Current Report Filing (8-k)

December 16 2020 - 5:30PM

Edgar (US Regulatory)

falsefalseAIMCO PROPERTIES, L.P.00009228640000926660MDDECOCO 0000922864 2020-12-16 2020-12-16 0000922864 aiv:AIMCOPropertiesLPMember 2020-12-16 2020-12-16

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 16, 2020

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

MARYLAND (Apartment Investment and Management Company)

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

|

SUITE 1450, DENVER, CO 80237

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (303)

224-7900

(Former name or Former Address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Investment and Management Company Class A Common Stock

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange act. ☐

|

|

Entry into a Material Definitive Agreement.

|

On December 1

6

, 2020, Apartment Investment and Management Company, a Maryland corporation (“Aimco”), AIMCO OP L.P., a Delaware limited partnership (“Aimco OP”), and certain subsidiaries of Aimco OP (the “Collateral Pool Loan Parties,” and, collectively with Aimco and Aimco OP, the “Loan Parties”) entered into a credit agreement (the “Credit Agreement”) with the lenders from time to time party thereto and PNC Bank, National Association, as administrative agent (in such capacity, the “Administrative Agent”), swingline loan lender and letter of credit issuing lender.

The Credit Agreement provides for a new $150

,000,000

secured revolving credit facility (the “Revolving Credit Facility”), including a $20,000,000 swingline loan

sub-facility

and a $30,000,000 letter of credit

sub-facility.

Aimco OP may from time to time request incremental commitments under the Revolving Credit Facility in an aggregate principal amount of $300,000,000, subject to the satisfaction of customary conditions, provided that any proposed incremental lender offered or approached to provide all or a portion of any incremental commitments may elect or decline, in its sole discretion, to provide such incremental commitments. The commitments under the Revolving Credit Facility expire on December [1

6

], 2023, but may be extended at the option of the Aimco OP by up to two twelve-month periods, subject to the satisfaction of customary conditions. The proceeds of loans made under the Revolving Credit Facility may be used only for working capital, general corporate purposes, including investments permitted under the Credit Agreement, to refinance indebtedness of any Loan Parties or subsidiaries of any Loan Parties, and as otherwise permitted by applicable law and the organizational documents of the Loan Parties.

The obligations of the Loan Parties under the Credit Agreement and the other loan documents are secured by mortgages or deeds of trust on certain parcels of real estate owned by the Collateral Pool Loan Parties (the “Collateral Pool Properties”). After giving effect to any borrowing of revolving loans or swingline loans or the issuance of any letter of credit under the Revolving Credit Facility, the outstanding amount of revolving loans and swingline loans and the aggregate amount available to be drawn under all outstanding letters of credit issued under the Revolving Credit Facility (collectively, the “Revolving Facility Usage”) may not exceed 55% of the “as is” values of the Collateral Pool Properties, as determined by the most recently delivered appraisals commissioned, reviewed and approved by the Administrative Agent (the “Borrowing Base Amount”).

Revolving loans (other than swingline loans) made under the Revolving Credit Facility will bear interest, at the borrowers’ option, at a per annum rate equal to (a) LIBOR plus a margin of 2.00% or (b) a base rate plus a margin of 1.00%. Swingline loans made under the Revolving Credit Facility will bear interest at a per annum rate equal to the base rate plus a margin of 1.00%. The base rate is defined as a fluctuating per annum rate of interest equal to the highest of (x) the overnight bank funding rate as reported by the Federal Reserve Bank of New York, plus 0.5%, (y) PNC Bank, National Association’s prime rate and

(z) one-month

LIBOR plus 1.00%. In connection with the issuance of letters of credit under the Revolving Credit Facility, the borrowers are required to pay (i) a fee to the Administrative Agent for the ratable account of the lenders equal to (A) LIBOR plus a margin of 2.00% times (B) the daily amount available to be drawn under each such letter of credit and (ii) a

one-time

issuance fee to the issuing lender for its own account equal to (A) 0.125% times (B) the face amount of each such letter of credit. In addition, the borrowers will pay an unused commitment fee equal to the Revolving Facility Usage (computed to exclude therefrom the full amount of the outstanding swingline loans) times (1) 0.25% per annum if the Revolving Facility Usage (computed to exclude therefrom the full amount of the outstanding swingline loans) is less than or equal to 50% of the aggregate commitments under the Revolving Credit Facility then in effect, or (2) 0.20% per annum if the Revolving Facility Usage (computed to exclude therefrom the full amount of the outstanding swingline loans) is greater than 50% of the aggregate commitments under the Revolving Credit Facility then in effect. The Credit Agreement contains customary provisions for the replacement of LIBOR with an alternative benchmark interest rate (plus, if applicable, a spread adjustment) in the event that the London interbank offered rate is no longer available or in certain other circumstances.

Aimco OP may terminate or, from time to time, reduce the aggregate amount of commitments under the Revolving Credit Facility; provided that no such termination or reduction of commitments shall be permitted if, after giving effect thereto and to any prepayments of revolving loans made at such time, the Revolving Facility Usage would exceed the aggregate commitments under the Revolving Credit Facility. The borrowers may prepay revolving loans from time to time without premium or penalty (except for customary compensation for

LIBOR breakage costs). If the Revolving Facility Usage exceeds the Borrowing Base Amount, the borrowers are required to repay revolving loans in a principal amount equal to such excess within one business day after learning of such excess.

The Credit Agreement contains customary representations and warranties and affirmative and negative covenants, including (subject to specified exclusions) limitations on the ability of Aimco OP or any Collateral Pool Loan Party to incur debt, create liens or become a party to any merger or consolidation; limitations on the ability of any Loan Party to pay dividends, repurchase equity interests or make other distributions to the holders of its equity interests if a default has occurred or is continuing or would result therefrom, enter into transactions with affiliates or amend its organizational documents; and limitations on the ability of any Collateral Pool Loan Party to acquire all or substantially all of the assets or equity interests of any other person or entity, own or create any subsidiary, become party to any joint venture or permit any material change in its business. In addition, Aimco may not (a) cease to have its common stock listed on any of the New York Stock Exchange, the American Stock Exchange or the NASDAQ Stock Exchange or (b) cease to have REIT status or fail to comply with the requirements of the Internal Revenue Code relating to qualified REIT subsidiaries in respect of its ownership of any subsidiary that is intended to be a qualified REIT subsidiary of Aimco to the extent required under the Internal Revenue Code and applicable law. The Loan Parties are subject to certain financial covenants, including a minimum fixed charge covenant ratio of 1.25 to 1.00, a maximum leverage ratio of 0.60 to 1.00 and a minimum adjusted tangible net worth of $625,000,000 plus 75.0% of the aggregate proceeds received by Aimco and its consolidated subsidiaries (net of reasonable related fees and expenses and net of any redemption of shares, units or other equity interests in Aimco and its consolidated subsidiaries during such period) in connection with any offering of any equity interests. The Collateral Pool Loan Parties are subject to certain additional representations, warranties and covenants relating to the Collateral Pool Properties.

The Credit Agreement also contains customary events of default, including nonpayment of principal and other amounts when due; breach of covenants; inaccuracy of representations and warranties; cross-default and cross-acceleration to other material indebtedness of any Loan Party or any of its subsidiaries; certain bankruptcy or insolvency events; material judgments against any Loan Party; certain ERISA matters; actual or asserted invalidity of any loan document; and a change of control. After the occurrence and during the continuance of an event of default, the Administrative Agent, with the consent of or upon the request of lenders holding a majority in principal amount of the commitments under the Revolving Credit Facility, may terminate the commitments or declare the unpaid principal amount of all outstanding loans and other amounts owing or payable under the loan documents to be immediately due and payable, in addition to certain other remedies, including remedies against the Collateral Pool Properties.

The description of the Credit Agreement above does not purport to be complete and is qualified in its entirety by reference to the Credit Agreement, which is filed as Exhibit 10.1 to this Current Report on Form

8-K

and is incorporated herein by reference.

|

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 above is incorporated by reference into this Item 2.03, insofar as it relates to the creation of a direct financial obligation.

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: December 1

6

, 2020

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

|

|

|

|

|

|

|

|

|

|

|

Wes Powell

|

|

|

|

Chief Executive Officer

|

|

|

|

AIMCO OP L.P.

|

By Aimco OP GP, LLC, its general partner

By Apartment Investment and Management Company, its managing member

|

|

|

|

|

|

|

|

|

|

|

Wes Powell

|

|

|

|

Chief Executive Officer

|

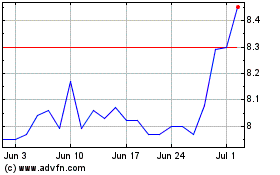

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

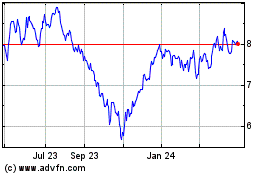

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2023 to Apr 2024