Canadian Natural Resources Limited (TSX: CNQ) (NYSE: CNQ)

In commenting on the Company's 2011 budget, Allan Markin,

Chairman, stated, "Canadian Natural's 2011 budget reflects our

strong asset base and a continued focus on projects that provide

the best returns for shareholders. We are targeting another year of

significant free cash flow generation, debt reduction and a

strengthening balance sheet. At the same time as we target

production volumes per barrel of oil equivalent to grow by 6% in

2011, we will be investing over $2.4 billion (approximately 45% of

2011 capital expenditures) on long-term growth initiatives that

provide no additional volumes in 2011 but will provide sustainable,

long-term returns in 2012 and beyond."

HIGHLIGHTS OF THE 2011 BUDGET

-- Equivalent production target of 645,000 boe/d to 694,000 boe/d before

royalties, representing a midpoint increase of 6% from the midpoint of

2010 forecasted annual average production guidance.

-- Crude oil and NGLs production target of 449,000 bbl/d to 486,000 bbl/d

before royalties, representing a midpoint increase of 10% from the

midpoint of 2010 forecasted annual guidance. This increase reflects the

following:

-- Primary heavy crude oil is targeted to increase 10% from 2010

volumes reflecting record drilling programs implemented in 2010 and

2011;

-- Production response at Pelican Lake due to the Company's ongoing

conversion to polymer flood will result in production volumes being

targeted to increase by 17% in 2011;

-- Increased production reliability at Horizon Oil Sands

("Horizon") with budgeted 2011 production targeted to range from

105,000 bbl/d to 112,000 bbl/d of SCO; approximately 19% higher than

2010;

-- Production increases targeted at Primrose East, North and South of

12% over 2010 levels; and,

-- Greater production rates of light crude oil due to a combination of

acquisitions completed in 2010 and increased light crude oil capital

spending over previous years resulting in approximately an 11%

annual increase.

The overall increase in crude oil and NGLs production will be

partially offset by production declines in Offshore West Africa and

the North Sea.

-- Natural gas production target of 1,177 mmcf/d to 1,246 mmcf/d before

royalties,representing a midpoint decrease of 3% from the midpoint of

2010 forecasted annual guidance. This decrease reflects the Company's

continued proactive reduction of natural gas drilling activity by 28%

from 2010 levels as a result of the Company's short to mid term outlook

for low natural gas pricing, offset somewhat by new Montney production

at Septimus and acquired volumes completed over the course of 2010.

-- Cash flow from operations is targeted to be between $7.0 billion and

$7.4 billion ($6.40 - $6.75 per common share), based upon targeted

production and forward strip pricing on November 24, 2010 (WTI crude oil

price of US$84.32/bbl, Western Canadian Select heavy oil differential of

22%, NYMEX natural gas price of US$4.31/mmbtu and an exchange rate of

US$0.98 = C$1.00).

-- Capital spending in 2011 will range between approximately $5.6 billion

and $6.0 billion. Approximately 45% of 2011 capital expenditures are

allocated to projects that will result in long-term production growth

beginning in 2012 and beyond. This $2.4 billion to $2.8 billion

investment will generate more sustainable, long-term returns for the

Company.

-- Free cash flow (cash flow after capital expenditures), is targeted

between $1.0 billion and $1.8 billion based on forward strip pricing.

-- Crude oil and natural gas capital expenditures in North America,

including Horizon Oil Sands and thermal projects but excluding

acquisitions, are targeted to be $5.0 billion to $5.4 billion in 2011,

representing a 52% - 64% increase in capital spending from 2010 levels.

The 2011 capital budget in North America reflects:

-- An allocation of $2.4 billion to $2.8 billion to long-term growth

initiatives that will add long-term production volumes in 2012 and

beyond;

-- A significant increase in thermal crude oil investment of 142% from

2010 levels. Kirby Phase 1 capital expenditures are targeted to be

$515 million in 2011 as the Company progresses its thermal growth

plan;

-- Continuation of record primary heavy crude oil drilling in 2011;

-- Progression of the polymer flooding program at Pelican Lake;

-- The Company's outlook for natural gas pricing is not favorable, and

as a result, 2011 natural gas capital expenditures are targeted to

decrease by 14% to $600 million from 2010 levels of $700 million;

and,

-- Increased expenditures at Horizon Oil Sands to meet regulatory

requirements for tailings, continue previously approved reliability

work (Tranche 2) and advance certain debottlenecking and expansion

projects.

-- At Horizon, approximately $220 million of sustaining and reclamation

capital has been allocated in 2011, an increase of $90 million from

2010. This increase reflects the Company's objective to improve overall

plant reliability and maintain the Company's targeted sustainable

production of 110,000 bbl/d SCO.

-- The Horizon 2011 Plan reflects the re-profiling of Horizon's expansion

in a staged project execution plan. Project capital will be allocated to

several different modules. Total expenditures on Horizon in 2011 will

range between $800 million and $1,200 million dependent upon

favorability of market conditions and whether the business case meets

the Company's investment criteria.

-- International conventional crude oil and natural gas capital

expenditures are budgeted to be $505 million, an increase of 17% from

2010. North Sea capital expenditures are budgeted to be $370, the

majority of which will be used to complete necessary sustaining capital

activities on North Sea platforms. Offshore West Africa expenditures are

budgeted to be $135 million, the majority of which will be spent on

drilling and completions.

-- Canadian Natural has significant capital flexibility in the 2011 capital

program allowing the Company to quickly adapt its capital spending

profile to any changes in the commodity price environment.

-- Continued strong balance sheet management which provides financial

flexibility for operating plans.

-- The Company continues to focus on operational excellence through

commitment to safe operations, a minimal environmental footprint and

focus on being the most efficient producer in its core areas. North

America crude oil operating costs are targeted to remain flat while only

a marginal increase is targeted for North America natural gas operating

costs despite a targeted midpoint production volume decrease of 3%.

Horizon operating costs are targeted to decline in 2011 to between

$30.00 and $36.00 per barrel of SCO production.

Capital and Production Guidance

Canadian Natural continues its strategy of maintaining a large

portfolio of varied projects. This enables the Company to provide

consistent growth in production and high shareholder returns over

an extended period of time. Annual budgets are developed,

scrutinized throughout the year and changed if necessary in the

context of project returns, product pricing expectations, and

balance project risks and time horizons. Canadian Natural maintains

a high ownership level and operatorship in its properties and can

therefore control the nature, timing and extent of expenditures in

each of its project areas.

The capital expenditures forecast in 2010 and budgeted for 2011

are as follows:

----------------------------

($ millions) 2010 Forecast 2011 Budget

----------------------------------------------------------------------------

Crude oil and natural gas

North America natural gas $ 700 $ 600

North America crude oil and NGLs 1,445 1,895

North America thermal crude oil

Primrose and Future 465 830

Kirby Phase 1 90 515

North Sea 180 370

Offshore West Africa 250 135

Property acquisitions, dispositions and

midstream 1,900 110

--------------------------

5,030 4,455

--------------------------

Horizon Oil Sands Mining and Upgrading

--------------------------

Sustaining and reclamation capital $ 130 $ 220

--------------------------

Project capital

Reliability - Tranche 2 $ 320 $ 370

Directive 74 and Technology 10 130

Phase 2A 25 200 - 230

Phase 2B 5 10 - 295

Phase 3 - 90 - 150

Phase 4 - 0 - 25

--------------------------

$ 360 $ 800 - 1,200

--------------------------

Capitalized interest and other 80 100

--------------------------

----------------------------------------------------------------------------

Corporate Total $ 5,600 $5,575 - 5,975

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The above capital expenditure profile incorporates the following

levels of drilling activity forecast for 2010 and budgeted for

2011:

-----------------------

Drilling activity (number of net wells) 2010 2011

Forecast Budget

----------------------------------------------------------------------------

Targeting natural gas 100.0 72.0

Targeting crude oil

Primary Heavy, Light and Pelican Lake 941.0 969.0

In situ oil sands 40.0 217.0

North Sea 0.9 1.6

Offshore West Africa 7.5 2.8

Stratigraphic test / service wells - excludes oil

sands mining and upgrading 231.9 519.6

Stratigraphic test / service wells - oil sands mining

and upgrading 244.0 280.0

----------------------------------------------------------------------------

Total 1,565.3 2,062.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The production guidance for 2011 is as follows:

-------------

Daily production volumes, before royalties 2011 Budget

----------------------------------------------------------------------------

Natural gas (mmcf/d)

North America 1,150 - 1,210

North Sea 7 - 10

Offshore West Africa 20 - 26

----------------------------------------------------------------------------

1,177 - 1,246

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Crude oil and NGLs (mbbl/d)

North America 295 - 315

North America - oil sands mining and upgrading 105 - 112

North Sea 27 - 32

Offshore West Africa 22 - 27

----------------------------------------------------------------------------

449 - 486

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total (boe/d) 645 - 694

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Forward-Looking Statements

Certain statements relating to Canadian Natural Resources

Limited (the "Company") in this document or documents incorporated

herein by reference constitute forward-looking statements or

information (collectively referred to herein as "forward-looking

statements") within the meaning of applicable securities

legislation. Forward-looking statements can be identified by the

words "believe", "anticipate", "expect", "plan", "estimate",

"target", "continue", "could", "intend", "may", "potential",

"predict", "should", "will", "objective", "project", "forecast",

"goal", "guidance", "outlook", "effort", "seeks", "schedule" or

expressions of a similar nature suggesting future outcome or

statements regarding an outlook. Disclosure related to expected

future commodity pricing, production volumes, royalties, operating

costs, capital expenditures and other guidance provided throughout

this Management's Discussion and Analysis ("MD&A"), constitute

forward-looking statements. Disclosure of plans relating to and

expected results of existing and future developments, including but

not limited to Horizon Oil Sands, Primrose East, Pelican Lake,

Olowi Field (Offshore Gabon), and the Kirby Thermal Oil Sands

Project also constitute forward-looking statements. This

forward-looking information is based on annual budgets and

multi-year forecasts, and is reviewed and revised throughout the

year if necessary in the context of targeted financial ratios,

project returns, product pricing expectations and balance in

project risk and time horizons. These statements are not guarantees

of future performance and are subject to certain risks. The reader

should not place undue reliance on these forward-looking statements

as there can be no assurances that the plans, initiatives or

expectations upon which they are based will occur.

In addition, statements relating to "reserves" are deemed to be

forward-looking statements as they involve the implied assessment

based on certain estimates and assumptions that the reserves

described can be profitably produced in the future. There are

numerous uncertainties inherent in estimating quantities of proved

crude oil and natural gas reserves and in projecting future rates

of production and the timing of development expenditures. The total

amount or timing of actual future production may vary significantly

from reserve and production estimates.

The forward-looking statements are based on current

expectations, estimates and projections about the Company and the

industry in which the Company operates, which speak only as of the

date such statements were made or as of the date of the report or

document in which they are contained, and are subject to known and

unknown risks and uncertainties that could cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include, among others:

general economic and business conditions which will, among other

things, impact demand for and market prices of the Company's

products; volatility of and assumptions regarding crude oil and

natural gas prices; fluctuations in currency and interest rates;

assumptions on which the Company's current guidance is based;

economic conditions in the countries and regions in which the

Company conducts business; political uncertainty, including actions

of or against terrorists, insurgent groups or other conflict

including conflict between states; industry capacity; ability of

the Company to implement its business strategy, including

exploration and development activities; impact of competition; the

Company's defense of lawsuits; availability and cost of seismic,

drilling and other equipment; ability of the Company and its

subsidiaries to complete capital programs; the Company's and its

subsidiaries' ability to secure adequate transportation for its

products; unexpected difficulties in mining, extracting or

upgrading the Company's bitumen products; potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures; ability of the Company to attract

the necessary labour required to build its thermal and oil sands

mining projects; operating hazards and other difficulties inherent

in the exploration for and production and sale of crude oil and

natural gas; availability and cost of financing; the Company's and

its subsidiaries' success of exploration and development activities

and their ability to replace and expand crude oil and natural gas

reserves; timing and success of integrating the business and

operations of acquired companies; production levels; imprecision of

reserve estimates and estimates of recoverable quantities of crude

oil, bitumen, natural gas and natural gas liquids ("NGLs") not

currently classified as proved; actions by governmental

authorities; government regulations and the expenditures required

to comply with them (especially safety and environmental laws and

regulations and the impact of climate change initiatives on capital

and operating costs); asset retirement obligations; the adequacy of

the Company's provision for taxes; and other circumstances

affecting revenues and expenses.

The Company's operations have been, and in the future may be,

affected by political developments and by federal, provincial and

local laws and regulations such as restrictions on production,

changes in taxes, royalties and other amounts payable to

governments or governmental agencies, price or gathering rate

controls and environmental protection regulations. Should one or

more of these risks or uncertainties materialize, or should any of

the Company's assumptions prove incorrect, actual results may vary

in material respects from those projected in the forward-looking

statements. The impact of any one factor on a particular

forward-looking statement is not determinable with certainty as

such factors are dependent upon other factors, and the Company's

course of action would depend upon its assessment of the future

considering all information then available.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Unpredictable or unknown factors not discussed in this

report could also have material adverse effects on forward-looking

statements. Although the Company believes that the expectations

conveyed by the forward-looking statements are reasonable based on

information available to it on the date such forward-looking

statements are made, no assurances can be given as to future

results, levels of activity and achievements. All subsequent

forward-looking statements, whether written or oral, attributable

to the Company or persons acting on its behalf are expressly

qualified in their entirety by these cautionary statements. Except

as required by law, the Company assumes no obligation to update

forward-looking statements should circumstances or Management's

estimates or opinions change.

CONFERENCE CALL

A conference call will be held at 9:00 a.m. Mountain Time, 11:00

a.m. Eastern Time on Thursday, December 2, 2010. The North American

conference call number is 1-800-769-8320 and the outside North

American conference call number is 001-416-695-6616. Please call in

about 10 minutes before the starting time in order to be patched

into the call. The conference call will also be broadcast live on

the internet and may be accessed through the Canadian Natural

website at www.cnrl.com.

A taped rebroadcast will be available until 6:00 p.m. Mountain

Time, Thursday, December 2, 2010. To access the postview in North

America, dial 1-800-408-3053. Those outside of North America, dial

001-416-695-5800. The passcode to use is 7456828.

WEBCAST

This call is being webcast and can be accessed on Canadian

Natural's website www.cnrl.com. Presentation slides will be

available on Canadian Natural's website in PDF format shortly

before the live conference call webcast.

Contacts: John G. Langille Vice Chairman Steve W. Laut President

Corey B. Bieber Vice-President, Finance & Investor Relations

Canadian Natural Resources Limited 2500, 855 - 2nd Street S.W.

Calgary, Alberta, T2P 4J8 (403) 514-7777 (403) 514-7888 (FAX)

ir@cnrl.com www.cnrl.com

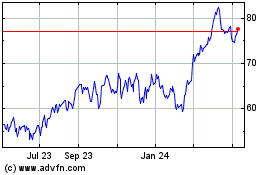

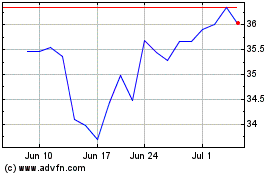

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024