Talk America to Acquire Network Telephone

October 19 2005 - 6:00AM

Business Wire

Talk America (NASDAQ:TALK) announced today that it has entered into

a definitive agreement to acquire Network Telephone Corporation, a

leading facilities-based communications provider serving business

customers in the BellSouth region. The merger will extend Talk

America's networking footprint to the Southeast and add

significantly to its commercial services capabilities. The

transaction will also allow Talk America to realize capital

expenditure savings and networking synergies in the Atlanta market,

where NTC has 22 end offices and Talk America has over 25,000

customers. Ed Meyercord, Chief Executive Officer and President of

Talk America, said "This will create growth opportunities for both

companies and strengthen our ability to capture market share in the

Southeast. We will add high-end IP services to NTC's product

portfolio utilizing our soft-switching infrastructure and leverage

NTC's extensive networking assets to deliver voice and broadband

services to small and medium sized businesses and consumers in new

markets. This combination will also accelerate the migration of our

Atlanta customers onto network facilities and add significantly to

our commercial revenue base." NTC is a privately held company based

in Pensacola, Florida and serves over 16,500 business customers

representing more than 150,000 voice and data equivalent lines

throughout 8 states in the BellSouth region. Among NTC's commercial

accounts, approximately 8,500 are T-1 customers served from 154 end

offices. NTC provides voice, data, hosting, virtual private network

and data back-up services through an 80-person direct sales force.

NTC has invested capital of over $240 million. Leo Cyr, Chief

Executive Officer and President of NTC, commented "We are excited

to become part of the Talk America team. They have executed

impressively on their networking buildout in Michigan, migrated

over 150,000 voice lines to their own network facilities and

expanded into commercial services through their acquisition of

LDMI. Talk America has a unique back office capability and a

soft-switching platform that will allow us to leverage our existing

networking assets and grow our business." Mr. Meyercord continued,

"The management and employees at NTC bring significant value and

depth to our team. Their experience in the commercial market will

allow us to elevate our service levels in all geographic markets.

With the acquisition and integration of LDMI and the closing of the

NTC transaction, Talk America will be poised for further expansion

in 2006." At the closing of the transaction, Talk America will pay

approximately $20 million, including transaction fees, in exchange

for all of the stock of NTC. NTC is expected to generate $60

million in revenue and $5.5 million in EBITDA in 2006, including

the impact of merger related synergies. Talk America will fund the

purchase price out of cash on hand. The NTC transaction has been

approved by the board of directors of both companies and is subject

to certain regulatory approvals, which both companies expect to

receive. The companies expect that the transaction will close in

early 2006. CONFERENCE CALL Talk America and Network Telephone

management will host a conference call to discuss the acquisition

of Network Telephone at 8:00 a.m. ET on October 19, 2005. The call

can be accessed by dialing the following: US (877) 690-6769,

International, (212) 231-2662. A replay of the call will be

available through 7:00 p.m. ET on October 26, 2005 by dialing the

following: US (800) 633-8284, International (402) 977-9140. The

reservation number for the replay is 21265900. About NTC Network

Telephone serves more than 16,500 small business customers with

phone and Internet services including local and long distance

telephone, high-speed Internet, Web hosting, Data Backup, VPN

service, Conferencing, and more. The company employs more than 375

at its headquarters in Pensacola, Fla., and at regional sales

offices located in Alabama, Louisiana, Mississippi, Florida,

Georgia, Kentucky, North Carolina and Tennessee. Network Telephone

was named one of America's fastest-growing private companies by

Inc. magazine in 2003 and 2004. For more information about Network

Telephone, visit the company's Web site at www.networktelephone.net

About Talk America Talk America is a leading competitive

communications provider that offers phone services and high speed

internet access to both residential and business customers. Talk

America delivers value in the form of savings, simplicity and

quality service to its customers through its leading edge network

and award-winning back office. Please Note: The statements

contained herein regarding the consummation of the acquisition of

NTC, the future results of NTC and the effects and results of the

acquisition on the business and results of operations of Talk

America should be, and certain other of the statements contained

herein may be considered forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such statements are

identified by the use of forward-looking words or phrases,

including, but not limited to, "estimates," "expects," "expected,"

"anticipates," "anticipated," "forecast," "guidance," and

"targets". These forward-looking statements are based on our

current expectations. Although we believe that the expectations

reflected in such forward-looking statements are reasonable, there

can be no assurance that such expectations will prove to have been

correct. Forward-looking statements involve risks and uncertainties

and our actual results could differ materially from our

expectations. In addition to those factors discussed in the

foregoing, important factors that could cause such actual results

to differ materially include, among others, the non-completion of

the NTC acquisition or our inability to integrate effectively and

as anticipated the business of NTC upon the completion of the

acquisition, dependence on the availability and functionality of

local exchange carriers' networks as they relate to the unbundled

network element platform, failure to establish and deploy our own

local network as we plan to do or to operate it in a profitable

manner, increased price competition for long distance and local

services, failure of the marketing of the bundle of local and long

distance services and long distance services under our direct

marketing channels to a smaller marketing footprint, attrition in

the number of end users, failure to manage our collection

management systems and credit controls for customers, interruption

in our network and information systems, failure to provide adequate

customer service, and changes in government policy, regulation and

enforcement and/or adverse judicial or administrative

interpretations and rulings relating to regulations and

enforcement, including, but not limited to, the continued

availability of the unbundled network element platform of the local

exchange carriers network and unbundled network element pricing

methodology. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see the discussions contained in

our Quarterly Report on Form 10-Q filed August 9, 2005, our Annual

Report on Form 10-K for the year-ended December 31, 2004, filed on

March 16, 2005, as amended by our Form 10-K/A filed March 30, 2005,

and any subsequent filings. We undertake no obligation to update

our forward-looking statements.

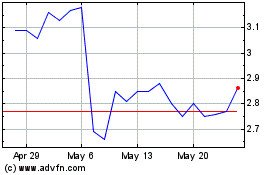

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From May 2024 to Jun 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2023 to Jun 2024