High Cat Loss Hurts Assurant's 2Q - Analyst Blog

July 28 2011 - 8:30AM

Zacks

Assurant Inc. (AIZ) has reported second quarter

2011 operating earnings of 76 cents per share, missing the Zacks

Consensus Estimate by 8 cents and significantly lagging the

prior-year quarter’s earnings of $1.35 per share. The quarter’s

results were hit by high catastrophe loss (cat loss) incidence and

a weak performance at the company’s health unit.

Total revenue for the reported quarter stood at $2.1 billion,

down 3.6% year over year. Lower earned premiums, along with a

decrease in net investment income, primarily accounted for the

decline.

Net earned premiums fell 4.4% year over year to $1.8 billion

owing to a decline in premium across all the business segments. Net

investment income inched down 0.8% to $173.8 owing to a drop in

yields, while the invested assets remained stable.

SegmentPerformance

Year over year, net operating income at Assurant

Solutions increased 31% to $39.7 million, primarily due to

stronger business from international operations and stable preneed

results. Net earned premiums inched down 1% to $679.5 million,

primarily owing to continued run-off of the domestic credit

business and service contract from old customers.This decline was

partly offset by premium growth in both domestic as well as

international units.

Assurant Specialty Property’s

net operating income plunged 59% year over year to $42.6 million.

The drop was primarily caused by $42.7 million of cat loss, coupled

with higher loss frequency from non-catastrophe events. Net

earned premiums decreased 3.0% to $483.3 million due to an increase

in ceded premiums coupled with higher cat reinsurance premium,

partly offset by a growth in creditor-placed homeowners as well as

flood and renters insurance.

Net premiums earned at Assurant Health fell

9.0% year over year to $434.3 million. This was attributable to

premium rebate accrual, partly offset by an increase in premium

from affordable choice and supplemental products. Net operating

income dropped 79% year over year to $5.2 million due to $10.9

million of after-tax accrual of premium rebates associated with the

minimum medical ratio requirement provisions as stated by the

Health Care Reform Act. Assurant Health competes with companies

like CIGNA Corp. (CI) and

Aetna Inc. (AET).

Year over year, Assurant Employee Benefits’ net

premiums earned slipped 4.0% to $270.6 million due to pricing

actions on a block of assumed disability business and lower sales

in 2010, partly mitigated by premium growth in voluntary and

supplemental products. Net operating income dropped significantly

by 31% to $8.5 million on the back of lower favorable loss

experience and low disability incidence.

The financial position of Assurant remains strong with $4.5

billion of equity capital, unchanged from the level at 2010 end.

The company maintains a low leverage ratio of 17.8% and has no debt

maturing until 2014.

Book value per share, excluding accumulated other comprehensive

income, increased 7.1% to $46.16 from $43.08 at December 31, 2010.

The company repurchased 3 million shares during the quarter at a

total cost of $110.4 million.

During the quarter under review, Assurant increased dividend by

13% to 18 cents, representing its eighth dividend increase since it

went public in 2004.

During the quarter, Assurant also entered into a comprehensive

catastrophe (CAT) reinsurance program to shield itself from

losses that looms ahead as an above-average hurricane season this

year. The program is intended to provide the shareholders with an

acceptable return on the risks assumed in the company’s property

business, and to reduce variability of earnings while providing

protection to its customers.

Based in New York’s financial district, Assurant competes with

Principal Financial Group Inc.

(PFG), Loews Corp.

(L), and Conesco Inc.

(CNO) among others.

ASSURANT INC (AIZ): Free Stock Analysis Report

CNO FINL GRP (CNO): Free Stock Analysis Report

LOEWS CORP (L): Free Stock Analysis Report

PRINCIPAL FINL (PFG): Free Stock Analysis Report

Zacks Investment Research

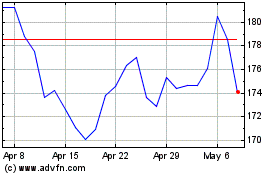

Assurant (NYSE:AIZ)

Historical Stock Chart

From May 2024 to Jun 2024

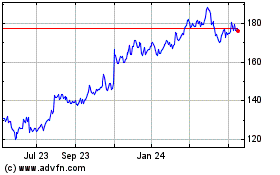

Assurant (NYSE:AIZ)

Historical Stock Chart

From Jun 2023 to Jun 2024