Talk America (NASDAQ:TALK), a leading provider of integrated voice

and data communications services, today announced second quarter

results for 2006. Talk America reported total revenue of $114.1

million and Adjusted EBITDA of $12.7 million. On-net revenue,

off-net revenue and long distance and other revenue in the second

quarter 2006 were $61.4 million, $39.5 million and $13.2 million,

respectively. Talk America ended the period with 653,000 local

voice and data equivalent lines of which 475,000 were on-net,

representing 73% of total lines. Growth in on-net lines for the

second quarter was driven by new customer additions throughout our

networking footprint in the midwest and southeast and 21,000

customer migrations, primarily in the Atlanta market. While on-net

churn tempered the line increase, it was lower than churn for the

first quarter. Our commercial business is poised for sequential

growth. During the second quarter, we invested in our commercial

sales and marketing channels, setting the stage for growth and

productivity improvements. We expanded our direct and agent sales

channels, ending the quarter with 168 sales professionals, up by

12% from the first quarter, which helped us to achieve record T-1

sales for the month of June. We are also investing in our network

and developing new service offerings strengthening our position in

the market. We've enabled fax and modem capabilities on our

integrated T-1 product, launched a bonded T-1 product suite for

higher bandwidth needs and rolled out IP PRI throughout Michigan.

During the quarter, we changed our consumer business strategy to

focus on the delivery of high-speed internet services. We

repackaged our service offerings, which now include unlimited voice

and 6 Mbps download speeds for $49.95 per month, a non-promotional

price for residential customers. We are seeing an immediate impact

from these offers from higher sales and conversion rates of new

customers. Our research and experience indicate that there is

clearly demand for a third competitor like Talk America in our

footprint. Although our churn during the quarter was higher than

expected in response to aggressive marketing of double and triple

play promotional offers from AT&T and Comcast, it is trending

lower in the third quarter. Ed Meyercord, Talk America's President

and Chief Executive Officer commented, "Our financial results

reflect our business transformation to a network-based provider in

a highly competitive and rapidly changing market. While our on-net

churn is not where we want it to be, we have taken aggressive

measures to improve our performance and our numbers are trending

favorably. We closed out June with over 460 T-1 sales and we expect

that the growth in our direct sales force and product enhancements

to drive commercial business revenue growth in the future." Mr.

Meyercord continued, "On the consumer side, our new high speed

internet offerings represent the best value in the market and we

expect a strong response from our new marketing initiatives. There

is room in the market for a third competitor to take share and for

the fourth year in a row we beat out our larger competitors in the

J.D. Power & Associates customer satisfaction surveys. People

still want the freedom of choice!" (Note: See the schedules

accompanying this news release and www.talkamerica.com for

reconciliation to generally accepted accounting principles (GAAP)

for the non-GAAP financial measures mentioned in this announcement

and to download a copy of the presentation to be reviewed on

today's conference call.) -0- *T Financial Guidance 2006

--------------------------------- Q3 2006 Previous Current

------------- -------------- ----------------- Revenue $101-$103

$437-$443 mm $437-$443mm Adjusted EBITDA $11-$13 $53-$58 mm $53-$58

mm Capital Expenditures -- $25-$30 mm $25-$30 mm *T Conference Call

Talk America management will host a conference call to discuss the

second quarter 2006 operating results at 5:00 p.m. ET on August 8,

2006. The call can be accessed by dialing the following: US

800-745-2192, International, 212-231-2661. A replay of the call

will be available through 7:00 p.m. ET on August 15, 2006 by

dialing the following: 800-633-8284, International 402-977-9140.

The reservation number for the replay is 21298254. Additionally, a

live web simulcast of the conference call will be available online

at www.talkamerica.com and www.streetevents.com. About Talk America

Talk America, is a leading competitive, integrated communications

provider that offers phone services and high speed Internet access

to both business and residential customers. Services include local

and long distance phone service, and data services such as

high-speed connectivity, security, web hosting, and network

services. Talk America delivers value in the form of savings,

simplicity and quality service to its customers through its leading

edge network and award-winning back office. Please Note: The

statements contained herein regarding the future results of

operations of Talk America should be, and certain other of the

statements contained herein may be, considered "forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are identified by the use of forward-looking words

or phrases, including, but not limited to, "estimates," "expects,"

"expected," "anticipates," "anticipated," "forecast," "guidance,"

and "targets". These forward-looking statements are based on our

current expectations. Although we believe that the expectations

reflected in such forward-looking statements are reasonable, there

can be no assurance that such expectations will prove to have been

correct. Forward-looking statements involve risks and uncertainties

and our actual results could differ materially from our

expectations. In addition to those factors discussed in the

foregoing, important factors that could cause such actual results

to differ materially include, among others, our inability to

integrate effectively and as anticipated acquired businesses,

dependence on the availability and functionality of local exchange

carriers' networks as they relate to the unbundled network element

platform, failure to operate our own local network in a profitable

manner, increased price competition for long distance, local and

data services, failure of the marketing of the bundle of local and

long distance services, long distance services and data services

under our direct marketing channels to a smaller marketing

footprint, attrition in the number of end users, failure to manage

our collection management systems and credit controls for

customers, interruption in our network and information systems,

failure to provide adequate customer service, and changes in

government policy, regulation and enforcement and/or adverse

judicial or administrative interpretations and rulings relating to

regulations and enforcement. Additional information concerning

these and other important factors can be found within Talk

America's filings with the Securities and Exchange Commission. The

forward-looking statements contained herein are made only as of the

date of this release, and we undertake no obligation to update the

forward-looking statements to reflect subsequent events or

circumstances. For a more detailed discussion of these factors, see

the Risk Factors discussion in Item 1A of our Annual Report on Form

10-K for the year ended December 31, 2005 filed March 16, 2006, as

amended by our Form 10-K/A filed March 28, 2006. -0- *T --

Financial Tables to Follow-- TALK AMERICA HOLDINGS, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands, except for per share data) (Unaudited) Three Months

Ended Six Months Ended June 30, June 30, -------------------

------------------- 2006 2005 2006 2005 --------- ---------

--------- --------- Revenue $114,052 $107,669 $234,568 $227,504

Costs and expenses: Network and line costs, excluding depreciation

and amortization 62,250 55,681 124,087 116,677 General and

administrative expenses 23,892 18,330 52,476 36,450 Provision for

doubtful accounts 4,201 4,806 8,251 10,394 Sales and marketing

expenses 13,006 3,773 23,942 14,041 Depreciation and amortization

11,916 9,615 23,151 19,116 --------- --------- --------- ---------

Total costs and expenses 115,265 92,205 231,907 196,678 ---------

--------- --------- --------- Operating income (loss) (1,213)

15,464 2,661 30,826 Other income (expense): Interest income 196 366

514 674 Interest expense (204) (25) (431) (50) Other expense, net

(60) (336) 53 (356) --------- --------- --------- --------- Income

(loss) before provision for income taxes (1,281) 15,469 2,797

31,094 Provision (benefit) for income taxes (14) 6,101 1,683 12,256

--------- --------- --------- --------- Net income (loss) $(1,267)

$9,368 $1,114 $18,838 ========= ========= ========= =========

Income (loss) per share - Basic: --------- --------- ---------

--------- Net income (loss) per share $(0.04) $0.34 $0.04 $0.69

========= ========= ========= ========= Weighted average common

shares outstanding 30,453 27,474 30,418 27,283 ========= =========

========= ========= Income (loss) per share - Diluted: ---------

--------- --------- --------- Net income (loss) per share $(0.04)

$0.33 $0.04 $0.67 ========= ========= ========= ========= Weighted

average common and common equivalent shares outstanding 30,453

28,218 30,598 28,021 ========= ========= ========= ========= TALK

AMERICA HOLDINGS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (In thousands, except for share and per share data)

(Unaudited) June 30, December 31, 2006 2005 ------------

------------ Assets Current assets: Cash and cash equivalents

$31,412 $46,288 Restricted cash 1,920 -- Accounts receivable, trade

(net of allowance for uncollectible accounts of $15,177 and $13,838

at June 30, 2006 and December 31, 2005, respectively) 38,370 43,600

Deferred income taxes 18,370 18,096 Prepaid expenses and other

current assets 11,333 10,297 ------------ ------------ Total

current assets 101,405 118,281 Property and equipment, net 98,327

98,492 Goodwill 36,479 36,479 Intangibles, net 3,768 4,934 Deferred

income taxes 33,650 21,033 Capitalized software and other assets

10,757 9,470 ------------ ------------ $284,386 $288,689

============ ============ Liabilities and Stockholders' Equity

Current liabilities: Accounts payable and accrued expenses $34,186

$40,025 Sales, use and excise taxes 7,416 7,316 Deferred revenue

14,126 13,824 Current portion of long-term debt 3,309 3,988 Accrued

compensation 6,342 9,405 Other current liabilities 11,688 12,933

------------ ------------ Total current liabilities 77,067 $87,491

------------ ------------ Long-term debt 750 1,289 Deferred income

taxes 3,942 4,853 Other non-current liabilities 5,789 3,269

Commitments and contingencies Stockholders' equity: Preferred stock

- $.01 par value, 5,000,000 shares authorized; no shares

outstanding -- -- Common stock - $.01 par value, 100,000,000 shares

authorized; 31,791,154 and 31,684,056 shares issued and 30,475,365

and 30,368,267 shares outstanding at June 30, 2006 and December 31,

2005, respectively 318 317 Additional paid-in capital 384,417

380,481 Accumulated deficit (182,897) (184,011) Treasury stock at

cost 1,315,789 shares at June 30, 2006 and December 31, 2005,

respectively (5,000) (5,000) ------------ ------------ Total

stockholders' equity 196,838 191,787 ------------ ------------

$284,386 $288,689 ============ ============ TALK AMERICA HOLDINGS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) (Unaudited) Six Months Ended June 30,

----------------- 2006 2005 -------- -------- Cash flows from

operating activities: Net income $1,114 $18,838 Adjustments to

reconcile net income to net cash provided by operating activities:

Provision for doubtful accounts 8,251 10,394 Depreciation and

amortization 23,151 19,115 Other non-cash charges 429 349 Deferred

income taxes 650 10,015 Stock-based compensation 3,217 -- Changes

in assets and liabilities: Accounts receivable, trade 1,422 162

Prepaid expenses and other current assets 1,173 (442) Other assets

(66) (47) Accounts payable and accrued expenses (9,009) (8,929)

Sales, use and excise taxes (537) (3,636) Deferred revenue (1,719)

(1,939) Accrued compensation (7,622) (1,926) Other liabilities

(3,083) 1,046 -------- -------- Net cash provided by operating

activities 17,371 43,000 -------- -------- Cash flows from

investing activities: Acquisition of NTC, net of cash acquired

(16,485) -- Proceeds from sale of fixed assets 48 42 Capital

expenditures (12,579) (19,986) Capitalized software development

costs (2,608) (2,023) Decrease in restricted cash 1,375 -- --------

-------- Net cash used in investing activities (30,249) (21,967)

-------- -------- Cash flows from financing activities: Payments of

capital lease obligations (2,656) (701) Proceeds from exercise of

options 358 1,643 Tax benefit of stock-based compensation 300 --

-------- -------- Net cash provided by (used in) financing

activities (1,998) 942 -------- -------- Net change in cash and

cash equivalents (14,876) 21,975 Cash and cash equivalents,

beginning of period 46,288 47,492 -------- -------- Cash and cash

equivalents, end of period $31,412 $69,467 ======== ======== TALK

AMERICA HOLDINGS, INC. AND SUBSIDIARIES NON-GAAP RECONCILIATION

Non-GAAP Financial Measure: The non-GAAP financial measure that we

use in this news release is listed below. We have included

reconciliation of this non-GAAP financial measure to the most

directly comparable GAAP measures in our financial statements.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (Adjusted EBITDA) is defined as operating income plus

depreciation and amortization, stock-based compensation expense and

gains/losses on the sale of property and equipment. Adjusted EBITDA

($ in thousands) Second Quarter June Year to Date

------------------ ----------------- 2006 2005 2006 2005

----------------- ----------------- Operating Income $(1,213)

$15,464 $2,661 $30,826 Depreciation and Amortization 11,916 9,615

23,151 19,116 Stock-based Compensation 1,609 -- 3,217 -- Loss on

Sale of Property and Equipment 410 -- 410 -- -------- --------

-------- -------- Adjusted EBITDA $12,722 $25,079 $29,439 $49,942

======== ======== ======== ======== *T

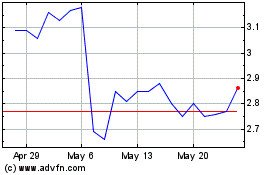

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From May 2024 to Jun 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2023 to Jun 2024