There is more to the present rally .... - Voice of the People

October 24 2011 - 1:07PM

Zacks

Zacks highlights commentary from People and Picks Member

«TickerBandit».

For more Voice of the People, visit http://at.zacks.com/?id=7872

Featured Post

There is more to the present rally ....

.... but are we through the woods? The answer ... i think

is both yes and no :-) . A number of key metrics point

to the likelihood of a retest of the early october low. One

of these metrics is volatility ... while another is the lack

of double 9 to 1's on this rally ... another which is not unrelated

to the prior ... is the lack of participation of smaller cap

issues. For example, fully 30% of the Russell 2000 is trading

in the lower 25% of their respective yearly ranges and 9% in the

the lower 10%. Presently there are two issues trading in the

lower 25% of its yearly range for every issue trading in the upper

25% ... for the largest 3000 publicly traded companies.

I could name a few more broad market metrics ... but in

essence ... it would only be more of the same ...

OK. So the present situation is that it is sprinkling

while the sun is shining. Near term, the metrics support

continuation of the present rally. Divergence which was

present in the first week of August has since dissipated and the

extent to which it occurred did not breech the Bear Market

threshold. It continues to decline and is presently

forecasting the long-term average market returns over the next 6

months. A shorter term indicator of the same metric is

indicating above average returns over the next twenty days.

:-) ... that said, I think a good portion of the gains are

already in ... with the remainder ... bumpier and with more modest

gains.

The bright spot is Large caps which is consistent with the

forecast of continuation of bull market (new 52 week highs for the

indices). So the present forecast is mostly sunny with good chance

of rain by mid-November. Not the kind of rain which destroys

the crop, but the kind that nurtures the crop and provides

opportunity.

But naturally, I am going to be following the market's

progress. What I don't want to see happening is an early

weakening/reversal of small cap issues. There remains a small

probablity that bear market thresholds in divergence could be

present when this present rally rolls. If there is, the

subsequent selling would probably be harsh. The good

news is that the evidence presently supports very low likelihood

that Bear Market thresholds will be met. On the other hand,

there is also the possiblity that short term metrics remain strong

and no retest occurs.

Happy Trading, TB (Oh and Uhm .... I told you

so)

The most recent picks by «TickerBandit» are:

A buy rating on Lexmark International (LXK),

a buy rating on DaVita (DVA) and

a buy rating on SanDisk (SNDK).

About the Zacks Community

In 2008, Zacks Investment Research launched PeopleAndPicks.com,

a stock-picking website where members of the Zacks community can

test their strategies and share ideas with other members. Each user

is scored on the accuracy of his or her picks, and top users are

rewarded with free products from Zacks. Registration is free. To

learn more about People And Picks, visit

http://at.zacks.com/?id=7870

Follow us on Twitter: http://www.twitter.com/PeopleAndPicks

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD in mathematics

Len knew he could find patterns in stock market data that would

lead to superior investment results. Amongst his many

accomplishments was the formation of his proprietary stock picking

system; the Zacks Rank, which continues to outperform the market by

nearly a 3:1 margin. The best way to unlock the profitable stock

recommendations and market insights of Zacks Investment Research is

through our free daily email newsletter; Profit from the Pros. In

short, it's your steady flow of Profitable ideas GUARANTEED to be

worth your time! Register for your free subscription to Profit From

the Pros by going to http://at.zacks.com/?id=7867.

DAVITA INC (DVA): Free Stock Analysis Report

LEXMARK INTL (LXK): Free Stock Analysis Report

SANDISK CORP (SNDK): Free Stock Analysis Report

Zacks Investment Research

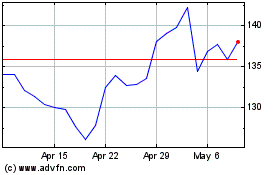

DaVita (NYSE:DVA)

Historical Stock Chart

From Aug 2024 to Sep 2024

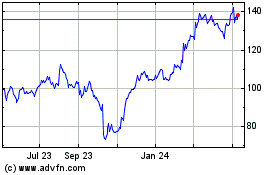

DaVita (NYSE:DVA)

Historical Stock Chart

From Sep 2023 to Sep 2024