Cincinnati Estimates Cat Loss - Analyst Blog

October 12 2011 - 11:33AM

Zacks

Yesterday, property and casualty insurer Cincinnati

Financial Corp. (CINF) declared a preliminary pre-tax

catastrophe loss (cat loss) estimate of about $88–$98 million,

which will be reflected in its third quarter 2011 results.

The losses mainly emanated from Hurricane Irene and other

catastrophes.

The Cincinnati, Ohio-based company stated that catastrophes

affected its loss ratio by an average of 4.9 % for the third

quarter and 4.4% on a full-year basis over the past decade.

However, the impact of the recent catastrophe on the third quarter

loss ratio will be approximately 11.5% to 12.5%, significantly

higher than the historical average.

In the previous quarter, Cincinnati incurred huge storm losses

of $290 million and reported an operating loss of 57 cents per

share, which was, however, narrower than the Zacks Consensus

Estimate of a loss of 64 cents per share.

Cincinnati’s use of reinsurance cover will, however, limit its

loss. Sensing a high catastrophe activity, the company has

replenished its catastrophe coverage for the remainder of 2011. The

company’s current program provides coverage for any single

catastrophe that causes losses above $70 million and up to $200

million, and coverage remains in place for losses up to $500

million.

Other property and casualty insurers who suffered from bad

weather during the third quarter include Assurant

Inc. (AIZ), The Chubb Corp. (CB),

W. R. Berkley Corp. (WRB) and Tower Group

Inc. (TWGP). While Assurant forecasts a pre-tax cat loss

of $80 million to $85 million, Chubb sees a significantly high

catastrophe loss of $400 million to $475 million pre-tax. Besides,

both Berkley and Tower expect an earnings hit of $50 – $60

million.

According to the Insurance Information Institute, the property

and casualty industry was hit hard during the first half of the

year, as profitability suffered greatly amid high cat losses. In

the third quarter, hurricane Irene along with other catastrophes is

estimated to have caused insured losses of $3 billion to $4 billion

to the industry.

Year to date, weather-related losses for the industry are

expected to trend above $25 billion, up $14.1 billion compared with

the cat losses incurred in first-half 2010 and about thrice the

$7.7 billion average for first-half catastrophe losses during the

past ten years.

However, the only silver lining to these catastrophe activities

is that the record high losses are gradually hardening the

commercial lines pricing. Also, the recent market surveys by the

CIAB (Council of Insurance Agents and Brokers) and MarketScout have

indicated that the moderation of declining commercial lines pricing

is accelerating, while select commercial lines pricing is

witnessing rate increases in certain lines.

Almost 67% of the projected cat loss is attributable to

Cincinnati’s Commercial Lines business, which is also its biggest

business segment. The unit’s business exposure in the states of

North Carolina and Virginia, which suffered from wind storms have

caused a considerable loss. Moreover, the segment has been

suffering from pricing pressure for the past several years.

Though the commercial lines rate is expected to harden, in the

most recent conference call management noted price increases across

certain areas (workers’ comp & E&S lines). Management also

noted a continued pricing pressure in large account business, which

is restraining the company’s commercial lines pricing. Moreover,

management guided a lackluster across-the-board pricing improvement

for all its lines.

Cincinnati’s Personal Line segment, which consists of Personal

auto, homeowners and other lines, had also underperformed from 2006

to 2009. However, with an improvement in new business levels,

strong retention levels, as well as rate increases that affected

the homeowner line in 2009, the segment has recently been

witnessing premium growth.

Though management is looking to diversify property risks by

writing more business in newer states (that carry lower inherent

cat risk), we think this effort will take time before any

noticeable benefit shows up in margins. Meanwhile, underwriting

could be subject to volatility if the storm activity remains at

historically high levels.

Despite the operating headwinds, Cincinnati has been able to

keep its long-standing dividend increase streak (50 years and

counting) intact this year, thus maintaining its attractiveness to

the investors. But given the weakness surrounding the company’s

business, we think that dividend alone will not be sufficient to

encourage investors to remain invested over the long

term.

Considering Cincinnati’s uncertain operating environment, we are

currently maintaining an Underperform recommendation. We may

revisit our recommendation if the third quarter earnings release

throws more positive light on the company’s operating

environment.

ASSURANT INC (AIZ): Free Stock Analysis Report

CHUBB CORP (CB): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

TOWER GROUP INC (TWGP): Free Stock Analysis Report

BERKLEY (WR) CP (WRB): Free Stock Analysis Report

Zacks Investment Research

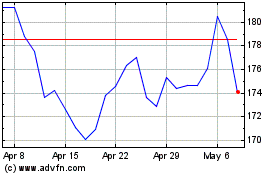

Assurant (NYSE:AIZ)

Historical Stock Chart

From May 2024 to Jun 2024

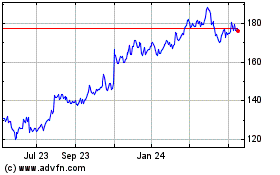

Assurant (NYSE:AIZ)

Historical Stock Chart

From Jun 2023 to Jun 2024