Talk America (NASDAQ:TALK), a leading provider of integrated voice

and data communications services, today announced third quarter

results for 2006. Talk America reported total revenue of $106.4

million and Adjusted EBITDA of $14.8 million. On-net revenue,

off-net revenue and long distance and other revenue in the third

quarter 2006 were $63.5 million, $30.8 million and $12.0 million,

respectively. Talk America ended the period with 614,000 local

voice and data equivalent lines of which 476,000 were on-net,

representing 78% of total lines. On-net lines were lower than

expected due to higher churn in the third quarter. We expect churn

to come down as network migrations have been completed and we roll

out our bundled broadband service offering. Revenues for the third

quarter reflected the benefit of customer price increases, as well

as the implementation of increases to late fees. In the third

quarter 2006, we recorded a reduction to network cost of $0.9

million related to the resolution of the Georgia rate case. (Note:

See the schedules accompanying this news release and

www.talkamerica.com for reconciliation to generally accepted

accounting principles (GAAP) for the non-GAAP financial measures

mentioned in this announcement and to download a copy of the

presentation to be reviewed on today's conference call.) As

previously announced, on September 22, 2006, we entered into a

merger agreement with Cavalier Telephone Corporation, under the

terms of which Cavalier will acquire all of Talk America�s

outstanding shares for $8.10 cash per share. Pending the approval

of our stockholders and the satisfaction of the other terms and

conditions of the merger agreement, we anticipate that the Cavalier

merger will be completed by year end 2006. Our regulatory approval

process is well underway and we have met the third quarter

financial performance closing condition in the merger agreement. In

connection with the proposed Cavalier merger, we have filed a

preliminary proxy statement, and will file a definitive proxy

statement, with the U.S. Securities and Exchange Commission (the

"SEC"). INVESTORS ARE ADVISED TO READ THE DEFINITIVE PROXY

STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE CAVALIER MERGER AND THE COMPANY.

Investors may obtain a free copy of the definitive proxy statement

(when available) and other documents filed by the Company with the

SEC at the SEC's web site at http://www.sec.gov. Free copies of the

definitive proxy statement, once available, and the Company's other

filings with the SEC may also be obtained from the Company. Free

copies of the Company's filings may be obtained by directing a

request to Talk America Holdings, Inc, 6805 Route 202. New Hope, PA

18938. The Company and our directors, executive officers and other

members of our management and employees may be deemed to be

soliciting proxies from our stockholders in favor of the Cavalier

merger. Investors and stockholders may obtain more detailed

information regarding the direct and indirect interests of our

executive officers and directors in the Cavalier merger by reading

the preliminary and definitive proxy statements regarding the

Cavalier merger, which have been and will be filed with the SEC.

About Talk America Talk America, is a leading competitive,

integrated communications provider that offers phone services and

high speed Internet access to both business and residential

customers. Services include local and long distance phone service,

and data services such as high-speed connectivity, security, web

hosting, and network services. Talk America delivers value in the

form of savings, simplicity and quality service to its customers

through its leading edge network and award-winning back office.

Please Note: The statements contained herein regarding the future

results of operations of Talk America should be, and certain other

of the statements contained herein may be, considered

�forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such statements are identified by the use of

forward-looking words or phrases, including, but not limited to,

"estimates," "expects," "expected," "anticipates," "anticipated,"

"forecast," "guidance," and "targets". These forward-looking

statements are based on our current expectations. Although we

believe that the expectations reflected in such forward-looking

statements are reasonable, there can be no assurance that such

expectations will prove to have been correct. Forward-looking

statements involve risks and uncertainties and our actual results

could differ materially from our expectations. In addition to those

factors discussed in the foregoing, important factors that could

cause such actual results to differ materially include, among

others, our inability to integrate effectively and as anticipated

acquired businesses, dependence on the availability and

functionality of local exchange carriers' networks as they relate

to the unbundled network element platform, failure to operate our

own local network in a profitable manner, increased price

competition for long distance, local and data services, failure of

the marketing of the bundle of local and long distance services,

long distance services and data services under our direct marketing

channels to a smaller marketing footprint, attrition in the number

of end users, failure to manage our collection management systems

and credit controls for customers, interruption in our network and

information systems, failure to provide adequate customer service,

and changes in government policy, regulation and enforcement and/or

adverse judicial or administrative interpretations and rulings

relating to regulations and enforcement. Additional information

concerning these and other important factors can be found within

Talk America�s filings with the Securities and Exchange Commission.

The forward-looking statements contained herein are made only as of

the date of this release, and we undertake no obligation to update

the forward-looking statements to reflect subsequent events or

circumstances. For a more detailed discussion of these factors, see

the Risk Factors discussions in Item 1A of our Annual Report on

Form 10-K for the year ended December 31, 2005 filed March 16,

2006, as amended by our Form 10-K/A filed March 28, 2006, and of

our subsequently filed Quarterly Reports on Form 10-Q. --Financial

Tables to Follow-- TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands,

except for per share data) (Unaudited) � Three Months Ended

September 30, Nine Months Ended September 30, 2006� 2005� 2006�

2005� � Revenue $106,353� $120,645� $ 340,921� $ 348,149� � Costs

and expenses: Network and line costs, excluding depreciation and

amortization 54,542� 64,413� 178,629� 181,090� General and

administrative expenses 21,684� 23,496� 74,160� 59,946� Provision

for doubtful accounts 4,359� 4,515� 12,610� 14,909� Sales and

marketing expenses 11,958� 7,294� 35,900� 21,335� Depreciation and

amortization 11,084� 11,618� 34,235� 30,734� Total costs and

expenses 103,627� 111,336� 335,534� 308,014� � Operating income

2,726� 9,309� 5,387� 40,135� Other income (expense): Interest

income 254� 199� 768� 873� Interest expense (185) (114) (616) (164)

Other income (expense), net (11) (5) 42� (361) Income before

provision for income taxes 2,784� 9,389� 5,581� 40,483� Provision

for income taxes 1,613� 4,172� 3,296� 16,428� � Net income $ 1,171�

$ 5,217� $ 2,285� $ 24,055� � Income per share � Basic: � � � � Net

income per share $ 0.04� $ 0.18� $ 0.08� $ 0.86� � Weighted average

common shares outstanding 30,494� 29,808� 30,444� 28,122� � Income

per share � Diluted: � � � � Net income per share $ 0.04� $ 0.17� $

0.07� $ 0.84� � Weighted average common and common equivalent

shares outstanding 30,673� 30,357� 30,624� 28,796� TALK AMERICA

HOLDINGS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands, except for share and per share data)

(Unaudited) � September 30, 2006 December 31, 2005 Assets Current

assets: Cash and cash equivalents $ 35,594� $ 46,288� Restricted

cash 1,920� --� Accounts receivable, trade (net of allowance for

uncollectible accounts of $14,740 and $13,838 at September 30, 2006

and December 31, 2005, respectively) 36,602� 43,600� Deferred

income taxes 11,158� 18,096� Prepaid expenses and other current

assets 12,091� 10,297� Total current assets 97,365� 118,281� �

Property and equipment, net 92,160� 98,492� Goodwill 36,479�

36,479� Intangibles, net 3,160� 4,934� Deferred income taxes

36,606� 21,033� Capitalized software and other assets 11,448�

9,470� Total assets $ 277,218� $ 288,689� � Liabilities and

Stockholders� Equity Current liabilities: Accounts payable and

accrued expenses $ 32,823� $ 40,025� Sales, use and excise taxes

8,298� 7,316� Deferred revenue 13,440� 13,824� Current portion of

long-term debt 2,554� 3,988� Accrued compensation 5,057� 9,405�

Other current liabilities 8,482� 12,933� Total current liabilities

70,654� 87,491� � Long-term debt 1,837� 1,289� � Deferred income

taxes 83� 4,853� � Other liabilities 5,515� 3,269� Commitments and

contingencies � Stockholders' equity: Preferred stock - $.01 par

value, 5,000,000 shares authorized; no shares outstanding --� --�

Common stock - $.01 par value, 100,000,000 shares authorized;

31,842,321 and 31,684,056 shares issued and 30,508,638 and

30,368,267 shares outstanding at September 30, 2006 and December

31, 2005, respectively 318� 317� Additional paid-in capital

385,639� 380,481� Accumulated deficit (181,726) (184,011) Treasury

stock � at cost, 1,333,683 and 1,315,789 shares at September 30,

2006 and December 31, 2005, respectively (5,102) (5,000) Total

stockholders' equity 199,129� 191,787� Total liabilities and

stockholders� equity $ 277,218� $ 288,689� TALK AMERICA HOLDINGS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited) � Nine Months Ended September 30,

2006� 2005� Cash flows from operating activities: Net income $

2,285� $ 24,055� Adjustments to reconcile net income to net cash

provided by operating activities: Provision for doubtful accounts

12,610� 14,909� Depreciation and amortization 34,235� 30,734�

Deferred income taxes 1,047� 13,341� Stock-based compensation

4,172� --� Other non-cash charges 456� 359� Changes in assets and

liabilities, net of effect of acquisition: Accounts receivable,

trade (1,169) 726� Prepaid expenses and other current assets 1,340�

1,745� Other assets 49� 80� Accounts payable and accrued expenses

(11,278) (19,835) Sales, use and excise taxes 22� (4,553) Deferred

revenue (2,405) (3,156) Accrued compensation (9,008) (1,563) Other

liabilities (6,194) (162) Net cash provided by operating activities

26,162� 56,680� � Cash flows from investing activities: Proceeds

from sale of fixed assets 675� 63� Acquisitions, net of cash

acquired (16,485) (26,850) Capital expenditures (15,377) (35,220)

Capitalized software development costs (4,172) (2,946) Decreases in

restricted cash 1,375� --� Net cash used in investing activities

(33,984) (64,953) � Cash flows from financing activities: Tax

benefit of stock based compensation 430� --� Payments of capital

lease obligations (3,667) (1,586) Proceeds from exercise of options

and warrants 365� 4,685� Net cash provided by (used in) financing

activities (2,872) 3,099� � Net change in cash and cash equivalents

(10,694) (5,174) Cash and cash equivalents, beginning of period

46,288� 47,492� Cash and cash equivalents, end of period $35,594�

$42,318� TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES NON-GAAP

RECONCILIATION Non-GAAP Financial Measure: The non-GAAP financial

measure that we use in this news release is listed below. We have

included reconciliation of this non-GAAP financial measure to the

most directly comparable GAAP measures in our financial statements.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (Adjusted EBITDA) is defined as operating income plus

depreciation and amortization, stock-based compensation expense and

gains/losses on the sale of property and equipment. Adjusted EBITDA

($ in thousands) Third Quarter September Year to Date 2006� � 2005�

2006� � 2005� Operating Income $2,726� $9,309� $5,387� $40,135�

Depreciation and Amortization 11,084� 11,618� 34,235� 30,734�

Stock-based Compensation 955� --� 4,172� --� Loss on Sale of

Property and Equipment 3� --� 413� --� Adjusted EBITDA $14,768�

$20,927� $44,207� $70,869� Talk America (NASDAQ:TALK), a leading

provider of integrated voice and data communications services,

today announced third quarter results for 2006. Talk America

reported total revenue of $106.4 million and Adjusted EBITDA of

$14.8 million. On-net revenue, off-net revenue and long distance

and other revenue in the third quarter 2006 were $63.5 million,

$30.8 million and $12.0 million, respectively. Talk America ended

the period with 614,000 local voice and data equivalent lines of

which 476,000 were on-net, representing 78% of total lines. On-net

lines were lower than expected due to higher churn in the third

quarter. We expect churn to come down as network migrations have

been completed and we roll out our bundled broadband service

offering. Revenues for the third quarter reflected the benefit of

customer price increases, as well as the implementation of

increases to late fees. In the third quarter 2006, we recorded a

reduction to network cost of $0.9 million related to the resolution

of the Georgia rate case. (Note: See the schedules accompanying

this news release and www.talkamerica.com for reconciliation to

generally accepted accounting principles (GAAP) for the non-GAAP

financial measures mentioned in this announcement and to download a

copy of the presentation to be reviewed on today's conference

call.) As previously announced, on September 22, 2006, we entered

into a merger agreement with Cavalier Telephone Corporation, under

the terms of which Cavalier will acquire all of Talk America's

outstanding shares for $8.10 cash per share. Pending the approval

of our stockholders and the satisfaction of the other terms and

conditions of the merger agreement, we anticipate that the Cavalier

merger will be completed by year end 2006. Our regulatory approval

process is well underway and we have met the third quarter

financial performance closing condition in the merger agreement. In

connection with the proposed Cavalier merger, we have filed a

preliminary proxy statement, and will file a definitive proxy

statement, with the U.S. Securities and Exchange Commission (the

"SEC"). INVESTORS ARE ADVISED TO READ THE DEFINITIVE PROXY

STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE CAVALIER MERGER AND THE COMPANY.

Investors may obtain a free copy of the definitive proxy statement

(when available) and other documents filed by the Company with the

SEC at the SEC's web site at http://www.sec.gov. Free copies of the

definitive proxy statement, once available, and the Company's other

filings with the SEC may also be obtained from the Company. Free

copies of the Company's filings may be obtained by directing a

request to Talk America Holdings, Inc, 6805 Route 202. New Hope, PA

18938. The Company and our directors, executive officers and other

members of our management and employees may be deemed to be

soliciting proxies from our stockholders in favor of the Cavalier

merger. Investors and stockholders may obtain more detailed

information regarding the direct and indirect interests of our

executive officers and directors in the Cavalier merger by reading

the preliminary and definitive proxy statements regarding the

Cavalier merger, which have been and will be filed with the SEC.

About Talk America Talk America, is a leading competitive,

integrated communications provider that offers phone services and

high speed Internet access to both business and residential

customers. Services include local and long distance phone service,

and data services such as high-speed connectivity, security, web

hosting, and network services. Talk America delivers value in the

form of savings, simplicity and quality service to its customers

through its leading edge network and award-winning back office.

Please Note: The statements contained herein regarding the future

results of operations of Talk America should be, and certain other

of the statements contained herein may be, considered

"forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such statements are identified by the use of

forward-looking words or phrases, including, but not limited to,

"estimates," "expects," "expected," "anticipates," "anticipated,"

"forecast," "guidance," and "targets". These forward-looking

statements are based on our current expectations. Although we

believe that the expectations reflected in such forward-looking

statements are reasonable, there can be no assurance that such

expectations will prove to have been correct. Forward-looking

statements involve risks and uncertainties and our actual results

could differ materially from our expectations. In addition to those

factors discussed in the foregoing, important factors that could

cause such actual results to differ materially include, among

others, our inability to integrate effectively and as anticipated

acquired businesses, dependence on the availability and

functionality of local exchange carriers' networks as they relate

to the unbundled network element platform, failure to operate our

own local network in a profitable manner, increased price

competition for long distance, local and data services, failure of

the marketing of the bundle of local and long distance services,

long distance services and data services under our direct marketing

channels to a smaller marketing footprint, attrition in the number

of end users, failure to manage our collection management systems

and credit controls for customers, interruption in our network and

information systems, failure to provide adequate customer service,

and changes in government policy, regulation and enforcement and/or

adverse judicial or administrative interpretations and rulings

relating to regulations and enforcement. Additional information

concerning these and other important factors can be found within

Talk America's filings with the Securities and Exchange Commission.

The forward-looking statements contained herein are made only as of

the date of this release, and we undertake no obligation to update

the forward-looking statements to reflect subsequent events or

circumstances. For a more detailed discussion of these factors, see

the Risk Factors discussions in Item 1A of our Annual Report on

Form 10-K for the year ended December 31, 2005 filed March 16,

2006, as amended by our Form 10-K/A filed March 28, 2006, and of

our subsequently filed Quarterly Reports on Form 10-Q. --Financial

Tables to Follow-- -0- *T TALK AMERICA HOLDINGS, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands, except for per share data) (Unaudited) Three Months

Ended Nine Months Ended September 30, September 30,

------------------- ------------------- 2006 2005 2006 2005

--------- --------- --------- --------- Revenue $106,353 $120,645

$340,921 $348,149 Costs and expenses: Network and line costs,

excluding depreciation and amortization 54,542 64,413 178,629

181,090 General and administrative expenses 21,684 23,496 74,160

59,946 Provision for doubtful accounts 4,359 4,515 12,610 14,909

Sales and marketing expenses 11,958 7,294 35,900 21,335

Depreciation and amortization 11,084 11,618 34,235 30,734 ---------

--------- --------- --------- Total costs and expenses 103,627

111,336 335,534 308,014 --------- --------- --------- ---------

Operating income 2,726 9,309 5,387 40,135 Other income (expense):

Interest income 254 199 768 873 Interest expense (185) (114) (616)

(164) Other income (expense), net (11) (5) 42 (361) ---------

--------- --------- --------- Income before provision for income

taxes 2,784 9,389 5,581 40,483 Provision for income taxes 1,613

4,172 3,296 16,428 --------- --------- --------- --------- Net

income $1,171 $5,217 $2,285 $24,055 ========= ========= =========

========= Income per share - Basic: --------- --------- ---------

--------- Net income per share $0.04 $0.18 $0.08 $0.86 =========

========= ========= ========= Weighted average common shares

outstanding 30,494 29,808 30,444 28,122 ========= =========

========= ========= Income per share - Diluted: --------- ---------

--------- --------- Net income per share $0.04 $0.17 $0.07 $0.84

========= ========= ========= ========= Weighted average common and

common equivalent shares outstanding 30,673 30,357 30,624 28,796

========= ========= ========= ========= *T -0- *T TALK AMERICA

HOLDINGS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands, except for share and per share data)

(Unaudited) September 30, December 31, 2006 2005 -------------

------------ Assets Current assets: Cash and cash equivalents

$35,594 $46,288 Restricted cash 1,920 -- Accounts receivable, trade

(net of allowance for uncollectible accounts of $14,740 and $13,838

at September 30, 2006 and December 31, 2005, respectively) 36,602

43,600 Deferred income taxes 11,158 18,096 Prepaid expenses and

other current assets 12,091 10,297 ------------- ------------ Total

current assets 97,365 118,281 Property and equipment, net 92,160

98,492 Goodwill 36,479 36,479 Intangibles, net 3,160 4,934 Deferred

income taxes 36,606 21,033 Capitalized software and other assets

11,448 9,470 ------------- ------------ Total assets $277,218

$288,689 ============= ============ Liabilities and Stockholders'

Equity Current liabilities: Accounts payable and accrued expenses

$32,823 $40,025 Sales, use and excise taxes 8,298 7,316 Deferred

revenue 13,440 13,824 Current portion of long-term debt 2,554 3,988

Accrued compensation 5,057 9,405 Other current liabilities 8,482

12,933 ------------- ------------ Total current liabilities 70,654

87,491 ------------- ------------ Long-term debt 1,837 1,289

Deferred income taxes 83 4,853 Other liabilities 5,515 3,269

Commitments and contingencies Stockholders' equity: Preferred stock

- $.01 par value, 5,000,000 shares authorized; no shares

outstanding -- -- Common stock - $.01 par value, 100,000,000 shares

authorized; 31,842,321 and 31,684,056 shares issued and 30,508,638

and 30,368,267 shares outstanding at September 30, 2006 and

December 31, 2005, respectively 318 317 Additional paid-in capital

385,639 380,481 Accumulated deficit (181,726) (184,011) Treasury

stock - at cost, 1,333,683 and 1,315,789 shares at September 30,

2006 and December 31, 2005, respectively (5,102) (5,000)

------------- ------------ Total stockholders' equity 199,129

191,787 ------------- ------------ Total liabilities and

stockholders' equity $277,218 $288,689 ============= ============

*T -0- *T TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited)

Nine Months Ended September 30, ----------------- 2006 2005

-------- -------- Cash flows from operating activities: Net income

$2,285 $24,055 Adjustments to reconcile net income to net cash

provided by operating activities: Provision for doubtful accounts

12,610 14,909 Depreciation and amortization 34,235 30,734 Deferred

income taxes 1,047 13,341 Stock-based compensation 4,172 -- Other

non-cash charges 456 359 Changes in assets and liabilities, net of

effect of acquisition: Accounts receivable, trade (1,169) 726

Prepaid expenses and other current assets 1,340 1,745 Other assets

49 80 Accounts payable and accrued expenses (11,278) (19,835)

Sales, use and excise taxes 22 (4,553) Deferred revenue (2,405)

(3,156) Accrued compensation (9,008) (1,563) Other liabilities

(6,194) (162) -------- -------- Net cash provided by operating

activities 26,162 56,680 -------- -------- Cash flows from

investing activities: Proceeds from sale of fixed assets 675 63

Acquisitions, net of cash acquired (16,485) (26,850) Capital

expenditures (15,377) (35,220) Capitalized software development

costs (4,172) (2,946) Decreases in restricted cash 1,375 --

-------- -------- Net cash used in investing activities (33,984)

(64,953) -------- -------- Cash flows from financing activities:

Tax benefit of stock based compensation 430 -- Payments of capital

lease obligations (3,667) (1,586) Proceeds from exercise of options

and warrants 365 4,685 -------- -------- Net cash provided by (used

in) financing activities (2,872) 3,099 -------- -------- Net change

in cash and cash equivalents (10,694) (5,174) Cash and cash

equivalents, beginning of period 46,288 47,492 -------- --------

Cash and cash equivalents, end of period $35,594 $42,318 ========

======== *T -0- *T TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATION *T Non-GAAP Financial Measure: The non-GAAP

financial measure that we use in this news release is listed below.

We have included reconciliation of this non-GAAP financial measure

to the most directly comparable GAAP measures in our financial

statements. Adjusted Earnings Before Interest, Taxes, Depreciation

and Amortization (Adjusted EBITDA) is defined as operating income

plus depreciation and amortization, stock-based compensation

expense and gains/losses on the sale of property and equipment. -0-

*T Adjusted EBITDA ($ in thousands) Third Quarter September Year to

Date ------------------------- ---------------------- 2006 2005

2006 2005 ------------------------- ----------------------

Operating Income $2,726 $9,309 $5,387 $40,135 Depreciation and

Amortization 11,084 11,618 34,235 30,734 Stock-based Compensation

955 -- 4,172 -- Loss on Sale of Property and Equipment 3 -- 413 --

------------ ------------ ----------- ---------- Adjusted EBITDA

$14,768 $20,927 $44,207 $70,869 ============ ============

=========== ========== *T

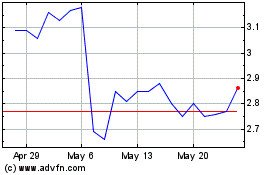

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From May 2024 to Jun 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2023 to Jun 2024