Form 8-K - Current report

September 17 2024 - 4:47PM

Edgar (US Regulatory)

0001824502FALSESan JoseCA00018245022024-09-162024-09-160001824502us-gaap:CommonClassAMember2024-09-162024-09-160001824502us-gaap:WarrantMember2024-09-162024-09-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: September 16, 2024

Archer Aviation Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39668 | | 85-2730902 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

| 190 W. Tasman Drive | | |

San Jose, CA | | 95134 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 650-272-3233

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | ACHR | | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | | ACHR WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events.

Pursuant to Archer Aviation Inc.’s (the “Company”) shelf registration statement on Form S-3 (File No. 333-279289), which was declared effective by the U.S. Securities and Exchange Commission on May 16, 2024, including the prospectus supplement dated September 16, 2024, and accompanying prospectus, the Company will issue up to $5,000,000 of shares of the Company’s Class A common stock, par value $0.0001 per share (“Class A common stock”) in satisfaction of payment to a service provider for services rendered (the “Vendor Shares”). The Company entered into a legal fee and retainer letter with the service provider on September 16, 2024, providing for the issuance of the Vendor Shares. A copy of the opinion of Fenwick & West LLP relating to the validity of the Vendor Shares is filed herewith as Exhibit 5.1.

The number of Vendor Shares to be issued will be equal to the dollar amount due to the service provider on the relevant payment date, divided by the volume weighted average trading price for a share of Class A common stock during the five (5) consecutive trading day period ending on (and including) the last trading date prior to the applicable payment date (as adjusted for any share splits, reverse splits, share dividends, rights issuances, subdivisions, reorganizations and recapitalization).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| 5.1 | | |

| 23.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ARCHER AVIATION INC. |

| Date: September 17, 2024 | | |

| By: | /s/ Eric Lentell |

| Name: | Eric Lentell |

| Title: | General Counsel and Secretary |

Exhibit 5.1 September 17, 2024 Archer Aviation Inc. 190 West Tasman Drive San Jose, California 95134 Ladies and Gentlemen: As counsel to Archer Aviation Inc. (the “Company”), we deliver this opinion with respect to certain matters in connection with the offering by the Company of up to $5,000,000 of shares (the “Shares”) of the Company’s Class A common stock, $0.0001 par value per share , to be issued and sold pursuant to that certain legal fee and retainer letter (the “Agreement”), dated September 16, 2024, between the Company and Fenwick & West LLP. The Shares were registered pursuant to the Registration Statement on Form S-3 (File No. 333-279289) filed by the Company with the Securities and Exchange Commission (the “Commission”) on May 10, 2024 and declared effective on May 16, 2024 (the registration statement at the time it was declared effective, including the documents or portions thereof incorporated by reference therein, as modified or superseded as described therein, and the information deemed to be a part thereof pursuant to Rule 430B under the Securities Act of 1933, as amended (the “Securities Act”), the “Registration Statement”) under the Securities Act, including the prospectus dated May 16, 2024 included therein (the “Base Prospectus”) as supplemented by the final prospectus supplement, dated September 16, 2024, filed with the Commission pursuant to Rule 424(b) under the Securities Act (the “Prospectus Supplement” and, together with the Base Prospectus, the “Prospectus”). The offering of the Shares by the Company pursuant to the Registration Statement, the Prospectus and the Agreement is referred to herein as the “Offering.” This opinion is being furnished in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act, and no opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement or related Prospectus, other than as expressly herein with respect to the issue of the Shares. As to matters of fact relevant to the opinions rendered herein, we have examined such documents, certificates and other instruments which we have deemed necessary or advisable, including a certificate addressed to us and dated the date hereof executed by the Company. We have not undertaken any independent investigation to verify the accuracy of any such information, representations or warranties or to determine the existence or absence of any fact, and no inference as to our knowledge of the existence or absence of any fact should be drawn from our representation of the Company or the rendering of the opinions set forth below. We have not considered parol evidence in connection with any of the agreements or instruments reviewed by us in connection with this letter. In our examination of documents for purposes of this letter, we have assumed, and express no opinion as to, the genuineness and authenticity of all signatures on original documents, the authenticity and completeness of all documents submitted to us as originals, that each document is what it purports to be, the conformity to originals of all documents submitted to us as copies or facsimile copies, the absence of any termination, modification or waiver of or amendment to any document reviewed by us (other than as has been disclosed to us), the legal competence or capacity of all persons or entities (other than the Company) executing the same and (other than the Company) the due authorization, execution

and delivery of all documents by each party thereto. We have also assumed the conformity of the documents filed with the Commission via the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”), except for required EDGAR formatting changes, to physical copies submitted for our examination. The opinions in this letter are limited to the existing General Corporation Law of the State of Delaware now in effect (the “Applicable Laws”). We express no opinion with respect to any other laws. In connection with our opinions expressed below, we have assumed that, (i) at or prior to the time of the issuance and delivery of the Shares, there will not have occurred any change in the law or the facts affecting the validity of the Shares, (ii) at the time of the offer, issuance and sale of the Shares, no stop order suspending the Registration Statement’s effectiveness will have been issued and remain in effect, (iii) no future amendments will be made to the Company’s current certificate of incorporation (as amended from time to time, the “Certificate of Incorporation”), or the Company’s Amended and Restated Bylaws (the “Bylaws” and, together with the Certificate of Incorporation, the “Charter Documents”) that would be in conflict with or inconsistent with the Company’s right and ability to issue the Shares and (iv) at the time of the issuance and sale of the Shares, the Company will be validly existing as a corporation and in good standing under the laws of the State of Delaware. We express no opinion regarding the effectiveness of any waiver or stay, extension or of unknown future rights. Further, we express no opinion regarding the effect of provisions relating to indemnification, exculpation or contribution to the extent such provisions may be held unenforceable as contrary to federal or state securities laws or public policy. Based upon the foregoing, and subject to the qualifications and exceptions contained herein, we are of the opinion that the Shares, when issued, sold and delivered in the manner and for the consideration stated in the Registration Statement and the Prospectus and in accordance with the resolutions adopted by the Company’s board of directors and the pricing committee thereof, will be validly issued, fully paid and nonassessable. We consent to the use of this opinion as an exhibit to the Current Report on Form 8-K to be filed by the Company with the Commission in connection with the offering of the Shares and further consent to all references to us, if any, in the Registration Statement, the Prospectus and any amendments or supplements thereto. In giving this consent we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder. [Concluding Paragraph Follows on Next Page]

This opinion is intended solely for use in connection with the issuance and sale of the Shares subject to the Registration Statement and is not to be relied upon for any other purpose. In providing this letter, we are opining only as to the specific legal issues expressly set forth above, and no opinion shall be inferred as to any other matter or matters. This opinion is rendered on, and speaks only as of, the date of this letter first written above, is based solely on our understanding of facts in existence as of such date after the aforementioned examination and does not address any potential changes in facts, circumstance or law that may occur after the date of this opinion letter. We assume no obligation to advise you of any fact, circumstance, event or change in the law or the facts that may hereafter be brought to our attention, whether or not such occurrence would affect or modify any of the opinions expressed herein. Very truly yours, /s/ Fenwick & West LLP FENWICK & WEST LLP

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

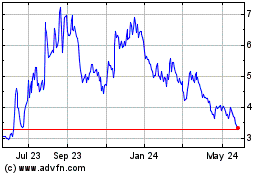

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Sep 2024 to Oct 2024

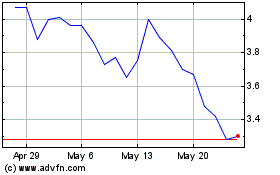

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Oct 2023 to Oct 2024