Sinclair Completes Largest Junk-Bond Sale Since 2016

July 18 2019 - 5:09PM

Dow Jones News

By Sam Goldfarb

A subsidiary of Sinclair Broadcast Group Inc. completed the

largest U.S. junk-bond sale in more than three years, drawing

substantial demand from investors to support its purchase of

regional sports networks from Walt Disney Co.

The subsidiary, Diamond Sports Group LLC, sold a combined $4.9

billion of speculative-grade bonds -- including both secured and

unsecured notes -- the most since Altice France SA issued $5.2

billion in April 2016, according to LCD, a unit of S&P Global

Market Intelligence.

Diamond Sports also issued a $3.3 billion loan to fund the

acquisition. Another subsidiary, which houses Sinclair's existing

local television stations, sold a $1.3 billion loan to fund the

acquisition from Disney and refinance bonds due in 2021.

Proposed interest rates on all of the new bonds and loans were

lowered from initial guidance set by a JPMorgan Chase & Co.-led

underwriting group, a sign of strong interest from investors. The

roughly $3.1 billion of secured notes due in 2026, for example,

priced at par with a 5.375% coupon, down from initial guidance in

the low 6% area, according to investors.

Although some investors noted the risks from customers

abandoning cable TV, they also pointed to the value in sports

networks, which are typically among the most expensive channels for

distributors and customers.

Sinclair, the nation's biggest owner of local television

stations, said in May that it would buy 21 regional sports networks

from Disney in a deal valued at $10.6 billion.

After the acquisition, Diamond Sports' debt is expected to total

more than five-times its earnings before interest, taxes,

depreciation and amortization. But it should still generate roughly

$830 million of annual free cash flow, according to the research

firm CreditSights, assuming no changes in its earnings.

Sinclair's debt sale has benefited from favorable market

conditions.

With the Federal Reserve expected to cut interest rates later

this month, investors generally have a positive outlook on the U.S.

economy -- providing a boost to speculative-grade bonds and riskier

assets more broadly.

The loan market has been something of a weak spot. That is

largely because loans become less appealing in a flat or declining

interest-rate environment due to their coupons that rise and fall

with benchmark rates.

Still, Sinclair's loans are rated at the high end of the

speculative-grade spectrum, making them attractive to investors who

have been searching for such debt.

The yield on the benchmark 10-year U.S. Treasury note settled at

2.040%, compared with 2.059% Wednesday. Yields, which fall when

bond prices rise, slid after Federal Reserve Bank of New York

President John Williams said the current environment requires the

Fed to move quickly to lower interest rates, and keep rates lower

for longer, when confronted with economic weakness.

The WSJ Dollar Index, which measures the U.S. currency against a

basket of 16 others, was recently down 0.5% at 89.68.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

July 18, 2019 16:54 ET (20:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

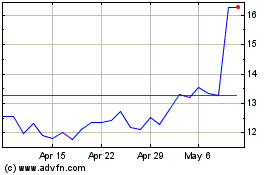

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

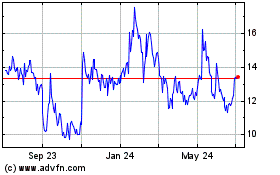

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024