United Security Bancshares and Taft National Bank Agree to Merge

December 11 2003 - 6:05PM

PR Newswire (US)

United Security Bancshares and Taft National Bank Agree to Merge

FRESNO, Calif., Dec. 11 /PRNewswire-FirstCall/ -- In a joint news

release, United Security Bancshares President and CEO, Dennis R.

Woods and Taft National Bank President, Dennis Tishma, announced

today the signing of a definitive merger agreement. Upon completion

of the merger, Taft National Bank branches will operate as branches

of United Security Bank, a wholly owned subsidiary of United

Security Bancshares. In the merger, United Security Bancshares

("USB") will issue shares of its stock in a tax free exchange for

all of the Taft National Bank shares. The value of the merger will

vary depending on the market price of USB stock at the time of the

merger closing. Based upon the closing price of USB common stock

today, the merger value is approximately $6.4 million or $24.00 per

Taft share. The minimum value of the transaction depending on the

price of a USB share, will not be less than $5.3 million, less a

dollar for dollar reduction if specified transaction costs exceed

$300,000. The merger which will be accounted as a purchase

transaction, is expected to be completed late in the first quarter

or early in the second quarter of 2004. Taft National Bank operates

branch offices in Taft and Bakersfield serving small business and

retail banking clients. As of September 30, 2003, Taft National

Bank had total assets of $52 million and deposits of $47 million.

For the nine months ended September 30, 2003, Taft's net income was

$80,000. Dennis Woods, President and Chief Executive Officer of

United Security Bancshares, stated, "The addition of Taft National

Bank to United Security Bank will strengthen our presence in the

San Joaquin Valley. Taft National Bank has built a solid business

banking and retail franchise with an excellent reputation for

service. With its small business and retail banking focus, Taft

National Bank provides a unique opportunity for United Security to

serve a loyal and growing small business niche and individual

client base." Dennis Tishma, President of Taft National Bank,

commented, "We have followed the success of United Security Bank

over the years and believe that its community banking philosophy

fits extremely well with the strong community commitment that Taft

has consistently maintained. This merger will enable us to expand

our ability to serve our clients and increase our lending

capabilities. We also believe this merger will give us an

opportunity to participate more fully in the economic growth of the

San Joaquin Valley." Terms of the Merger The terms of the agreement

provide for the shareholders of Taft National Bank to receive

shares of United Security Bancshares. Taft National Bank currently

has approximately 267,481 shares of common stock outstanding. If

the average closing price of United Security Banchares common

stock, which will be determined over the twenty trading days

preceding the closing, is $22.00 or above, each share of Taft

National Bank stock will be exchanged for approximately 0.90899 of

a share of United Security Bancshares stock. The merger is subject

to certain conditions, including the approval of the shareholders

of Taft National Bank and regulatory approval. Upon consummation of

the merger, former Taft National Bank shareholders will own

approximately 4.2% of United Security Bancshares outstanding

shares. Safe Harbor Certain matters discussed in this press release

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements relate to future financial performance

and condition and pending acquisitions. These forward looking

statements are subject to certain risks and uncertainties that

could cause the actual results, performance or achievements to

differ materially from those expressed, suggested or implied by the

forward looking statements due to a number of factors, including,

but not limited to, when and if the proposed merger is consummated,

the success of United Security Bancshares in integrating the new

bank into its organization and other risks detailed in the United

Secuirity Bancshares reports filed with the Securities and Exchange

Commission and Taft National Bank reports filed with the Office of

the Comptroller of Currency, including their Annual Reports for the

year ending December 31, 2003. United Security Bancshares will file

a registration statement on Form S-4 with the SEC in connection

with the proposed merger. The registration statement will include a

prospectus/proxy statement which will be sent to shareholders of

Taft National Bank seeking their approval of the proposed merger.

When filed, the registration statement can be obtained at

http://www.sec.gov/ . For investor information on United Security

Bancshares please contact Dennis R. Woods, President & CEO,

559-248-4928, or Ken Donahue, SVP& CFO, 559-248-4943. For

questions regarding Taft National Bank, please contact Dennis

Tishma, President & CEO, 661-763-5151. DATASOURCE: United

Security Bancshares CONTACT: Dennis R. Woods, President & CEO,

+1-559-248-4928, or Ken Donahue, SVP& CFO, +1-559-248-4943,

both of United Security Bancshares; or Dennis Tishma, President

& CEO of Taft National Bank, +1-661-763-5151 Web site:

http://www.unitedsecuritybank.com/

Copyright

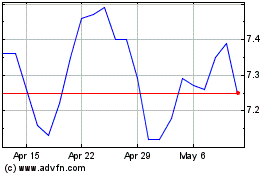

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jun 2024 to Jul 2024

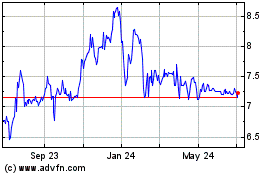

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jul 2023 to Jul 2024