AG Mortgage Investment Trust, Inc. Stockholders Approve Issuance of Common Stock in Merger With Western Asset Mortgage Capital Corporation

November 07 2023 - 4:04PM

Business Wire

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (“MITT”)

announced that at the special meeting of stockholders held today

its stockholders approved the issuance of MITT’s common stock

pursuant to the terms of the previously announced merger agreement

with Western Asset Mortgage Capital Corporation (“WMC”). Pursuant

to the merger agreement, MITT will acquire WMC through WMC’s merger

with and into a wholly owned subsidiary of MITT (the “Merger”). The

Merger is expected to close in the fourth quarter of 2023, subject

to WMC’s stockholders approving the Merger and the other closing

conditions in the merger agreement being satisfied.

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a diversified credit and real

estate investing platform within TPG.

Additional information can be found on MITT’s website at

www.agmit.com.

About TPG Angelo Gordon

Founded in 1988, Angelo, Gordon & Co., L.P. (“TPG Angelo

Gordon”) is a diversified credit and real estate investing platform

within TPG. The platform currently manages approximately $74

billion* across a broad range of credit and real estate strategies.

TPG Angelo Gordon has over 700 employees, including more than 230

investment professionals, across offices in the U.S., Europe and

Asia. For more information, visit www.angelogordon.com.

*TPG Angelo Gordon’s currently stated assets under management

(“AUM”) of approximately $74 billion as of June 30, 2023 reflects

fund-level asset-related leverage. Prior to May 15, 2023, TPG

Angelo Gordon calculated its AUM as net assets under management

excluding leverage, which resulted in TPG Angelo Gordon AUM of

approximately $53 billion as of December 31, 2022. The difference

reflects a change in the TPG Angelo Gordon’s AUM calculation

methodology and not any material change to TPG Angelo Gordon’s

investment advisory business. For a description of the factors TPG

Angelo Gordon considers when calculating AUM, please see the

disclosure at www.angelogordon.com/disclaimers/.

Forward-Looking Statements

This document contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. MITT intends such forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995

and include this statement for purposes of complying with the safe

harbor provisions. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” “will,”

“should,” “may,” “projects,” “could,” “estimates” or variations of

such words and other similar expressions are intended to identify

such forward-looking statements, which generally are not historical

in nature, but not all forward-looking statements include such

identifying words. Forward-looking statements include, but are not

limited to, statements related to the proposed Merger, including

the anticipated timing, benefits and financial and operational

impact thereof; other statements of management’s belief, intentions

or goals; and other statements that are not historical facts. These

forward-looking statements are based on MITT’s current plans,

objectives, estimates, expectations and intentions and inherently

involve significant risks and uncertainties. Actual results and the

timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and

uncertainties associated with: MITT’s ability to complete the

proposed Merger on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to

securing the necessary stockholder approval from WMC’s stockholders

and satisfaction of other closing conditions to consummate the

proposed Merger; the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger

Agreement; risks related to diverting the attention of MITT

management from ongoing business operations; failure to realize the

expected benefits of the proposed Merger; significant transaction

costs and/or unknown or inestimable liabilities; the risk of

stockholder litigation in connection with the proposed Merger,

including resulting expense or delay; the risk that MITT’s and

WMC’s respective businesses will not be integrated successfully or

that such integration may be more difficult, time-consuming or

costly than expected; the amount and timing of MITT’s remaining

fourth quarter dividend; and effects relating to the announcement

of the proposed Merger or any further announcements or the

consummation of the proposed Merger on the market price of MITT’s

common stock. Additional risks and uncertainties related to MITT’s

business are included under the headings “Forward-Looking

Statements” and “Risk Factors” in MITT’s Annual Report on Form 10-K

for the year ended December 31, 2022, MITT’s Quarterly Report on

Form 10-Q for the quarter ended June 30, 2023, the joint proxy

statement/prospectus filed with the Securities and Exchange

Commission (the “SEC”) on September 29, 2023, and in other reports

and documents filed by MITT with the SEC from time to time.

Moreover, other risks and uncertainties of which MITT is not

currently aware may also affect its forward-looking statements and

may cause actual results and the timing of events to differ

materially from those anticipated. The forward-looking statements

made in this communication are made only as of the date hereof or

as of the dates indicated in the forward-looking statements, even

if they are subsequently made available by MITT on its website or

otherwise. MITT undertakes no obligation to update or supplement

any forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107340859/en/

Investors AG Mortgage Investment Trust, Inc. Investor

Relations (212) 692-2110 ir@agmit.com

Media AG Mortgage Investment Trust, Inc.

media@angelogordon.com

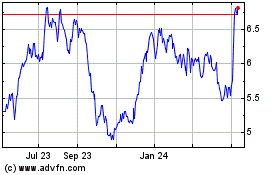

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Mar 2024 to Apr 2024

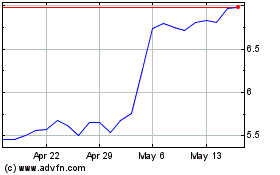

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Apr 2023 to Apr 2024