Armada Hoffler Properties Provides September Rent Collection Update

September 24 2020 - 6:00AM

Armada Hoffler Properties, Inc. (NYSE: AHH) today provided an

update on rent collections for September. As of September 22nd, the

Company collected 94% of total portfolio rents due for the month;

office tenants paid 100%, multifamily tenants paid 95%, and retail

tenants paid 90%.

“We are pleased to report continued and sustained improvement in

our portfolio rent collections,” said Louis Haddad, President &

CEO. “Collections for the month of September are ahead of our prior

month’s pace across the portfolio and we anticipate finishing the

quarter with over 96% of portfolio rents collected. These results

coupled with added liquidity provide us further confidence as we

turn our attention to growing our asset base through acquisitions

and ground-up development.”

Monthly rent collections by tenant type and in the aggregate

across the Company’s portfolio are presented in the below

table:

|

|

Rent Collected as a % of Monthly Billings |

|

|

Full Month |

As of |

|

Tenant Type(1) |

July 2020 |

August 2020 |

September

22, 2020 |

|

Office |

100% |

100% |

100% |

|

Multifamily |

99% |

97% |

95% |

|

Retail |

92% |

92% |

90% |

|

Portfolio |

96% |

96% |

94% |

|

(1) May differ from financial reporting segment groupings for

tenants in mixed-use properties. |

About Armada

Hoffler Properties, Inc. Armada

Hoffler Properties, Inc. (NYSE: AHH) is a vertically-integrated,

self-managed real estate investment trust ("REIT") with four

decades of experience developing, building, acquiring, and managing

high-quality, institutional-grade office, retail, and multifamily

properties located primarily in the Mid-Atlantic and Southeastern

United States. In addition to developing and building properties

for its own account, the Company also provides development and

general contracting construction services to third-party clients.

Founded in 1979 by Daniel A. Hoffler, the Company has elected to be

taxed as a REIT for U.S. federal income tax purposes. For more

information, visit ArmadaHoffler.com.

Forward-Looking

StatementsCertain matters within this press release are

discussed using forward-looking language as specified in the

Private Securities Litigation Reform Act of 1995, and, as

such, may involve known and unknown risks, uncertainties and other

factors that may cause the actual results or performance to

differ from those projected in the forward-looking statements. When

used, the words "anticipate," "believe," "expect," "intend,"

"may," "might," "plan," "estimate," "project," "should," "will,"

"result," and similar expressions, which do not relate solely

to historical matters, are intended to identify forward-looking

statements. Forwarding-looking statements may include, but are

not limited to, comments relating to the Company’s development

pipeline, the timing of future dividend payments, if any, the

Company’s construction and development businesses, including

backlog, timing of deliveries and estimated costs, and the

Company’s expectations and projections, including estimated

rent collections, the estimated construction segment gross profit

range, projected mezzanine loan interest income and expected

financing activities such as issuances under the Company’s

at-the-market equity offering program. The Company’s

actual future results and trends may differ materially from

expectations depending on a variety of factors discussed in the

Company’s filings with the Securities and Exchange

Commission (the “SEC”). These factors include, without limitation:

(a) the impact of the coronavirus (COVID-19) pandemic on

macroeconomic conditions and economic conditions in the markets in

which the Company operates, including, among others: (i)

disruptions in, or a lack of access to, the capital markets or

disruptions in the Company’s ability to borrow amounts subject

to existing construction loan commitments; (ii) adverse impacts to

the Company’s tenants’ and other third parties’ businesses and

financial condition that adversely affect the ability and

willingness of the Company’s tenants and other third parties

to satisfy their rent and other obligations to the Company,

including deferred rent; (iii) the ability and willingness of

the Company’s tenants to renew their leases with the Company

upon expiration of the leases or to re-lease the Company’s

properties on the same or better terms in the event of

nonrenewal or early termination of existing leases; and (iv)

federal, state and local government initiatives to mitigate

the impact of the COVID-19 pandemic, including additional

restrictions on business activities, shelter-in-place orders

and other restrictions, and the timing and amount of economic

stimulus or other initiatives; (b) the Company’s ability to

continue construction on development and construction projects, in

each case on the timeframes and on terms currently

anticipated; (c) the Company’s ability to accurately assess and

predict the impact of the COVID-19 pandemic on the amount and

timing of rent collections, results of operations, financial

condition, acquisition and disposition activities and growth

opportunities; (d) the Company’s ability to maintain

compliance with the covenants under its existing debt agreements or

to obtain modifications to such covenants from the applicable

lenders; and (e) the information under the heading “Risk Factors”

included in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2019 and in other filings the

Company makes from time to time with the SEC, including

the Company’s Current Report on Form 8-K filed with the SEC on

April 2, 2020.

Contact:Michael P. O’HaraArmada Hoffler

Properties, Inc.Chief Financial Officer, Treasurer, and

SecretaryEmail: MOHara@ArmadaHoffler.com Phone: (757) 366-6684

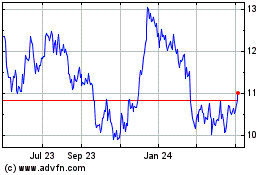

Armada Hoffler Properties (NYSE:AHH)

Historical Stock Chart

From Oct 2024 to Nov 2024

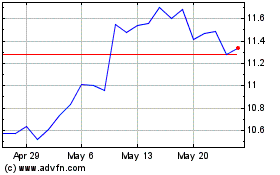

Armada Hoffler Properties (NYSE:AHH)

Historical Stock Chart

From Nov 2023 to Nov 2024