Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

June 05 2019 - 2:38PM

Edgar (US Regulatory)

Amendment No. 7 to Prospectus

Supplement dated March 10, 2017

(to Prospectus dated February 23, 2017)

|

|

Filed pursuant to Rule 424(b)(5)

File No. 333-216191

|

ZION OIL & GAS, INC.

This Amendment No.

7 to Prospectus Supplement amends the Prospectus Supplement dated March 10, 2017 (“Original Prospectus Supplement”).

This Amendment No. 7 to Prospectus Supplement should be read in conjunction with the Original Prospectus Supplement and the base

Prospectus effective March 10, 2017 and Amendment No. 6. This Amendment No. 7 is incorporated by reference into the Original Prospectus

Supplement. This Amendment No. 7 is not complete without, and may not be delivered or utilized except in connection with, the Original

Prospectus Supplement, including any amendments or supplements thereto.

Investing in our

common stock is risky. See “Risk Factors” commencing at page S-22 of the Original Prospectus Supplement, as well as the

“Risk Factors” in our most recent Annual Report on Form 10-K for the year ended December 31, 2018, to read about the

risks that you should consider before buying shares of our stock.

Neither the U.S.

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the prospectus or any prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Continuation of Unit Option under the

Unit Program

Under our Dividend

Reinvestment and Common Stock Purchase Plan (the “Plan”), we are extending the current Unit Option that was filed under

Amendment No. 6, dated April 24, 2019. Our Unit Program consists of the combination of Common Stock and warrants with an extended

time period, but otherwise the same Unit Program features, conditions and terms in the Prospectus Supplement and Amendment No.

6 apply. We are extending under our Unit Program that began April 24, 2019 and that was to terminate June 6, 2019, but now

will terminate June 26, 2019. The Unit Option Program consists of Units of our securities where each Unit (priced at $250.00) is

comprised of (i) a certain number of shares of Common Stock determined by dividing $250.00 (the price of one Unit) by the average

of the high and low sale prices of the Company’s publicly traded common stock as reported on the NASDAQ on the Unit Purchase

Date and (ii) Common Stock purchase warrants to purchase an additional fifty (50) shares of Common Stock at a per share exercise

price of $2.00. The participant’s Plan account will be credited with the number of shares of the Company’s Common Stock

and Warrants that are acquired under the Units purchased. Each warrant affords the participant the opportunity to purchase one

share of our Common Stock at a warrant exercise price of $2.00 for two (2) years from the warrant exercise date. The warrant shall

have the company notation of “ZNWAL.” The warrants will not be registered for trading on the NASDAQ Stock Market or

any other stock market.

For Plan participants

who enroll into the Unit Program with the purchase of at least one Unit and also enroll in the separate Automatic Monthly Investments

(“AMI”) program at a minimum of $50.00 per month or more, will receive an additional twenty-five (25) Warrants at an

exercise price of $2.00 during this Unit Option Program. The twenty-five (25) additional warrants are for enrolling into the AMI

program. Existing subscribers to the AMI are entitled to the additional twenty-five (25) warrants once, if they purchase at least

one (1) Unit during the Unit program.

The warrants will be first exercisable on

August 26, 2019, instead of August 6, 2019, which is to extend to the first trading day after the 60

th

day following

the extended Unit Option Termination Date (i.e., on June 26, 2019) and continue to be exercisable through August 26, 2021 at a

per share exercise price of $2.00. No change will be made to the warrant exercise price of $2.00 per share. The Unit is priced

at $250.00 per Unit.

Accordingly, all references

in the Original Prospectus Supplement and Amendment No. 6, concerning the Unit Option, continue, except for the substitution of

the revised Unit Option dates and features above. All other Plan features, conditions and terms remain unchanged.

|

The date of this Amendment No. 7 to Prospectus Supplement is June 5, 2019.

|

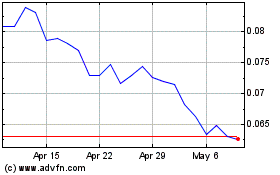

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

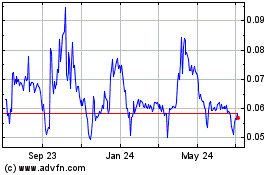

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Apr 2023 to Apr 2024