0001236275

false

0001236275

2023-07-11

2023-07-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 11, 2023

| SILVERSUN TECHNOLOGIES, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-38063 |

|

16-1633636 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

120 Eagle Rock Ave

East Hanover, NJ 07936

(Address of Principal Executive Offices)

(973) 396-1720

Registrant’s telephone number, including

area code

Check the appropriate box below if the 8-K filing is intended to simultaneously

satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

SSNT |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement

On July 11, 2023, SilverSun

Technologies, Inc. (the “Company”) entered into the Fifth Amendment to Merger Agreement (the “Amendment”) with

Rhodium Enterprises Acquisition Corp., a Delaware corporation and direct wholly owned subsidiary of the Company, Rhodium Enterprises Acquisition

LLC, a Delaware limited liability company and direct wholly owned subsidiary of the Company, and Rhodium Enterprises, Inc., a Delaware

corporation (“Rhodium”), amending that certain Agreement and Plan of Merger, dated as of September 29, 2022 by and among the

parties referenced above (as amended from time to time, the “Merger Agreement”). The Amendment provides that the Merger Agreement

may be terminated, and the transactions abandoned, by either the Company or Rhodium at any time before the First Effective Time (as defined

in the Merger Agreement), by written notice from one to the other if the closing has not occurred on or before September 30, 2023.

The Amendment also removes Section 7.06 from the Agreement. This section had provided for the payment of a $5,000,000 termination fee

by the Company or Rhodium, as applicable, upon certain enumerated termination events. Following such removal, the Company and Rhodium

continue to retain all other legal remedies available to them upon such termination events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: July 12, 2023

| |

SILVERSUN TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Mark Meller |

| |

|

Name: Mark Meller |

| |

|

Title: Chief Executive Officer |

2

Exhibit 2.6

FIFTH AMENDMENT TO

MERGER AGREEMENT

This FIFTH AMENDMENT TO MERGER

AGREEMENT (this “Amendment”), executed and effective as of July 11, 2023 (the “Effective Date”),

is made by and among SilverSun Technologies, Inc., a Delaware Corporation (“Parent”), Rhodium Enterprises Acquisition

Corp., a Delaware corporation and direct wholly owned subsidiary of Parent (“Merger Sub I”), Rhodium Enterprises

Acquisition LLC, a Delaware limited liability company and direct wholly owned subsidiary of Parent (“Merger Sub II”

and together with Parent and Merger Sub I, the “Parent Entities”), and Rhodium Enterprises, Inc., a Delaware

corporation (the “Company”, and collectively with the Parent Entities, the “Parties”),

to that certain Agreement and Plan of Merger, dated as of September 29, 2022 (as amended, the “Merger Agreement”),

by and among the Parties.

WITNESSETH:

WHEREAS, in accordance with

Section 8.08 of the Merger Agreement, the Merger Agreement may be amended by an instrument in writing signed by the Parent Entities and

Company; and

WHEREAS, each of the Parent

Entities and the Company desire to amend the Merger Agreement as set forth in this Amendment.

NOW, THEREFORE, in consideration

of good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby,

each of the Parent Entities and the Company agree as follows:

1. Section 7.02 (a) of the

Merger Agreement is hereby deleted and replaced in its entirety with the following:

| (a) | if the if the Closing has not occurred on or before September 30, 2023 (the “Termination Date”),

except that the right to terminate this Agreement under this Section 7.02(a) shall not be available to any Party who is then in

material breach of this Agreement; |

2. Section 7.06 of the Merger

Agreement, including subsections 7.06 (a) through (f) thereof, is hereby deleted in its entirety.

3. Section 8.11 of the Merger

Agreement is hereby deleted and replaced in its entirety with the following:

Section 8.11 No Third-Party Beneficiaries.

Except (a) as provided in Section 5.08 (Directors’ and Officers’ Indemnification and Insurance), (b) for the provisions

of Section 2.01, Section 2.01(f) and Section 2.03 (which, only from and after the Effective Time, shall be for the

benefit of holders of Parent Common Stock as of the Effective Time), (c) the rights of Covered Persons under Section 5.17, (d)

the rights of the Parent Entities or any of their respective Affiliates, respective current or former stockholders, directors, managers,

officers, employees, agents, advisors or other Representatives, and the Company or any of its Affiliates, respective current or former

stockholders, directors, managers, officers, employees, agents, advisors or other Representatives, under Section 8.18, the Parent

Entities and the Company agree that their respective representations, warranties and covenants set forth in this Agreement are solely

for the benefit of the other Parties, in accordance with and subject to the terms of this Agreement, and this Agreement are not intended

to, and do not, confer upon any Person other than the Parties any rights or remedies, including the right to rely upon the representations

and warranties set forth in this Agreement.

4. Section 8.15 of the Merger

Agreement is hereby deleted and replaced in its entirety with the following:

Section 8.15 Remedies.

No failure or delay on the part of any Party in the exercise of any right under this Agreement shall impair such right or be construed

to be a waiver of, or acquiescence in, any breach of any representation, warranty or agreement within, nor shall any single or partial

exercise of any such right preclude any other or further exercise of any other right. All rights and remedies existing under this Agreement

are cumulative to, and not exclusive of, any rights or remedies otherwise available and the exercise by a Party of any one remedy shall

not preclude the exercise by it of any other remedy to the extent permitted.

5. Section 8.16 of the Merger

Agreement is hereby deleted and replaced in its entirety with the following:

Section 8.16 Specific Performance.

The Parties agree that irreparable injury would occur if any of the provisions of this Agreement are not performed in accordance with

their specific terms or are otherwise breached, and further agree that, (a) damages to the Company caused by the non-occurrence of the

Closing, including damages related to reputational harm, customer or employee losses, increased costs, harm to the Company’s business,

and/or a reduction in the actual or perceived value of the Company or any of its direct or indirect Subsidiaries, would be difficult or

impossible to calculate, (b) the provisions of this Agreement are not intended to and do not adequately compensate the Company for

the harm that would result from a breach by Parent, and will not be construed to diminish or otherwise impair in any respect any the Company’s

rights to an injunction, specific performance or other equitable relief, and (c) the right of specific performance is an integral part

of this Agreement and without that right the Company would not have entered into this Agreement. Further, it is explicitly agreed that

the Company shall have the right to an injunction, specific performance or other equitable relief with respect to the Parent Entities’

obligations to consummate the Transactions. It is further agreed that the Company shall be entitled to an injunction or injunctions, specific

performance or other equitable relief to prevent breaches or threatened breaches of this Agreement and to enforce specifically the terms

and provisions of this Agreement in the Court of Chancery of the State of Delaware or other court of the United States as specified in

Section 8.05, and the Parties waive any requirement for the posting of any bond or similar collateral in connection with any such

equitable relief. Parent agrees that it will not oppose the granting of an injunction or specific performance on the basis that (i) the

Company has an adequate remedy at law or (ii) an award of specific performance is not an appropriate remedy for any reason at law or equity.

6. Except as expressly amended

or modified hereby, the terms and conditions of the Merger Agreement shall continue in full force and effect among the Parties. This Amendment

shall form a part of the Merger Agreement for all purposes, and each Party shall be bound by this Amendment.

7. All capitalized terms used

but not defined in this Amendment shall have the meanings set forth in the Merger Agreement. Each reference to “this Agreement”

and each other similar reference contained in the Agreement shall, after this Amendment becomes effective, refer to the Merger Agreement

as amended by this Amendment.

8. This Amendment may be executed

in any number of counterparts (including by means of facsimile and electronically transmitted portable document format (.pdf) signature

pages), each of which shall be an original but all of which together shall constitute one and the same instrument.

9. The provisions of Article

8 of the Merger Agreement are incorporated by reference, mutatis mutandis, as if set forth in full in this Amendment.

10. Each party to this Amendment

represents and warrants that it has obtained all corporate, board and other approvals necessary to execute and deliver this Amendment

and for this Amendment to be effective.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned

have executed this Amendment as of the Effective Date.

| |

PARENT |

| |

|

| |

SilverSun Technologies, Inc. |

| |

|

|

| |

By: |

/s/ Mark Meller |

| |

Name: |

Mark Meller |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

MERGER SUB I |

| |

|

| |

Rhodium Enterprises Acquisition Corp. |

| |

|

|

| |

By: |

/s/ Mark Meller |

| |

Name: |

Mark Meller |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

MERGER SUB II |

| |

|

| |

Rhodium Enterprises Acquisition LLC |

| |

|

|

| |

By: |

/s/ Mark Meller |

| |

Name: |

Mark Meller |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

COMPANY |

| |

|

| |

Rhodium

Enterprises, Inc. |

| |

|

|

| |

By: |

/s/ Chase Blackmon |

| |

Name: |

Chase Blackmon |

| |

Title: |

Chief Executive Officer |

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

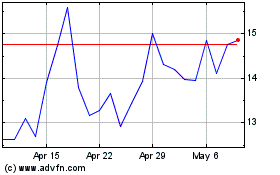

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Apr 2024 to May 2024

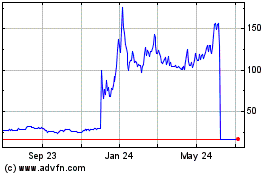

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From May 2023 to May 2024