0001754820

false

0001754820

2023-09-28

2023-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 28, 2023

Desktop Metal, Inc.

(Exact name of Registrant as Specified in

Its Charter)

| Delaware |

|

001-38835 |

|

83-2044042 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

63 3rd

Avenue

Burlington,

MA 01803

(Address of principal

executive offices) (Zip Code)

(978)

224-1244

(Registrant’s telephone number, include

area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common stock, par value $0.0001 per share |

|

DM |

|

The New

York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.02. Termination of a Material Definitive Agreement.

As previously disclosed, on May 25, 2023, Desktop Metal, Inc.,

a Delaware corporation (“Desktop Metal”), entered into an Agreement and Plan of Merger (the “Merger Agreement”),

by and among the Company, Stratasys Ltd., an Israeli company (“Stratasys”), and Tetris Sub Inc., a Delaware corporation and

a direct wholly owned subsidiary of Stratasys (“Merger Sub”). The Merger Agreement would have provided, subject to its terms

and conditions, that Merger Sub would merge with and into Desktop Metal, with Desktop Metal surviving the merger as a direct wholly owned

subsidiary of Stratasys (the “Merger”).

At an extraordinary general meeting of shareholders of Stratasys held

on September 28, 2023, Stratasys shareholders did not approve the terms of the Merger Agreement. Accordingly, on September 28,

2023, Stratasys sent Desktop Metal a notice of termination of the Merger Agreement. The notice terminates the Merger Agreement, and Desktop

Metal expects to be compensated for certain agreed-upon expenses in accordance with the terms of the Merger Agreement.

Item 5.07. Submission of Matters to a Vote of Security Holders.

A special meeting of stockholders (the “Special Meeting”)

of Desktop Metal, Inc. (“Desktop Metal”) was held virtually at 9:00 a.m. Eastern Time on September 28, 2023.

The Special Meeting was held in order to consider and vote upon the proposals set forth in the joint proxy statement/prospectus filed

with the U.S. Securities and Exchange Commission (the “SEC”) on August 28, 2023 (the “Proxy Statement”),

to (i) adopt the Merger Agreement (the “Merger Agreement Proposal”), (ii) approve, on an advisory (non-binding)

basis, the compensation that may be paid or become payable to Desktop Metal’s named executive officers that is based on or otherwise

relates to the transactions contemplated by the Merger Agreement (the “Advisory Compensation Proposal”) and (iii) approve

the adjournment of the Special Meeting to solicit additional proxies if there are not sufficient votes at the time of the Desktop Metal

special meeting to approve the Desktop Metal Merger Agreement proposal or to ensure that any supplement or amendment to the accompanying

joint proxy statement/prospectus is timely provided to Desktop Metal stockholders (the “Adjournment Proposal”). The proposals

are described in detail in the Proxy Statement.

At the Special Meeting, (i) the Merger Agreement Proposal was

approved by the affirmative vote of holders of a majority in voting power of the outstanding Desktop Metal Class A common stock entitled

to vote thereon, and (ii) the Advisory Compensation Proposal was approved by the affirmative vote of the holders of a majority in

voting power of the votes cast. As there were sufficient votes to approve the Merger Agreement at the time of the Special Meeting, the

Adjournment Proposal was not presented to stockholders.

As

of the close of business on July 31, 2023, the record date for the Special Meeting, there were an aggregate of 322,892,034 shares

of Class A common stock, par value $0.0001 per share (the “Common Stock”) outstanding, each of which was entitled to

one vote with respect to each proposal. A total of 173,037,065 shares of Common Stock, representing approximately 53.58% of the

outstanding shares of Common Stock entitled to vote, were present in person or represented by proxy, constituting a quorum to conduct

business at the Special Meeting.

The following are the final voting results on the proposals considered

and voted upon at the Special Meeting, each of which is more fully described in the Proxy Statement:

| I. | The Merger Agreement Proposal – To adopt the Merger Agreement: |

| For |

|

Against |

|

Abstain |

| 163,878,200 |

|

8,779,644 |

|

379,221 |

| II. | The Advisory Compensation Proposal

– To approve, on an advisory (non-binding) basis, the compensation that may be paid or become payable to Desktop Metal’s

named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement: |

| For |

|

Against |

|

Abstain |

| 158,919,794 |

|

12,028,318 |

|

2,088,953 |

| III. | The Adjournment Proposal –

To approve the adjournment of the Special Meeting to solicit additional proxies if there are not sufficient votes at the time of

the Desktop Metal special meeting to approve the Desktop Metal Merger Agreement proposal or to ensure that any supplement or amendment

to the Proxy Statement is timely provided to Desktop Metal stockholders: |

| For |

|

Against |

|

Abstain |

| 156,667,036 |

|

14,901,103 |

|

1,468,926 |

Item 8.01. Other Information.

On September 28, 2023, Desktop Metal issued a release announcing

the results of the Special Meeting and the expected termination of the Merger Agreement. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

Desktop Metal, Inc. |

| |

|

|

| Date: |

September 29, 2023 |

By: |

/s/ Meg Broderick |

| |

|

Name: |

Meg Broderick |

| |

|

Title: |

General Counsel and Corporate Secretary |

Exhibit 99.1

Desktop Metal Remains Focused on

Path to Profitability After Preliminary Tally Shows Stratasys Shareholders Did Not Approve the Merger Agreement

| ● | While Desktop Metal stockholders voted to approve the merger agreement, Stratasys announced its stockholders – faced with

two alternative acquisition offers for its company – did not likely vote in favor of the merger agreement proposals |

| ● | Merger agreement with Stratasys has been terminated, with DM to be compensated agreed-upon fees |

| ● | Desktop Metal remains focused on continued improvements in non-GAAP gross margins, operating expenses, adjusted EBITDA, and operating

cash flow – en route to our stated goal of adjusted Q4 EBITDA profitability |

BOSTON--(BUSINESS WIRE)-- Desktop Metal, Inc. (NYSE: DM), a global

leader in Additive Manufacturing (AM) 2.0 technologies for mass production of metal, polymer, ceramic, and health products, today announced

that its stockholders approved the merger agreement with Stratasys Ltd. (Nasdaq: SSYS), a leader in polymer 3D printing solutions.

However, at a special meeting of Stratasys stockholders on Sept. 28,

Stratasys announced that a preliminary tally indicated that it did not obtain stockholder approval for the proposals related to the merger

agreement. Consequently, the previously announced merger agreement has been terminated and DM is to be compensated agreed-upon fees.

“We’re grateful for our shareholders’ support. While

the team at Desktop Metal believed in the merits of our combination, and is disappointed in the outcome of the merger agreement, we are

completely confident in the trajectory of our business, which continues to lower operating costs while growing revenue,” said Ric

Fulop, Founder and CEO of Desktop Metal. “Our plan to reduce costs and generate revenue remains on track as customers continue transitioning

to our AM 2.0 technologies for mass production of metal, polymer, ceramic and health products.”

Desktop Metal entered the second half with cash of $127.6 million,

and has demonstrated improvements to operating cash management over multiple quarters.

About Desktop Metal

Desktop Metal (NYSE:DM) is driving Additive Manufacturing

2.0, a new era of on-demand, digital mass production of industrial, medical, and consumer products. Our innovative 3D printers, materials,

and software deliver the speed, cost, and part quality required for this transformation. We’re the original inventors and world

leaders of the 3D printing methods we believe will empower this shift, binder jetting and digital light processing. Today, our systems

print metal, polymer, sand and other ceramics, as well as foam and recycled wood. Manufacturers use our technology worldwide to save

time and money, reduce waste, increase flexibility, and produce designs that solve the world’s toughest problems and enable once-impossible

innovations. Learn more about Desktop Metal and our #TeamDM brands at www.desktopmetal.com.

Forward-looking Statements

This press release contains certain forward-looking statements within

the meaning of the federal securities laws, including statements about Desktop Metal’s strategic integration and cost savings initiatives,

expected restructuring charges, anticipated cost savings, long-term growth, market share, liquidity and profitability, are forward-looking

statements. Forward-looking statements generally are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and

other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and

uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including but not limited to, the risks and uncertainties set forth in Desktop Metal, Inc.'s filings with the U.S. Securities and

Exchange Commission. There is no guarantee Desktop Metal will achieve the cost savings it expects. These filings identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and Desktop Metal, Inc. assumes no obligation and does not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise.

Media Relations:

Sarah Webster

sarahwebster@desktopmetal.com

(313) 715-6988

Investor Relations:

Jay Gentzkow

jaygentzkow@desktopmetal.com

(781) 730-2110

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

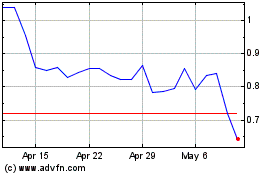

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2024 to May 2024

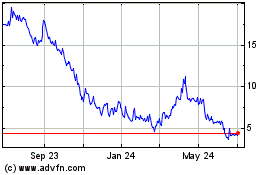

Desktop Metal (NYSE:DM)

Historical Stock Chart

From May 2023 to May 2024