CACI Strengthens Cybersecurity - Analyst Blog

August 03 2011 - 11:34AM

Zacks

In an effort to enhance cybersecurity capabilities, CACI

International (CACI) recently signed a definitive

agreement to acquire Paradigm Holdings Inc., the parent of Paradigm

Solutions Corporation. The financial details of the contract were

not disclosed.

Headquartered in Rockville, Maryland, Paradigm Holdings provides

cybersecurity and enterprise IT solutions to federal civilian

agencies, the Defense Department and the intelligence

community.

Having 185 employees with

strong credentials, Paradigm generated revenues of $55 million for

calendar year 2011. Paradigm clients include the Federal Aviation

Administration, Defense Information Systems Agency, and the

Departments of State, Energy and Treasury.

As a consequence of the merger, the company will gain Paradigm’s

offerings ranging from cybersecurity and software engineering to

cyber operations.

Paradigm will support CACI’s strategy of providing integrated

solutions for cyber operations and enterprise IT/security

engineering. Furthermore, CACI would increase its support for

national security missions.

The acquisition will be completed in the fall of 2011.

Management stated that the acquisition will be accretive to CACI’s

earnings per share during its first 12 months.

The company had earlier completed the acquisition of Pangia

Technologies, LLC., a software engineering company.

Based in Maryland, Pangia provides technical solutions in the

areas of computer network operations, information assurance,

mission systems, software and systems engineering, and IT

infrastructure support.

With this acquisition, the company would expand its presence in

the Intelligence Community and strengthen its technical offerings

in the area of cybersecurity. The acquisition is expected to be

accretive to CACI’s earnings per share during its first 12

months.

We are confident about CACI International’s recent acquisition

activities strengthening its products and services, new contract

wins and share repurchase activities. We have an Outperform

recommendation on the stock. Our recommendation is supported

by a Zacks #2 Rank, which translates into a short-term rating

of Buy.

CACI INTL A (CACI): Free Stock Analysis Report

Zacks Investment Research

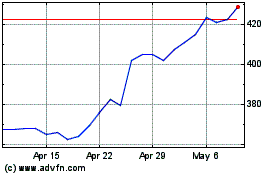

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

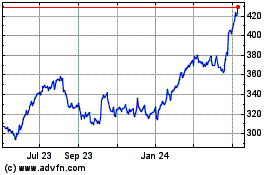

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024