Amended Statement of Beneficial Ownership (sc 13d/a)

December 15 2022 - 8:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 4)1

Titan Pharmaceuticals, Inc.

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

888314606

(CUSIP Number)

DAVID E. LAZAR

Villa 1, 14-43rd Street

Jumeirah 2

Dubai, United Arab Emirates

(646) 768-8417

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 14, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box ☐.

Note. Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies

are to be sent.

(Continued on following pages)

| 1 | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the

Notes).

| 1 |

NAME OF REPORTING PERSONS

DAVID E. LAZAR |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO, PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Portugal, Israel |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

3,331,402 |

| 8 |

SHARED VOTING POWER

359,066 |

| 9 |

SOLE DISPOSITIVE POWER

3,331,402 |

| 10 |

SHARED DISPOSITIVE POWER

359,066 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,690,468 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

25.2% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| 1 |

NAME OF REPORTING PERSONS

ACTIVIST INVESTING LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER

- 0 - |

| 8 |

SHARED VOTING POWER

359,066 |

| 9 |

SOLE DISPOSITIVE POWER

- 0 - |

| 10 |

SHARED DISPOSITIVE POWER

359,066 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

359,066 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.5% |

| 14 |

TYPE OF REPORTING PERSON

OO |

The following constitutes Amendment

No. 4 to the Schedule 13D filed by the undersigned (“Amendment No. 4”). This Amendment No. 4 amends the Schedule 13D as specifically

set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended to

add the following:

In connection with the Issuer’s

previously disclosed review of strategic alternatives, on December 15, 2022, the Issuer issued a press release (the “Press Release”)

disclosing its entry into a non-binding letter of intent (the “Non-Binding Letter of Intent”) to acquire a leading developer

of personal air and land vehicles specializing in the Advanced Air Mobility market (the “Acquisition Target”) in a reverse

merger transaction (the “Proposed Reverse Merger”), subject to, among other things, the negotiation of a definitive merger

agreement, approval of the Proposed Reverse Merger by the Issuer’s Board of Directors (the “Board”) and shareholders,

approval of the continued listing by Nasdaq of the Shares on the Nasdaq Capital Market on a post-reverse merger basis (which is anticipated

to require raising additional financing in connection with the closing of the Proposed Reverse Merger), the completion of due diligence

to the satisfaction of the parties, financing and the satisfaction of certain conditions that are to be negotiated as part of a definitive

merger agreement. The foregoing description of the Proposed Reverse Merger is qualified in its entirety by reference to the full text

of the Press Release, which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In connection with the Proposed

Reverse Merger, the Reporting Persons have entered into an Intention and Exclusivity Agreement (the “Intention and Exclusivity Agreement”)

with the Acquisition Target to jointly explore and pursue the possibility of the Proposed Reverse Merger in accordance with the terms

of the Non-Binding Letter of Intent. The Intention and Exclusivity Agreement expresses the Reporting Persons’ and the Acquisition

Target’s interests in continuing discussions regarding the Potential Reverse Merger and is not intended to, and does not, create

any legally binding obligation on any party to consummate the Potential Reverse Merger and the transactions contemplated thereby.

In addition, and other than

in connection with Proposed Reverse Merger, the Reporting Persons are contemplating a sale of 100% of the Reporting Persons’ Shares

in a block sale/single lot transaction, on such terms and at such times as the Reporting Persons may deem advisable, and depending upon

overall market conditions, other investment opportunities available to the Reporting Persons, and the availability of Shares at prices

that would make sale of the Shares desirable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is hereby amended to

add the following:

On December 14, 2022, the Issuer

and David E. Lazar, the Issuer’s Chief Executive Officer, entered into an Employment Agreement (the “Employment Agreement”),

pursuant to which the Issuer hired Mr. Lazar to serve as the Issuer’s Chief Executive Officer, effective August 16, 2022. Pursuant

to the terms of the Employment Agreement, Mr. Lazar will be paid a base salary of $406,000 per year, and will participate in the Issuer’s

equity incentive plan (the “Plan”). Due to the Issuer’s current liquidity situation, approximately 70% of Mr. Lazar’s

compensation will be deferred until such time as the Compensation Committee of the Board determines that the Issuer has sufficient liquidity

to pay the full salary. Mr. Lazar will be eligible to receive an annual bonus, with a target of fifty percent (50%) of his base salary.

In addition, Mr. Lazar will be eligible for three performance bonuses on an annual basis, payable in (i) cash and/or (ii) restricted stock

under the Plan, each equal to fifty percent (50%) of his base salary, which shall be dependent on the achievement by the Issuer of certain

milestones. Furthermore, in the event of a Change of Control (as such term is defined in the Employment Agreement), the Issuer shall pay

Mr. Lazar a bonus equal to three percent (3%) of the increased valuation of the surviving corporation resulting from such Change of Control.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement,

which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended to add the following

exhibits:

SIGNATURES

After reasonable inquiry and

to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: December 15, 2022

| |

ACTIVIST INVESTING LLC |

| |

|

| |

By: |

/s/ David E. Lazar |

| |

|

Name: |

David E. Lazar |

| |

|

Title: |

Chief Executive Officer |

| |

/s/ David E. Lazar |

| |

DAVID E. LAZAR |

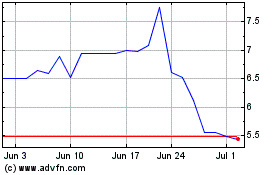

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Pharmaceuticals (NASDAQ:TTNP)

Historical Stock Chart

From Apr 2023 to Apr 2024