Talk America Reports Withdrawal of Sun Capital as Potential Purchaser

October 23 2006 - 9:15AM

Business Wire

Talk America (NASDAQ:TALK) announced today that Sun Capital

Securities Group, LLC (�Sun Capital�) has advised the Company that

it has determined, after extensive due diligence review and

consideration, that it would not make a definitive offer to acquire

the Company at a price greater than the $8.10 price per share

provided under Talk America�s September 22, 2006 merger agreement

with Cavalier Telephone Corporation and, accordingly, that Sun

Capital was withdrawing its earlier conditional proposal to acquire

the Company. As previously reported, Sun Capital, by letter dated

September 28, 2006, had proposed �to purchase for cash all of the

outstanding shares of Company Common Stock for $9.00 per share,�

subject, among other things, to satisfactory completion of a due

diligence review of the Company. In reply to the letter, on

September 28, 2006, our Board of Directors determined, as permitted

by the terms of the Cavalier merger agreement, to make available,

and subsequently made available, to Sun Capital access to the

information and our management and other personnel that Sun Capital

requested to conduct its more extensive review. Sun Capital�s

review and consideration commenced promptly after our Board�s

determination and continued through Friday, October 20, 2006. The

closing of the Cavalier merger is subject to Company stockholder

approval and certain other conditions, including the receipt of

certain regulatory approvals, including applicable approvals from

the Federal Communications Commission and certain state public

utility commissions that regulate the Company�s business, and the

absence of certain litigation. Last week, the Antitrust Division of

the Department of Justice and the Federal Trade Commission granted

early termination of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976 applicable to the proposed

Cavalier merger. In addition, a number of lawsuits, by persons

stated to be Company stockholders, have been filed against the

Company and our Board of Directors, generally seeking, among other

things, to enjoin the proposed Cavalier merger and claiming

breaches by our Board of its fiduciary duties to our stockholders.

We consider these lawsuits to be without merit and intend

vigorously to contest them. Additional Information and Where to

Find It In connection with the proposed Cavalier merger, the

Company will file a definitive proxy statement with the U.S.

Securities and Exchange Commission (the �SEC�). Investors and

security holders are advised to read the definitive proxy statement

when it becomes available because it will contain important

information about the Cavalier merger and the Company. Investors

and security holders may obtain a free copy of the definitive proxy

statement (when available) and other documents filed by the Company

with the SEC at the SEC�s web site at www.sec.gov. Free copies of

the definitive proxy statement, once available, and the Company�s

other filings with the SEC may also be obtained from the Company.

Free copies of the Company�s filings may be obtained by directing a

request to Talk America Holdings, Inc, 6805 Route 202, New Hope, PA

18938, Attention: Aloysius T. Lawn, IV, General Counsel. The

Company and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from its stockholders in connection

with the proposed merger. Information concerning the interests of

the Company�s participants in the solicitation is set forth in the

Company�s proxy statements and Annual Reports on Form 10-K,

previously filed with the SEC, and in the definitive proxy

statement relating to the merger when it becomes available. About

Talk America Talk America, is a leading competitive, integrated

communications provider that offers phone services and high speed

Internet access to both business and residential customers.

Services include local and long distance phone service, and data

services such as high-speed connectivity, security, web hosting,

and network services. Talk America delivers value in the form of

savings, simplicity and quality service to its customers through

its leading edge network and award-winning back office.

Forward-Looking Statements Under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, certain

statements contained in this press release regarding our and our

management�s intentions, hopes, beliefs, expectations or

predictions of the future are forward-looking statements. These

forward-looking statements are not historical facts and are only

estimates or predictions. Actual results may differ materially from

those projected as a result of risks and uncertainties detailed

from time to time in our filings with the SEC. We undertake no

obligation to update publicly any forward-looking statements,

whether as a result of future events, new information, or

otherwise. Talk America (NASDAQ:TALK) announced today that Sun

Capital Securities Group, LLC ("Sun Capital") has advised the

Company that it has determined, after extensive due diligence

review and consideration, that it would not make a definitive offer

to acquire the Company at a price greater than the $8.10 price per

share provided under Talk America's September 22, 2006 merger

agreement with Cavalier Telephone Corporation and, accordingly,

that Sun Capital was withdrawing its earlier conditional proposal

to acquire the Company. As previously reported, Sun Capital, by

letter dated September 28, 2006, had proposed "to purchase for cash

all of the outstanding shares of Company Common Stock for $9.00 per

share," subject, among other things, to satisfactory completion of

a due diligence review of the Company. In reply to the letter, on

September 28, 2006, our Board of Directors determined, as permitted

by the terms of the Cavalier merger agreement, to make available,

and subsequently made available, to Sun Capital access to the

information and our management and other personnel that Sun Capital

requested to conduct its more extensive review. Sun Capital's

review and consideration commenced promptly after our Board's

determination and continued through Friday, October 20, 2006. The

closing of the Cavalier merger is subject to Company stockholder

approval and certain other conditions, including the receipt of

certain regulatory approvals, including applicable approvals from

the Federal Communications Commission and certain state public

utility commissions that regulate the Company's business, and the

absence of certain litigation. Last week, the Antitrust Division of

the Department of Justice and the Federal Trade Commission granted

early termination of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976 applicable to the proposed

Cavalier merger. In addition, a number of lawsuits, by persons

stated to be Company stockholders, have been filed against the

Company and our Board of Directors, generally seeking, among other

things, to enjoin the proposed Cavalier merger and claiming

breaches by our Board of its fiduciary duties to our stockholders.

We consider these lawsuits to be without merit and intend

vigorously to contest them. Additional Information and Where to

Find It In connection with the proposed Cavalier merger, the

Company will file a definitive proxy statement with the U.S.

Securities and Exchange Commission (the "SEC"). Investors and

security holders are advised to read the definitive proxy statement

when it becomes available because it will contain important

information about the Cavalier merger and the Company. Investors

and security holders may obtain a free copy of the definitive proxy

statement (when available) and other documents filed by the Company

with the SEC at the SEC's web site at www.sec.gov. Free copies of

the definitive proxy statement, once available, and the Company's

other filings with the SEC may also be obtained from the Company.

Free copies of the Company's filings may be obtained by directing a

request to Talk America Holdings, Inc, 6805 Route 202, New Hope, PA

18938, Attention: Aloysius T. Lawn, IV, General Counsel. The

Company and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from its stockholders in connection

with the proposed merger. Information concerning the interests of

the Company's participants in the solicitation is set forth in the

Company's proxy statements and Annual Reports on Form 10-K,

previously filed with the SEC, and in the definitive proxy

statement relating to the merger when it becomes available. About

Talk America Talk America, is a leading competitive, integrated

communications provider that offers phone services and high speed

Internet access to both business and residential customers.

Services include local and long distance phone service, and data

services such as high-speed connectivity, security, web hosting,

and network services. Talk America delivers value in the form of

savings, simplicity and quality service to its customers through

its leading edge network and award-winning back office.

Forward-Looking Statements Under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, certain

statements contained in this press release regarding our and our

management's intentions, hopes, beliefs, expectations or

predictions of the future are forward-looking statements. These

forward-looking statements are not historical facts and are only

estimates or predictions. Actual results may differ materially from

those projected as a result of risks and uncertainties detailed

from time to time in our filings with the SEC. We undertake no

obligation to update publicly any forward-looking statements,

whether as a result of future events, new information, or

otherwise.

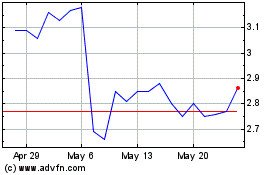

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From May 2024 to Jun 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2023 to Jun 2024