu-ray

players and high-definition TVs, more cellphones and other mobile

broadband options.

In some Wal-Mart stores, Common Cents will sit alongside a rival

prepaid service, Straight Talk, which is sold through America Movil

S.A.B. de C.V.'s (AMX) Tracfone Wireless and runs on Verizon

Wireless's network.

Last week, Sprint unveiled a data-centric wireless plan through

its Virgin Mobile brand that costs $25 for unlimited texting,

e-mail and mobile Internet, along with 300 minutes. Another option,

for $40, gives the user 1,200 minutes, while users can get

unlimited minutes for $60.

While the prepaid plans offer less revenue per customer, there

are fewer costs because they lack phone subsidies or extensive

customer service of the core postpaid offering.

Sprint has been the most aggressive national carrier in prepaid,

but the other carriers are moving to capitalize on the shifting

trends. Verizon Wireless, which is jointly owned by Verizon

Communications Inc. (VZ) and Vodafone Group PLC (VOD, VOD.LN), has

expanded its wholesale agreements, which include Straight Talk,

while Deutsche Telekom AG's (DT, DTE.XE) T-Mobile USA has launched

several no-contract plans in the past few months. AT&T Inc. (T)

has looked to connecting non-cellphone devices. All are dealing

with declining growth in their traditional postpaid businesses.

Sprint shares rose 3.6% to $4.30 in early trading.

-By Roger Cheng, Dow Jones Newswires; 212-416-2153;

roger.cheng@dowjones.com

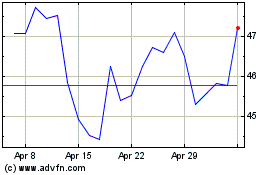

Dynatrace (NYSE:DT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dynatrace (NYSE:DT)

Historical Stock Chart

From Sep 2023 to Sep 2024