WalkMe Ltd. (NASDAQ:WKME), a leading provider of digital adoption

solutions, today announced financial results for its second quarter

ended June 30, 2023.

Management Commentary

“We are seeing positive trends all across the business, our path

to profitability is clearer and closer than ever. With over $300M

cash in the bank, strong unit economics, improved internal

execution and advancements in AI and product innovation - WalkMe is

well positioned to increase market share and make the right

investments as we shift our focus towards profitable growth,” said

Dan Adika, CEO of WalkMe.

“We are very pleased with the financial achievements, reaching

cash flow positive two quarters ahead of plan and improving our

operating margin for six consecutive quarters,” said Hagit Ynon,

CFO of WalkMe. “WalkMe is well capitalized and we will continue to

invest in our growth and explore strategic investment

opportunities.”

Second Quarter 2023 Financial Highlights:

- Revenue: Total revenue was $66.2 million, an

increase of 10% year-over-year. Subscription revenue was $61.4

million, an increase of 13% year-over-year.

- Gross Margin: GAAP Gross margin was 82%

compared to 76% in the second quarter of 2022 and Non-GAAP was 84%

compared to 78% in the second quarter of 2022.

- GAAP Operating Loss: was $15.8 million, or 24%

of total revenue, compared to $31.2 million, or 52% in the second

quarter of 2022.

- Non-GAAP Operating Loss: was $2.3 million or

4% of total revenue, compared to $16.7 million, or 28% in the

second quarter of 2022.

- Operating Cash Flow: Net cash provided by

operating activity was $6.2 million, or 9% of total revenue,

compared to $10.0 million used in operating activity or 17% in the

second quarter of 2022.

- Free Cash Flow: was a positive $5.2 million or

8% of total revenue, compared to negative $12.2 million, or 20% in

the second quarter of 2022.

- Cash, Cash Equivalents, Short-term Deposits and

Marketable Securities: were $304.6 million as of June 30,

2023.

Second Quarter and Recent Business

Highlights:

- A successful launch of WalkMe Discovery, Data AI solutions grew

100% quarter over quarter on the number of employees covered.

- Launched new pricing and packaging to accelerate land motion

and deepen the expansion path to DAP.

- Expanded Global partner ecosystem by adding Deloitte India and

Deloitte New Zealand.

- Added three net new Enterprise-Wide DAP customers during the

quarter for a total of 183, representing DAP customer count growth

of 29% year-over-year.

- Customers with over $1 million in ARR grew 23% year-over-year

to 38. Customers with over $100,000 in ARR grew 8% year-over-year

to 527 customers.

- WalkMe announces ‘Realize’ annual customer and partner event on

October 25th, 2023.

- WalkMe introduces ‘Shadow AI’ as part of WalkMe Discovery to

unlock observability and compliance into AI tools consumed in the

Enterprise.

Financial Outlook:

For the third quarter of 2023, the Company currently

expects:

- Revenue of $66 to $68 million, representing a growth rate of 4%

to 7% year-over-year

- Non-GAAP Operating Loss of $3 to $2 million

For the full year 2023, the Company currently expects:

- Revenue of $266 to $270 million, representing a growth rate of

9% to 10% year-over-year

- Non-GAAP Operating Loss of $16 to $14 million

The section titled “Non-GAAP Financial Measures and Key

Performance Indicators” below contains a description of the

non-GAAP financial measures and Key Performance Indicators

discussed in this press release and reconciliations between

historical GAAP and non-GAAP information are contained in the

tables below. The Company is unable to provide a reconciliation of

non-GAAP Operating Income (Loss) to Operating Income (Loss), its

most directly comparable GAAP financial measure, on a

forward-looking basis without unreasonable effort, because items

that impact this GAAP financial measure are not within the

Company’s control and/or cannot be reasonably predicted. These

items may include, but are not limited to, predicting

forward-looking share-based compensation. Such information may have

a significant, and potentially unpredictable, impact on the

Company’s future financial results.

Throughout this press release, we provide a number of key

performance indicators used by our management and often used by

competitors in our industry. These and other key performance

indicators are discussed in more detail in the section entitled

“Non-GAAP Financial Measures and Key Performance Indicators” in

this press release.

Conference Call

Information:

WalkMe will host a conference call and live webcast for analysts

and investors at 5:00 a.m. Pacific Time on August 10, 2023. The

press release with the financial results as well as the investor

presentation materials will be accessible from the Company’s

website prior to the conference call.

A live webcast of the conference call will be accessible on the

WalkMe investor relations website at https://ir.walkme.com.

Approximately one hour after completion of the live call and for

at least 30 days thereafter, an archived version of the webcast

will be available on the Company’s investor relations website at

https://ir.walkme.com.

Supplemental Financial

and Other Information:

We intend to announce material information to the public through

the WalkMe Investor Relations website at ir.walkme.com, SEC

filings, press releases, public conference calls, and public

webcasts. We use these channels to communicate with our investors,

customers, and the public about our company, our offerings, and

other issues. As such, we encourage investors, the media, and

others to follow the channels listed above, and to review the

information disclosed through such channels.

Any updates to the list of disclosure channels through which we

will announce information will be posted on the investor relations

page of our website.

Non-GAAP Financial

Measures and Key Performance Indicators:

In addition to our financial results reported in accordance with

GAAP, this press release and the accompanying tables and related

presentation materials may contain one or more of the following

non-GAAP financial measures: Non-GAAP Gross Profit, Non-GAAP Gross

Margin, Non-GAAP Operating Income (Loss), Non-GAAP Operating

Margin, Non-GAAP Net Income (Loss) attributable to WalkMe Ltd.,

Non-GAAP Net Income (Loss) per share attributable to WalkMe Ltd.

and Free Cash Flow, all of which are non-GAAP financial measures.

We believe that these measures provide useful information about

operating results, enhance the overall understanding of past

financial performance and future prospects, and allow for greater

transparency with respect to key measures used by management in its

financial and operational decision making. Non-GAAP financial

measures have limitations as analytical tools and may differ from

similarly titled measures presented by other companies. The

presentation of this financial information is not intended to be

considered as a substitute for the financial information prepared

and presented in accordance with GAAP. Investors are encouraged to

review the related GAAP financial measures and the reconciliation

of these non-GAAP financial measures to their most directly

comparable GAAP financial measures and not rely on any single

financial measure to evaluate our business.

Non-GAAP Gross Profit and Non-GAAP Gross Margin. We define

Non-GAAP Gross Profit as gross profit excluding share-based

compensation, amortization of acquired intangibles and

restructuring costs. We exclude these items because they occur for

reasons that may be unrelated to our core operating performance

during the period, and because we believe that such items may

obscure underlying business trends and make comparisons of

long-term performance difficult. We use Non-GAAP Gross Profit with

traditional GAAP measures to evaluate our financial performance.

Non-GAAP Gross Margin is calculated as a percentage of

revenues.

Non-GAAP Operating Income (Loss) and Non-GAAP Operating Margin.

We define Non-GAAP Operating Income (Loss) as net income (loss)

from operations excluding share-based compensation and

amortization, impairment of acquired intangible assets and

restructuring costs. We exclude these items because they occur for

reasons that may be unrelated to our core operating performance

during the period, and because we believe that such items may

obscure underlying business trends and make comparisons of

long-term performance difficult. We use Non-GAAP Operating Income

(Loss) with traditional GAAP measures to evaluate our financial

performance. Non-GAAP Operating Margin is calculated as a

percentage of revenues.

Non-GAAP Net Income (Loss) attributable to WalkMe Ltd. We define

Non-GAAP Net Income (Loss) attributable to WalkMe Ltd. as Net

Income (Loss) attributable to WalkMe Ltd. excluding share-based

compensation, amortization and impairment of acquired intangibles,

restructuring costs and adjustment attributable to non-controlling

interest. We exclude these items because they occur for reasons

that may be unrelated to our core operating performance during the

period, and because we believe that such items may obscure

underlying business trends and make comparisons of long-term

performance difficult. We use Non-GAAP Net Income (Loss)

attributable to WalkMe Ltd. with traditional GAAP measures to

evaluate our financial performance. Non-GAAP Net Income (Loss) per

Share attributable to WalkMe Ltd. is calculated based on the

periodic weighted average of ordinary shares outstanding.

Free Cash Flow. We define Free Cash Flow as net cash provided by

(used in) operating activities, less cash used for purchases of

property and equipment and capitalized internal-use software

development costs. We believe that Free Cash Flow is a useful

indicator of liquidity that provides information to management and

investors, even if negative, about the amount of cash used in our

business. Our Free Cash Flow may vary from period to period and be

impacted as we continue to invest for growth in our business.

For more information on the non-GAAP financial measures, please

see the reconciliation tables provided below. The accompanying

reconciliation tables have more details on the GAAP financial

measures that are most directly comparable to non-GAAP financial

measures and the related reconciliations between these financial

measures.

ARR. We define ARR as the annualized value of customer

subscription contracts as of the measurement date, assuming any

contract that expires during the next 12 months is renewed on its

existing terms (including contracts for which we are negotiating a

renewal). Our calculation of ARR is not adjusted for the impact of

any known or projected future events (such as customer

cancellations, upgrades or downgrades, or price increases or

decreases) that may cause any such contract not to be renewed on

its existing terms. In addition, the amount of actual revenue that

we recognize over any 12-month period is likely to differ from ARR

at the beginning of that period, sometimes significantly. This may

occur due to new bookings, cancellations, upgrades, downgrades or

other changes in pending renewals, as well as the effects of

professional services revenue and acquisitions or divestitures. As

a result, ARR should be viewed independently of, and not as a

substitute for or forecast of, revenue and deferred revenue. Our

calculation of ARR may differ from similarly titled metrics

presented by other companies.

Enterprise-Wide DAP Customers: We define Enterprise-Wide DAP

Customers as those who have purchased enterprise-wide subscriptions

or who have department-wide usage of our Digital Adoption Platform

across four or more applications.

Special Note Regarding

Forward-Looking Statements:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). All statements contained in

this press release other than statements of historical fact,

including, without limitation, statements regarding the Company’s

future financial results, including revenue and non-GAAP operating

loss guidance, and expectations regarding the company’s operations

and future profitability are forward-looking statements. The words

“believe,” “may,” “will,” “estimate,” “potential,” “continue,”

“anticipate,” “intend,” “expect,” “could,” “would,” “project,”

“plan,” “target,” and similar expressions are intended to identify

forward-looking statements, though not all forward-looking

statements use these words or expressions. These forward-looking

statements are subject to risks, uncertainties and assumptions,

some of which are beyond our control. In addition, these

forward-looking statements reflect our current views with respect

to future events and are not a guarantee of future performance.

Actual outcomes may differ materially from the information

contained in the forward-looking statements as a result of a number

of factors, including, without limitation, the following: our

ability to manage our growth effectively, sustain our historical

growth rate in the future or achieve or maintain profitability; the

impact of adverse macro-economic changes on our business, financial

condition and results of operations; the growth and expansion of

the markets for our offerings and our ability to adapt and respond

effectively to evolving market conditions; our estimates of, and

future expectations regarding, our market opportunity; our ability

to keep pace with technological and competitive developments and

develop or otherwise introduce new products and solutions and

enhancements to our existing offerings; our ability to maintain the

interoperability of our offerings across devices, operating systems

and third-party applications and to maintain and expand our

relationships with third-party technology partners; the effects of

increased competition in our target markets and our ability to

compete effectively; our ability to attract and retain new

customers and to expand within our existing customer base; the

success of our sales and marketing operations, including our

ability to realize efficiencies and reduce customer acquisition

costs; our ability to meet the service-level commitments under our

customer agreements and the effects on our business if we are

unable to do so; our relationships with, and dependence on, various

third-party service providers; our ability to maintain and enhance

awareness of our brand; our ability to offer high quality customer

support; our ability to effectively develop and expand our

marketing and sales capabilities; our ability to maintain the sales

prices of our offerings and the effects of pricing fluctuations;

the sustainability of, and fluctuations in, our gross margin; risks

related to our international operations and our ability to expand

our international business operations; the effects of currency

exchange rate fluctuations on our results of operations; challenges

and risks related to our sales to government entities; our ability

to consummate acquisitions at our historical rate and at acceptable

prices, to enter into other strategic transactions and

relationships, and to manage the risks related to these

transactions and arrangements; our ability to protect our

proprietary technology, or to obtain, maintain, protect and enforce

sufficiently broad intellectual property rights therein; our

ability to maintain the security and availability of our platform,

products and solutions; our ability to comply with current and

future legislation and governmental regulations to which we are

subject or may become subject in the future; changes in applicable

tax law, the stability of effective tax rates and adverse outcomes

resulting from examination of our income or other tax returns;

risks related to political, economic and security conditions in

Israel; the effects of unfavorable conditions in our industry or

the global economy or reductions in information technology

spending; factors that may affect the future trading prices of our

ordinary shares; and other risk factors set forth in the section

titled “Risk Factors” in our Annual Report on form 20-F filed with

the Securities and Exchange Commission on March 14, 2023, and other

documents filed with or furnished to the SEC. These statements

reflect management’s current expectations regarding future events

and operating performance and speak only as of the date of this

press release. You should not put undue reliance on any

forward-looking statements. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by applicable law, we undertake no obligation to update

or revise publicly any forward-looking statements, whether as a

result of new information, future events or otherwise, after the

date on which the statements are made or to reflect the occurrence

of unanticipated events.

About WalkMe

WalkMe’s cloud-based Digital Adoption Platform enables

organizations to measure, drive and act to ultimately accelerate

their digital transformations and better realize the value of their

software investments. Our platform leverages proprietary technology

to provide visibility to an organization’s Chief Information

Officer and business leaders, while improving user experience,

productivity and efficiency for employees and customers. Alongside

walkthroughs and third-party integration capabilities, our platform

can be customized to fit an organization’s needs.

Media Contact:Christina

Knittelpress@walkme.com

Investor Contact:John

Streppainvestors@walkme.com

|

WalkMe Ltd. |

|

Condensed Consolidated Statements of

Operations |

|

(in thousands, except share and per share data;

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

Subscription |

|

$ |

61,395 |

|

$ |

54,200 |

|

$ |

122,024 |

|

$ |

105,589 |

|

|

Professional services |

|

|

4,763 |

|

|

5,742 |

|

|

10,026 |

|

|

11,201 |

|

|

Total revenues |

|

|

66,158 |

|

|

59,942 |

|

|

132,050 |

|

|

116,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

|

Subscription(1)(2)(3) |

|

|

6,458 |

|

|

6,696 |

|

|

12,847 |

|

|

13,571 |

|

|

Professional services(1)(3) |

|

|

5,397 |

|

|

7,394 |

|

|

11,200 |

|

|

14,287 |

|

|

Total cost of revenues |

|

|

11,855 |

|

|

14,090 |

|

|

24,047 |

|

|

27,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

54,303 |

|

|

45,852 |

|

|

108,003 |

|

|

88,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Research and development(1)(3) |

|

|

14,212 |

|

|

16,120 |

|

|

28,484 |

|

|

31,595 |

|

|

Sales and marketing(1)(3) |

|

|

39,459 |

|

|

43,113 |

|

|

83,917 |

|

|

85,192 |

|

|

General and administrative(1)(2)(3) |

|

|

16,474 |

|

|

17,850 |

|

|

37,221 |

|

|

33,018 |

|

|

Total operating expenses |

|

|

70,145 |

|

|

77,083 |

|

|

149,622 |

|

|

149,805 |

|

|

Operating loss |

|

|

(15,842 |

) |

|

(31,231 |

) |

|

(41,619 |

) |

|

(60,873 |

) |

|

Financial income, net |

|

|

3,246 |

|

|

551 |

|

|

6,489 |

|

|

1,127 |

|

|

Loss before income taxes |

|

|

(12,596 |

) |

|

(30,680 |

) |

|

(35,130 |

) |

|

(59,746 |

) |

|

Income taxes |

|

|

(1,385 |

) |

|

(479 |

) |

|

(2,497 |

) |

|

(1,158 |

) |

|

Net loss |

|

|

(13,981 |

) |

|

(31,159 |

) |

|

(37,627 |

) |

|

(60,904 |

) |

|

Net loss attributable to non-controlling interest |

|

|

(124 |

) |

|

(91 |

) |

|

(147 |

) |

|

(349 |

) |

|

Adjustment attributable to non-controlling interest |

|

|

(253 |

) |

|

(3,174 |

) |

|

2,247 |

|

|

(9,632 |

) |

|

Net loss attributable to WalkMe Ltd. |

|

$ |

(13,604 |

) |

$ |

(27,894 |

) |

$ |

(39,727 |

) |

$ |

(50,923 |

) |

|

Net loss per share attributable to WalkMe Ltd. basic and

diluted |

|

$ |

(0.15 |

) |

$ |

(0.33 |

) |

$ |

(0.45 |

) |

$ |

(0.60 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to ordinary shareholders, basic and diluted |

|

|

88,604,385 |

|

|

84,727,799 |

|

|

87,949,871 |

|

|

84,348,046 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes share-based compensation expense as follows: |

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Cost of subscription revenues |

|

$ |

313 |

|

$ |

279 |

|

$ |

599 |

|

$ |

539 |

|

|

Cost of professional services |

|

|

436 |

|

|

681 |

|

|

973 |

|

|

1,272 |

|

|

Research and development |

|

|

2,549 |

|

|

2,074 |

|

|

4,918 |

|

|

3,640 |

|

|

Sales and marketing |

|

|

3,944 |

|

|

4,645 |

|

|

8,555 |

|

|

8,457 |

|

|

General and administrative |

|

|

4,731 |

|

|

5,739 |

|

|

13,825 |

|

|

10,386 |

|

|

Total share-based compensation expense |

|

$ |

11,973 |

|

$ |

13,418 |

|

$ |

28,870 |

|

$ |

24,294 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Includes amortization and impairment of acquired

intangibles as follows: |

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Cost of revenues |

|

$ |

68 |

|

$ |

176 |

|

$ |

136 |

|

$ |

352 |

|

|

General and administrative |

|

|

- |

|

|

979 |

|

|

- |

|

|

979 |

|

|

Total amortization and impairment |

|

$ |

68 |

|

$ |

1,155 |

|

$ |

136 |

|

$ |

1,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Includes restructuring expense as follows: |

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Cost of subscription revenues |

|

$ |

40 |

|

$ |

- |

|

$ |

40 |

|

$ |

- |

|

|

Cost of professional services |

|

|

223 |

|

|

- |

|

|

223 |

|

|

- |

|

|

Research and development |

|

|

86 |

|

|

- |

|

|

86 |

|

|

- |

|

|

Sales and marketing |

|

|

964 |

|

|

- |

|

|

964 |

|

|

- |

|

|

General and administrative |

|

|

160 |

|

|

- |

|

|

160 |

|

|

- |

|

|

Total restructuring expense |

|

$ |

1,473 |

|

$ |

- |

|

$ |

1,473 |

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

WalkMe Ltd. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands; unaudited) |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

2023 |

|

2022 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

169,953 |

|

$ |

94,105 |

|

|

Short-term deposits |

|

51,820 |

|

|

125,231 |

|

|

Short-term marketable securities |

|

28,906 |

|

|

42,187 |

|

|

Trade receivables, net |

|

43,892 |

|

|

45,024 |

|

|

Deferred contract acquisition costs |

|

26,476 |

|

|

26,287 |

|

|

Prepaid expenses and other current assets |

|

8,670 |

|

|

6,243 |

|

|

Total current assets |

|

329,717 |

|

|

339,077 |

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

Long-term marketable securities |

|

53,933 |

|

|

43,334 |

|

|

Deferred contract acquisition costs |

|

34,212 |

|

|

40,110 |

|

|

Other assets |

|

523 |

|

|

584 |

|

|

Property and equipment, net |

|

12,573 |

|

|

13,268 |

|

|

Operating lease right-of-use assets |

|

14,737 |

|

|

7,003 |

|

|

Goodwill and Intangible assets, net |

|

1,695 |

|

|

1,830 |

|

|

Total non-current assets |

|

117,673 |

|

|

106,129 |

|

|

|

|

|

|

|

|

Total assets |

$ |

447,390 |

|

$ |

445,206 |

|

|

|

|

|

|

|

|

Liabilities, redeemable non-controlling interest and

shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Trade payables |

$ |

3,614 |

|

$ |

5,957 |

|

|

Accrued expenses and other current liabilities |

|

46,258 |

|

|

53,414 |

|

|

Deferred revenues |

|

116,131 |

|

|

108,097 |

|

|

Total current liabilities |

|

166,003 |

|

|

167,468 |

|

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Deferred revenues |

|

2,147 |

|

|

1,613 |

|

|

Other long-term liabilities |

|

12,846 |

|

|

10,038 |

|

|

Operating lease liabilities |

|

9,541 |

|

|

3,833 |

|

|

Total long-term liabilities |

|

24,534 |

|

|

15,484 |

|

|

Total liabilities |

|

190,537 |

|

|

182,952 |

|

|

|

|

|

|

|

|

Redeemable non-controlling interest |

|

10,142 |

|

|

8,080 |

|

|

Shareholders’ equity: |

|

|

|

|

|

Share capital and additional paid-in capital |

|

719,391 |

|

|

688,636 |

|

|

Other comprehensive loss |

|

(2,555 |

) |

|

(1,817 |

) |

|

Accumulated deficit |

|

(470,125 |

) |

|

(432,645 |

) |

|

Total shareholders’ equity |

|

246,711 |

|

|

254,174 |

|

|

Total Liabilities, redeemable non-controlling interest and

shareholders’ equity |

$ |

447,390 |

|

$ |

445,206 |

|

|

|

|

|

|

|

|

WalkMe Ltd. |

|

Condensed Consolidated Statements of Cash

Flow |

|

(in thousands; unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(13,981 |

) |

$ |

(31,159 |

) |

$ |

(37,627 |

) |

$ |

(60,904 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

11,973 |

|

|

13,418 |

|

|

28,870 |

|

|

24,294 |

|

|

Depreciation, amortization and impairment |

|

|

1,468 |

|

|

2,477 |

|

|

2,823 |

|

|

3,973 |

|

|

Operating lease right-of-use assets and liabilities, net |

|

|

(497 |

) |

|

- |

|

|

(900 |

) |

|

- |

|

|

Finance income |

|

|

271 |

|

|

52 |

|

|

(3 |

) |

|

(34 |

) |

|

Amortization of premium and accretion of discount on marketable

securities, net |

|

|

(482 |

) |

|

- |

|

|

(1,010 |

) |

|

- |

|

|

Decrease (increase) in trade receivables, net |

|

|

4,852 |

|

|

6,543 |

|

|

1,132 |

|

|

(3,194 |

) |

|

Decrease (increase) in prepaid expenses and other current and

non-current assets |

|

|

(56 |

) |

|

3,257 |

|

|

(2,174 |

) |

|

(141 |

) |

|

Decrease (increase) in deferred contract acquisition costs |

|

|

2,323 |

|

|

(2,621 |

) |

|

5,709 |

|

|

(3,175 |

) |

|

Decrease in trade payables |

|

|

(1,649 |

) |

|

(1,080 |

) |

|

(2,343 |

) |

|

(2,064 |

) |

|

Increase (decrease) in accrued expenses and other current

liabilities |

|

|

153 |

|

|

1,147 |

|

|

(7,789 |

) |

|

(7,954 |

) |

|

Increase (decrease) in deferred revenues |

|

|

611 |

|

|

(2,495 |

) |

|

9,167 |

|

|

19,798 |

|

|

Increase in other long-term liabilities |

|

|

1,248 |

|

|

436 |

|

|

2,847 |

|

|

1,089 |

|

|

Net cash provided by (used in) operating activities |

|

|

6,234 |

|

|

(10,025 |

) |

|

(1,298 |

) |

|

(28,312 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(149 |

) |

|

(1,388 |

) |

|

(329 |

) |

|

(2,038 |

) |

|

Investment in short-term deposits |

|

|

- |

|

|

(16,500 |

) |

|

- |

|

|

(43,500 |

) |

|

Proceeds from short-term deposits |

|

|

36,500 |

|

|

42,000 |

|

|

73,500 |

|

|

57,257 |

|

|

Investment in marketable securities |

|

|

(13,452 |

) |

|

- |

|

|

(23,809 |

) |

|

- |

|

|

Proceeds from maturity of marketable securities |

|

|

16,123 |

|

|

- |

|

|

26,583 |

|

|

- |

|

|

Proceeds from restricted deposits |

|

|

- |

|

|

295 |

|

|

- |

|

|

295 |

|

|

Capitalization of software development costs |

|

|

(911 |

) |

|

(813 |

) |

|

(1,478 |

) |

|

(2,185 |

) |

|

Net cash provided by investing activities |

|

|

38,111 |

|

|

23,594 |

|

|

74,467 |

|

|

9,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of options |

|

|

479 |

|

|

1,106 |

|

|

1,021 |

|

|

1,798 |

|

|

Proceeds from employees share purchase plan |

|

|

1,107 |

|

|

2,451 |

|

|

2,301 |

|

|

6,734 |

|

|

Net cash provided by financing activities |

|

|

1,586 |

|

|

3,557 |

|

|

3,322 |

|

|

8,532 |

|

|

Effect of foreign currency exchange rate changes on cash, cash

equivalents, and restricted cash |

|

|

(775 |

) |

|

(520 |

) |

|

(966 |

) |

|

(826 |

) |

|

Increase (decrease) in cash, cash equivalents and restricted

cash |

|

|

45,156 |

|

|

16,606 |

|

|

75,525 |

|

|

(10,777 |

) |

|

Cash, cash equivalents and restricted cash - Beginning of

period |

|

|

124,797 |

|

|

249,868 |

|

|

94,428 |

|

|

277,251 |

|

|

Cash, cash equivalents and restricted cash - End of period |

|

$ |

169,953 |

|

$ |

266,474 |

|

$ |

169,953 |

|

$ |

266,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

WalkMe Ltd. |

|

Reconciliation from GAAP to Non-GAAP Results |

|

(in thousands, except share and per share data;

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

Reconciliation of gross profit and gross

margin |

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

54,303 |

|

$ |

45,852 |

|

|

$ |

108,003 |

|

$ |

88,932 |

|

|

Plus: Share-based compensation expense |

|

|

749 |

|

|

960 |

|

|

|

1,572 |

|

|

1,811 |

|

|

Plus: Amortization of acquired intangibles |

|

|

68 |

|

|

176 |

|

|

|

136 |

|

|

352 |

|

|

Plus: Restructuring expense |

|

|

263 |

|

|

- |

|

|

|

263 |

|

|

- |

|

|

Non-GAAP gross profit |

|

$ |

55,383 |

|

$ |

46,988 |

|

|

$ |

109,974 |

|

$ |

91,095 |

|

|

GAAP gross margin |

|

|

82 |

% |

|

76 |

% |

|

|

82 |

% |

|

76 |

% |

|

Non-GAAP gross margin |

|

|

84 |

% |

|

78 |

% |

|

|

83 |

% |

|

78 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of operating expenses |

|

|

|

|

|

|

|

|

|

|

|

GAAP research and development |

|

$ |

14,212 |

|

$ |

16,120 |

|

|

$ |

28,484 |

|

$ |

31,595 |

|

|

Less: Share-based compensation expenses |

|

|

(2,549 |

) |

|

(2,074 |

) |

|

|

(4,918 |

) |

|

(3,640 |

) |

|

Less: Restructuring expense |

|

|

(86 |

) |

|

- |

|

|

|

(86 |

) |

|

- |

|

|

Non-GAAP research and development |

|

$ |

11,577 |

|

$ |

14,046 |

|

|

$ |

23,480 |

|

$ |

27,955 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP sales and marketing |

|

$ |

39,459 |

|

$ |

43,113 |

|

|

$ |

83,917 |

|

$ |

85,192 |

|

|

Less: Share-based compensation expenses |

|

|

(3,944 |

) |

|

(4,645 |

) |

|

|

(8,555 |

) |

|

(8,457 |

) |

|

Less: Restructuring expense |

|

|

(964 |

) |

|

- |

|

|

|

(964 |

) |

|

- |

|

|

Non-GAAP sales and marketing |

|

$ |

34,551 |

|

$ |

38,468 |

|

|

$ |

74,398 |

|

$ |

76,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP general and administrative |

|

$ |

16,474 |

|

$ |

17,850 |

|

|

$ |

37,221 |

|

$ |

33,018 |

|

|

Less: Share-based compensation expenses |

|

|

(4,731 |

) |

|

(5,739 |

) |

|

|

(13,825 |

) |

|

(10,386 |

) |

|

Less: impairment of acquired intangibles |

|

|

- |

|

|

(979 |

) |

|

|

- |

|

|

(979 |

) |

|

Less: Restructuring expense |

|

|

(160 |

) |

|

- |

|

|

|

(160 |

) |

|

- |

|

|

Non-GAAP general and administrative |

|

$ |

11,583 |

|

$ |

11,132 |

|

|

$ |

23,236 |

|

$ |

21,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of operating loss and operating

margin |

|

|

|

|

|

|

|

|

|

|

|

GAAP operating loss |

|

$ |

(15,842 |

) |

$ |

(31,231 |

) |

|

$ |

(41,619 |

) |

$ |

(60,873 |

) |

|

Plus: Share-based compensation expense |

|

|

11,973 |

|

|

13,418 |

|

|

|

28,870 |

|

|

24,294 |

|

|

Plus: Amortization and impairment of acquired intangibles |

|

|

68 |

|

|

1,155 |

|

|

|

136 |

|

|

1,331 |

|

|

Plus: Restructuring expense |

|

|

1,473 |

|

|

- |

|

|

|

1,473 |

|

|

- |

|

|

Non-GAAP operating loss |

|

$ |

(2,328 |

) |

$ |

(16,658 |

) |

|

$ |

(11,140 |

) |

$ |

(35,248 |

) |

|

GAAP operating margin |

|

|

(24 |

)% |

|

(52 |

)% |

|

|

(32 |

)% |

|

(52 |

)% |

|

Non-GAAP operating margin |

|

|

(4 |

)% |

|

(28 |

)% |

|

|

(8 |

)% |

|

(30 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net loss |

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss attributable to WalkMe Ltd. |

|

$ |

(13,604 |

) |

$ |

(27,894 |

) |

|

$ |

(39,727 |

) |

$ |

(50,923 |

) |

|

Plus: Share-based compensation expense |

|

|

11,973 |

|

|

13,418 |

|

|

|

28,870 |

|

|

24,294 |

|

|

Plus: Amortization and impairment of acquired intangibles |

|

|

68 |

|

|

1,155 |

|

|

|

136 |

|

|

1,331 |

|

|

Plus: Restructuring expense |

|

|

1,473 |

|

|

- |

|

|

|

1,473 |

|

|

- |

|

|

Plus: Adjustment attributable to non-controlling interest |

|

|

(253 |

) |

|

(3,174 |

) |

|

|

2,247 |

|

|

(9,632 |

) |

|

Non-GAAP net loss attributable to WalkMe Ltd. |

|

$ |

(343 |

) |

$ |

(16,495 |

) |

|

$ |

(7,001 |

) |

$ |

(34,930 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net loss per share attributable to WalkMe Ltd. basic and

diluted |

|

$ |

(0.00 |

) |

$ |

(0.19 |

) |

|

$ |

(0.08 |

) |

$ |

(0.41 |

) |

|

Shares used in non-GAAP per share calculations: |

|

|

|

|

|

|

|

|

|

|

|

GAAP weighted-average shares used to compute net loss per share,

basic and diluted |

|

|

88,604,385 |

|

|

84,727,799 |

|

|

|

87,949,871 |

|

|

84,348,046 |

|

|

Non-GAAP weighted-average shares used to compute net loss per

share, basic and diluted |

|

|

88,604,385 |

|

|

84,727,799 |

|

|

|

87,949,871 |

|

|

84,348,046 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WalkMe Ltd. |

|

Reconciliation of GAAP Cash Flow from Operating Activities

to Free Cash Flow |

|

(in thousands; unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

Net cash provided by (used in) operating

activities |

|

$ |

6,234 |

|

$ |

(10,025 |

) |

|

$ |

(1,298 |

) |

$ |

(28,312 |

) |

|

Less: Purchases of property and equipment |

|

|

(149 |

) |

|

(1,388 |

) |

|

|

(329 |

) |

|

(2,038 |

) |

|

Less: Capitalized software development costs |

|

|

(911 |

) |

|

(813 |

) |

|

|

(1,478 |

) |

|

(2,185 |

) |

|

Free Cash Flow |

|

$ |

5,174 |

|

$ |

(12,226 |

) |

|

$ |

(3,105 |

) |

$ |

(32,535 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

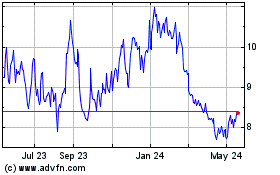

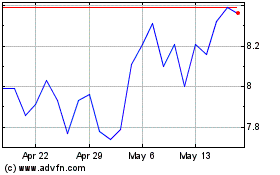

WalkMe (NASDAQ:WKME)

Historical Stock Chart

From Mar 2024 to Apr 2024

WalkMe (NASDAQ:WKME)

Historical Stock Chart

From Apr 2023 to Apr 2024