0000793074false00007930742024-02-092024-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 9, 2024

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nebraska | 0-14690 | 47-0648386 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| |

| 14507 Frontier Road | | |

| Post Office Box 45308 | | |

| Omaha | , | Nebraska | | 68145-0308 |

| (Address of principal executive offices) | | (Zip Code) |

(402) 895-6640

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR40.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | WERN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

Compensatory Arrangement of Certain Officers

On February 9, 2024, the Compensation Committee (the “Committee”) of the Board of Directors of Werner Enterprises, Inc. (the “Company”) approved the following base salaries, Restricted Stock (“RS”) awards, and Performance Stock (“PS”) awards for each of the Company’s named executive officers ("NEOs").

| | | | | | | | | | | | | | | | | | | | |

| Named Executive Officer | | Base Salary | | RS (#) | | PS (#) |

| Derek J. Leathers | | $ | 945,000 | | | 48,080 | | 48,693 |

| Chairman and Chief Executive Officer | | | | | | |

| | | | | | |

| Christopher D. Wikoff | | $ | 520,000 | | | 5,301 | | | 5,369 | |

| Executive Vice President, Treasurer and Chief Financial Officer | | | | | | |

| | | | | | |

| Jim S. Schelble | | $ | 420,000 | | | 4,315 | | | 4,370 | |

| Executive Vice President and Chief Administrative Officer | | | | | | |

| | | | | | |

| James L. Johnson | | $ | 475,000 | | | 5,301 | | | 5,369 | |

| Executive Vice President and Chief Accounting Officer | | | | | | |

| | | | | | |

| H. Marty Nordlund | | $ | 250,000 | | | — | | | — | |

| Executive Vice President of Strategic Partnerships | | | | | | |

The base salaries are effective February 9, 2024.

The grants of restricted stock and performance stock are subject to the terms and conditions of the Company’s 2023 Long-Term Incentive Plan approved by stockholders on May 9, 2023 (the “Plan”), and to the agreements governing the terms and conditions of the awards. The restricted stock vests in three installments of 34%, 33% and 33%, respectively, on each of the first three anniversaries from the grant date.

The performance stock is earned and issued upon vesting, in one installment on the third anniversary from the grant date, if the Company meets specified performance objectives related to cumulative diluted earnings per share (“Diluted EPS”) for the two-year period January 1, 2024 through December 31, 2025 (the “Performance Period”). The above table shows performance stock at the target level of performance. Actual vesting ranges between 0% and 200% of the target, depending on actual level of Diluted EPS for the Performance Period, subject to a total shareholder return (“TSR”) modifier that can increase or decrease the vesting percentage by 25% based on the Company's TSR for the three-year period ending December 31, 2026, relative to the TSR of a peer group of companies for the same period.

The Committee also approved the parameters of the performance-based cash bonus program (“AIP”) for the 2024 fiscal year, subject to Plan terms and conditions. The performance goals for the 2024 AIP relate to the Company’s (i) operating income, (ii) revenues, excluding fuel surcharge revenues, and (iii) individual performance. Each NEO may earn a bonus ranging from 0% to 200% of his 2024 target bonus, based on the level of attainment of the performance goals. The target bonus amounts range from 30% to 125% of each NEO’s 2024 annual base salary.

In addition to the cash and equity compensation described above, certain NEOs may also receive certain of the following perquisites: personal use of a Company-provided vehicle, personal use of the Company's aircraft, country club membership, and participation in a personal medical care membership program. The NEOs are also eligible to participate in the Company’s 401(k) retirement savings and employee stock purchase plans (in each case including the ability to receive Company contributions), and in voluntary, Company-sponsored health and welfare benefit programs.

The foregoing descriptions are not complete descriptions of all the rights and obligations and are qualified in their entirety by reference to the Plan, which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K dated May 9, 2023, the agreement governing the restricted stock, which is filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, and the agreement governing the performance stock, which is filed as an exhibit to this report, all of which are incorporated by reference herein.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| | | | | | | | |

| | |

| | |

| 101 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| WERNER ENTERPRISES, INC. |

| | |

Date: February 15, 2024 | By: | | /s/ Christopher D. Wikoff |

| | | Christopher D. Wikoff |

| | | Executive Vice President, Treasurer and

Chief Financial Officer |

| | |

Date: February 15, 2024 | By: | | /s/ James L. Johnson |

| | | James L. Johnson |

| | | Executive Vice President and Chief Accounting

Officer |

Exhibit 10.1

FORM OF

PERFORMANCE STOCK AWARD AGREEMENT

THIS PERFORMANCE STOCK AWARD AGREEMENT (this “Agreement”) is made and entered into as of the ______ day of _________________20__ (the “Grant Date”), by and between Werner Enterprises, Inc., a Nebraska corporation (the “Company”), and ________, an eligible participant and recipient (“Participant”) under the Werner Enterprises, Inc. 2023 Long-Term Incentive Plan (as defined and described below). As set forth herein, this Agreement is subject to the terms and conditions of the Werner Enterprises, Inc. 2023 Long-Term Incentive Plan.

RECITALS

WHEREAS, the Company has in effect the Werner Enterprises, Inc. 2023 Long-Term Incentive Plan, which was initially adopted by the Board of Directors (the “Board”) of the Company on March 16, 2023, subject to shareholder approval, and ratified and approved by the stockholders of the Company on May 9, 2023, and which may be amended and restated from time to time (collectively, the “Plan”);

WHEREAS, the Plan permits the granting of Performance Awards to be settled in shares of the Company’s common stock, $0.01 par value (the “Common Stock” or “Performance Stock”), to (i) any key employee (including an employee who is a member of the Company’s Board and/or an officer of the Company and/or its subsidiaries); (ii) any non-employee member of the Board; or (iii) any consultant to the Company;

WHEREAS, the Company believes it to be in the best interests of the Company and its stockholders for certain (i) key employees, (ii) non-employee members of the Board, and (iii) consultants to obtain or increase their stock ownership interest in the Company in order to establish a greater incentive in providing services to the Company and to further align their interests with those of the stockholders of the Company; and

WHEREAS, Participant is either a (i) key employee, (ii) non-employee member of the Board, or (iii) consultant, and Participant has been selected by the Compensation Committee of the Board (the “Committee”) to receive a Performance Award under the Plan.

AGREEMENT

NOW, THEREFORE, in consideration of the promises and of the covenants and agreements herein set forth, the parties hereby mutually covenant and agree as follows:

1. Grant of Performance Award. Subject to the terms and conditions of the Plan (attached hereto as Exhibit A and made a part hereof) and this Agreement, the Company hereby grants to Participant a target number of Award units (“performance stock units,” “PSUs,” or the “Award”). Each vested PSU is equivalent to the right to receive upon vesting one share of Performance Stock. The Award was granted to Participant on the aforementioned Grant Date.

The number of shares of Performance Stock earned by Participant on the Vesting Date(s) is based on the level of attainment of the Performance Measure(s) for the Performance Period(s) as established by the Committee, all as set forth in the Performance Stock Schedule (attached hereto as Exhibit B and made a part hereof). The number earned may be more or less than the target Award number set forth in Exhibit B. As soon as practicable after the end of the Performance Period(s), the Committee will determine and certify in writing the level of attainment, if any, of the Performance Measure(s) and the number of shares of Performance Stock, if any, earned or eligible to be earned as provided in Exhibit B.

2. Acceptance of Award. The granting of this Award does not impose any obligation on Participant to accept such Award. By accepting the Award, however, Participant agrees to be subject to and bound in accordance with the terms and conditions of this Agreement and the Plan and acknowledges that the Award may be subject to forfeiture, recovery by the Company or other action pursuant to any clawback or recoupment policy which the Company may adopt from time to time, including without limitation any such policy identified in Exhibit B. Participant’s execution of this Agreement shall evidence and constitute Participant’s acceptance of the Award contemplated herein, including the recoupment and other terms and conditions of Exhibit B.

3. Vesting. Subject to the Committee’s determination that the applicable Performance Measures have been achieved, separate designated portions of the Award shall become vested on the “Vesting Date(s)” as set forth in Exhibit B to this Agreement and will be distributed in the form of Common Stock. Subject to Section 7 of this Agreement and the terms of the Plan and until the occurrence of the Vesting Date(s), each portion of the Award for which the respective Vesting Date has not occurred shall be non-vested, may be canceled and forfeited upon (i) Participant’s termination of employment, (ii) Participant’s removal from the Board, or (iii) termination of the consulting agreement between Participant and the Company and may not be subject to further vesting under this Agreement.

4. Value of Performance Stock. Participant acknowledges that the value of each share of Performance Stock issued to Participant upon vesting under this Agreement is not predetermined, fixed, permanent or otherwise set, specified or guaranteed whatsoever. On the Vesting Date(s) and each subsequent date thereafter, the value of each such share shall equal the Fair Market Value of one share of Common Stock on the applicable date. Participant acknowledges that the Fair Market Value of such shares may fluctuate and vary according to market conditions and other factors.

5. Taxes. Participant will be solely responsible for any federal, state, local or other taxes imposed in connection with the granting and acceptance of the Performance Stock pursuant to the terms of this Agreement and the Plan and with the issuance of Performance Stock to Participant upon vesting. Participant acknowledges that upon Participant’s recognition of income with respect to the Performance Stock granted hereunder, the Company may withhold taxes pursuant to the terms of the Plan.

6. Issuance Upon Vesting; Withholdings.

(a) On the designated Vesting Date(s), Participant shall have all rights as a stockholder for any Performance Stock that was issued to Participant upon vesting and became unrestricted upon Participant’s satisfaction of all applicable tax withholding amounts and requirements. The shares are payable to Participant upon vesting and shall be transferred to the holder in book entry form.

(b) The Company is not obligated to deliver any Performance Stock that was issued to Participant upon vesting and became unrestricted unless Participant has satisfied all applicable federal, state, local and other tax withholding requirements. Participant may pay all required withholding amounts pursuant to the provisions of the Plan.

7. Termination of Employment; Death and Disability; Retirement; and Removal or Departure.

(a)Subject to the terms of the Plan and this Agreement and unless the Plan and Agreement provide otherwise, during Participant’s lifetime, only Participant is entitled to receive and vest in the Award granted hereunder.

(b)Subject to subsections 7(c) and 7(d) below or accelerated vesting on a Change in Control as provided pursuant to Section 7.7 of the Plan, termination of Participant’s employment with the Company will affect the forfeiture of, and rights to become vested in, the Award granted herein, and such forfeiture shall be governed by the provisions of the Plan.

(c)In the event Participant is an employee and Participant (i) dies while holding the Award (not otherwise forfeited), or (ii) terminates employment by reason of Disability, the established Performance Measure(s) will be evaluated for actual performance to date and all service period and other restrictions applicable to such Award shall lapse, and such Award shall become fully vested and nonforfeitable in accordance with the Plan and Exhibit B. The termination of employment of an employee for reasons other than death or Disability shall be governed by the terms of Section 7.17(a) of the Plan.

(d)In the event Participant is an employee and Participant terminates employment by reason of Retirement at least twelve months after the Grant Date, the Award granted herein that is then unvested (and not otherwise forfeited) shall remain outstanding and eligible to vest based on actual achievement of the Performance Measure(s) during the Performance Period(s) as set forth in Exhibit B, and the applicable number of shares of Performance Stock earned by Participant shall vest on the Vesting Date(s).

For purposes of this Agreement, “Retirement” means the termination of a Participant’s employment by the Company (other than for Cause or due to death or Disability) or by the Participant, in each case upon or after the Participant is Retirement Eligible; provided, that (i) in the case of termination of employment by the Participant, the Participant has provided to the Company at least three (3) months’ prior written notice of his/her intention to retire (this notice is not meant to be a formal notice of retirement, but it is intended to begin discussions regarding retirement to assist the Company in transition and succession planning), and (ii) promptly upon request by the Company, the Participant executes a restrictive covenants agreement (in a form requested by the

Company). “Retirement Eligible” shall mean that (i) the Participant is at least fifty-five (55) years of age and (ii) the Participant’s age plus years of employment with the Company or its subsidiaries equals at least 70.

(e)The removal of a non-employee member of the Board for misconduct will affect the forfeiture of, and rights to become vested in, the Award granted herein and such forfeiture shall be governed by the provisions of the Plan. The departure of a non-employee member of the Board for reasons other than removal for misconduct shall be governed by the terms of Section 7.17(b)(2) of the Plan.

(f)The removal of a consultant for misconduct will affect the forfeiture of, and rights to become vested in, the Award granted herein and such forfeiture shall be governed by the provisions of the Plan. The departure of a consultant for reasons other than removal for misconduct shall be governed by the terms of Section 7.17(c)(2) of the Plan.

8. Nonassignability of Award. The Award shall not be assigned, mortgaged, pledged, attached, sold, transferred or otherwise encumbered by Participant other than by will or the applicable laws of descent and distribution, except as may be permitted by the Board or Committee from time to time in accordance with the Plan. If Participant attempts to alienate, assign, pledge, hypothecate or otherwise dispose of the Award, such Award may be terminated and become null and void pursuant to the Plan without any payment or consideration by the Company to the Participant.

9. No Stockholder and Dividend Rights. Participant shall not be deemed for any purpose to have any dividend, voting, liquidation or other rights with respect to the Award granted hereunder, except to the extent that such Award vests and unrestricted Common Stock is issued to Participant upon vesting.

10. Restrictions on Transfers of Common Stock.

(a) Participant agrees individually and for Participant’s heirs, legatees and legal representatives, with respect to all unrestricted shares of Common Stock acquired pursuant to the terms and conditions of this Agreement (or any shares of Common Stock issued pursuant to a stock dividend or stock split thereon or any securities issued in lieu thereof or in substitution or exchange therefor), that Participant and Participant’s heirs, legatees and legal representatives shall not sell or otherwise dispose of such shares except pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”), or except in a transaction which, in the opinion of counsel for the Company, is exempt from the registration and prospectus delivery requirements under the Securities Act.

(b) As further conditions to Participant’s receipt of the unrestricted Common Stock acquired pursuant to this Agreement and the Plan, Participant agrees individually and for Participant’s heirs, legatees and legal representatives, prior to such acquisition, to take any actions, as counsel for the Company determines may be necessary or appropriate for compliance with the Securities Act and any applicable securities laws. Participant also understands and acknowledges that federal and state securities laws govern Participant’s right to sell, transfer and otherwise dispose of the Performance Stock.

(c) Unless otherwise determined by the Board, no certificates representing restricted shares of Common Stock acquired under this Agreement shall be issued to

Participant. In lieu of certificates, shares representing Performance Stock acquired under this Agreement shall be transferred to the holder in book entry form with restrictions on the shares duly noted.

(d) Unless the Board determines otherwise, any unrestricted shares of Common Stock acquired under this Agreement and in accordance with the Plan shall not bear a restrictive legend, provided Participant satisfies the requirements set forth in Section 6 hereto and state and federal securities laws.

11. Adjustments. In the event there is a change in the number or rights and privileges of the outstanding shares of Common Stock (or of any stock or other securities into which such Common Stock may be changed or for which it may be exchanged), then the Board or Committee may adjust the number or rights and privileges of the Award or Performance Stock if the Board or Committee in its sole discretion determines that such change equitably requires such an adjustment. As part of the adjustment, the Board or Committee shall determine, in its sole discretion, the manner of any such adjustment. Any adjustment or substitution provided for in this Section 11 or the Plan shall not result in the issuance of any fractional shares.

12. Board and Committee Authority. As consistent with the Plan and this Agreement, the Board and Committee have the power and discretion to interpret this Agreement; adopt rules for the administration, interpretation and application of this Agreement; and interpret or revoke any such rules (including, but not limited to, determinations relating to the termination of Participant’s employment, removal from the Board, or termination of Participant’s consulting relationship, and whether any Award has vested or shall be deemed vested). All actions taken and all interpretations and determinations made by the Board and Committee in good faith will be final and binding upon Participant, the Company and all other interested parties. No member of the Board or Committee will be personally liable for any action, determination or interpretation made in good faith with respect to this Agreement.

13. Rights and Powers of Company Not Affected. The existence of the Award granted or the Performance Stock issued to Participant upon vesting under this Agreement shall not affect in any way the rights or powers of the Company or its stockholders to authorize and effect any or all adjustments, recapitalizations, reorganizations or other transformations or alterations to the Company’s capital structure, business or operations; any merger or acquisition of the Company; any issuance of bonds or debentures; any preferred or prior preference stock ahead of or affecting the Common Stock or the rights thereof; a dissolution or liquidation of the Company; any sale or transfer of all or any part of the Company’s assets or business; or any other lawful corporate act or proceeding of a similar character or otherwise.

14. No Right to Employment or Continued Relationship with the Company.

(a) To the extent Participant is an employee, the provisions of this Agreement (including the granting or vesting of the Award and issuance of Performance Stock to Participant upon vesting) do not confer upon Participant any right to continued employment with the Company or its subsidiaries, nor do any of such provisions interfere in any way with the right of the Company or subsidiary (as the case may be) to terminate Participant’s employment or to make any modification to Participant’s compensation at any time.

(b) To the extent Participant is a non-employee member of the Board or a consultant, the provisions of this Agreement (including the granting or vesting of the Award and the issuance of Performance Stock upon vesting) do not confer upon Participant any right to a continued relationship with the Company or its subsidiaries.

15. Changes in Circumstances Affecting Common Stock. Participant expressly understands and agrees that Participant assumes all risks incident to (i) any change hereafter in any applicable laws or regulations or (ii) any change in the value of the Award, any Performance Stock issued to Participant upon vesting under this Agreement, or the outstanding Common Stock after the date hereof.

16. Notice. All notices, claims, certificates, requests, demands and other communications provided hereunder shall be in writing and shall be deemed duly given if personally delivered or if sent by a recognized overnight courier; registered or certified mail (return receipt requested and postage prepaid); or electronic correspondence (with confirmed delivery receipt). Participant shall send notice to the Corporate Secretary of the Company at the Company’s principal executive offices in Omaha, Nebraska, and the Company shall send notice to Participant at an address designated and provided by Participant to the Corporate Secretary. Notice shall be deemed to be received as follows: (i) for personal delivery, on the date of such delivery; (ii) for recognized courier, on the next business day after sent; (iii) for registered or certified mail, on the third business day following that on which the notice was postmarked; and (iv) for electronic correspondence, when receipt of confirmation is given (or if no receipt is provided, on the business day following the date of electronic delivery).

17. Assignment of Agreement. Participant is prohibited from assigning, transferring or otherwise conveying this Agreement, including any or all of Participant’s duties and obligations hereunder, until the terms, conditions and restrictions contained herein have been satisfied and released or unless the Board or Committee consents and permits otherwise.

18. Amendment or Modification; Counterparts. This Agreement may be amended, modified or supplemented only by a written instrument executed by all parties to this Agreement. This Agreement may be executed in one or more counterparts. Each counterpart shall be deemed original, but all such counterparts together shall constitute but one agreement.

19. Severability. If any provision of this Agreement is adjudicated or determined by a court of competent jurisdiction to be invalid, prohibited or unenforceable for any lawful reason, such provision (as to such jurisdiction) shall be ineffective and rendered null and void. In such event, the remaining provisions of this Agreement shall remain effective, valid and enforceable.

20. Governing Law. This Agreement shall be governed by the laws of the State of Nebraska without regard to the principles of conflicts of laws and with respect to all matters, including (but not limited to) matters of validity, construction, effect, performance and remedies. Participant expressly submits to the exclusive personal jurisdiction and exclusive venue of the federal and state courts of competent jurisdiction in the State of Nebraska.

21. Waiver of Jury Trial. Each party to this Agreement hereby irrevocably and unconditionally waives, to the fullest extent permitted by law, the right to trial by jury in any suit, action or proceeding arising hereunder.

22. Terms of the Plan Govern. All parties acknowledge that the Award is granted and vests, and any Performance Stock is issued to Participant, under and pursuant to the Plan, which shall govern all rights, interests, obligations and undertakings of the Company and Participant. The terms and provisions of the Plan, as it may be amended from time to time, are hereby incorporated herein by reference. The Plan shall govern and be controlling in the event (i) any of the terms of the Plan and this Agreement are inconsistent or conflict, or (ii) this Agreement is silent and does not include provisions with respect to a particular matter or circumstance. All capitalized terms not otherwise defined herein shall have the meanings assigned to such terms in the Plan.

23. Acceptance. The Participant hereby acknowledges receipt of a copy of the Plan and this Agreement. The Participant has read and understands the terms and provisions thereof and accepts the Award and any Performance Stock issued to Participant upon vesting subject to all terms and conditions of the Plan and this Agreement.

IN WITNESS WHEREOF, the parties hereto agree to the terms and conditions herein and have executed this Performance Stock Award Agreement, effective as of the Grant Date first set forth above.

| | | | | | | | |

| PARTICIPANT: | | WERNER ENTERPRISES, INC.: |

| By: | |

| Signature | | Signature |

| | |

| | |

| | |

| Name (Print) | | Name (Print) |

| | |

| | |

| | |

| Title | | Title |

| | |

| | |

| | |

| Date | | Date |

| | |

v3.24.0.1

Document and Entity Information Document

|

Feb. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 09, 2024

|

| Entity File Number |

0-14690

|

| Entity Registrant Name |

WERNER ENTERPRISES, INC.

|

| Entity Central Index Key |

0000793074

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NE

|

| Entity Tax Identification Number |

47-0648386

|

| Entity Address, Address Line One |

14507 Frontier Road

|

| Entity Address, Address Line Two |

Post Office Box 45308

|

| Entity Address, City or Town |

Omaha

|

| Entity Address, State or Province |

NE

|

| Entity Address, Postal Zip Code |

68145-0308

|

| City Area Code |

402

|

| Local Phone Number |

895-6640

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

WERN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

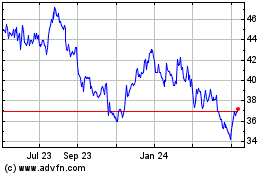

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

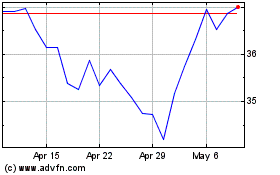

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Apr 2023 to Apr 2024