Armada Hoffler Announces Commencement of Public Offering of 6.75% Series A Preferred Stock

August 13 2020 - 9:53AM

Armada Hoffler Properties, Inc. (NYSE: AHH) (the “Company”)

announced today that it has commenced an underwritten public

offering of its 6.75% Series A Cumulative Redeemable Perpetual

Preferred Stock (the “Series A Preferred Stock”). The Company

expects to grant the underwriters a 30-day option to purchase

additional shares of Series A Preferred Stock.

This offering is a re-opening of the Company’s

previous issuances of Series A Preferred Stock. The additional

shares of Series A Preferred Stock sold in this offering will form

a single series, and be fully fungible, with the outstanding shares

of Series A Preferred Stock. The Series A Preferred Stock is listed

on the New York Stock Exchange under the symbol “AHHPrA.”

The Company intends to use the net proceeds from

the offering to repay outstanding indebtedness, including amounts

outstanding under its unsecured revolving credit facility, to fund

potential acquisitions and/or for general corporate purposes and

working capital, including development, redevelopment, construction

and other commitments.

BofA Securities, Raymond James and Jefferies are

acting as joint book-running managers for the offering. Janney

Montgomery Scott is acting as co-manager for the offering.

The offering is being made pursuant to a shelf

registration statement on Form S-3 that became automatically

effective upon filing with the Securities and Exchange Commission

on March 9, 2020. A preliminary prospectus supplement relating to

the offering will be filed by the Company with the Securities and

Exchange Commission. This press release shall not constitute an

offer to sell or a solicitation of an offer to buy, nor shall there

be any sale of these securities, in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

Copies of the preliminary prospectus supplement

and related prospectus relating to the offering may be obtained

from BofA Securities, Inc., Attention: Prospectus Department, 200

North College Street, 3rd Floor, Charlotte, NC 28255, by telephone

at (800) 294-1322 or by email at dg.prospectus_requests@bofa.com;

from Raymond James & Associates, Inc., Attention: Equity

Syndicate, 880 Carillon Parkway, St. Petersburg, Florida 33716, by

telephone at (800) 248-8863 or by e-mail at

prospectus@raymondjames.com; and from Jefferies LLC, Attention:

Equity Syndicate Prospectus Department, 520 Madison Avenue, 2nd

Floor, New York, New York 10022, by email at

Prospectus_Department@Jefferies.com, or by telephone at (877)

547-6340.

Forward-Looking Statements

Certain matters within this press release are

discussed using forward-looking language as specified in the

Private Securities Litigation Reform Act of 1995, and, as such, may

involve known and unknown risks, uncertainties, and other factors

that may cause the actual results or performance to differ from

those projected in the forward-looking statements. These statements

relate to the Company’s offering of preferred stock and the

anticipated use of the net proceeds therefrom. No assurance can be

given that the offering will be completed on the terms described,

or at all, or that the net proceeds from the offering will be used

as indicated. Completion of the offering on the terms described,

and the application of net proceeds, are subject to numerous

conditions, many of which are beyond the control of the Company,

including market conditions, general economic conditions and other

factors, including those set forth under the heading “Risk Factors”

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2019 and Quarterly Report on Form 10-Q for the

quarter ended March 31, 2020 and the other documents filed by the

Company with the Securities and Exchange Commission from time to

time.

About Armada Hoffler Properties,

Inc.

Armada Hoffler Properties, Inc. (NYSE: AHH) is a

vertically-integrated, self-managed real estate investment trust

(“REIT”) with four decades of experience developing, building,

acquiring, and managing high-quality, institutional-grade office,

retail, and multifamily properties located primarily in the

Mid-Atlantic and Southeastern United States. In addition to

developing and building properties for its own account, the Company

also provides development and general contracting construction

services to third-party clients. Founded in 1979 by Daniel A.

Hoffler, the Company has elected to be taxed as a REIT for U.S.

federal income tax purposes.

Contact:

Michael P. O’HaraArmada Hoffler Properties, Inc.

Chief Financial Officer, Treasurer, and SecretaryEmail:

MOHara@ArmadaHoffler.com Phone: (757) 366-6684

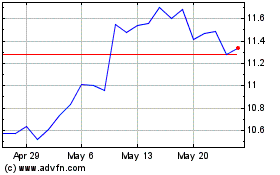

Armada Hoffler Properties (NYSE:AHH)

Historical Stock Chart

From Oct 2024 to Nov 2024

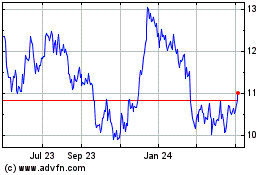

Armada Hoffler Properties (NYSE:AHH)

Historical Stock Chart

From Nov 2023 to Nov 2024