July 29, 202300007688351/312023Q2falseAccelerated Filerfalse3713649191182182P5YP3YP3YP3Y00007688352023-01-292023-07-2900007688352023-09-01xbrli:shares00007688352023-04-302023-07-29iso4217:USD00007688352022-05-012022-07-3000007688352022-01-302022-07-30iso4217:USDxbrli:shares00007688352023-07-2900007688352023-01-280000768835us-gaap:CommonStockMember2022-04-300000768835us-gaap:TreasuryStockCommonMember2022-04-300000768835us-gaap:AdditionalPaidInCapitalMember2022-04-300000768835us-gaap:RetainedEarningsMember2022-04-3000007688352022-04-300000768835us-gaap:CommonStockMember2022-05-012022-07-300000768835us-gaap:TreasuryStockCommonMember2022-05-012022-07-300000768835us-gaap:AdditionalPaidInCapitalMember2022-05-012022-07-300000768835us-gaap:RetainedEarningsMember2022-05-012022-07-300000768835us-gaap:CommonStockMemberus-gaap:PerformanceSharesMember2022-05-012022-07-300000768835us-gaap:PerformanceSharesMemberus-gaap:TreasuryStockCommonMember2022-05-012022-07-300000768835us-gaap:PerformanceSharesMemberus-gaap:AdditionalPaidInCapitalMember2022-05-012022-07-300000768835us-gaap:RetainedEarningsMemberus-gaap:PerformanceSharesMember2022-05-012022-07-300000768835us-gaap:PerformanceSharesMember2022-05-012022-07-300000768835us-gaap:CommonStockMember2022-07-300000768835us-gaap:TreasuryStockCommonMember2022-07-300000768835us-gaap:AdditionalPaidInCapitalMember2022-07-300000768835us-gaap:RetainedEarningsMember2022-07-3000007688352022-07-300000768835us-gaap:CommonStockMember2022-01-290000768835us-gaap:TreasuryStockCommonMember2022-01-290000768835us-gaap:AdditionalPaidInCapitalMember2022-01-290000768835us-gaap:RetainedEarningsMember2022-01-2900007688352022-01-290000768835us-gaap:CommonStockMember2022-01-302022-07-300000768835us-gaap:TreasuryStockCommonMember2022-01-302022-07-300000768835us-gaap:AdditionalPaidInCapitalMember2022-01-302022-07-300000768835us-gaap:RetainedEarningsMember2022-01-302022-07-300000768835us-gaap:CommonStockMemberus-gaap:PerformanceSharesMember2022-01-302022-07-300000768835us-gaap:PerformanceSharesMemberus-gaap:TreasuryStockCommonMember2022-01-302022-07-300000768835us-gaap:PerformanceSharesMemberus-gaap:AdditionalPaidInCapitalMember2022-01-302022-07-300000768835us-gaap:RetainedEarningsMemberus-gaap:PerformanceSharesMember2022-01-302022-07-300000768835us-gaap:PerformanceSharesMember2022-01-302022-07-300000768835us-gaap:CommonStockMember2023-04-290000768835us-gaap:TreasuryStockCommonMember2023-04-290000768835us-gaap:AdditionalPaidInCapitalMember2023-04-290000768835us-gaap:RetainedEarningsMember2023-04-2900007688352023-04-290000768835us-gaap:CommonStockMember2023-04-302023-07-290000768835us-gaap:TreasuryStockCommonMember2023-04-302023-07-290000768835us-gaap:AdditionalPaidInCapitalMember2023-04-302023-07-290000768835us-gaap:RetainedEarningsMember2023-04-302023-07-290000768835us-gaap:CommonStockMember2023-07-290000768835us-gaap:TreasuryStockCommonMember2023-07-290000768835us-gaap:AdditionalPaidInCapitalMember2023-07-290000768835us-gaap:RetainedEarningsMember2023-07-290000768835us-gaap:CommonStockMember2023-01-280000768835us-gaap:TreasuryStockCommonMember2023-01-280000768835us-gaap:AdditionalPaidInCapitalMember2023-01-280000768835us-gaap:RetainedEarningsMember2023-01-280000768835us-gaap:CommonStockMember2023-01-292023-07-290000768835us-gaap:TreasuryStockCommonMember2023-01-292023-07-290000768835us-gaap:AdditionalPaidInCapitalMember2023-01-292023-07-290000768835us-gaap:RetainedEarningsMember2023-01-292023-07-29big:storexbrli:pure00007688352023-01-292024-02-0300007688352021-01-312022-01-290000768835big:A2022CreditAgreementMember2022-09-012022-09-210000768835big:A2022CreditAgreementMember2022-09-210000768835big:A2022CreditAgreementMember2023-07-290000768835us-gaap:NotesPayableOtherPayablesMember2023-04-302023-07-29utr:Rate0000768835us-gaap:LineOfCreditMember2023-07-290000768835us-gaap:LineOfCreditMember2023-01-280000768835us-gaap:NotesPayableOtherPayablesMember2023-07-290000768835us-gaap:NotesPayableOtherPayablesMember2023-01-280000768835us-gaap:CommonStockMemberbig:A2021RepurchaseAuthorizationMember2021-12-010000768835us-gaap:CommonStockMemberbig:A2021RepurchaseAuthorizationMember2023-04-302023-07-290000768835us-gaap:CommonStockMemberbig:A2021RepurchaseAuthorizationMember2023-07-2900007688352023-01-292023-04-290000768835us-gaap:RestrictedStockUnitsRSUMember2023-01-280000768835us-gaap:RestrictedStockUnitsRSUMember2023-01-292023-04-290000768835us-gaap:RestrictedStockUnitsRSUMember2023-04-290000768835us-gaap:RestrictedStockUnitsRSUMember2023-04-302023-07-290000768835us-gaap:RestrictedStockUnitsRSUMember2023-07-290000768835us-gaap:RestrictedStockUnitsRSUMember2023-01-292023-07-290000768835us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2023-04-302023-07-290000768835us-gaap:RestrictedStockUnitsRSUMembersrt:BoardOfDirectorsChairmanMember2023-04-302023-07-290000768835us-gaap:PerformanceSharesMember2023-04-302023-07-290000768835us-gaap:PerformanceSharesMember2023-01-292023-07-290000768835big:A2021PSUAwardsMember2023-07-290000768835big:A2022TSRPSUAwardsMember2023-07-290000768835big:A2022PSUAwardsMember2023-07-290000768835big:A2023PSUAwardsMember2023-07-290000768835big:A2023TSRPSUMember2023-07-290000768835big:A2023SVCAPSUAwardsMember2023-07-290000768835big:PSUMember2023-07-290000768835us-gaap:PerformanceSharesMember2022-05-012022-07-300000768835us-gaap:PerformanceSharesMember2022-01-302022-07-300000768835us-gaap:PerformanceSharesMember2023-01-280000768835us-gaap:PerformanceSharesMember2023-01-292023-04-290000768835us-gaap:PerformanceSharesMember2023-04-290000768835us-gaap:PerformanceSharesMember2023-07-290000768835us-gaap:RestrictedStockMember2023-04-302023-07-290000768835us-gaap:RestrictedStockMember2022-05-012022-07-300000768835us-gaap:RestrictedStockMember2023-01-292023-07-290000768835us-gaap:RestrictedStockMember2022-01-302022-07-300000768835big:FurnitureMember2023-04-302023-07-290000768835big:FurnitureMember2022-05-012022-07-300000768835big:FurnitureMember2023-01-292023-07-290000768835big:FurnitureMember2022-01-302022-07-300000768835big:SeasonalMember2023-04-302023-07-290000768835big:SeasonalMember2022-05-012022-07-300000768835big:SeasonalMember2023-01-292023-07-290000768835big:SeasonalMember2022-01-302022-07-300000768835big:FoodMember2023-04-302023-07-290000768835big:FoodMember2022-05-012022-07-300000768835big:FoodMember2023-01-292023-07-290000768835big:FoodMember2022-01-302022-07-300000768835big:SoftHomeMember2023-04-302023-07-290000768835big:SoftHomeMember2022-05-012022-07-300000768835big:SoftHomeMember2023-01-292023-07-290000768835big:SoftHomeMember2022-01-302022-07-300000768835big:ConsumablesMember2023-04-302023-07-290000768835big:ConsumablesMember2022-05-012022-07-300000768835big:ConsumablesMember2023-01-292023-07-290000768835big:ConsumablesMember2022-01-302022-07-300000768835big:ApparelElectronicsOtherMember2023-04-302023-07-290000768835big:ApparelElectronicsOtherMember2022-05-012022-07-300000768835big:ApparelElectronicsOtherMember2023-01-292023-07-290000768835big:ApparelElectronicsOtherMember2022-01-302022-07-300000768835big:HardHomeMember2023-04-302023-07-290000768835big:HardHomeMember2022-05-012022-07-300000768835big:HardHomeMember2023-01-292023-07-290000768835big:HardHomeMember2022-01-302022-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended July 29, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 001-08897

BIG LOTS, INC.

(Exact name of registrant as specified in its charter)

Ohio 06-1119097

(State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.)

4900 E. Dublin-Granville Road, Columbus, Ohio 43081

(Address of Principal Executive Offices) (Zip Code)

(614) 278-6800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

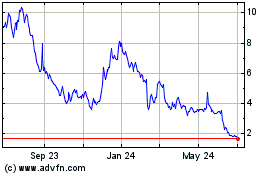

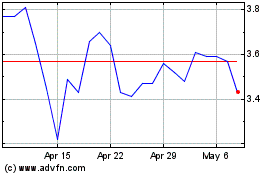

| Common shares | BIG | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ Noo

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yesþ Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer o | Accelerated filer þ | Non-accelerated filer o | Smaller reporting company o | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of the registrant’s common shares, $0.01 par value, outstanding as of September 1, 2023, was 29,194,640.

BIG LOTS, INC.

FORM 10-Q

FOR THE FISCAL QUARTER ENDED JULY 29, 2023

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| |

| | | |

| Item 1. | | |

| | | |

| a) | | |

| | | |

| b) | | |

| | | |

| c) | | |

| | |

| d) | | |

| | | |

| e) | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| Item 5. | | |

| | | |

| Item 6. | | |

| | | |

| | |

Part I. Financial Information

Item 1. Financial Statements

| | |

BIG LOTS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In thousands, except per share amounts) |

| | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Twenty-six Weeks Ended |

| | July 29, 2023 | July 30, 2022 | | July 29, 2023 | July 30, 2022 |

| Net sales | $ | 1,139,361 | | $ | 1,346,221 | | | $ | 2,262,938 | | $ | 2,720,935 | |

| Cost of sales (exclusive of depreciation expense shown separately below) | 763,477 | | 907,673 | | | 1,494,585 | | 1,777,793 | |

| Gross margin | 375,884 | | 438,548 | | | 768,353 | | 943,142 | |

| Selling and administrative expenses | 456,689 | | 510,444 | | | 1,073,755 | | 991,223 | |

| Depreciation expense | 41,282 | | 37,197 | | | 77,864 | | 74,553 | |

| Operating loss | (122,087) | | (109,093) | | | (383,266) | | (122,634) | |

| Interest expense | (11,175) | | (3,904) | | | (20,324) | | (6,654) | |

| Other income (expense) | — | | 257 | | | 5 | | 1,297 | |

| Loss before income taxes | (133,262) | | (112,740) | | | (403,585) | | (127,991) | |

| Income tax expense (benefit) | 116,575 | | (28,590) | | | 52,325 | | (32,759) | |

| Net loss and comprehensive loss | $ | (249,837) | | $ | (84,150) | | | $ | (455,910) | | $ | (95,232) | |

| | | | | |

| Earnings (loss) per common share | | | | | |

| Basic | $ | (8.56) | | $ | (2.91) | | | $ | (15.67) | | $ | (3.31) | |

| Diluted | $ | (8.56) | | $ | (2.91) | | | $ | (15.67) | | $ | (3.31) | |

| | | | | |

| Weighted-average common shares outstanding | | | | | |

| Basic | 29,175 | | 28,919 | | | 29,096 | | 28,770 | |

| Dilutive effect of share-based awards | — | | — | | | — | | — | |

| Diluted | 29,175 | | 28,919 | | | 29,096 | | 28,770 | |

| | | | | |

| Cash dividends declared per common share | $ | — | | $ | 0.30 | | | $ | 0.30 | | $ | 0.60 | |

The accompanying notes are an integral part of these consolidated financial statements.

| | |

BIG LOTS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited)

(In thousands, except par value) |

| | | | | | | | | | | |

| | July 29, 2023 | | January 28, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 46,034 | | | $ | 44,730 | |

| Inventories | 983,225 | | | 1,147,949 | |

| Other current assets | 99,902 | | | 92,635 | |

| Total current assets | 1,129,161 | | | 1,285,314 | |

| Operating lease right-of-use assets | 1,490,076 | | | 1,619,756 | |

| Property and equipment - net | 721,896 | | | 691,111 | |

| Deferred income taxes | — | | | 56,301 | |

| Other assets | 38,555 | | | 38,449 | |

| Total assets | $ | 3,379,688 | | | $ | 3,690,931 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 338,473 | | | $ | 421,680 | |

| Current operating lease liabilities | 240,076 | | | 252,320 | |

| Property, payroll, and other taxes | 72,352 | | | 71,274 | |

| Accrued operating expenses | 123,454 | | | 111,752 | |

| Insurance reserves | 35,707 | | | 35,871 | |

| Accrued salaries and wages | 28,135 | | | 26,112 | |

| Income taxes payable | 598 | | | 845 | |

| Total current liabilities | 838,795 | | | 919,854 | |

| Long-term debt | 493,200 | | | 301,400 | |

| Noncurrent operating lease liabilities | 1,453,961 | | | 1,514,009 | |

| Deferred income taxes | 485 | | | — | |

| Insurance reserves | 57,845 | | | 58,613 | |

| Unrecognized tax benefits | 8,456 | | | 8,091 | |

| Other liabilities | 220,917 | | | 125,057 | |

| Shareholders’ equity: | | | |

Preferred shares - authorized 2,000 shares; $0.01 par value; none issued | — | | | — | |

Common shares - authorized 298,000 shares; $0.01 par value; issued 117,495 shares; outstanding 29,192 shares and 28,959 shares, respectively | 1,175 | | | 1,175 | |

Treasury shares - 88,303 shares and 88,536 shares, respectively, at cost | (3,093,779) | | | (3,105,175) | |

| Additional paid-in capital | 623,347 | | | 627,714 | |

| Retained earnings | 2,775,286 | | | 3,240,193 | |

| Total shareholders’ equity | 306,029 | | | 763,907 | |

| Total liabilities and shareholders’ equity | $ | 3,379,688 | | | $ | 3,690,931 | |

The accompanying notes are an integral part of these consolidated financial statements.

| | |

BIG LOTS, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity (Unaudited)

(In thousands) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Common | Treasury | Additional

Paid-In

Capital | Retained Earnings | |

| | Shares | Amount | Shares | Amount | Total |

| Thirteen Weeks Ended July 30, 2022 |

| Balance - April 30, 2022 | 28,893 | | $ | 1,175 | | 88,602 | | $ | (3,107,806) | | $ | 619,754 | | $ | 3,467,205 | | $ | 980,328 | |

| Comprehensive loss | — | | — | | — | | — | | — | | (84,150) | | (84,150) | |

Dividends declared ($0.30 per share) | — | | — | | — | | — | | — | | (9,068) | | (9,068) | |

| Purchases of common shares | (9) | | — | | 9 | | (241) | | — | | — | | (241) | |

| Restricted shares vested | 48 | | — | | (48) | | 1,687 | | (1,687) | | — | | — | |

| Performance shares vested | — | | — | | — | | — | | — | | — | | — | |

| | | | | | | |

| Share-based compensation expense | — | | — | | — | | — | | 3,858 | | — | | 3,858 | |

| Balance - July 30, 2022 | 28,932 | | $ | 1,175 | | 88,563 | | $ | (3,106,360) | | $ | 621,925 | | $ | 3,373,987 | | $ | 890,727 | |

| | | | | | | |

| Twenty-Six Weeks Ended July 30, 2022 |

| Balance - January 29, 2022 | 28,476 | | $ | 1,175 | | 89,019 | | $ | (3,121,602) | | $ | 640,522 | | $ | 3,487,268 | | $ | 1,007,363 | |

| Comprehensive loss | — | | — | | — | | — | | — | | (95,232) | | (95,232) | |

Dividends declared ($0.60 per share) | — | | — | | — | | — | | — | | (18,049) | | (18,049) | |

| Purchases of common shares | (289) | | — | | 289 | | (10,880) | | — | | — | | (10,880) | |

| Restricted shares vested | 404 | | — | | (404) | | 14,170 | | (14,170) | | — | | — | |

| Performance shares vested | 341 | | — | | (341) | | 11,952 | | (11,952) | | — | | — | |

| | | | | | | |

| Share-based compensation expense | — | | — | | — | | — | | 7,525 | | — | | 7,525 | |

| Balance - July 30, 2022 | 28,932 | | $ | 1,175 | | 88,563 | | $ | (3,106,360) | | $ | 621,925 | | $ | 3,373,987 | | $ | 890,727 | |

| | | | | | | |

| Thirteen Weeks Ended July 29, 2023 |

| Balance - April 29, 2023 | 29,139 | | $ | 1,175 | | 88,356 | | $ | (3,095,791) | | $ | 620,971 | | $ | 3,025,004 | | $ | 551,359 | |

| Comprehensive loss | — | | — | | — | | — | | — | | (249,837) | | (249,837) | |

Dividends declared ($0.00 per share) | — | | — | | — | | — | | — | | 119 | | 119 | |

| Purchases of common shares | (6) | | — | | 6 | | (49) | | — | | — | | (49) | |

| Restricted shares vested | 59 | | — | | (59) | | 2,061 | | (2,061) | | — | | — | |

| | | | | | | |

| | | | | | | |

| Share-based compensation expense | — | | — | | — | | — | | 4,437 | | — | | 4,437 | |

| Balance - July 29, 2023 | 29,192 | | $ | 1,175 | | 88,303 | | $ | (3,093,779) | | $ | 623,347 | | $ | 2,775,286 | | $ | 306,029 | |

| | | | | | | |

| Twenty-Six Weeks Ended July 29, 2023 |

| Balance - January 28, 2023 | 28,959 | | $ | 1,175 | | 88,536 | | $ | (3,105,175) | | $ | 627,714 | | $ | 3,240,193 | | $ | 763,907 | |

| Comprehensive loss | — | | — | | — | | — | | — | | (455,910) | | (455,910) | |

Dividends declared ($0.30 per share) | — | | — | | — | | — | | — | | (8,997) | | (8,997) | |

| Purchases of common shares | (134) | | — | | 134 | | (1,466) | | — | | — | | (1,466) | |

| Restricted shares vested | 367 | | — | | (367) | | 12,862 | | (12,862) | | — | | — | |

| | | | | | | |

| | | | | | | |

| Share-based compensation expense | — | | — | | — | | — | | 8,495 | | — | | 8,495 | |

| Balance - July 29, 2023 | 29,192 | | $ | 1,175 | | 88,303 | | $ | (3,093,779) | | $ | 623,347 | | $ | 2,775,286 | | $ | 306,029 | |

The accompanying notes are an integral part of these consolidated financial statements.

| | |

BIG LOTS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows (Unaudited)

(In thousands) |

| | | | | | | | | |

| | Twenty-six Weeks Ended | |

| | July 29, 2023 | July 30, 2022 | |

| Operating activities: | | | |

| Net loss | $ | (455,910) | | $ | (95,232) | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization expense | 79,216 | | 75,152 | | |

| Non-cash lease expense | 178,890 | | 137,618 | | |

| Deferred income taxes | 56,787 | | (31,432) | | |

| Non-cash impairment charge | 84,389 | | 24,328 | | |

| Gain on disposition of property and equipment | (6,144) | | (1,531) | | |

| Non-cash share-based compensation expense | 8,495 | | 7,525 | | |

| Unrealized gain on fuel derivatives | — | | (257) | | |

| Change in assets and liabilities: | | | |

| Inventories | 164,724 | | 78,789 | | |

| Accounts payable | (83,207) | | (183,800) | | |

| Operating lease liabilities | (183,638) | | (129,436) | | |

| Current income taxes | 1,005 | | 10,982 | | |

| Other current assets | 42 | | (4,330) | | |

| Other current liabilities | 8,021 | | (19,133) | | |

| Other assets | (1,953) | | 348 | | |

| Other liabilities | (1,328) | | (5,000) | | |

| Net cash used in operating activities | (150,611) | | (135,409) | | |

| Investing activities: | | | |

| Capital expenditures | (29,998) | | (89,372) | | |

| Cash proceeds from sale of property and equipment | 9,630 | | 2,509 | | |

| Other | (10) | | (9) | | |

| Net cash used in investing activities | (20,378) | | (86,872) | | |

| Financing activities: | | | |

| Net proceeds from long-term debt | 191,800 | | 249,100 | | |

| Net repayments of sale and leaseback financing | (1,517) | | — | | |

| Payment of finance lease obligations | (1,356) | | (967) | | |

| Dividends paid | (9,740) | | (19,496) | | |

| Payments for other financing liabilities | (5,428) | | — | | |

| Payment for treasury shares acquired | (1,466) | | (10,880) | | |

| Payment for debt issuance cost | — | | (54) | | |

| Net cash provided by financing activities | 172,293 | | 217,703 | | |

| Increase (decrease) in cash and cash equivalents | 1,304 | | (4,578) | | |

| Cash and cash equivalents: | | | |

| Beginning of period | 44,730 | | 53,722 | | |

| End of period | $ | 46,034 | | $ | 49,144 | | |

The accompanying notes are an integral part of these consolidated financial statements.

| | |

BIG LOTS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Unaudited) |

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

All references in this report to “we,” “us,” or “our” are to Big Lots, Inc. and its subsidiaries. We are a home discount retailer in the United States (“U.S.”). At July 29, 2023, we operated 1,422 stores in 48 states and an e-commerce platform. We make available, free of charge, through the “Investor Relations” section of our website (www.biglots.com) under the “SEC Filings” caption, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). The contents of our websites are not part of this report.

The accompanying consolidated financial statements and these notes have been prepared in accordance with the rules and regulations of the SEC for interim financial information. The consolidated financial statements reflect all normal recurring adjustments which management believes are necessary to present fairly our financial condition, results of operations, and cash flows for all periods presented. The consolidated financial statements, however, do not include all information necessary for a complete presentation of financial condition, results of operations, and cash flows in conformity with accounting principles generally accepted in the United States of America (“GAAP”). Interim results may not necessarily be indicative of results that may be expected for, or actually result during, any other interim period or for the year as a whole. We have historically experienced seasonal fluctuations, with a larger percentage of our net sales and operating profit realized in our fourth fiscal quarter. The accompanying consolidated financial statements and these notes should be read in conjunction with the audited consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended January 28, 2023 (“2022 Form 10-K”).

Fiscal Periods

Our fiscal year ends on the Saturday nearest to January 31, which results in fiscal years consisting of 52 or 53 weeks. Unless otherwise stated, references to years in this report relate to fiscal years rather than calendar years. Fiscal year 2023 (“2023”) is comprised of the 53 weeks that began on January 29, 2023 and will end on February 3, 2024. Fiscal year 2022 (“2022”) was comprised of the 52 weeks that began on January 30, 2022 and ended on January 28, 2023. The fiscal quarters ended July 29, 2023 (“second quarter of 2023”) and July 30, 2022 (“second quarter of 2022”) were both comprised of 13 weeks. The year-to-date periods ended July 29, 2023 (“year-to-date 2023”) and July 30, 2022 (“year-to-date 2022”) were both comprised of 26 weeks.

Long-Lived Assets

Our long-lived assets primarily consist of property and equipment - net and operating lease right-of-use assets. If the net book value of a store’s long-lived assets is not recoverable by the expected undiscounted future cash flows of the store, we estimate the fair value of the store’s assets and recognize an impairment charge for the excess net book value of the store’s long-lived assets over its fair value (categorized as Level 3 under the fair value hierarchy). Fair value at the store level is typically based on projected discounted cash flows over the remaining lease term.

In the year-to-date 2023, the Company recorded aggregate asset impairment charges of $82.9 million related to 237 underperforming store locations, which were comprised of $62.1 million of operating lease right-of-use assets and $22.3 million of property and equipment - net, and partially offset by gains on extinguishment of lease liabilities from lease cancellations from previously impaired stores of $1.5 million. In the year-to-date 2022, the Company recorded aggregate asset impairment charges of $24.1 million related to 56 underperforming store locations, which were comprised of $17.5 million of operating lease right-of-use assets and $6.6 million of property and equipment - net. The impairment charges for 2022 and 2023 were recorded in selling and administrative expenses in our accompanying consolidated statements of operations and comprehensive loss.

In the year-to-date 2023, the Company completed the sale of two owned store locations that were classified as held for sale at the end of fiscal 2022 with an aggregate net book value of $2.2 million. The net cash proceeds on the sale of real estate were $9.3 million and resulted in a gain after related expenses of $7.1 million. The gain on the sales of real estate after related expenses were recorded in selling and administrative expenses in our accompanying consolidated statements of operations and comprehensive loss.

Selling and Administrative Expenses

Selling and administrative expenses include store expenses (such as payroll and occupancy costs) and costs related to warehousing, distribution, outbound transportation to our stores, advertising, purchasing, insurance, non-income taxes, accepting credit/debit cards, impairment charges, and overhead. Our selling and administrative expense rates may not be comparable to those of other retailers that include warehousing, distribution, and outbound transportation costs to stores in cost of sales. Distribution and outbound transportation costs included in selling and administrative expenses were $63.8 million and $81.9 million for the second quarter of 2023 and the second quarter of 2022, respectively, and $204.1 million and $164.0 million for the year-to-date 2023 and the year-to-date 2022, respectively. Included in our distribution and outbound transportation costs for the second quarter of 2023 were $2.0 million of closing costs associated with the closure of our forward distribution centers (“FDCs”), and immaterial expense associated with the exit from our Prior Synthetic Lease (as defined below in Note 3) that was refinanced in the first quarter of 2023. In the year-to-date 2023, we recognized $10.6 million of FDC closing costs and $53.6 million of costs related to the exit from our Prior Synthetic Lease. As of the end of the second quarter of 2023, we have ceased all business operations at our FDCs and are actively marketing each of these locations for sublease.

Advertising Expense

Advertising costs, which are expensed as incurred, consist primarily of television and print advertising, digital, social media, internet and e-mail marketing and advertising, payment card-linked marketing and in-store point-of-purchase signage and presentations. Advertising expenses are included in selling and administrative expenses. Advertising expenses were $19.4 million and $22.0 million for the second quarter of 2023 and the second quarter of 2022, respectively, and $44.3 million and $43.4 million for the year-to-date 2023 and the year-to-date 2022, respectively.

Supplemental Cash Flow Disclosures

The following table provides supplemental cash flow information for the year-to-date 2023 and the year-to-date 2022:

| | | | | | | | | | | |

| Twenty-six Weeks Ended |

| (In thousands) | July 29, 2023 | | July 30, 2022 |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 17,992 | | | $ | 7,977 | |

| Cash paid for income taxes, excluding impact of refunds | 570 | | | 3,879 | |

| Gross proceeds from long-term debt | 910,500 | | | 998,000 | |

| Gross payments of long-term debt | 718,700 | | | 748,900 | |

| | | |

| | | |

| Cash paid for operating lease liabilities | 241,652 | | | 183,186 | |

| Non-cash activity: | | | |

| Assets acquired under finance lease | 6,680 | | | 3,792 | |

| Accrued property and equipment | 8,653 | | | 26,086 | |

| Deemed acquisition in “failed sale-leaseback transaction” | 100,000 | | | — | |

| Operating lease assets obtained in exchange for operating lease liabilities | 112,743 | | | 123,906 | |

| Valuation allowance on deferred tax assets | 147,850 | | | — | |

| | | |

Reclassifications

We periodically assess, and make minor adjustments to, our product hierarchy, which can impact the roll-up of our merchandise categories. Our financial reporting process utilizes the most current product hierarchy in reporting net sales by merchandise category for all periods presented. Therefore, there may be minor reclassifications of net sales by merchandise category compared to previously reported amounts.

Recent Accounting Pronouncements

In September 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2022-04, Enhanced Disclosures about the Supplier Finance Programs. ASU 2022-04 requires buyers in supplier finance programs to disclose qualitative and quantitative information about their supplier finance programs. Interim and annual requirements include disclosure of outstanding amounts under the obligations as of the end of the reporting period, and annual requirements include a rollforward of those obligations for the annual reporting period, as well as a description of payment and other key terms of the programs. The Company adopted this ASU in fiscal year 2023, except for the disclosure of rollforward activity, which is effective on a prospective basis beginning in fiscal year 2024. See Note 9 - Supplier Finance Program for disclosure related to the Company’s supplier financing program obligations.

There are currently no additional new accounting pronouncements with a future effective date that are of significance, or potential significance, to us.

NOTE 2 – DEBT

Bank Credit Facility

On September 21, 2022, we entered into a five-year asset-based revolving credit facility (“2022 Credit Agreement”) in an aggregate committed amount of up to $900 million (the “Commitments”) that expires on September 21, 2027. In connection with our entry into the 2022 Credit Agreement, we paid bank fees and other expenses in the aggregate amount of $3.4 million, which are being amortized over the term of the 2022 Credit Agreement.

Revolving loans under the 2022 Credit Agreement are available in an aggregate amount equal to the lesser of (1) the aggregate Commitments and (2) a borrowing base consisting of eligible credit card receivables and eligible inventory (including in-transit inventory), subject to customary exceptions and reserves. Under the 2022 Credit Agreement, we may obtain additional Commitments on no more than five occasions in an aggregate amount of up to $300 million, subject to agreement by the lenders to increase their respective Commitments and certain other conditions. The 2022 Credit Agreement includes a swing loan sublimit of 10% of the then applicable aggregate Commitments and a $90 million letter of credit sublimit. Loans made under the 2022 Credit Agreement may be prepaid without penalty. Borrowings under the 2022 Credit Agreement are available for general corporate purposes, working capital and to repay certain of our indebtedness. Our obligations under the 2022 Credit Agreement are secured by our working capital assets (including inventory, credit card receivables and other accounts receivable, deposit accounts, and cash), subject to customary exceptions. The pricing and certain fees under the 2022 Credit Agreement fluctuate based on our availability under the 2022 Credit Agreement. The 2022 Credit Agreement allows us to select our interest rate for each borrowing from multiple interest rate options. The interest rate options are generally derived from the prime rate or one, three or six month adjusted Term SOFR. We will also pay an unused commitment fee of 0.20% per annum on the unused Commitments. The 2022 Credit Agreement contains an environmental, social and governance (“ESG”) provision, which may provide favorable pricing and fee adjustments if we meet ESG performance criteria to be established by a future amendment to the 2022 Credit Agreement.

The 2022 Credit Agreement contains customary affirmative and negative covenants (including, where applicable, restrictions on our ability to, among other things, incur additional indebtedness, pay dividends, redeem or repurchase stock, prepay certain indebtedness, make certain loans and investments, dispose of assets, enter into restrictive agreements, engage in transactions with affiliates, modify organizational documents, incur liens and consummate mergers and other fundamental changes) and events of default. In addition, the 2022 Credit Agreement requires us to maintain a fixed charge coverage ratio of not less than 1.0 if (1) certain events of default occur and continue or (2) borrowing availability under the 2022 Credit Agreement is less than the greater of (a) 10% of the Maximum Credit Amount (as defined in the 2022 Credit Agreement) or (b) $67.5 million. A violation of these covenants could result in a default under the 2022 Credit Agreement which could permit the lenders to restrict our ability to further access the 2022 Credit Agreement for loans and letters of credit and require the immediate repayment of any outstanding loans under the 2022 Credit Agreement.

As of July 29, 2023, we had a Borrowing Base (as defined under the 2022 Credit Agreement) of $829.4 million under the 2022 Credit Agreement. At July 29, 2023, we had $493.2 million in borrowings outstanding under the 2022 Credit Agreement and $41.2 million committed to outstanding letters of credit, leaving $295.0 million available under the 2022 Credit Agreement, subject to certain borrowing base limitations as further discussed above. At July 29, 2023, we had $212.1 million available under the 2022 Credit Agreement, net of the borrowing base limitations discussed above.

The fair values of our long-term obligations under the 2022 Credit Agreement are estimated based on quoted market prices for the same or similar issues and the current interest rates offered for similar instruments. These fair value measurements are classified as Level 2 within the fair value hierarchy. We believe the carrying value of our debt is a reasonable approximation of fair value.

Secured Insurance Premium Financing Obligation

In the second quarter of 2023, we entered into three individual financing agreements (“2023 Term Notes”) aggregating to $16.2 million, which are secured by our unearned insurance premiums. The 2023 Term Notes will expire between January 2024 and May 2024. We are required to make monthly payments over the term of the 2023 Term Notes and are permitted to prepay, subject to penalties, at any time. The 2023 Term Notes carry annual interest rates ranging from 7.1% to 8.5%. The Company did not receive any cash in connection with the 2023 Term Notes.

Debt was recorded in our consolidated balance sheets as follows:

| | | | | | | | | | | | | | |

Instrument (In thousands) | | July 29, 2023 | | January 28, 2023 |

| 2022 Credit Agreement | | $ | 493,200 | | | $ | 301,400 | |

| 2023 Term Notes | | 11,239 | | | — | |

| Total debt | | $ | 504,439 | | | $ | 301,400 | |

| Less current portion of 2023 Term Notes (included in Accrued operating expenses) | | (11,239) | | | — | |

| Long-term debt | | $ | 493,200 | | | $ | 301,400 | |

NOTE 3 – SYNTHETIC LEASE

Synthetic Lease

On March 15, 2023, AVDC, LLC (“Lessee”), a wholly-owned indirect subsidiary of the Company, Bankers Commercial Corporation (“Lessor”), the rent assignees parties thereto (“Rent Assignees” and, together with Lessor, “Participants”), MUFG Bank, Ltd., as collateral agent for the Rent Assignees (in such capacity, “Collateral Agent”), and MUFG Bank, Ltd., as administrative agent for the Participants, entered into a Participation Agreement (the “Participation Agreement”), pursuant to which the Participants funded $100 million to Wachovia Service Corporation (“Prior Lessor”) to finance Lessor’s purchase of the land and building related to our Apple Valley, CA distribution center (“Leased Property”) from the Prior Lessor.

Also on March 15, 2023, we entered into a Lease Agreement and supplement to the Lease Agreement (collectively, the “Lease” and together with the Participation Agreement and related agreements, the “2023 Synthetic Lease”) pursuant to which the Lessor will lease the Leased Property to Lessee for an initial term of 60 months. The Lease may be extended for up to an additional five years, in one-year or longer annual periods, with each renewal subject to approval by the Participants. The 2023 Synthetic Lease requires Lessee to pay basic rent on the scheduled payment dates in arrears in an amount equal to (a) a per annum rate equal to Term SOFR for the applicable payment period plus a 10 basis point spread adjustment plus an applicable margin equal to 250 basis points multiplied by (b) the portion of the lease balance not constituting the investment by Lessor in the Leased Property. In addition to basic rent, Lessee must pay all costs and expenses associated with the use or occupancy of the Leased Property, including without limitation, maintenance, insurance and certain indemnity payments. GAAP treatment of the synthetic lease refinancing transaction requires us to treat the assignment of the purchase option from Prior Lessor to Lessor as a deemed acquisition of the Leased Property due to the Company’s control of the Leased Property under GAAP at the time the assigned purchase option was exercised. Accordingly, the Company applied sale and leaseback accounting to the transfer of the property from the Prior Lessor to the Lessor. The transaction met the criteria of a “failed sale-leaseback” under GAAP, which required us to record an asset for the deemed acquisition and an equivalent financing liability that represents the cost to acquire the Leased Property. The asset of $100.0 million was recorded in property and equipment – net in the consolidated balance sheets. The financing liability of $100.0 million was recorded in accrued operating expenses (current) and other liabilities (noncurrent) in the consolidated balance sheets.

Concurrently with Lessor’s purchase of the Leased Property from Prior Lessor, the participation agreement and lease agreement associated with our former synthetic lease arrangement, in each case entered into on November 30, 2017, and most recently amended on September 21, 2022 (the “Prior Synthetic Lease”), were terminated effective on March 15, 2023. In connection with the termination of the Prior Synthetic Lease, the Company paid a termination fee of approximately $53.4 million to Prior Lessor using borrowings under the 2022 Credit Agreement. As a result of the termination of the Prior Synthetic Lease, the borrowing base under the 2022 Credit Agreement is no longer subject to a reserve for the outstanding balance under the Prior Synthetic Lease.

The Company, together with all of its direct and indirect subsidiaries that serve as guarantors under the 2022 Credit Agreement guarantee the payment and performance obligations under the 2023 Synthetic Lease. The obligations under the 2023 Synthetic Lease are also secured by a pledge of Lessee’s interest in the Leased Property. In addition, Lessee, no less frequently than annually, will be subject to a test (the “LTV Test”) that requires the ratio of (a) the adjusted lease balance minus any Lessee Letter of Credit (as defined below) to (b) the Leased Property’s fair market value to not be greater than 60 percent. If Lessee does not comply with the LTV Test, Lessee must deliver or adjust a letter of credit in favor of the Collateral Agent (“Lessee Letter of Credit”) in an amount necessary to comply with the LTV Test. The 2023 Synthetic Lease also contains customary representations and warranties, covenants and events of default.

The Participation Agreement also requires us to maintain a fixed charge coverage ratio of not less than 1.0 if (1) certain events of default occur and continue or (2) borrowing availability under the 2022 Credit Agreement is less than the greater of (a) 10%

of the Maximum Credit Amount (as defined in the 2022 Credit Agreement) or (b) $67.5 million, which is consistent with the terms of the 2022 Credit Agreement.

If an event of default occurs under the Lease, Lessor generally has the right to recover the adjusted lease balance and certain other costs and amounts payable under the 2023 Synthetic Lease and, following such payment, Lessee would be entitled to receive ownership in the Leased Property from Lessor.

The 2023 Synthetic Lease related to our Apple Valley, CA distribution center was terminated and paid off on August 25, 2023 in connection with the closing of the sale and leaseback transactions described in more detail in Note 10 - Subsequent Event.

NOTE 4 – SHAREHOLDERS’ EQUITY

Earnings per Share

No adjustments were required to be made to the weighted-average common shares outstanding for purposes of computing basic and diluted earnings per share for all periods presented. At July 29, 2023, performance share units that vest based on relative total shareholder return (“TSR PSUs” - see Note 5 - Share Based Plans for a more detailed description of these awards) and shareholder value creation awards (“SVCA PSUs” - see Note 5 - Share Based Plans for a more detailed description of these awards) were excluded from our computation of earnings (loss) per share because the minimum applicable performance conditions had not been attained. Antidilutive restricted stock units (“RSUs”), performance share units (“PSUs”), SVCA PSUs, and TSR PSUs are excluded from the calculation because they decrease the number of diluted shares outstanding under the treasury stock method. The aggregate number of RSUs, PSUs, SVCA PSUs, and TSR PSUs that were antidilutive, as determined under the treasury stock method, was 1.7 million and 0.6 million for the second quarter of 2023 and the second quarter of 2022, respectively, and 1.3 million and 0.4 million for the year-to-date 2023 and the year-to-date 2022, respectively. Due to the net loss recorded in each respective period presented in the consolidated statements of operations, any potentially dilutive shares were excluded from the denominator in computing diluted earnings (loss) per common share for the second quarter of 2023, second quarter of 2022, the year-to-date 2023, and the year-to-date 2022.

Share Repurchase Programs

On December 1, 2021, our Board of Directors authorized the repurchase of up to $250 million of our common shares (“2021 Repurchase Authorization”). Pursuant to the 2021 Repurchase Authorization, we may repurchase shares in the open market and/or in privately negotiated transactions at our discretion, subject to market conditions, our compliance with the terms of the 2022 Credit Agreement, and other factors. The 2021 Repurchase Authorization has no scheduled termination date. In the second quarter of 2023, second quarter of 2022, the year-to-date 2023, and the year-to-date 2022, no shares were repurchased under the 2021 Repurchase Authorization. As of July 29, 2023, we had $159.4 million available for future repurchases under the 2021 Repurchase Authorization.

Purchases of common shares reported in the consolidated statements of shareholders’ equity include shares acquired to satisfy income tax withholdings associated with the vesting of share-based awards.

Dividends

The Company declared and paid cash dividends per common share during the quarterly periods presented as follows:

| | | | | | | | | | | | | | | | | |

| Dividends

Per Share | | Amount Declared | | Amount Paid |

| 2023: | | | (In thousands) | | (In thousands) |

| First quarter | $ | 0.30 | | | $ | 9,116 | | | $ | 9,587 | |

| Second quarter | — | | | (119) | | | 153 | |

| Total | $ | 0.30 | | | $ | 8,997 | | | $ | 9,740 | |

| | | | | |

The amount of dividends declared may vary from the amount of dividends paid in a period due to the vesting of share-based awards. Furthermore, dividends declared may fluctuate on a periodic basis due to the forfeiture of unpaid dividends associated with unvested share-based awards. On May 23, 2023, our Board of Directors suspended the Company’s quarterly cash dividend. The payment of any future dividends will be at the discretion of our Board of Directors and will depend on our financial condition, results of operations, capital requirements, compliance with applicable laws and agreements and any other factors deemed relevant by our Board of Directors.

NOTE 5 – SHARE-BASED PLANS

We have issued RSUs, PSUs, SVCA PSUs, and TSR PSUs under our shareholder-approved equity compensation plans. We recognized share-based compensation expense of $4.4 million and $3.9 million in the second quarter of 2023 and the second quarter of 2022, respectively, and $8.5 million and $7.5 million for the year-to-date 2023 and the year-to-date 2022, respectively.

Non-vested Restricted Stock Units

The following table summarizes the non-vested RSU activity for the year-to-date 2023:

| | | | | | | | |

| Number of Shares | Weighted Average Grant-Date Fair Value Per Share |

| Outstanding non-vested RSUs at January 28, 2023 | 875,503 | | $ | 34.75 | |

| Granted | 1,354,505 | | $ | 13.40 | |

| Vested | (308,051) | | $ | 29.28 | |

| Forfeited | (45,949) | | $ | 29.99 | |

| Outstanding non-vested RSUs at April 29, 2023 | 1,876,008 | | $ | 20.35 | |

| Granted | 228,662 | | $ | 8.71 | |

| Vested | (58,823) | | $ | 31.28 | |

| Forfeited | (63,066) | | $ | 20.12 | |

| Outstanding non-vested RSUs at July 29, 2023 | 1,982,781 | | $ | 18.68 | |

The non-vested RSUs granted in the year-to-date 2023 generally vest, and are expensed, on a ratable basis over three years from the grant date of the award, if the grantee remains employed by us through the vesting dates. The RSUs granted in 2023 have no required financial performance objectives.

Non-vested Restricted Stock Units Granted to Non-Employee Directors

In the second quarter of 2023, 46,937 common shares underlying the restricted stock units granted in 2022 to the non-employee directors vested on the trading day immediately preceding our 2023 Annual Meeting of Shareholders (“2023 Annual Meeting”). These units were part of the annual compensation of the non-employee directors of the Board. In the second quarter of 2023, the chairman of our Board received an annual restricted stock unit grant having a grant date fair value of approximately $245,000 and the remaining non-employees elected to our Board at our 2023 Annual Meeting each received an annual restricted stock unit grant having a grant date fair value of approximately $145,000. The 2023 restricted stock units will vest on the earlier of (1) the trading day immediately preceding our 2024 Annual Meeting of Shareholders, or (2) the non-employee director’s death or disability. However, the non-employee directors will forfeit their restricted stock units if their service on the Board terminates before either vesting event occurs.

Performance Share Units

In the year-to-date 2023, we issued PSUs to certain members of management, which will vest if certain minimum financial performance objectives are achieved over a three-year performance period and the grantee remains employed by us during the performance period. The minimum financial performance objectives will be established for each fiscal year within the three-year performance period and are generally approved by the Human Capital and Compensation Committee of our Board of Directors during the first quarter of the respective fiscal year. Based on the uncertain macroeconomic environment and a wide range of potential outcomes, the Committee chose to defer establishment of the financial performance objectives for 2023 to later in the fiscal year.

In the third quarter of 2023, the Committee established the financial performance objectives for the 2023 fiscal year, which apply to the 2021 PSUs, 2022 PSUs, and the 2023 PSUs awards.

The 2023 PSU awards were issued with three distinct annual minimum financial performance objectives. The annual minimum financial performance objectives for the fiscal years 2024 and 2025 are expected to be set at the beginning of each of the respective fiscal years. As a result of the process used to establish the minimum financial performance objectives, we may meet the requirements for establishing a grant date for the 2023 PSUs when we communicate the financial performance objectives

for 2023 to the award recipients, which will then trigger the service inception date, the fair value of the awards, and the associated expense recognition period. If we meet the applicable minimum threshold financial performance objectives in any of the three performance periods and the grantee remains employed by us through the end of the performance period, the PSUs will vest on the first trading day after we file our Annual Report on Form 10-K for the last fiscal year in the three-year performance period.

In 2021 and 2022, we issued PSUs to certain members of management, which will vest if certain financial performance objectives are achieved over a three-year performance period and the grantee remains employed by us during the performance period. The financial performance objectives for each fiscal year within the three-year performance period are generally approved by the Human Capital and Compensation Committee of our Board of Directors during the first quarter of the respective fiscal year.

As a result of the process used to establish the financial performance objectives, we will only meet the requirements for establishing a grant date for PSUs issued in 2021 and 2022 when we communicate the financial performance objectives for the third fiscal year of the award to the award recipients, which will then trigger the service inception date, the fair value of the awards, and the associated expense recognition period. If we meet the applicable threshold financial performance objectives over the three-year performance period and the grantee remains employed by us through the end of the performance period, the PSUs will vest on the first trading day after we file our Annual Report on Form 10-K for the last fiscal year in the performance period.

The number of shares distributed upon vesting of the 2021 and 2022 PSUs depends on the average performance attained during the three-year performance period compared to the performance targets established by the Human Capital and Compensation Committee, and may result in the distribution of an amount of shares that is greater or less than the number of 2021 and 2022 PSUs granted, as defined in the award agreement.

In 2022 and the year-to-date 2023, we also awarded TSR PSUs to certain members of management, which vest based on the achievement of total shareholder return (“TSR”) targets relative to a peer group over a three-year performance period and require the grantee to remain employed by us through the end of the performance period. If we meet the applicable performance thresholds over the three-year performance period and the grantee remains employed by us through the end of the performance period, the TSR PSUs will vest on the first trading day after we file our Annual Report on Form 10-K for the last fiscal year in the performance period. We use a Monte Carlo simulation to estimate the fair value of the TSR PSUs on the grant date and recognize expense over the service period. The TSR PSUs have a contractual period of three years.

The number of shares distributed upon vesting of the TSR PSUs depends on the average performance attained during the three-year performance period compared to the performance targets established by the Human Capital and Compensation Committee, and may result in the distribution of an amount of shares that is greater or less than the number of TSR PSUs granted, as defined in the award agreement.

In the year-to-date 2023, we also awarded SVCA PSUs to certain members of management, which vest based on the achievement of multiple share price performance goals over a three-year contractual term and require the grantee to remain employed by us through the end of the contractual term. We use a Monte Carlo simulation to estimate the fair value of the SVCA PSUs on the grant date and recognize expense ratably over the service period. If we meet the applicable performance thresholds over the three-year performance period and the grantee remains employed by us through the end of the contractual term, the SVCA PSUs will vest at the end of the contractual term. If the share price performance goals applicable to the SVCA PSUs are not achieved prior to expiration, the unvested portion of the awards will be forfeited.

We have begun or expect to begin recognizing expense related to PSUs, TSR PSUs, and SVCA PSUs as follows:

| | | | | | | | | | | | | | | | | |

| Issue Year | PSU Category | Outstanding Units at July 29, 2023 | Actual Grant Date | Expected Valuation (Grant) Date | Actual or Expected Expense Period |

| 2021 | PSU | 121,123 | | August 2023 | | Fiscal 2023 |

| 2022 | TSR PSU | 55,144 | | Fiscal 2022 | | Fiscal 2022 - 2024 |

| 2022 | PSU | 220,618 | | | March 2024 | Fiscal 2024 |

| 2023 | PSU | 475,548 | | August 2023 | March 2024 and 2025 | Fiscal 2023 - 2025 |

| 2023 | TSR PSU | 118,881 | | March 2023 | | Fiscal 2023 - 2025 |

| 2023 | SVCA PSU | 554,031 | | March 2023 | | Fiscal 2023 - 2025 |

| Total | | 1,545,345 | | | | |

We recognized $0.4 million and $0.3 million of share-based compensation expense related to SVCA PSUs and TSR PSUs in the second quarter of 2023 and the second quarter of 2022, respectively, and $0.8 million and $0.4 million of share-based compensation expense related to SVCA PSUs and TSR PSUs in the year-to-date 2023 and the year-to-date 2022, respectively. As of July 29, 2023, financial performance objectives have not been set for the 2021 PSUs, 2022 PSUs, and the 2023 PSUs. As a result, there were no PSUs outstanding at July 29, 2023.

The following table summarizes the activity related to TSR PSUs and SVCA PSUs for the year-to-date 2023:

| | | | | | | | |

| Number of Units | Weighted Average Grant-Date Fair Value Per Share |

| Outstanding TSR PSUs and SVCA PSUs at January 28, 2023 | 60,924 | | $ | 55.76 | |

| Granted | 712,293 | | $ | 4.82 | |

| Vested | — | | $ | — | |

| Forfeited | (5,750) | | $ | 24.36 | |

| Outstanding TSR PSUs and SVCA PSUs at April 29, 2023 | 767,467 | | $ | 8.90 | |

| Granted | 12,733 | | $ | 4.28 | |

| Vested | — | | $ | — | |

| Forfeited | (52,144) | | $ | 8.50 | |

| Outstanding TSR PSUs and SVCA PSUs at July 29, 2023 | 728,056 | | $ | 8.66 | |

The following activity occurred under our share-based plans during the respective periods shown:

| | | | | | | | | | | | | | | | | |

| Second Quarter | | Year-to-Date |

| (In thousands) | 2023 | 2022 | | 2023 | 2022 |

| Total fair value of restricted stock vested | $ | 458 | | $ | 1,289 | | | $ | 3,868 | | $ | 13,920 | |

| Total fair value of performance shares vested | $ | — | | $ | — | | | $ | — | | $ | 13,753 | |

The total unearned compensation expense related to all share-based awards outstanding, excluding PSUs issued in 2021, 2022, and 2023, at July 29, 2023, was approximately $30.8 million. We expect to recognize this compensation cost through June 2026 based on existing vesting terms with the weighted-average remaining expense recognition period being approximately 2.2 years from July 29, 2023.

NOTE 6 – INCOME TAXES

The provision for income taxes was based on a current estimate of the annual effective tax rate, adjusted to reflect the effect of discrete items.

For the year-to-date 2023, the Company determined it could estimate the effective income tax rate with sufficient precision. Therefore, the income tax expense (benefit) was based on the estimated annual effective tax rate, adjusted to reflect the effect of discrete items.

We have estimated the reasonably possible expected net change in unrecognized tax benefits through August 3, 2024, based on (1) expected cash and noncash settlements or payments of uncertain tax positions, and (2) lapses of the applicable statutes of limitations for unrecognized tax benefits. The estimated net decrease in unrecognized tax benefits for the next 12 months is approximately $2.0 million. Actual results may differ materially from this estimate.

We record income tax expense, income tax receivable, and deferred tax assets and related liabilities based on management’s best estimates. Additionally, we assess the likelihood of realizing the benefits of our deferred tax assets. Our ability to recover these deferred tax assets depends on several factors, including our ability to project future taxable income. In evaluating future taxable income, significant weight is given to positive and negative evidence that is objectively verifiable. As a result of the losses recorded in fiscal 2022 and year-to-date 2023, our cumulative three-year results are in a loss position as of July 29, 2023, which is significant objective negative evidence in considering whether deferred tax assets are realizable. Such objective evidence limits the ability to consider other subjective evidence, such as the projection of future taxable income. As a result, as of July 29, 2023 a valuation allowance has been recognized as a reserve on the total deferred tax asset balance due to the uncertainty of realization of our loss carry forwards and other deferred tax assets. Valuation allowances recorded on deferred taxes were $147.9 million and $0.0 million in the second quarter of 2023 and the second quarter of 2022, respectively, and $147.9 million and $0.0 million in the year-to-date 2023 and year-to-date 2022, respectively.

NOTE 7 – CONTINGENCIES

California Wage and Hour Matters

We have defended several wage and hour matters in California. The cases were brought by various current and/or former California associates alleging various violations of California wage and hour laws. During the second quarter of 2023, we determined an incremental loss from the wage and hour matters was probable and we increased our accrual for litigation by recording an additional $0.9 million charge as our settlement accrual for these matters in aggregate. At July 29, 2023, our remaining accrual for California wage and hour matters was $0.9 million.

Other Legal Proceedings

We are involved in legal actions and claims arising in the ordinary course of business. We currently believe that each such action and claim will be resolved without a material effect on our financial condition, results of operations, or liquidity. However, litigation involves an element of uncertainty. Future developments could cause these actions or claims to have a material effect on our financial condition, results of operations, and liquidity.

NOTE 8 – BUSINESS SEGMENT DATA

We use the following seven merchandise categories, which are consistent with our internal management and reporting of merchandise net sales: Food; Consumables; Soft Home; Hard Home; Furniture; Seasonal; and Apparel, Electronics, & Other. The Food category includes our beverage & grocery; specialty foods; and pet departments. The Consumables category includes our health, beauty and cosmetics; plastics; paper; and chemical departments. The Soft Home category includes our home organization; fashion bedding; utility bedding; bath; window; decorative textile; and area rugs departments. The Hard Home category includes our small appliances; table top; food preparation; home maintenance; and toys departments. The Furniture category includes our upholstery; mattress; ready-to-assemble; case goods; and home décor departments. The Seasonal category includes our lawn & garden; summer; Christmas; and other holiday departments. The Apparel, Electronics, & Other department includes our apparel; electronics; jewelry; hosiery; and candy & snacks departments, as well as the assortments for The Lot, our cross-category presentation solution, the Queue Line, our streamlined checkout experience, and our “Bargains, Treasures, and Essentials” closeout offerings.

We periodically assess, and make minor adjustments to, our product hierarchy, which can impact the roll-up of our merchandise categories. Our financial reporting process utilizes the most current product hierarchy in reporting net sales by merchandise

category for all periods presented. Therefore, there may be minor reclassifications of net sales by merchandise category compared to previously reported amounts.

The following table presents net sales data by merchandise category:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Second Quarter | | Year-to-Date |

| (In thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Furniture | | $ | 263,720 | | | $ | 322,744 | | | $ | 575,864 | | | $ | 746,003 | |

| Seasonal | | 244,359 | | | 331,299 | | | 421,367 | | | 565,470 | |

| Food | | 159,171 | | | 172,513 | | | 323,991 | | | 349,133 | |

| Soft Home | | 143,926 | | | 163,672 | | | 285,806 | | | 333,338 | |

| Consumables | | 135,197 | | | 151,989 | | | 270,964 | | | 309,223 | |

| Apparel, Electronics, & Other | | 116,592 | | | 115,870 | | | 232,288 | | | 238,905 | |

| Hard Home | | 76,396 | | | 88,134 | | | 152,658 | | | 178,863 | |

| Net sales | | $ | 1,139,361 | | | $ | 1,346,221 | | | $ | 2,262,938 | | | $ | 2,720,935 | |

NOTE 9 – SUPPLIER FINANCE PROGRAM

We facilitate a voluntary supply chain finance (“SCF”) program through a participating financial institution. This SCF program enables our suppliers to sell their receivables due from the Company to a participating financial institution at their discretion. As of July 29, 2023, the SCF program had a $55.0 million revolving capacity. We are not a party to the agreements between the participating financial institution and the suppliers in connection with the SCF program. The range of payment terms we negotiate with our suppliers is consistent, irrespective of whether a supplier participates in the SCF program. No guarantees are provided by the Company or any of our subsidiaries under the SCF program.

The amounts payable to the participating financial institution for suppliers who voluntarily participate in the SCF program are included within the accounts payable on our consolidated balance sheets. Amounts under the SCF program included within accounts payable were $17.6 million and $35.4 million as of July 29, 2023, and January 28, 2023, respectively. Payments made under the SCF program to the financial institution, like payments of other accounts payable, are a reduction to our operating cash flow.

As of August 1, 2023, the SCF program had a $0.0 million revolving capacity for new commitments as the previous participating financial institution is no longer participating in the SCF program. All outstanding commitments as of August 1, 2023, will be fulfilled under the original terms of the SCF program. As of September 1, 2023, a new participating financial institution has agreed to participate in the SCF program. As of September 1, 2023, the SCF program had a revolving capacity of approximately $30.0 million. All other terms except for the revolving capacity, under the SCF program will remain substantially similar under the new participating financial institution.

NOTE 10 – SUBSEQUENT EVENT

On August 25, 2023, we simultaneously terminated the Synthetic Lease for our Apple Valley, CA distribution center (“AVDC”), took title to the AVDC property and completed sale and leaseback transactions for the AVDC and 22 owned store locations (“SLB Stores”). The transactions, which were completed with the same buyer-lessor of our four other regional distribution centers, also included a five-year extension of the lease for our Columbus, OH distribution center (“CODC”). The aggregate gross cash consideration received in the transaction was $300.1 million, which we used to pay transaction expenses, fully pay off the 2023 Synthetic Lease for approximately $101 million and repay borrowings under the 2022 Credit Agreement. The accounting treatment for these transactions has not yet been finalized; however, our initial expectations are disclosed below.

We expect to allocate a portion of the cash consideration received to the extension of the lease for CODC and we expect that cash consideration to be treated as a lease incentive. We expect the remainder of the cash consideration received to be allocated to the sale-leaseback transactions. In accordance with sale-leaseback accounting guidelines, the remaining cash received will be compared, on an individual property basis, to the fair market value of the properties. Any property sales determined to be above-market sales will give rise to an aggregate off-market adjustment liability, with any below market sales resulting in an aggregate off-market adjustment to net proceeds on the sale and a corresponding increase in prepaid rent associated with the

leases. The aggregate net book value of AVDC and the SLB Stores assets was approximately $122.0 million as of July 29, 2023. As a result, we expect to record a significant gain on the sale of assets in the third quarter of 2023.

We expect that the leases we entered into with the buyer-lessor will be treated as operating leases, in which case we would record the right of use assets within operating lease right of use asset in our consolidated balance sheets. For above-market transactions, expected future payments to the buyer-lessor would be allocated between the lease liability and the off-market adjustment liability. The leases will have an initial term of 20 years and multiple extension options. The purchase and sale agreement restricts us from drawing on the 2022 Credit Agreement for any purpose other than working capital, general corporate, operational requirements or capital expenditures for 180 days following the closing of the transactions unless our availability under the 2022 Credit agreement exceeds $500 million as of the end of a quarterly reporting period.

Our aggregate initial annual cash payments to the buyer-lessor for AVDC and the SLB stores are approximately $23 million and the payments will escalate two percent annually.

We currently expect to close sale and leaseback transactions with respect to two additional owned store locations in the third quarter of 2023, subject to due diligence and other customary closing conditions.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS FOR PURPOSES OF THE SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The Private Securities Litigation Reform Act of 1995 (“Act”) provides a safe harbor for forward-looking statements to encourage companies to provide prospective information, so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those discussed in the statements. We wish to take advantage of the “safe harbor” provisions of the Act.

Certain statements in this report are forward-looking statements within the meaning of the Act, and such statements are intended to qualify for the protection of the safe harbor provided by the Act. The words “anticipate,” “estimate,” “approximate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “may,” “target,” “forecast,” “guidance,” “outlook,” and similar expressions generally identify forward-looking statements. Similarly, descriptions of our objectives, strategies, plans, goals or targets are also forward-looking statements. Forward-looking statements relate to the expectations of management as to future occurrences and trends, including statements expressing optimism or pessimism about future operating results or events and projected sales, earnings, capital expenditures and business strategy. Forward-looking statements are based upon a number of assumptions concerning future conditions that may ultimately prove to be inaccurate. Forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Although we believe the expectations expressed in forward-looking statements are based on reasonable assumptions within the bounds of our knowledge, forward-looking statements, by their nature, involve risks, uncertainties and other factors, any one or a combination of which could materially affect our business, financial condition, results of operations or liquidity.

Forward-looking statements that we make herein and in other reports and releases are not guarantees of future performance and actual results may differ materially from those discussed in such forward-looking statements as a result of various factors, including, but not limited to, the current economic and credit conditions, inflation, the cost of goods, our inability to successfully execute strategic initiatives, competitive pressures, economic pressures on our customers and us, the availability of brand name closeout merchandise, trade restrictions, freight costs, the risks discussed in the Risk Factors section of our most recent Annual Report on Form 10-K, and other factors discussed from time to time in our other filings with the SEC, including Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. This report should be read in conjunction with such filings, and you should consider all of these risks, uncertainties and other factors carefully in evaluating forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to publicly update forward-looking statements whether as a result of new information, future events or otherwise. Readers are advised, however, to consult any further disclosures we make on related subjects in our public announcements and SEC filings.

OVERVIEW

The discussion and analysis presented below should be read in conjunction with the accompanying consolidated financial statements and related notes. Each term defined in the notes to the accompanying consolidated financial statements has the same meaning in this item and the balance of this report.

The following are the results from the second quarter of 2023 that we believe are key indicators of our operating performance when compared to our operating performance from the second quarter of 2022:

•Net sales decreased $206.9 million, or 15.4%.

•Comparable sales for stores open at least fifteen months, plus our e-commerce net sales, decreased $187.3 million, or 14.6%.

•Gross margin dollars decreased $62.6 million, while gross margin rate increased 40 basis points to 33.0% of net sales.

•Selling and administrative expenses decreased $53.7 million to $456.7 million. As a percentage of net sales, selling and administrative expenses increased 220 basis points to 40.1% of net sales.

•Included within our selling and administrative expenses were contract termination costs and other related expenses associated with closure of our forward distribution centers (“FDCs”) of $2.0 million. Included in depreciation expense was $7.0 million related to accelerated depreciation due to the closure of FDCs.

•Also included within our selling and administrative expenses was a gain on sale of real estate and related expenses of $3.4 million.

•Also included within our selling and administrative expenses were fees related to cost reduction and productivity initiatives of $5.4 million.

•Operating loss rate increased 260 basis points to (10.7)%.

•Income tax expense (benefit) increased $145.2 million from an income tax benefit of $28.6 million in the second quarter of 2022 to income tax expense of $116.6 million in the second quarter of 2023. The increase in expense was primarily due to a valuation allowance recorded on our deferred tax assets of $147.9 million.

•Diluted loss per share increased to $(8.56) per share in the second quarter of 2023 from $(2.91) per share in the second quarter of 2022.

•Inventory decreased by 15.2%, or $175.8 million, from $1,159.0 million at the end of the second quarter of 2022 to $983.2 million at the end of the second quarter of 2023. This decrease is primarily due to a 5% decrease in average unit cost of on hand inventory, and a 6% decrease in units on hand.

•On May 23, 2023, our Board of Directors suspended the Company’s quarterly cash dividend. As a result, we did not declare, or pay, a quarterly cash dividend in the second quarter of 2023; compared to the quarterly cash dividend of $0.30 per common share paid in the second quarter of 2022.

See the discussion and analysis below for additional details regarding our operating results.

STORES

The following table presents stores opened and closed during the year-to-date 2023 and the year-to-date 2022:

| | | | | | | | | | | |

| | 2023 | 2022 |

| Stores open at the beginning of the fiscal year | 1,425 | | 1,431 | |

| Stores opened during the period | 4 | | 18 | |

| Stores closed during the period | (7) | | (7) | |

| Stores open at the end of the period | 1,422 | | 1,442 | |

We expect our store count at the end of 2023 to decrease by over 35 stores compared to our store count at the end of 2022.

RESULTS OF OPERATIONS

The following table compares components of our consolidated statements of operations and comprehensive income (loss) as a percentage of net sales at the end of each period:

| | | | | | | | | | | | | | |

| Second Quarter | Year-to-Date |

| 2023 | 2022 | 2023 | 2022 |

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

| Cost of sales (exclusive of depreciation expense shown separately below) | 67.0 | | 67.4 | | 66.0 | | 65.3 | |

| Gross margin | 33.0 | | 32.6 | | 34.0 | | 34.7 | |

| Selling and administrative expenses | 40.1 | | 37.9 | | 47.4 | | 36.4 | |

| Depreciation expense | 3.6 | | 2.8 | | 3.4 | | 2.7 | |

| | | | |

| Operating loss | (10.7) | | (8.1) | | (16.9) | | (4.5) | |

| Interest expense | (1.0) | | (0.3) | | (0.9) | | (0.2) | |

| Other income (expense) | 0.0 | | 0.0 | | 0.0 | | 0.0 | |

| Loss before income taxes | (11.7) | | (8.4) | | (17.8) | | (4.7) | |

| Income tax expense (benefit) | 10.2 | | (2.1) | | 2.3 | | (1.2) | |

| Net loss and comprehensive loss | (21.9) | % | (6.3) | % | (20.1) | % | (3.5) | % |

SECOND QUARTER OF 2023 COMPARED TO SECOND QUARTER OF 2022

Net Sales

Net sales by merchandise category (in dollars and as a percentage of total net sales), net sales change (in dollars and percentage), and comparable sales (“comp” or “comps”) in the second quarter of 2023 compared to the second quarter of 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter |

| ($ in thousands) | 2023 | | 2022 | | Change | | Comps |

| Furniture | $ | 263,720 | | 23.2 | % | | $ | 322,744 | | 24.0 | % | | $ | (59,024) | | (18.3) | % | | (18.5) | % |

| Seasonal | 244,359 | | 21.4 | | | 331,299 | | 24.6 | | | (86,940) | | (26.2) | | | (26.2) | |

| Food | 159,171 | | 14.0 | | | 172,513 | | 12.8 | | | (13,342) | | (7.7) | | | (5.2) | |

| Soft Home | 143,926 | | 12.6 | | | 163,672 | | 12.2 | | | (19,746) | | (12.1) | | | (11.5) | |

| Consumables | 135,197 | | 11.9 | | | 151,989 | | 11.3 | | | (16,792) | | (11.0) | | | (7.4) | |

| Apparel, Electronics, & Other | 116,592 | | 10.2 | | | 115,870 | | 8.6 | | | 722 | | 0.6 | | | 0.5 | |

| Hard Home | 76,396 | | 6.7 | | | 88,134 | | 6.5 | | | (11,738) | | (13.3) | | | (11.8) | |

| Net sales | $ | 1,139,361 | | 100.0 | % | | $ | 1,346,221 | | 100.0 | % | | $ | (206,860) | | (15.4) | % | | (14.6) | % |

We periodically assess, and make minor adjustments to, our product hierarchy, which can impact the roll-up of our merchandise categories. Our financial reporting process utilizes the most current product hierarchy in reporting net sales by merchandise category for all periods presented. Therefore, there may be minor reclassifications of net sales by merchandise category compared to previously reported amounts.