Form SC TO-T/A - Tender offer statement by Third Party: [Amend]

October 27 2023 - 8:49AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

American Strategic Investment Co.

| [text] |

| (Name of Subject Company (Issuer)) |

| |

| Bellevue Capital Partners, LLC |

| (Name of Filing Persons (Offerors)) |

| |

| Class A Common Stock, Par Value $0.01 per share |

| (Title of Class of Securities) |

| |

| 649439304 |

| (CUSIP Number of Class of Securities) |

| |

|

Nicholas S. Schorsch

Managing Member

Bellevue Capital Partners, LLC

222 Bellevue Avenue

Newport, RI 02840

(212) 415-6500

|

(Name, address and telephone number of person authorized to receive notices

and communications on behalf of filing persons) |

With a copy to:

|

David S. Huntington, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

|

| ☐ | Check the box if the filing relates

solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which

the statement relates:

| |

☒ |

third-party tender offer subject to Rule 14d-1. |

| |

|

|

| |

☐ |

issuer tender offer subject to Rule 13e-4. |

| |

|

|

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

|

|

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the

results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate

rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

|

|

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

AMENDMENT NO. 2 TO SCHEDULE TO

This Amendment No. 2 (“Amendment No. 2”)

amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission on September

27, 2023 (as previously amended, the “Schedule TO”) in connection with the offer (the “Offer”) by Bellevue Capital

Partners, LLC (“Bellevue”, “we”, “us” or “our”) to purchase for cash up to 350,000 shares

(the “shares”) of Class A common stock, par value $0.01 per share (the “common stock”), of American Strategic

Investment Co. (the “Company”), the subject company, at a purchase price equal to $10.25 per share (the “Purchase Price”),

in cash, less any applicable withholding taxes and without interest.

The Offer is being

made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated September 27, 2023, as amended and

supplemented by Amendment No. 1, dated October 4, 2023 (the “Offer to Purchase”).

The purpose of this Amendment No. 2 is to file

as an exhibit to the Schedule TO a press release issued by the Company on October 27, 2023 announcing the final results of the Offer.

This Amendment No. 2 is being filed in accordance

with Rule 14d-3(b)(2) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Except as specifically provided

herein, the information contained in the Schedule TO and the other documents that constitute part of the Offer remain unchanged. This

Amendment No. 2 should be read in conjunction with the Schedule TO and the other documents that constitute part of the Offer, as amended

or supplemented. Every item in the Schedule TO is automatically updated, to the extent such item incorporates by reference any section

of the Offer to Purchase that is amended or supplemented therein. All capitalized terms used but not otherwise defined in this Amendment

No. 2 have the meanings ascribed to such terms in the Offer to Purchase.

| Item 11. | Additional Information. |

Item 11 of the Schedule TO is hereby amended and

supplemented by adding the following:

On October 27, 2023, Bellevue issued a press

release announcing the final results of the Offer, which expired at 11:59 p.m., New York City time, on Thursday, October 26, 2023. A copy

of the press release is filed as Exhibit (a)(4) to the Schedule TO and is incorporated herein by reference.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: October 27, 2023

| |

BELLEVUE CAPITAL PARTNERS, LLC |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Nicholas Schorsch |

|

| |

|

Name: |

Nicholas Schorsch |

|

| |

|

Title: |

Managing Member |

|

EXHIBIT (a)(4)

BELLEVUE CAPITAL PARTNERS, LLC ANNOUNCES

FINAL RESULTS OF TENDER OFFER FOR SHARES OF AMERICAN STRATEGIC INVESTMENT CORP.

NEW YORK, October 27, 2023 – Bellevue

Capital Partners, LLC (“Bellevue”) announced today the final results of its tender offer to purchase for cash up to 350,000

shares of American Strategic Investment Co. (NYSE: NYC) (“ASIC”) common stock

at a price of $10.25 per share (the “Tender Offer”), which expired at 11:59 p.m., New York City time, on October 26, 2023.

Based on the final count by Computershare Trust

Company, N.A., the depositary for the tender offer, 223,460 shares of ASIC’s common stock were properly tendered and not properly

withdrawn at a price of $10.25 per share, for an aggregate cost of approximately $2,290,465, in cash, less any fees, expenses or applicable

withholding taxes relating to the tender offer. The repurchased shares represent approximately 9.6% of ASIC’s shares outstanding

as of August 8, 2023.

Computershare Trust Company, N.A., the depositary

for the tender offer, will promptly issue payment for the shares of ASIC common stock validly tendered and accepted for purchase in the

tender offer, and will return all other shares tendered and not purchased in the tender offer.

About Bellevue Capital Partners, LLC

Bellevue is a leading, diversified investment,

asset management and operating platform and the sole member of AR Global Investments, LLC, the parent company to the advisor and property

manager of ASIC.

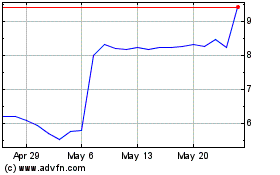

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

From Apr 2024 to May 2024

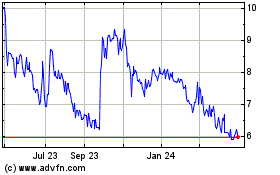

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

From May 2023 to May 2024