Avista Requests Natural Gas and Electric Price Adjustments in Idaho

September 14 2006 - 5:30PM

PR Newswire (US)

SPOKANE, Wash., Sept. 14 /PRNewswire-FirstCall/ -- Avista

(NYSE:AVA) today filed two requests with the Idaho Public Utilities

Commission (IPUC) to increase natural gas rates and two requests to

adjust electric rates. Avista requested a Nov. 1, 2006, effective

date for all rate changes. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO ) In its

natural gas filings, Avista requested an annual purchased gas cost

adjustment (PGA) increase of 3.2 percent, or $2.7 million in annual

revenues. Also filed was a request to increase the rate charged to

fund natural gas conservation programs, resulting in an average

increase of 1.4 percent and generating an additional $1.1 million

per year to fund these important programs. Avista Utilities would

make no additional profits from either of these requested rate

changes. PGAs are filed each year to reflect changes in the cost of

natural gas purchased by the company to serve its customers.

Avista's requested PGA reflects a continued increase in the

wholesale price of natural gas during the past year. While the

price of natural gas has fallen from the post-hurricane levels

during late-2005, the average cost of gas for this next year is

higher than the average cost of gas during the past year. As a gas

distribution company, Avista passes through directly, without

markup, changes in natural gas commodity prices to consumers. The

second requested natural gas rate adjustment is to provide

additional funding for Avista's conservation programs to serve

increasing customer participation. The program, in place since

2001, provides for partial financial reimbursement to customers who

install certain conservation measures and use less natural gas as a

result. To date, the program has saved 4.5 million annual therms of

natural gas, that's enough natural gas to supply 5,300 homes for a

year. If both requests are approved by the IPUC, a residential or

small commercial natural gas customer using an average of 65 therms

per month can expect to see an average increase of $3.48 per month,

or about 4.3 percent, for a total monthly bill of $83.91. Larger

commercial and industrial customers can expect to see an average

increase of 4.7 percent and 5.0 percent respectively. The higher

increase percentages for larger commercial and industrial customers

are due to lower base rates. In its electric filings, Avista has

requested the IPUC to increase the credit used to pass through

benefits from the Bonneville Power Administration (BPA) Residential

Exchange Program. The BPA program provides residential and small

farm customers in the Northwest a share of the benefits associated

with federal hydroelectric projects. The result to customers is a

proposed 0.75 percent decrease in electric rates or a monthly

reduction of $0.47 for a residential customer using 1,000

kilowatt-hours. Avista has also filed a request to sunset the 1.45

percent or $0.91 per month credit that residential customers have

been receiving from the company's May 2000 sale of the Centralia

Power Plant located near Centralia, Wash. The customer portion of

the gain is expected to be fully refunded to customers by Nov. 1,

2006. The total benefit to customers over the last six years has

been $15.1 million. If both electric requests are approved by the

IPUC, a residential electric customer in Idaho using 1,000

kilowatt-hours per month can expect to see a $0.44 or 0.70 percent

increase per month for a total monthly bill of $63.35. "Avista

continues to offer a number of programs to assist both our electric

and natural gas customers in managing their energy bills," said

Scott Morris, Avista Corp president and chief operating officer and

president of Avista Utilities. "I encourage our customers to visit

http://www.avistautilities.com/ or call us at (800) 227-9187 for

information on Avista's energy assistance programs, conservation

tips and bill payment plans." Avista is an energy company involved

in the production, transmission and distribution of energy as well

as other energy-related businesses. Avista Utilities is a company

operating division that provides service to 339,000 electric and

298,000 natural gas customers in three western states. Avista's

non-regulated subsidiaries include Avista Advantage and Avista

Energy. Avista Corp.'s stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista Corp.

logo are trademarks of Avista Corporation. This news release

contains forward-looking statements, including statements regarding

expected rates and costs for electricity and natural gas. Such

statements are subject to a variety of risks, uncertainties and

other factors, most of which are beyond the company's control, and

many of which could have a significant impact on the company's

operations, results of operations and financial condition, and

could cause actual results to differ materially from those

anticipated. For a further discussion of these factors and other

important factors, please refer to the company's Annual Report on

Form 10-K for the year ended Dec. 31, 2005 and Quarterly Report on

Form 10-Q for the quarter ended June 30, 2006. The forward-looking

statements contained in this news release speak only as of the date

hereof. The company undertakes no obligation to update any

forward-looking statement or statements to reflect events or

circumstances that occur after the date on which such statement is

made or to reflect the occurrence of unanticipated events. New

factors emerge from time to time, and it is not possible for

management to predict all of such factors, nor can it assess the

impact of each such factor on the company's business or the extent

to which any such factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statement.

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

Media, Catherine Markson, +1-509-495-2916, or , or Investors, Jason

Lang, +1-509-495-2930, or , or Avista 24/7 Media Access,

+1-509-495-4174, all of Avista Web site:

http://www.avistautilities.com/ Web site:

http://www.avistacorp.com/

Copyright

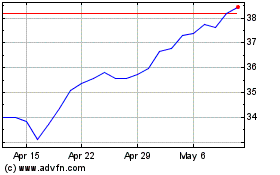

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

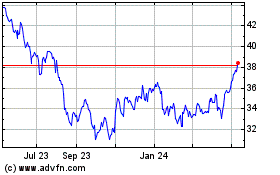

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024