Form 8-K/A - Current report: [Amend]

March 07 2024 - 5:20PM

Edgar (US Regulatory)

0000793074false00007930742024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 27, 2024

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nebraska | 0-14690 | 47-0648386 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| |

| 14507 Frontier Road | | |

| Post Office Box 45308 | | |

| Omaha | , | Nebraska | | 68145-0308 |

| (Address of principal executive offices) | | (Zip Code) |

(402) 895-6640

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR40.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | WERN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

Resignation of Director

As previously reported, Werner Enterprises, Inc. (the “Company”) filed a Current Report on Form 8-K dated February 27, 2024, with the Securities and Exchange Commission on March 1, 2024 (the "Original Report"), reporting the resignation of Vikram Mansharamani, Ph.D. as a director from the Company’s Board of Directors.

The Company provided a copy of the Original Report to Dr. Mansharamani, and in response to such filing, Dr. Mansharamani submitted a letter dated March 5, 2024, to Derek Leathers, CEO and Chairman, Nathan Meisgeier, President and Chief Legal Officer, and the independent members of the Board of Directors of the Company. The Company strongly disagrees with the contentions set forth in Dr. Mansharamani’s letter and has no reason to comment further.

A copy of Dr. Mansharamani’s March 5, 2024 letter is included as Exhibit 17.2 to this Form 8-K/A.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| | | | | | | | |

| 17.1* | | Letter dated February 27, 2024, from Vikram Mansharamani, Ph.D. addressed to Derek Leathers, CEO and Chairman of the Board of Werner Enterprises, Inc. |

| | |

| 101 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

| | |

| *Filed as an exhibit to the Original Report. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| WERNER ENTERPRISES, INC. |

| | |

Date: March 7, 2024 | By: | | /s/ Christopher D. Wikoff |

| | | Christopher D. Wikoff |

| | | Executive Vice President, Treasurer and

Chief Financial Officer |

| | |

Date: March 7, 2024 | By: | | /s/ James L. Johnson |

| | | James L. Johnson |

| | | Executive Vice President and

Chief Accounting Officer |

Vikram Mansharamani, PhD PO Box 932, Lincoln, NH 03251 vikram@mansharamani.com March 5, 2024 Derek Leathers Chairman and Chief Executive Officer Werner Enterprises 14507 Frontier Road Omaha, NE 68138 Dear Mr. Leathers: The Company’s incomplete presentation of the facts relating to my resignation from the Board requires clarification. I write to set the record straight and to answer the obvious question arising from the Company’s commentary: Why did Werner decide not to renominate me to its Board? The answer, I believe, is quite simple: For the very reasons I resigned. I disagreed with the Board and its Nominating and Corporate Governance Committee’s policies and related practices with respect to related party transactions and the Company’s overemphasis on ESG considerations. These disagreements ran headlong into a culture of conformity that appears increasingly entrenched. I was willing to work with the Board to serve shareholders because I believed healthy friction would lead to better decisions over time. The Board and its Nominating and Corporate Governance Committee disagreed. Once unable to serve the shareholders who elected me, I felt compelled to resign. Related Party Transactions To start, I was the only director who disagreed with the process, or, in my opinion, lack thereof, surrounding the Company’s award of a $381,000 contract to a company owned and run by a member of the Nominating and Corporate Governance Committee and Chair of the ESG Committee. (See the Company’s 2023 Proxy Statement, Form Def 14-A, page 56). Notwithstanding claims that the director in question recused herself from negotiations, it is naïve to suggest the director’s personal interest wasn’t a factor or somehow mitigates the inherent conflict of interest. Overemphasis on ESG A risk factor noted in the Company’s 2023 Form 10-K is worth highlighting: “Increasing scrutiny from investors and other stakeholders regarding ESG related matters may have a negative impact on our business” (page 10). I agree. Unfortunately, the apparent prioritization of stakeholders over shareholders is so deep that the risk is described only in terms of failure to implement ESG initiatives. The Company even suggests that not doing enough with respect to ESG might have a “negative impact on our revenues, stock price, and access to and costs of capital” (Page 11). Given Werner admits the ESG focus “imposes additional costs” (page 11), might doing too much also be a risk? Perhaps Company leadership and the board should (re)read Milton Friedman’s thinking on the social responsibility of business? See my attached article on the topic. Let me be clear: I support efforts to explore alternative fuels and new engine technology, not to improve an ESG scorecard, but because Werner is a leading transportation company. I support efforts to recruit from underrepresented communities, not as part of a DEI agenda, but because Werner should seek to hire the most capable people, regardless of skin color, gender, or religion (as required by law). Exhibit 17.2

Despite opposing the Board’s formation of an ESG Committee, I willingly served on it with an open mind. However, the Committee failed, in my opinion and experience, to embrace, let alone tolerate, diversity of perspective. I repeatedly suggested that environmental social and governance efforts properly pursued would simply be good business and didn’t warrant a standalone ESG effort. I also argued that any hiring decision that needed a DEI justification or corporate initiative that only made sense from an ESG perspective, would be imposing, as described by Friedman, a “tax” on shareholders. On May 9, 2023, the Nominating and Corporate Governance Committee removed me from the ESG Committee. How has the Company’s relentless prioritization of ESG efforts impacted shareholders? While it’s impossible to answer that question with certainty, it does not appear to be helping. Werner stock has meaningfully underperformed the US stock market, the transportation sector, and the Company’s peer group (see 2023 Form 10-K page 15) over multiple time frames, including being down almost 20% in the past year while the S&P500 was up almost 27% (as of March 4, 2024). Culture of Conformity The Board that nominated me almost three years ago craved and actively sought diversity of perspective. Today, I cannot say, based on my experience, that the Board welcomes or even tolerates differences in thinking on strategic matters. It is worth asking if a culture that penalizes disagreement was a factor in the successful 2023 unionization efforts at Werner (as employees felt their voices could not otherwise be heard) or might result in additional broad-based unionization, a development that, in the Company’s own words, “could have a material adverse effect on our costs, efficiency, and profitability” (2023 Form 10-K, page 8). Regardless, the message sent by the Nominating and Corporate Governance Committee by deciding to not nominate me for a second term was a clear message to other directors: Get on board with our views or you’ll be off the Board. Self-censorship may soon replace open dissent as deference to consensus emerges as criteria for the (re)appointment of current and future directors. Moving Forward Werner is a great American company, one that I was proud to serve. It’s filled with many terrific people who literally, as the Company tagline states, keep America moving. While there are lots of considerations that impact a stock price, my experience teaching classes on business ethics and corporate governance suggests the issues highlighted in this letter are contributing factors. As a shareholder of Werner Enterprises, I strongly believe an immediate course correction towards a shareholder focus is urgently needed to get the Company and its stock moving in the right direction. Regards, Vikram Mansharamani Attachment Mansharamani, Vikram. “The Social Responsibility of Business is…” Navigating Uncertainty, February 26, 2024; accessible via https://mansharamani.substack.com/p/the-social-responsibility-of-business.

v3.24.0.1

Document and Entity Information Document

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

0-14690

|

| Entity Registrant Name |

WERNER ENTERPRISES, INC.

|

| Entity Central Index Key |

0000793074

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NE

|

| Entity Tax Identification Number |

47-0648386

|

| Entity Address, Address Line One |

14507 Frontier Road

|

| Entity Address, Address Line Two |

Post Office Box 45308

|

| Entity Address, City or Town |

Omaha

|

| Entity Address, State or Province |

NE

|

| Entity Address, Postal Zip Code |

68145-0308

|

| City Area Code |

402

|

| Local Phone Number |

895-6640

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

WERN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

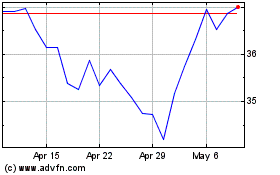

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

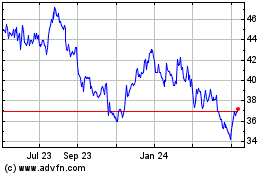

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Apr 2023 to Apr 2024