Growth Worries Replace Debt Fear - Analyst Blog

August 02 2011 - 4:49AM

Zacks

It is amazing to see how fast the markets have started to look past

the Debt Deal even as it has yet to become to the law of the land.

We will likely get the President's signature on the bill after the

Senate passes it later today; the House passed it Monday

evening.

With default no longer a concern but a rating downgrade that may

still be in the cards, stocks have moved on to fretting about the

growth question. And there are plenty of reasons for investors to

keep an eye on the U.S. economy's growth outlook.

The market was looking for a rebound in economic growth in the back

half of the year after the first half fell victim to what appeared

to be temporary factors such as high gasoline prices, theJapan

disaster and unusual weather. Friday's GDP report showed us that

growth in the first half of the year was even weaker than what we

thought we had.

This meant that the U.S. economy has entered the second half of the

year with a lot less momentum than all of us had expected. Add to

this the weak July ISM Manufacturing report from Monday, and we

have a less than reassuring start to the third quarter.

Will GDP growth expectations for the third quarter, which currently

remain above 3%, come down in the coming days or we will start

seeing evidence of above-trend growth in the days to come? It is

hard to answer that question with any level of certainty at this

stage. The July non-farm payroll numbers coming out this Friday may

help a little in answering it. But my feeling is that we may have

to wait a bit longer than that.

In contrast to the erratic behavior of the economic recovery since

the end of the Great Recession in the summer of 2009, the corporate

earnings recovery has been a standout performer. We are still going

through the second-quarter reporting season, but I have no

hesitation in saying that earnings reports in the first half of the

year have been signficantly better than what the underlying economy

has done. Given this track record, it may not be unreasonable to

extrapoloate this performance to the back half of the year.

We are more than two-thirds done with the second quarter earnings

reports, but we had results from a handful of important companies

this morning. Drug giant

Pfizer (PFE) beat EPS

expectations by a penny on lower taxes as revenue came inline with

expectations.

Coach (COH), the handbag maker, came

ahead of EPS expectations on inline top-line results.

Archer Daniels Midland (ADM) missed earnings

expectations as revenue gains were offset by compressed by

processing margins.

ARCHER DANIELS (ADM): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

PFIZER INC (PFE): Free Stock Analysis Report

Zacks Investment Research

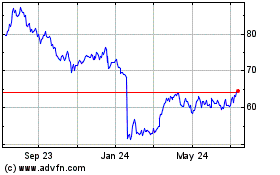

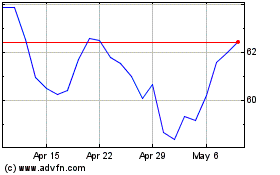

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2024 to Jun 2024

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Jun 2023 to Jun 2024