Talk America (NASDAQ:TALK): THIRD QUARTER HIGHLIGHTS -- Voice

equivalent lines on network of 192,000 -- Total voice equivalent

lines of 580,000 -- Data equivalent lines of 65,000 -- Total

revenue of $120.6 million -- EBITDA of $20.9 million -- Net income

of $5.2 million, or $0.17 per share on a diluted basis -- Cash

balance of $42.3 million; total debt of $5.9 million Talk America

(NASDAQ:TALK) today announced results for the third quarter 2005.

For the third quarter 2005, we reported net income of $5.2 million,

or $0.17 per share on a diluted basis, as compared to net income of

$9.0 million, or $0.32 per share on a diluted basis, for the third

quarter 2004. For the third quarter 2005, on-net revenues, off-net

revenues and long distance only and other revenues were $23.9

million, $79.9 million and $16.8 million, respectively. Results for

the quarter include the operations of LDMI from July 13, 2005, the

closing date of the acquisition. (Note: See the schedule

accompanying this news release for reconciliation to generally

accepted accounting principles (GAAP) for the non-GAAP financial

measure mentioned in this release) INCREASING YEAR-END TARGET FOR

NETWORKED LINES During the third quarter 2005, we migrated over

80,000 customer lines onto our network representing new sales and

existing customer migrations. Ed Meyercord, Chief Executive Officer

and President of Talk America, commented "our success in achieving

these aggressive targets is based on focused execution and the

coordination of networking, IT and customer operations. Our

automated back office systems allow us to seamlessly migrate

customers onto our own networking platform. We expect to migrate

over 100,000 customer lines in the fourth quarter and are raising

our year-end target for voice lines on network to the range of

275,000 to 285,000." INTEGRATION OF LDMI ACQUISITION Mr. Meyercord

commented, "We closed the acquisition of LDMI in the third quarter

and integration initiatives are going well. We have used our core

competency in operations to improve quality of service, streamline

business processes and drive economic efficiencies. The successful

integration of LDMI provides a roadmap for future combinations."

NEW GROWTH OPPORTUNITIES WITH NETWORK TELEPHONE ACQUISITION Our

acquisition of NTC will open new markets and create new growth

opportunities for the combined entity. Our current plans are to

commence sales and customer migrations in the Atlanta market in the

first quarter of 2006 and augment 22 NTC end offices with five

additional end offices to address our footprint of 25,000 lines and

a market of approximately 1.6 million business and residential

lines. We will use our soft-switched IP network to deliver voice

and broadband services in the Southeast. This new network will

enable NTC's business-focused sales team to begin offering

customers a higher end product solution for more complex

telecommunication needs. In addition, we have begun to jointly

evaluate with NTC the remaining markets where they've been

successful in building business franchises for potential expansion

into the consumer market. FINANCIAL GUIDANCE Our financial guidance

for 2006 reflects the acquisition of NTC assuming closing on

January 3, 2006. Guidance for 2006 EBITDA excludes the impact from

the expensing of options pursuant to FAS 123(R). We expect that the

expensing of options will have a negative effect on EBITDA for 2006

and will adjust our guidance when we have more information on the

projected impact. Our operational and financial targets are as

follows: -0- *T Metrics Q4 2005 ----------------- ---------------

Voice Equivalent Lines on Network 275k-285k Data Equivalent Lines

70k Total Revenue $107-$110 mm EBITDA $13-$16 mm 2005 2006

-------------------------- ------------------------- Metrics

Previous Current Previous Current -----------------

-------------------------- ------------------------- Voice

Equivalent Lines on Network 255k 275k-285k 400k 455k Data

Equivalent Lines 70k 70k 90k 160k Total Revenue $430-$440 mm

$455-$458 mm $385-$395 mm $445-$455 mm EBITDA $83-$87 mm $84-$87 mm

$55-$65 mm $60-$70 mm Capital Expenditures (Including Software)

$53-$58 mm $53-$58 mm $18-$22 mm $21-$25 mm *T CONFERENCE CALL Talk

America management will host a conference call to discuss the third

quarter 2005 operating results at 5:00 p.m. ET on November 1, 2005.

The call can be accessed by dialing the following: US 800-255-2466,

International, 212-676-4900. A replay of the call will be available

through 7:00 p.m. ET on November 8, 2005 by dialing the following:

800-633-8284, International 402-977-9140. The reservation number

for the replay is 21265816. Additionally, a live web simulcast of

the conference call will be available online at www.talkamerica.com

and www.streetevents.com. About Talk America Talk America is a

leading competitive communications provider that offers phone

services and high speed internet access to both residential and

business customers. Talk America delivers value in the form of

savings, simplicity and quality service to its customers through

its leading edge network and award-winning back office. Please

Note: The statements contained herein regarding the consummation of

the acquisition of NTC, the future results of NTC and the effects

and results of the acquisition on the business and results of

operations of Talk America should be, and certain other of the

statements contained herein may be, considered forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are identified by the use of forward-looking words

or phrases, including, but not limited to, "estimates," "expects,"

"expected," "anticipates," "anticipated," "forecast," "guidance,"

and "targets". These forward-looking statements are based on our

current expectations. Although we believe that the expectations

reflected in such forward-looking statements are reasonable, there

can be no assurance that such expectations will prove to have been

correct. Forward-looking statements involve risks and uncertainties

and our actual results could differ materially from our

expectations. In addition to those factors discussed in the

foregoing, important factors that could cause such actual results

to differ materially include, among others, the non-completion of

the NTC acquisition or our inability to integrate effectively and

as anticipated the business of NTC upon the completion of the

acquisition, dependence on the availability and functionality of

local exchange carriers' networks as they relate to the unbundled

network element platform, failure to establish and deploy our own

local network as we plan to do or to operate it in a profitable

manner, increased price competition for long distance and local

services, failure of the marketing of the bundle of local and long

distance services and long distance services under our direct

marketing channels to a smaller marketing footprint, attrition in

the number of end users, failure to manage our collection

management systems and credit controls for customers, interruption

in our network and information systems, failure to provide adequate

customer service, and changes in government policy, regulation and

enforcement and/or adverse judicial or administrative

interpretations and rulings relating to regulations and

enforcement, including, but not limited to, the continued

availability of the unbundled network element platform of the local

exchange carriers network and unbundled network element pricing

methodology. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see the discussions contained in

our Quarterly Report on Form 10-Q filed August 9, 2005, our Annual

Report on Form 10-K for the year-ended December 31, 2004, filed on

March 16, 2005, as amended by our Form 10-K/A filed March 30, 2005,

and any subsequent filings. We undertake no obligation to update

our forward-looking statements. -- Financial Tables To Follow-- -0-

*T TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except for per share data)

(Unaudited) Three Months Ended Nine Months Ended September 30,

September 30, ------------------- ------------------- 2005 2004

2005 2004 --------- --------- --------- --------- Revenue $120,645

$120,929 $348,149 $345,761 Costs and expenses: Network and line

costs, excluding depreciation and amortization (see below) 64,413

58,260 181,090 164,500 General and administrative expenses 23,496

17,925 59,946 52,544 Provision for doubtful accounts 4,515 5,728

14,909 14,054 Sales and marketing expenses 7,294 19,318 21,335

55,806 Depreciation and amortization 11,618 5,442 30,734 15,895

--------- --------- --------- --------- Total costs and expenses

111,336 106,673 308,014 302,799 --------- --------- ---------

--------- Operating income 9,309 14,256 40,135 42,962 Other income

(expense): Interest income 199 61 873 204 Interest expense (114)

561 (164) (698) Other expense, net (5) -- (361) -- ---------

--------- --------- --------- Income before provision for income

taxes 9,389 14,878 40,483 42,468 Provision for income taxes 4,172

5,867 16,428 16,747 --------- --------- --------- --------- Net

income $5,217 $9,011 $24,055 $25,721 ========= ========= =========

========= Income per share - Basic: --------- --------- ---------

--------- Net income per share $0.18 $0.33 $0.86 $0.96 =========

========= ========= ========= Weighted average common shares

outstanding 29,808 26,974 28,122 26,799 ========= =========

========= ========= Income per share - Diluted: --------- ---------

--------- --------- Net income per share $0.17 $0.32 $0.84 $0.92

========= ========= ========= ========= Weighted average common and

common equivalent shares outstanding 30,357 27,737 28,796 27,854

========= ========= ========= ========= TALK AMERICA HOLDINGS, INC.

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except

for share and per share data) (Unaudited) September 30, December

31, 2005 2004 ------------- ------------- Assets Current assets:

Cash and cash equivalents $42,318 $47,492 Accounts receivable,

trade (net of allowance for uncollectible accounts of $14,835 and

$17,508 at September 30, 2005 and December 31, 2004, respectively)

45,240 48,873 Deferred income taxes 20,207 34,815 Prepaid expenses

and other current assets 8,010 6,888 ------------- -------------

Total current assets 115,775 138,068 Property and equipment, net

95,234 65,823 Goodwill 39,492 13,013 Intangibles, net 4,997 1,966

Deferred income taxes 21,893 14,291 Capitalized software and other

assets 9,234 8,567 ------------- ------------- $286,625 $241,728

============= ============= Liabilities and Stockholders' Equity

Current liabilities: Accounts payable and accrued expenses $42,535

$38,843 Sales, use and excise taxes 7,142 11,179 Deferred revenue

15,294 15,321 Current portion of long-term debt 4,207 2,529 Accrued

compensation 8,321 6,690 Other current liabilities 13,341 10,022

------------- ------------- Total current liabilities 90,840 84,584

------------- ------------- Long-term debt 1,714 1,717 Deferred

income taxes 4,589 13,906 Commitments and contingencies -- --

Stockholders' equity: Preferred stock - $.01 par value, 5,000,000

shares authorized; no shares outstanding -- -- Common stock - $.01

par value, 100,000,000 shares authorized; 30,299,778 and 27,037,096

shares issued and outstanding at September 30, 2005 and December

31, 2004, respectively 316 284 Additional paid-in capital 380,283

356,409 Accumulated deficit (186,117) (210,172) Treasury stock -

$.01 par value, 1,315,789 shares at September 30, 2005 and December

31, 2004, respectively (5,000) (5,000) ------------- -------------

Total stockholders' equity 189,482 141,521 -------------

------------- $286,625 $241,728 ============= ============= TALK

AMERICA HOLDINGS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

CASH FLOWS (In thousands) (Unaudited) Nine Months Ended September

30, --------------------- 2005 2004 ---------- ---------- Cash

flows from operating activities: Net income $24,055 $25,721

Adjustments to reconcile net income to net cash provided by

operating activities: Provision for doubtful accounts 14,909 14,054

Depreciation and amortization 30,734 15,895 Loss on sale,

retirement and write-down of assets 359 -- Non-cash interest and

amortization of accrued interest liabilities -- (956) Deferred

income taxes 13,341 14,257 Non-cash compensation -- 9 Changes in

assets and liabilities: Accounts receivable, trade 726 (22,609)

Prepaid expenses and other current assets 1,745 (1,979) Other

assets 80 (17) Accounts payable and accrued expenses (20,149) 7,238

Sales, use and excise taxes (4,553) (977) Deferred revenue (3,156)

4,715 Accrued compensation (1,563) (5,217) Other current

liabilities (162) (653) ---------- ---------- Net cash provided by

operating activities 56,366 49,481 ---------- ---------- Cash flows

from investing activities: Proceeds from sale of fixed assets 63 --

LDMI acquisition (26,536) Capital expenditures (35,220) (8,053)

Capitalized software development costs (2,946) (2,673) ----------

---------- Net cash used in investing activities (64,639) (10,726)

---------- ---------- Cash flows from financing activities:

Payments of borrowings -- (44,258) Payments of capital lease

obligations (1,586) (949) Proceeds from exercise of options 4,685

564 ---------- ---------- Net cash provided by (used in) financing

activities 3,099 (44,643) ---------- ---------- Net change in cash

and cash equivalents (5,174) (5,888) Cash and cash equivalents,

beginning of period 47,492 35,242 ---------- ---------- Cash and

cash equivalents, end of period $42,318 $29,354 ==========

========== TALK AMERICA HOLDINGS, INC. AND SUBSIDIARIES NON-GAAP

RECONCILIATION *T Non-GAAP Financial Measure: The non-GAAP

financial measure that we use in this news release is listed below.

We have included reconciliation of this non-GAAP financial measure

to the most directly comparable GAAP measures in our financial

statements. Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) is defined as operating income plus

depreciation and amortization. -0- *T EBITDA ($ in thousands) Third

Quarter --------------------- 2005 2004 ---------- ----------

Operating Income $9,309 $14,256 Depreciation and Amortization

11,618 5,442 ---------- ---------- EBITDA $20,927 $19,698

========== ========== *T

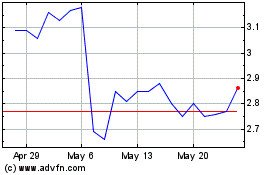

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From May 2024 to Jun 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2023 to Jun 2024