DaVita Inc. (DVA) reported third-quarter income

from continuing operations of $138.2 million, or $1.45 per share,

which exceeded the Zacks Consensus Estimate by a penny. The

earnings were also higher than $119.5 million or $1.15 per share

earned in the comparable quarter of 2010.

Net income was $135.4 million or $1.42 per share, showing a hike

from $119.4 million or $1.15 per share in the year-ago quarter.

The increased income was attributable to better-than-expected

revenues and higher income from discontinued operations, which were

partly offset by higher expenses.

Net operating revenues for the reported quarter climbed to $1.81

billion, surpassing the year-ago revenue of $1.65 billion. Total

operating expenses and charges climbed to $1.49 billion from $1.39

billion in the third quarter of 2010.

Segment wise, revenues from the Dialysis and related

Lab Services segment for the quarter came in at $1.68

billion, against $1.55 billion in the prior-year quarter.

Operating income for the segment increased to $328 million in

the reported quarter from $266 million in the year-ago quarter.

Ancillary services and strategic

initiatives generated revenues of $137 million,

increasing substantially from $101 million in the year-ago quarter.

The segment recorded operating income of $2 million in the reported

quarter, while there was no operating income in the year-ago

quarter.

Income from discontinued operations in the reported quarter was

$1.08 million, showing a substantial surge

from a loss of $0.095 million in the year-ago quarter. However, the

company also recorded a loss of $3.69 million on disposal of

discontinued operations.

DaVita provided administrative services across 1,777 outpatient

dialysis centers serving approximately 138,000 patients as of

September 30, 2011. However, only 1,745 centers were consolidated

in the financial statements in the third quarter of 2011.

DaVita acquired and opened a total of 138 centers during the

reported quarter, of which 113 centers were associated with the DSI

acquisition. Additionally, the company divested 28 centers in order

to complete the acquisition.

Total treatments for the reported quarter came in at

approximately 5.01 million. This represents a per day increase of

9.6% over the year-ago quarter. The growth of non-acquired

treatment in the quarter stood at 5.0%.

The company's effective tax rate was 36.4% in the reported

quarter. The third party owners’ income attributable to non-tax

paying entities impacted the effective tax rate. The effective tax

rate attributable to DaVita in the reported quarter was 40.5%.

Financial Update

In the reported quarter operating cash flow was $495 million and

free cash flow was $408 million, both showing substantial increment

from $161 million and $91 million, respectively, in the prior-year

quarter.

Total assets at the end of September 2011 were $8.71 billion, up

from $8.11 billion on December 31, 2010. The total long-term debt

on September 30, 2011 increased to $4.42 billion from $4.23 billion

as of December 31, 2010.

Loan Update

On August 26, 2011, DaVita entered into an Increase Joinder

Agreement under the existing senior secured credit agreement,

pursuant to which the company increased the revolving credit

facility by $100 million, taking the total to $350 million. DaVita

also entered into a $200 million Term Loan A-2, which will mature

in October 2016.

Acquisition Update

On September 2, 2011, DaVita completed the acquisition of its

competitor DSI Renal Inc. (DSI). The deal was announced on February

4, 2011, with Credit Suisse Group (CS) acting as

the financial advisor.

DaVita purchased DSI for approximately $724 million in net cash

and took over certain liabilities of DSI, subject to certain

post-close adjustments.

The operating results of DSI have been consolidated with

DaVita’s earnings from September 1, 2011 onwards. Additionally, the

operating results of those DSI centers which have been divested or

will be divested are included in the financial statements as

discontinued operations from September 1, 2011 onwards, along with

the results of all other divested centers of DaVita.

Outlook

DaVita affirmed its previously disclosed operating income

guidance of $1.125-1.155 billion for fiscal 2011. The guidance

excludes a non-cash goodwill impairment charge recorded in the

second quarter of 2011. The company also affirmed the operating

income guidance range of $1.2-1.3 billion for 2012.

Additionally, the company raised the 2011 operating cash flow

guidance range to $1.02-1.10 billion. For 2012, DaVita expects

operating cash flow to remain flat or decline marginally from

2011.

The company expects the effective tax rate attributable to

DaVita to be in the range of 30-40% for fiscal 2011.

Our Take

DaVita is showing sharp earnings growth in both its business

segments coupled with strong cash flows. Income from discontinued

operations also increased due to disposal of DSI centers.

Further, the acquisition of DSI will provide access to new areas

of work for DaVita in the Midwestern, Southern and some Western

states, further improving its operational performance.

Additionally, the strong cash position expands the potential for

meaningful mergers and acquisitions in future.

DaVita carries a Zacks #2 Rank, implying a short-term Buy

rating.

CREDIT SUISSE (CS): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

Zacks Investment Research

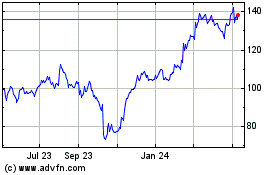

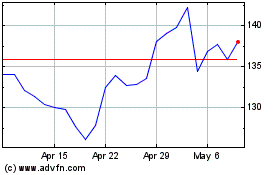

DaVita (NYSE:DVA)

Historical Stock Chart

From Aug 2024 to Sep 2024

DaVita (NYSE:DVA)

Historical Stock Chart

From Sep 2023 to Sep 2024