| |

Filed by

Informa PLC |

| |

Pursuant to Rule 425

under the Securities Act of 1933 |

| |

and deemed filed pursuant

to Rule 14a-12 under |

| |

the Securities Exchange

Act of 1934 |

| |

|

| |

Subject Company: TechTarget,

Inc. |

| |

Commission File No.:

001-33472 |

The following is a

transcript of an interview of Stephen A. Carter, Chief Executive Officer of Informa PLC, by Flashes & Flames on February 9, 2024.

The

Global Media Weekly for executives and entrepreneurs

How

I do it: Stephen Carter, CEO, Informa

Stephen Carter is CEO of Informa,

the UK-listed B2B group which is the world's largest organiser of trade shows. He is a former telecoms-advertising-media executive and

political adviser - who has also been a non-elected government minister and was first head of the UK's communications industry regulator,

Ofcom.

Ten years ago, he succeeded Peter

Rigby who (with group managing director David Gilbertson) had transformed Informa through a series of deals which had started

with their own 1998 merger of International Business Communications and LLP (Lloyd's List). Six years later came the coup of a no-cash

merger with academic publisher Taylor & Francis. But the prices and value of two other acquisitions - the £770mn conference

organiser IIR (in 2005) and £500mn research group Datamonitor (2007) - all but eclipsed Informa's sometimes spectacular progress

during the first decade of the century.

By the time Carter became CEO, shareholders

had become restless, not least over Rigby's failed merger discussions with UBM. Ironically, it was the seriously-digital Carter (an Informa

non-executive director for the previous two years) who developed clear views on the company's events strategy. It had been focused on

conferences rather than on the fast-growing (and appetisingly fragmented) global market for trade shows. The next irony was that the

2018 step-change with which Informa leap-frogged RELX, the longtime trade show market leader, was the £3.9bn acquisition of UBM

which had recently divested its B2B publishing in order to become a pureplay events group.

But two years later, the pandemic

paralysed the trade show industry and almost everything else.

It was a cold, hard test for Carter

and his new management team which, ultimately, has been credited with being: quick to refinance the company; willing to divest its data-rich

pharma, maritime, infrastructure and finance intelligence companies for dizzy proceeds of £2.5bn; and being ready post-pandemic

to make the £1bn acquisitions of Industry Dive newsletters and Tarsus exhibitions.

Last month, Informa announced

another audacious deal, de-merging its tech portfolio into the NASDAQ listed TechTarget. Informa's 2023 results, showing

the complete rebound of trade shows, saw revenue up by 30% to £3.2bn and operating profit of £845mn. It is forecasting £3.5bn

revenue for this year.

While being upfront with neatly-branded

strategies (eg the Global Acceleration Plan), the CEO is more media-shy than his CV suggests. The Scotland-born Stephen Carter graduated

in law from Aberdeen University, following which he joined JWT as a trainee, becoming CEO eight years later.

"It’s

much better to be a mile deep than a mile wide"

How and why did you become CEO?

Well, you'd have to ask the board at

the time, who gave me the job. But I subsequently discovered that quite a lot of our then shareholders felt that Informa should sell

off much of the business. My pitch to the board was 'I think we can turn this into a long-standing successful business, but we're going

to have to do some different things and it will take 3-4 years to prove.'

My point was that we weren't going to

be the company we've since become unless we did some fundamentally different things. And, if we didn’t make those changes, someone

was going to come along and buy us on the cheap, or we were going to get broken up into pieces. That was the stark reality.

In my first meetings, shareholders were

telling me they didn’t know why they should invest in the company, what the purpose of Informa was - and ‘who the hell are

you?’. So, in a funny sort of way, that shareholder feedback gave us a license to take some time and think about how we could change

what we were doing.

What were your first steps?

Our first Growth Acceleration Plan marked

the decision, at that time, not to sell anything but to make it all work better. I told the board that we could make our academic publishing

into a growth business. It was essentially a static business that had not gone into open access, which was an existential crisis for

that industry. The conference business was in decline because the internet was gaining pace, we had a tiny trade show operation and our

data and intelligence businesses were all in double digit declines. So, I said: ‘We could get value from our data business

and that, while conferences were not the future of the company, trade shows could be'.

Those were the choices facing the board.

But we had some fundamentally good assets. We had some good positions in markets - but we were not maximizing them. We were massively

under-invested in technology and products. We were running the business for cash rather than growth. Our equity was was anaemic, so we

had no access to equity finance. In such cases, you are completely dependent on annual cash flows or debt. That's a very limiting place

to be if you want to grow a business.

How was the culture?

The Informa culture was (and still is)

quite special. An awful lot of the ingredients of the culture today were in the company then: low ego, low profile, quite human, slightly

sceptical about unnecessary process and bureaucracy, fast decision-making and quite entrepreneurial. As a non-executive, I always

thought that my predecessors Peter Rigby and David Gilbertson had done a great job of creating that culture. And by and large, I

don't think its changed that much. At least, I hope not.

How has B2B changed in the past decade?

My own view is that its in another period

of flux, interestingly. But the change that has helped us immeasurably throughout the past decade has been the rise and rise of specialism.

As markets metastasize and break down into new niches of subject matter, content or analysis, that's actually a gift for the Informa

business model.

We latched on to that really early on.

We used to say we do best in ‘nano niches’. That's why our mission statement says we are ‘The Champion of the Specialist’.

That’s not a culture change in the company but we have really leaned into it. If you get that deepdown specialisation right - whether

in the academic or B2B market - there's real growth because specialist knowledge and expertise has become much, much more valuable. At

the same time, generalist knowledge has become much less valuable.

It’s much better to be a mile

deep than a mile wide.

That means, of course, that our customers

are much more demanding buyers and sellers. The deployment of technology in almost every industry is gaining pace. And so the sophistication

of customer needs keeps going up and up. And I would say that the B2B market is now, in many ways, more sophisticated than the B2C was

when I started out 30 odd years ago, where everything was focused on it and B2B was viewed as a slightly odd area. Nowhere is that more

acute than in the market for enterprise technology providers. If you can make yourself valuable in that ecosystem, you become an essential

part of the industry. It's all about deep, deep personalization in very specific and quite intense markets.

We've also made some choices in B2B

about which markets we will play in. One of the advantages we've had is that we didn't start with a completely blank sheet of paper -

other than in trade shows. So we were able to do quite a bit of market analysis and ask what markets we wanted to be in - and not.

We've chosen markets which are highly

international with very fragmented supply chains and, therefore, relatively high margins. Our customers are very focused on value rather

than just volume and price. It helps us achieve market leadership and we've got customers who themselves are very knowledgeable. If you

can align all that, you can really take a good position in the value chain. At their best, that’s what trade shows do really well.

But aren’t many trade shows

more ‘mass market’ than ‘specialist’?

Most trade shows really do involve a

lot of that 'specialist' approach. We are particularly involved in end markets where sheer volume matters to a degree but where the quality

of attendee, content, exhibitor and the way in which they participate is disproportionately important. That plays to our strengths

with data.

There is certainly a demand for some

sizzle and a need for the sense that ‘anyone who’s anyone is here’. There is a need for the crowd. But you've got to

have more steak than sizzle. It’s a balance and we're investing in data, professional content, specialist and tracking information,

matchmaking and market discovery. We don't do it in all of our shows every day of the week all of the time. But, if you look at our top

50-100 shows, there's a lot more of that specialist focus, which is what we care most about.

How has the pandemic changed trade

shows?

First, we have migrated more towards

major brands and larger events. So we closed, co-located or rationalised about 100 events and we've doubled-down our investment more

towards those premier brands. That's definitely been a change.

Second, the level of customer desire

for trade shows has returned and actually exceeded pre-COVID levels, both in absolute numbers of participation, attendees and exhibitors,

and also in post-event satisfaction scores and demand for further services before the next event. Customers want events more than ever

and are willing to pay for them. It’s all about being in front of your customer, the power of life.

Back in my pitch

to the Informa board in 2013, I was saying that 'live' has got real long-term value. Bearing in mind I have spent most of my professional

life working in digital, I believe the only thing in a digital world that has become even more valuable than digital is ‘live’.

And, crucially, part of the reason is because ‘live’ is becoming more digital. Which is why we and other trade show groups

are increasingly using digital to create more successful events.

Would you have preferred not to

sell the Intelligence businesses?

Yes and no! Back to my original pitch

to the board, I said everyone keeps telling us to sell our academic publishing because open access is coming. We decided to do the

opposite and lean into open access and become a scale player which is what we’ve also done in the events business. And then, in

our data businesses, the pitch was we've got these half a dozen data businesses. None of them are performing optimally. But that's basically

because we've never invested much in them. This needs technology, it needs product management.

If you're going

to have a subscription business, you want to be north of 95% subscription renewal rates, and you want 5 or 10% year-on-year growth rates

to turn it into a valuable business. We were a country mile away from that. We were at 60-65%, renewal rates and declining at 10% a year.

You're a dead man walking if that's that's your model. It took us 6-8 years to work through each of the businesses. Then, having turned

them into relatively high-performing, high-renewal, respectable businesses, along came Covid and we had to make some difficult decisions.

It took me personally about three months

to get comfortable with the decision that we needed to make. I didn't make the decision in a moment and I was very open with the board

that I was not finding it an easy outcome because we'd spent eight years making these businesses really attractive. But I was 100% convinced

that we could get very, very attractive returns for the work that we had done. We sold those businesses for more than what the whole

of Informa was worth back in 2012.

Is the TechTarget deal a way (eventually)

of selling your Tech business?

When we started out doing what we did

with the Intelligence businesses, many people asked: 'Are you doing this in order to sell them?’ I said I had no idea. But the

first task is we've got to create businesses that can compete at world class levels. And, if we can do that, we haven't made a pre-determined

decision. We might scale-up, we might double-down and we might exit. But the thing I know is that we'll have some real options and choices.

So, right now, I believe it's better to travel than arrive. So what are we travelling towards? We are going to build a world class,

market-leading business in technology, because no one else has done that yet. We can do it. And the best place to do that is in North

America, not here in the UK. Therefore, the partnership with TechTarget <Informa will have a 57% shareholding> gives us a vehicle

to create something potentially very exciting.

We've got a lot of work to do and, in

3-5 years, we'll have real choices. Now, if one of those choices means that someone comes along and says, ‘this is a thing of beauty,

and actually I can take it to the next level…' We're running a public company and making rational choices. But, right now, what's

driving us is that we see a market opportunity and think we can create it.

Why was the relatively new acquisition

Industry Dive included in the deal?

Because it has it has an ‘audience

capture’ model which is highly complementary to TechTarget’s model. The two together give you some kind of market leadership.

Were Industry Dive’s newsletters

supposed to be the catalyst for new Informa events?

That was a

possibility but we came to the conclusion that the bigger prize was in audience. And, while we are generating audience data from our

events business, increasingly it's not fundamentally an audience business. It's a buyer meets seller connection business. Whereas

the “new” TechTarget is all about audience from which you can get to 'buyer intent'. It's much more data and analytics

-based.

Ironically, at the time when we bought

Industry Dive, TechTarget was the under -bidder for exactly those reasons. But, last year, Industry Dive actually launched 6 or

7 new newsletters on the back of data from our events. They can still do that, and we can still use their data to market events and cross-promote.

We have retained that flexibility in the TechTarget deal, which includes a data sharing agreement.

Is Taylor & Francis really

a core business?

I think we are very good owners and

operators of a business that knows how to monetize specialist content. Its not really very different from what we do elsewhere. It's

just a different type of specialist content. We’ve been a very, very good home for a business that, today, is literally twice the

revenue of 2014. But, even back then, it was already 2.5x the business acquired by Informa in 2004. So, if you are an Informa shareholder

who had been a Taylor & Francis shareholder, you have had a very good return. That's the proof.

Informa has been a supportive environment.

We've invested more in the business recently, in technology and platforms. We've diversified into open access, open research and open

science. We've diversified our revenue sources from just educational institutions into researchers and funders. And we've diversified

the geographies in which we operate. As I move between internal discussion for many of our businesses, I don't feel that suddenly

this is a different universe. There are the same questions and the same fundamental issues. It’s 'how do you champion the specialist

in 77 reference subjects and 2,500 journal subjects?' It's not a structurally different operating model. Just a different product.

What’s your vision for Informa?

I'm very optimistic. We are in two main

end-markets, both of which have got significant forward runway. You know, at a meta level, the market for pure research and advanced

learning is growing. In the UK, some 50-60% of people are now in follow-on education after school. It was 4% when I went to university.

There are more specialist subjects and more category expertise in B2B markets. And there’s more and more effort around the world

put into industrial strategies. These are areas of continually growing interest and investment. We're now big enough as a company. I'm

certainly not saying we won't get bigger - and I hope we will. But we’ll have £3.5bn revenue in 2024 and our cashflow and

margins are getting better and our technology is starting to deliver real results. I think we've got a scaleable model with real operational

leverage. I personally don't think we've lost any of our energy or agility either.

I also think also that, as a company,

we have managed to retain that important culture - created way back by Peter Rigby and David Gilbertson - while getting some of the benefits

of scale. If you're a small company, you want all the benefits of a big company and vice versa. We constantly try to work on our agiility,

speed, innovation, ‘ownership’ and try to get stuff done. If you really can do both of those things and you're facing positive

end markets, that's a pretty damn good place to be.

What about disappointments and regrets?

I wish I had known

then more than I know now. Of course. When I was younger, I used to run on a mixture of adrenaline, ambition, financial necessity

and a bit of arrogance. Now, I feel like I know more, but I know less if you understand what I mean! So I sort of wish I'd been

a bit more questioning in those early days, maybe a bit bolder. I think we were cautious when we were when we started on this. We could

have done more, sooner, instead of asking ourselves: ‘How much time do you think shareholders can give us? How much money do you

think they'll let us invest?’ We came up, say, with three years and about £100mn.You always look back at that and think ‘maybe

at the start we should have been bolder and said five years and £200mn...'

It's difficult, of course, to have this

retrospective conversation without talking about Covid which was existential for Informa as for so many others. In just four weeks, we

closed more than half the company. That was a life-changing experience for the company as well as individuals. We had to make what you

might call ill-informed or certainly not factually, fully-informed decisions, like: 'How do you refinance? When do you refinance? Do

you over-finance? Do you take government money? Do you lay-off people or not? Do you hold or do you sell to pay-down debt? Do you use

your cash to pay off debt?' These are big calls because they're binary.

But once you've done them, you've done

them.

There's nothing about Covid that any

of us want to repeat. One of my parents died during Covid, so I'm not casual about the human tragedy involved in it. But, for our company, I

think we are much better on the other side of it because we're more focused, and we probably wouldn't have made the decision to sell

the Intelligence businesses with the clarity we had. The timing was absolutely spot on, which was a mixture of judgment and luck - the

best way to make decisions. In retrospect, we wouldn't have raised as much money. But we were able to recycle that capital and buy assets

at lower rates. We wouldn't have had the confidence to do that before.

It also made us a much tighter management

team. When you have that kind of near-death commercial experience and come out the other side, it is bonding for a management team.

Reproduced with permisson from Flashes &

Flames 9 February 2024

© Flashes & Flames Media

2024

www.flashesandflames.com

Additional Information and Where to Find It

In connection with the proposed transaction

(the “proposed transaction”) between Informa and TechTarget, Toro CombineCo, Inc. (“NewCo”

or, after the completion of the proposed transaction, “New TechTarget”) and TechTarget will prepare and file relevant

materials with the Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4

that will contain a proxy statement of TechTarget that also constitutes a prospectus of NewCo (the “Proxy Statement/Prospectus”).

A definitive Proxy Statement/Prospectus will be mailed to stockholders of TechTarget. TechTarget and NewCo may also file other documents

with the SEC regarding the proposed transaction. This communication is not a substitute for any proxy statement, registration statement

or prospectus, or any other document that TechTarget or NewCo (as applicable) may file with the SEC in connection with the proposed transaction.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF TECHTARGET ARE URGED TO READ CAREFULLY AND IN THEIR

ENTIRETY THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED BY

TECHTARGET OR NEWCO WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION,

WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. TechTarget investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus (when they become

available), as well as other filings containing important information about TechTarget, NewCo, and other parties to the proposed transaction

(including Informa), without charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the

SEC by TechTarget will be available free of charge under the tab “Financials” on the “Investor Relations” page

of TechTarget’s internet website at www.TechTarget.com or by contacting TechTarget’s Investor Relations Department at investor@TechTarget.com.

Participants in the Solicitation

Informa, TechTarget, NewCo, and their respective directors and certain

of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies from TechTarget’s

stockholders in connection with the proposed transaction. Information regarding the directors of Informa is contained in Informa’s

annual reports and accounts available on Informa’s website at www.informa.com/investors/ and in the National Storage Mechanism

at data.fca.org.uk/#/nsm/nationalstoragemechanism. Information regarding the directors and executive officers of TechTarget is contained

in TechTarget’s proxy statement for its 2023 annual meeting of stockholders, filed with the SEC on April 19, 2023, and in

other documents subsequently filed with the SEC. Additional information regarding the participants in the proxy solicitations and a description

of their direct or indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus and other

relevant materials filed with the SEC (when they become available). These documents can be obtained free of charge from the sources indicated

above.

No Offer or Solicitation

This communication is for informational purposes only and is not intended

to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval,

nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Note Regarding Forward-Looking Statements

This communication contains “forward-looking” statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve substantial

risks and uncertainties. All statements, other than historical facts, are forward-looking statements, including: statements regarding

the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering

the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced revenues and

cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability

and position of NewCo following completion of the proposed transaction; legal, economic, and regulatory conditions; and any assumptions

underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not

historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,”

“intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,”

“overestimate,” “underestimate,” “believe,” “plan,” “could,” “would,”

“project,” “predict,” “continue,” “target,” or the negatives of these words or other

similar terms or expressions that concern TechTarget’s or NewCo’s expectations, strategy, priorities, plans, or intentions.

Forward-looking statements are based upon current plans, estimates, and expectations that are subject to risks, uncertainties, and assumptions.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may

vary materially from those indicated or anticipated by such forward-looking statements. We can give no assurance that such plans, estimates,

or expectations will be achieved, and therefore, actual results may differ materially from any plans, estimates, or expectations in such

forward-looking statements.

Important factors that could cause actual results to differ materially

from such plans, estimates, or expectations include, among others: that one or more closing conditions to the proposed transaction, including

certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may

prohibit, delay, or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations, or

restrictions in connection with such approvals or that the required approval by the shareholders of TechTarget may not be obtained; the

risk that the proposed transaction may not be completed in the time frame expected by Informa, TechTarget, or NewCo, or at all; unexpected

costs, charges, or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of NewCo

following completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including

as a result of delay in completing the proposed transaction or integrating the relevant portion of the Informa Tech business with

the business of TechTarget; the ability of NewCo to implement its business strategy; difficulties and delays in achieving revenue

and cost synergies of NewCo; the occurrence of any event that could give rise to termination of the proposed transaction; potential

litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence

of the proposed transaction or result in significant costs of defense, indemnification, and liability; evolving legal, regulatory, and

tax regimes; changes in economic, financial, political, and regulatory conditions, in the United States and elsewhere, and other factors

that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics, geopolitical uncertainty, and

conditions that may result from legislative, regulatory, trade, and policy changes associated with the current or subsequent U.S. administration;

risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions

during the pendency of the proposed transaction that may impact TechTarget’s ability to pursue certain business opportunities or

strategic transactions; Informa’s, TechTarget’s, and NewCo’s ability to meet expectations regarding the accounting

and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse

effects on the market price of TechTarget’s common stock; the risk that the proposed transaction and its announcement could have

an adverse effect on the ability of TechTarget to retain customers and retain and hire key personnel and maintain relationships with

customers, suppliers, employees, stockholders, strategic partners and other business relationships and on its operating results and business

generally; market acceptance of TechTarget’s and the relevant portion of the Informa Tech business’s products and services;

the impact of pandemics and future health epidemics and any related economic downturns, on TechTarget’s business and the markets

in which it and its customers operate; changes in economic or regulatory conditions or other trends affecting the internet, internet

advertising and information technology industries; data privacy and artificial intelligence laws, rules, and regulations; the impact

of foreign currency exchange rates; certain macroeconomic factors facing the global economy, including instability in the regional banking

sector, disruptions in the capital markets, economic sanctions and economic slowdowns or recessions, rising inflation and interest rate

fluctuations on TechTarget’s and the relevant portion of the Informa Tech business’s results; and other matters included

in TechTarget’s filings with the SEC, including in Item 1A of its Annual Report on Form 10-K for the year ended December 31, 2022

and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. These risks, as well as other risks associated with the

proposed transaction, will be more fully discussed in the Proxy Statement/Prospectus that will be included in the registration statement

on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is,

and the list of factors to be presented in registration statement on Form S-4 will be, considered representative, no such list should

be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional

obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking

statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without

limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments

in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication.

Any forward-looking statements speak only as of the date of this communication.

None of Informa, TechTarget, or NewCo undertakes any obligation to update any forward-looking statements, whether as a result of new

information or developments, future events, or otherwise, except as required by law. Neither future distribution of this communication

nor the continued availability of this communication in archive form on TechTarget’s website at www.TechTarget.com or Informa’s

website at www.informa.com/investors should be deemed to constitute an update or re-affirmation of these statements as of any future

date.

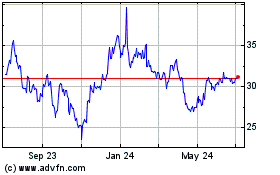

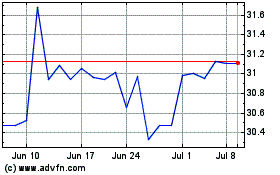

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2023 to Apr 2024