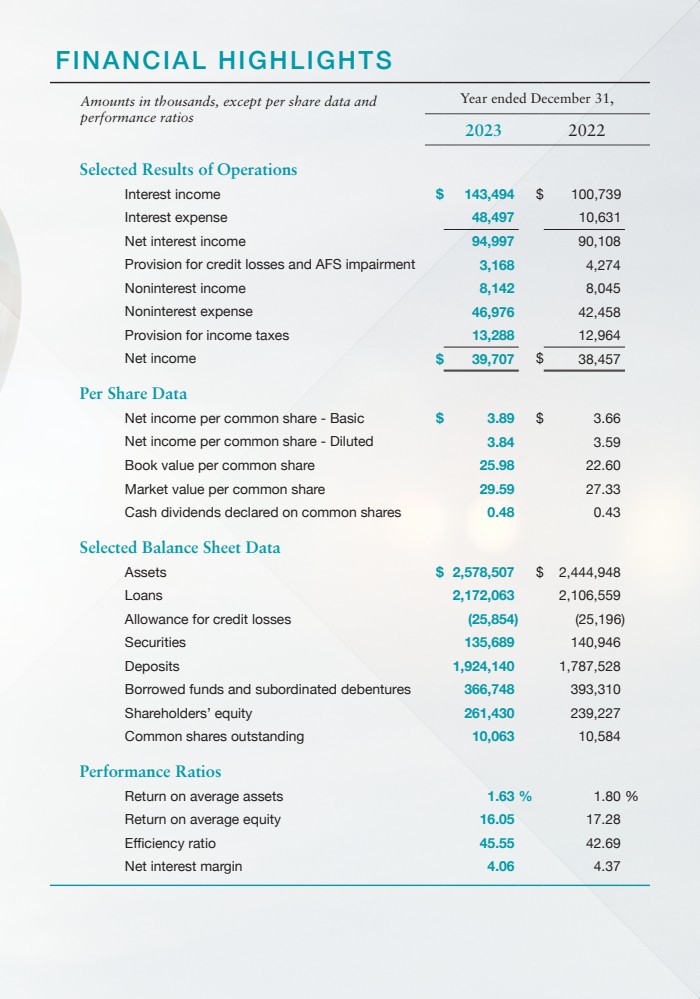

| FINANCIAL HIGHLIGHTS

Amounts in thousands, except per share data and

performance ratios

Year ended December 31,

2023 2022

Selected Results of Operations

Interest income $ 143,494 $ 100,739

Interest expense 48,497 10,631

Net interest income 94,997 90,108

Provision for credit losses and AFS impairment 3,168 4,274

Noninterest income 8,142 8,045

Noninterest expense 46,976 42,458

Provision for income taxes 13,288 12,964

Net income $ 39,707 $ 38,457

Per Share Data

Net income per common share - Basic $ 3.89 $ 3.66

Net income per common share - Diluted 3.84 3.59

Book value per common share 25.98 22.60

Market value per common share 29.59 27.33

Cash dividends declared on common shares 0.48 0.43

Selected Balance Sheet Data

Assets $ 2,578,507 $ 2,444,948

Loans 2,172,063 2,106,559

Allowance for credit losses (25,854) (25,196)

Securities 135,689 140,946

Deposits 1,924,140 1,787,528

Borrowed funds and subordinated debentures 366,748 393,310

Shareholders’ equity 261,430 239,227

Common shares outstanding 10,063 10,584

Performance Ratios

Return on average assets 1.63 % 1.80 %

Return on average equity 16.05 17.28

Efficiency ratio 45.55 42.69

Net interest margin 4.06 4.37 |