For Immediate Release

Chicago, IL – March 9, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include NRG Energy, Inc. (

NRG), SunPower Corporation ( SPWR), BJ's

Restaurants Inc. ( BJRI), Brinker International

Inc. ( EAT) and Texas Roadhouse Inc. (

TXRH).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Thursday’s Analyst

Blog:

NRG Set to Ramp Solar Portfolio

NRG Energy, Inc.’s ( NRG) subsidiary, NRG Solar

LLC is on its way to expand its solar power generation portfolio.

The company plans to develop projects, with a capacity of over 11

megawatt (MW), in collaboration with PsomasFMG LLC. The deal

comprises a 7.3 MW project at William S. Hart School District in

Santa Clarita, California and another project with a capacity of

3.3 MW in the County of Orange, California.

NRG will be in charge of the financial resources and raw

materials, primarily power inverters and solar panels. On the other

hand, PsomasFMG will provide support in terms of the design and

construction of the project.

After completion of this project, the companies will sell

solar-generated electricity to the facility owners who sign the

power purchase agreements. The revenue-sharing will be done on the

basis of individual contributions for each project.

In November 2011, NRG and SunPower Corporation

( SPWR) began the construction of a 250-megawatt project at

California Valley Solar Ranch. During the 2-year construction

period, the project is expected to create 350 jobs and inject $315

million in the local economy.

During NRG’s earnings conference call, the company announced its

plans to allocate approximately $553 million for environment

capital expenditure for the 2012–2016 span. The investment would be

made in compliance with the government’s stringent environmental

rules and regulations.

Earlier, NRG acquired stakes in three Utility Scale Solar

facilities namely California Valley Solar Ranch, Agua Caliente and

Ivanpah for approximately $165 million as part of its efforts to

capitalize on the future growth opportunities in renewables.

As of December 31, 2011, NRG reported total electricity

generation of 25,135 MW, out of which 95 MW was contributed by

Utility Scale Solar and Distributed Solar segments. NRG Energy is a

pioneer in developing cleaner and smarter energy choices for its

customers.

The company is expanding its solar energy portfolio and

continues to maintain its dominance in the sustainable energy

space. The company has a large-scale photovoltaic and solar thermal

projects pipeline, with an approximate capacity of 2,000 MW, spread

across different locations in Southwestern United States and the

Western Hemisphere. The company expects the output to go up to 860

MW next year.

We expect that NRG is well positioned with a consistent cash

balance and is using the same to increase shareholder value through

share repurchases and expansion of its solar power generation

portfolio. The company entered into several agreements to acquire

solar power generation assets and distribution companies and

develop solar power plants with its partners.

NRG Energy currently retains a Zacks #3 Rank, which translates

into a short-term Hold rating.

BJ’s Restaurants Downgraded

We have recently downgraded our long-term rating on the shares

of BJ's Restaurants Inc. ( BJRI) to Neutral from

Outperform due to the higher cost structure for 2012 as well as

tougher sales comparison in the upcoming first quarter.

Boasting a unique position in the commoditized hyper-competitive

bar and grill segment, along with a viable business strategy, BJ’s

Restaurants offer investors one of the strongest growth stories in

the U.S. restaurant industry.

The company’s earnings have been able to beat the consensus over

the trailing four quarters by an average surprise of 15.08%. While

the new menu and beverage ready for rollout this spring and summer

will likely add some flavors to the upcoming quarters’ earnings of

BJ’s, there is set of factors which could put its growth on hold in

the near term.

BJ’s always experiences higher labor costs in the first quarter

of each year due to the resetting of state unemployment taxes and

FICA limits. Management generally incurs increased payroll taxes in

the first and second quarter of each year. BJ’s expects to see some

higher state payroll taxes as many states have increased their

payroll taxes to help fund their unemployment deficit.

There will also be pressure on medical benefits in 2012, which

currently account for approximately 1% of sales. Additionally, the

company continues to witness higher hourly labor, primarily in the

kitchen, due to the complexity of new menu offerings.

Some increases in consulting costs related to certain ongoing

initiatives and higher training as well as recruiting costs related

to expected openings in 2012 are also likely. Total commodity

basket is expected to be up around 4% in 2012. Hence, a higher cost

structure, in turn, will lessen the magnitude of margin

rebound.

Operation for the first quarter of fiscal 2012 began on January

4, 2012 compared to December 29 last year. Hence, the first quarter

of 2012 is seeing tougher comparison with the absence of Christmas

and New Year. This will hurt first quarter comparable restaurant

sales as well as the change in average weekly sales.

Following the earnings, there was a negative sentiment

prevailing among the analysts regarding the upcoming quarters with

majority of estimates moving southward.

BJ's Restaurants, which competes with the likes of

Brinker International Inc. ( EAT) and

Texas Roadhouse Inc. ( TXRH), currently retains

the Zacks #3 Rank that translates into a short-term Hold

rating.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

BJ'S RESTAURANT (BJRI): Free Stock Analysis Report

BRINKER INTL (EAT): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

SUNPOWER CORP-A (SPWR): Free Stock Analysis Report

TEXAS ROADHOUSE (TXRH): Free Stock Analysis Report

To read this article on Zacks.com click here.

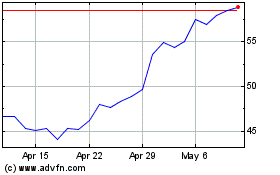

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

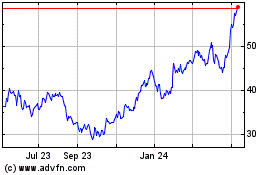

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024